AI In Medical Imaging Market Size & Overview:

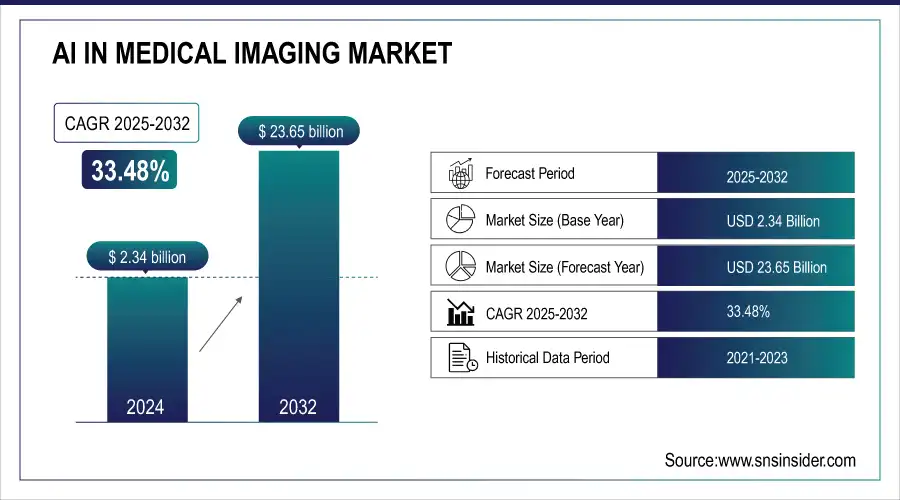

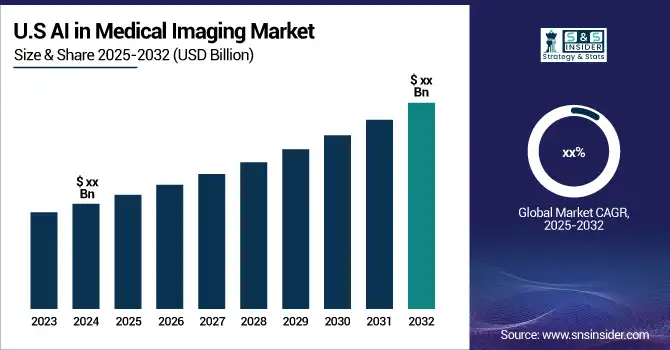

The AI in Medical Imaging Market size was valued at USD 2.34 billion in 2024 and is projected to reach USD 23.65 billion by 2032, growing at a 33.48% CAGR.

The AI in medical imaging market is expected to grow with great momentum due to the increasing requirement to deal with complex and large datasets. Other factors include the reduction in the workloads of radiologists, as well as increased cross-industry collaborations. Private sector funding for AI-based start-ups and government initiatives to incorporate AI into the healthcare sector will be key growth drivers. For instance, this June 2021, VUNO Inc. reported that it will partner with Samsung Electronics to integrate VUNO's AI-powered chest X-ray diagnostic tool on Samsung's GM85 mobile digital X-ray the kind of product that builds on industry adoption of AI-driven solutions. The need for effective management of big medical data has hastened the consumption of AI in medical imaging because it enhances diagnostic accuracy, speeds up image analysis, and enables improved healthcare efficiency. Koninklijke Philips N.V. announced in November 2023 an expansion of its HealthSuite Imaging AI offerings on Amazon Web Services to speed access, optimize workflows with artificial intelligence, and advance patient care.

