Antibody Discovery Market Report Scope & Overview:

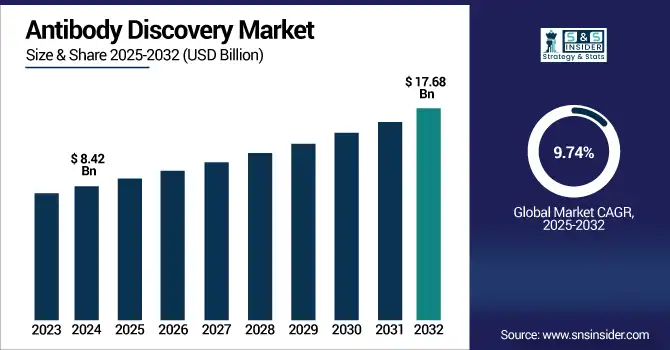

The antibody discovery market size was valued at USD 8.42 billion in 2024 and is expected to reach USD 17.68 billion by 2032, growing at a CAGR of 9.74% over 2025-2032.

To Get more information on Antibody Discovery Market - Request Free Sample Report

The global antibody discovery market is gaining substantial momentum, primarily due to the increasing requirement for targeted therapies and biologics for the treatment of chronic diseases, such as cancer, infectious diseases, and autoimmune diseases.

In May 2024, AbCellera expanded its platform to enable faster antibody discovery and development with AI-driven tools for better epitope coverage, driver models that leverage AI to enable better epitope targeting, and increased market share of antibody discovery for AI-integrated platforms.

Significant growth in the antibody discovery market can be attributed to the increasing R&D activity in the area of therapeutic antibodies and rising demand for protein therapeutics, technical advances in antibody engineering, maturation of parents of antibody targets, and robust features of antibodies. In 2023, U.S. biopharmaceutical companies' investment in R&D reached more than USD 102 billion, including substantial capital in research to unlock the potential of antibody therapies, according to the Pharmaceutical Research and Manufacturers of America (PhRMA). Furthermore, regulatory recommendations by the FDA and EMA to grant accelerated approval for mAbs and biosimilars are favouring the market.

The U.S. antibody discovery market is driven by the presence of large antibody discovery companies, well-established academic research partnerships, and a large number of clinical studies. The increasing trend toward personalized medicine, as well as the increasing demand for new antibody formats, such as bispecific antibodies and antibody-drug conjugates (ADCs), will drive further growth. In addition, enhanced antibody discovery market research shows improved supply potential with specialized expression systems and CROs providing full-service antibody development.

For instance, the collaboration between AstraZeneca and Absci on generative AI for antibody discovery, in March 2024, also reflects the current antibody discovery market dynamics toward integrating machine learning into early-stage biologic development-contrasting with the increasing corporate investments in creative antibody discovery market trends.

Table: Adoption of Emerging Technologies in Antibody Discovery (2021–2025)

|

Technology |

Description |

Adoption Rate (%) in 2025 |

Key Players Utilizing Technology |

|---|---|---|---|

|

AI-based Antibody Design |

Accelerates epitope prediction |

64% |

AbCellera, Evotec, Twist Bioscience |

|

Single B-Cell Screening |

Enables identification of rare antibodies |

48% |

Berkeley Lights, Creative Biolabs |

|

Phage Display Optimization |

Enhances high-affinity binder selection |

72% |

GenScript, Fairjourney Biologics |

|

Nanodisc Platforms |

Stabilizes membrane proteins for screening |

35% |

BioIntron, private research labs |

|

CRISPR-based Functional Assays |

Speeds up target validation |

28% |

Charles River, Genscript |

Market Dynamics:

Drivers:

-

Rising Demand for Targeted Therapies and Innovations in Biologics Pipeline Fuel Market Growth

The demand for targeted therapies and precision medicine, backed by continuous biologic drug development, will be the major driver for the antibody discovery market growth. The increasing incidence rate of complex diseases, including cancer, autoimmune disease, and infectious disease, is compelling the biopharmaceutical company to invest largely in monoclonal antibodies and related biologics. Biologics (with antibodies leading) are expected to account for more than 55% of global top 100 drug sales in 2026, as per the Evaluate Pharma report.

The market is buoyed by increased R&D spending (for instance, Roche, Pfizer, and Merck spend upward of USD 12 billion on research each year). More efficient ways to facilitate such animals’ immunity have grown the antibody discovery market analysis with great speed, with new screening technologies, like phage display, single B-cell technologies, and microfluidics, have revolutionized the discovery of antibodies, such that it is extremely fast and specific. Furthermore, other Food and Drug Administration (FDA) accelerated antibody product approvals early in the second quarter will drive increased regulatory support and provide additional incentive to commercial-scale approval (for instance, Talvey and Tepkinly, 2023).

Based on collaboration between biotech start-ups and academia, and rising partnership with CROs and CDMOs, the market is expected to become more attractive across early-stage and late-stage development, due to the continuous supply of antibody discovery solutions.