To Get More Information on AI In Medical Imaging Market - Request Sample Report

Advances in AI technology, deep learning, convolutional neural networks, and generative adversarial networks have enhanced the accuracy of medical image analysis. According to a study by Microsoft and IDC, in March 2024, 79% of healthcare organizations are using AI technology with an ROI of USD 3.20 for each USD 1 invested. This is mainly because of the required accuracy in diagnosis and the complexity of medical imaging data.

| Region | Regulatory Body | Key Regulations | Approval Process |

| North America | FDA | Digital Health Innovation Action Plan | Pre-market approval |

| Europe | EMA, MDR | EU Medical Device Regulation | CE marking process |

| Asia-Pacific | PMDA (Japan), NMPA (China) | Japan Pharmaceuticals and Medical Devices Act | National approval process |

| Latin America | ANVISA (Brazil) | Brazilian Health Regulatory Norms | Risk-based classification |

| Global | WHO, ISO | International standards for AI | Collaborative standards |

Market Size and Forecast:

-

Market Size in 2024 USD 2.34 Billion

-

Market Size by 2032 USD 23.65 Billion

-

CAGR of 33.48% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

AI In Medical Imaging Market Trends:

-

Increasing integration of AI algorithms in diagnostic imaging to improve detection of subtle abnormalities and enhance accuracy.

-

Growing use of deep learning for automated segmentation and analysis in cardiac, retinal, and other specialized imaging.

-

Expansion of AI-powered workflow automation to reduce time spent on image interpretation and improve operational efficiency.

-

Rising adoption of AI to process large volumes of medical images quickly, enabling faster emergency diagnoses.

-

Continuous technological advancements enabling handling of bigger datasets, higher precision diagnostics, and enhanced healthcare delivery.

AI In Medical Imaging Market Growth Drivers:

-

AI Revolutionizing Medical Imaging by Enhancing Diagnostic Accuracy and Streamlining Healthcare Workflows

AI's adoption within medical imaging greatly influences the healthcare market as it provides diagnostic procedures that are much more accurate and time-effective. AI's ability to read complex data, particularly X-rays, MRIs, and CT scans, produces a huge amount of data. The use of AI algorithms, especially in diagnostic imaging, enables practitioners and professionals in the health sector to potentially detect and quantify clinical disorders even more precisely. Such systems have proven to be very sensitive and accurate, hence essential in detecting very minute abnormalities not even noticeable by a human radiologist. For example, deep learning is applied in segmenting the left ventricle in cardiac MRI as well as detecting diabetic retinopathy from the retinal images, thus increasing the diagnostics' precision.

The inclusion of AI into healthcare workflows also streamlines operations. With the automation of mundane tasks, AI minimizes the time spent on examinations, and consequently, more time is spent by the healthcare staff on the patients. This expedites emergency diagnoses and also improves patient satisfaction. Furthermore, AI allows for the processing of huge volumes of medical images to determine markers for diseases that may not be detected through other forms of diagnostics. For example, AI can read a CT scan with 200-400 images in just 20 seconds. Otherwise, it would take a senior radiologist about 20 minutes to do so. Such speed and accuracy have extremely fueled the adoption of AI globally in medical imaging, making it the outcome of improving patient health conditions and market growth.

AI In Medical Imaging Market Restraints:

Medical professionals often hesitate to adopt AI technologies due to concerns that these systems might undermine essential human qualities, such as empathy and patient communication. Additionally, skepticism regarding the diagnostic accuracy of AI makes it challenging to convince healthcare providers of the value, affordability, and effectiveness of these solutions. This caution slows the integration of AI into clinical workflows, as practitioners prioritize maintaining quality patient care while evaluating whether AI tools can reliably complement, rather than replace, human expertise in diagnostics and treatment decisions.

AI In Medical Imaging Market Segment Analysis:

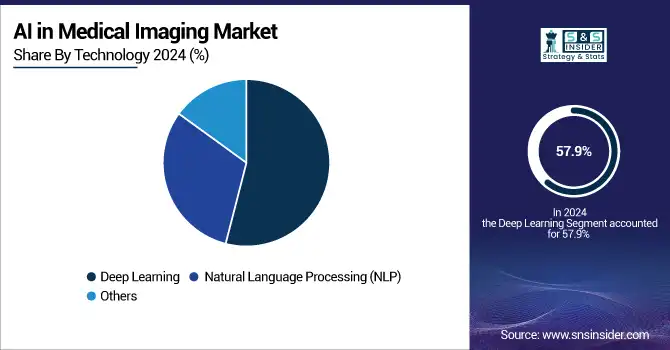

By Technology

The deep learning segment held the highest market share of 57.9% in 2024 because it is advanced enough to analyze complex medical images properly and render precise diagnoses. Deep learning algorithms, particularly CNN, have been phenomenal in image recognition and therefore represent a core technology in the domain of medical imaging. Medical image analysis is the core of this approach, which is widely adopted at such a rapid pace because it supports quicker and more precise readings; the treatment plans become better and more personalized in a smooth flow of health operations. Its development will continue to flourish through interdisciplinary collaborations and ongoing research, revamping medical imaging in years to come with its sophisticated algorithms that will be playing a vital role in healthcare. For example, in November 2023 OpenAI announced the OpenAI Data Partnerships a program aimed to engage different kinds of organizations in producing high-quality datasets to use for training AI quality will have a lot to say about the improvement of neural networks' reliability and accuracy, for example, on a medical image analysis task.

The Natural Language Processing (NLP) segment is also anticipated to grow at the highest compound annual growth rate in the forecast period. This is because NLP can turn unstructured textual data into actionable insights improve workflows and support clinical decision-making by extracting and analyzing unstructured data from medical records and radiology reports among others.

By Application

In 2024, the neurology segment dominated the market primarily due to the rise in the adoption of AI in neurology for better and more efficient patient care. AI can handle immense imaging data and can become an effective tool in detecting neurological conditions while providing a timely and accurate diagnosis. Some examples include brain tumors, which are the most prevalent of the misdiagnosed conditions in neuro-oncology. This is mainly because the symptoms may have been misconstrued or wrongly analyzed reports. AI implementation will significantly increase the detection and diagnosis of brain tumors and other neurological cancers, with tremendous accuracy and consistency, which in turn lead to growth within the segment. Optical imaging with deep convolutional neural networks can predict brain tumors in less than 150 seconds, and therefore, encourages the use of AI in neurological disorder diagnosis.

On the other hand, the breast screening segment is expected to witness the fastest CAGR during the forecast period. However, there are rising instances of breast cancer and a growing need for early-stage diagnosis to manage its treatment sooner and more accurately. According to the World Health Organization, in 2022, breast cancer was responsible for 670,000 global deaths. Early detection is the way to better survival chances, and AI does enhance accuracy and efficiency in screening processes.

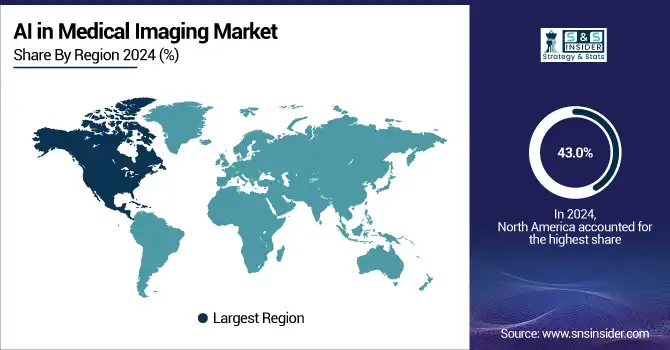

AI In Medical Imaging Market Regional Analysis:

North America AI In Medical Imaging Market Insights

North America dominated the AI in medical imaging market in 2024, accounting for more than 43.0% of revenue. This is largely due to extensive R&D, particularly in the U.S., where AI applications in medical imaging are transforming diagnostics. Strong regulatory support, coupled with various collaborations between technology firms and healthcare providers, is a major driver and is also supported by the growing demand for early disease detection.

Do You Need any Customization Research on AI In Medical Imaging Market - Inquire Now

Europe AI In Medical Imaging Market Insights

Europe is also growing significantly, because of collaborative research projects like CERN and Horizon 2020. The European Union has the Medical Device Regulation (MDR), ensuring there is a clear roadmap to the approval of AI technologies, which drives the adoption and innovation of new technologies. The UK has the most prospects for profitable growth, especially with government-led initiatives such as the AI Sector Deal and with strong participation by the NHS in AI deployment.