Restraints:

-

High Costs, Technical Complexity, and Regulatory Barriers in Development Hamper Market Expansion

Despite potential growth, the antibody discovery market has significant barriers, including high cost and prolonged development time of antibodies. According to the Tufts Center for the Study of Drug Development, on average, it takes 10 to 15 years and costs more than USD 2.6 billion to bring a new biologic drug to market. The technical complexity of antibody selection, validation, and optimization, particularly for bispecific and humanized antibodies, requires significant expertise, infrastructure, and investment. In addition, as strict regulatory requirements are imposed, for instance by the FDA and EMA, a complete preclinical and clinical development data set is required, which in many cases may result in delays and added costs of compliance.

High failure rates in biologic drug development have persisted, particularly in early discovery and clinical phases, because of challenges such as immunogenicity, suboptimal pharmacokinetics, or off-target activities. Supply chain interference for raw materials, including recombinant proteins and cell culture reagents, may also hinder efficient development-staging workflows. Additionally, it can be costly to invest in research and development, particularly if you are a smaller biotech company competing and trying to justify long-term research and development projects. Cumulatively, these factors limit the level of the revenue antibody discovery market share, particularly for emerging players and in high-risk therapeutic segments where the ROI is not guaranteed.

Segmentation Analysis:

By Antibody Type

Monoclonal antibodies were the largest segment of the antibody discovery market in 2024, with a market share of around 68%. Due to their higher specificity, long half-life, and successful initial application in treating complicated diseases, like cancer, rheumatoid arthritis, and infectious diseases, mAb has become a new star in the field of antibody medicine. Their dominance is also being bolstered by multiple FDA approvals and growing biosimilar pipelines. Moreover, polyclonal antibodies are the fastest-growing segment, which is driven by their ability to bind to a variety of epitopes of a single antigen, which is useful in diagnostics, vaccines, and basic research. Their potential for quick and cheap fabrication and wide dissemination in academic and industrial labs has also contributed to their expanded use.

By Service

By service, phage display was the largest segment in 2024, accounting for 47% of the global antibody discovery market. This predominance is due to the capacity of this technology to produce humanized, high-affinity antibodies with fast screening and selection, especially in cancer and autoimmune disease studies. Phage display platforms have been made more efficient by the inclusion of automation and AI in such technology. Conversely, the hybridoma section is the fastest growing, owing its most significant contribution to the generation of monoclonal antibodies, especially in animal models and in vaccine candidate studies. Its relevance remains in the academic and preclinical arena, and therefore development of NMR for early discovery is logical and growing.

By End-User

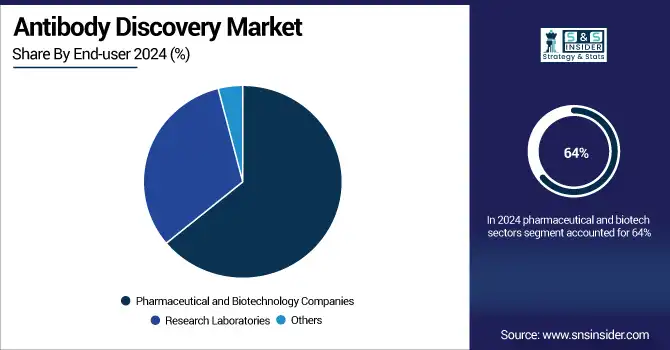

In 2024, the pharmaceutical and biotech sectors dominated the antibody discovery market, accounting for a 64% share. Their leadership is anchored in R&D investment, expansion of biologics pipelines, and collaborations with CROs and academia. They are highly dependent on antibody discovery platforms for new drug development, with particular emphasis on new cancer and immune treatments. Contrarily, research laboratories are the fastest-growing end-user segment, owing to rising government and institutional funding and custom antibody services. Experimental validation, biomarker studies, and translational research between universities and institutes to driving the growth of this segment.

Table: End-User Investment Trends in Antibody Discovery (2021–2025)

|

End-User Type |

Avg. Annual R&D Spending (USD Bn) |

% Increase Since 2021 |

Key Investment Areas |

|---|---|---|---|

|

Pharmaceutical Companies |

45.3 |

24% |

Monoclonal and bispecific mAbs |

|

Biotechnology Firms |

32.8 |

36% |

Recombinant Antibodies, AI Tools |

|

Academic & Research Labs |

11.4 |

41% |

Custom antibody development |

Regional Analysis:

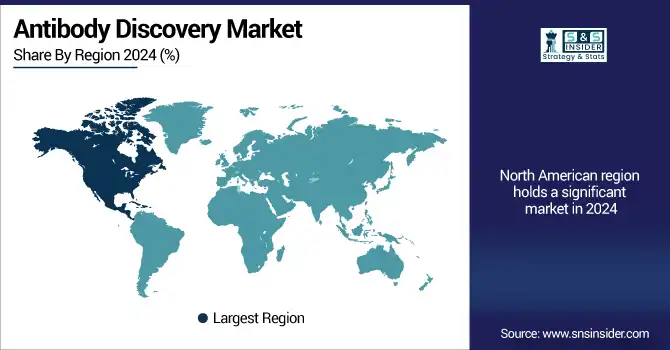

The largest share of the global antibody discovery market in 2024 was estimated to be North America, due to significant investment in biopharmaceutical R&D, a strong clinical trial infrastructure, and the presence of a large number of leading market players.

The U.S. antibody discovery market size was valued at USD 2.75 billion in 2024 and is expected to reach USD 5.12 billion by 2032, growing at a CAGR of 8.13% over 2025-2032. The U.S. continues to hold the largest share in part because government and private sector support U.S. biopharma R&D spending totaled more than USD 102 billion in 2023, PhRMA found. The US FDA also approved several monoclonal antibody therapies in recent years, driving demand for development. Infrastructure, academic collaborations, and the existence of key players such as Charles River Laboratories and Danaher also boost the strength of the region. In Canada, growth is on the rise based on a greater emphasis on biotech innovation and favorable government grants, and Mexico is slowly moving the needle on its biosimilars and clinical trial support, according to the research. The market in the region is backed by supportive regulations, advanced modes of screening, and the increasing requirement for patient-specific treatments.

The European region is the second-largest market for antibody discovery, with a robust infrastructure to support pharmaceutical manufacturing, a favorable regulatory environment, and an expanding biosimilars pipeline. Germany is the leading country owing to its developed biomanufacturing facilities, large R&D spending, and an established clinical research environment. Germany is host to many leading biotech hubs and public-private partnerships that drive innovation in antibody development. France and the U.K. are also big players, with France investing heavily in immunotherapy and the U.K. in AI-powered discovery platforms. The biggest European market is a “fast-growing” Poland, due to increasing clinical trial activity and foreign investment in biotech. Through the scientific advice and fast approval for biologics in Europe, a more rapid development and commercialization can be achieved in different countries.

The Asia Pacific is the fastest-growing region of the antibody discovery market globally due to a developing biotech industry, increasing healthcare spending, and a burgeoning demand for targeted therapies. China is the clear leader in the region because of big investments in biopharma, government-backed innovation programs, and local players such as WuXi Biologics leading the way on antibody platforms. National biotech investment topped more than USD 30 billion in 2023, according to China’s Ministry of Science and Technology. India, too, is growing at a fast clip, led by government-sponsored efforts such as “Biotech Startup Accelerators” and growing partnerships for CROs. Japan also contributes substantially via innovative technologies and an aligned regulatory framework for approvals of therapeutic antibodies. Growth is being driven by a higher use of Asian CROs for discovery services and by production cost efficiency. Nations such as South Korea and Singapore are playing an increasingly powerful role through innovation hubs and R&D-driven policies, which in turn are driving regional growth.

Table: Strategic Collaborations and Licensing Deals (2023–2025)

|

Year |

Partner Companies |

Deal Type |

Value (USD Million) |

Focus Area |

|---|---|---|---|---|

|

2023 |

AbSci – AstraZeneca |

AI-based Discovery |

247 |

Oncology, Autoimmune |

|

2024 |

Twist Bioscience – Astellas |

Target Discovery |

95 |

Oncology |

|

2025 |

Sanofi – Earendil Labs |

Bispecific Antibodies |

1,720 (milestones) |

Inflammatory Diseases |

|

2025 |

Evotec – Korean Gov’t & Zymedi |

R&D Grant |

4.5 |

Pulmonary Disorders |

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Leading antibody discovery companies in the market comprise Eurofins Scientific, Evotec, Twist Bioscience, Genscript Technology Corporation, Biocytogen, Sartorius AG, Danaher Corporation, Fairjourney Biologics S.A., Creative Biolabs, and Charles River Laboratories.

Recent Developments:

-

In April 2025, Sanofi licensed global rights to a pair of bispecific antibody candidates (HXN‑1002, HXN‑1003) from Earendil Labs, paying USD125 million upfront and with the potential of USD1.72 billion in milestones.

-

In April 2025, Evotec announced substantial progress in its molecular glue collaboration with Bristol Myers Squibb, triggering USD 75 million in performance-based and program-based milestone payments.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.42 billion |

| Market Size by 2032 | USD 17.68 billion |

| CAGR | CAGR of 9.74% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Antibody Type (Monoclonal, Polyclonal, and Others) • By Service (Phage Display, Hybridoma, and Others) • By End-user (Pharmaceutical and Biotechnology Companies, Research Laboratories, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Eurofins Scientific, Evotec, Twist Bioscience, Genscript Technology Corporation, Biocytogen, Sartorius AG, Danaher Corporation, Fairjourney Biologics S.A., Creative Biolabs, and Charles River Laboratories. |