Asia Pacific AI In Medical Imaging Market Insights

The Asia Pacific market is likely to grow rapidly, led by the likes of China and Japan. The ambition of China to take the lead in AI globally by 2032 is underpinned by huge government investments; it drives the market. Since AI will replace some of these traditional healthcare professionals, an industry with a more acute shortage in this region, this industry sector is likely to be one of the major drivers of the market. Another massive country is Japan, whose market leaders, including Fujifilm and Canon, are at the embryonic stage of advanced AI development. Simultaneously, smaller players like NOVIUS shall launch innovations, for instance, N-Vision 3D, which has the potential to raise medical imaging performances. All this shall drive regional growth in the forecast period.

AI In Medical Imaging Market Key Players:

-

GE HealthCare- Edison Platform

-

Canon Medical Systems USA, Inc.-Aplio i-series

-

Microsoft-Azure Machine Learning

-

Digital Diagnostics Inc.-Iris AI

-

TEMPUS-Tempus Labs

-

Butterfly Network, Inc.-Butterfly iQ

-

HeartFlow, Inc.-HeartFlow FFRct

-

Enlitic, Inc.-Enlitic Deep Learning Platform

-

Viz.ai, Inc.-Viz Stroke

-

EchoNous, Inc.-EchoNous Vein and EchoNous Bladder

-

HeartVista, Inc.-HeartVista MRI platform

-

Exo Imaging, Inc.-Exo ultrasound system

-

Nano-X Imaging Ltd.-Nano-X imaging system

Competitive Landscape for AI In Medical Imaging Market:

GE HealthCare is a leading provider of medical imaging solutions, leveraging AI to enhance diagnostic accuracy and streamline workflows. Through its Edison Platform, the company integrates advanced AI algorithms into imaging systems, enabling faster, more precise analysis of X-rays, MRIs, and CT scans. GE HealthCare serves hospitals and healthcare providers globally, driving innovation and adoption in the AI-powered medical imaging market.

-

In January 2024, GE HealthCare announced an agreement to acquire MIM Software, a global leader in medical imaging analysis and AI solutions based in Cleveland. This acquisition aims to integrate MIM Software's advanced imaging analytics and digital workflow capabilities across multiple care areas, including molecular radiotherapy, radiation oncology, urology, and diagnostic imaging, enhancing GE HealthCare's innovative offerings to improve patient outcomes and healthcare systems worldwide.

Canon Medical Systems USA develops advanced medical imaging solutions, integrating AI technologies to improve diagnostic precision and workflow efficiency. Its Aplio i-series leverages AI for enhanced image analysis, automated measurements, and faster interpretation of ultrasound and other imaging data. Serving healthcare providers globally, Canon Medical Systems drives innovation in AI-powered medical imaging, supporting accurate diagnostics and improved patient care.

-

In November 2023, Canon Medical Systems launched two new computed tomography (CT) scanners, built on the upgraded Aquilion CT platform. These scanners utilize artificial intelligence algorithms to enhance image quality and simplify scanning workflows, marking a significant advancement in CT technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.34 Billion |

| Market Size by 2032 | USD 23.65 Billion |

| CAGR | CAGR of 33.48% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Deep Learning, Natural Language Processing (NLP), Others) • By Application (Neurology, Respiratory and Pulmonary, Cardiology, Breast Screening, Orthopedics, Others) • By Modalities (CT Scan, MRI, X-rays, Ultrasound, Nuclear Imaging) • By End-Use (Hospitals, Diagnostic Imaging Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | GE Healthcare, Microsoft, Digital Diagnostics Inc., TEMPUS, Butterfly Network, Inc., Advanced Micro Devices, Inc., HeartFlow, Inc., Enlitic, Inc., Canon Medical Systems USA, Inc., Viz.ai, Inc., EchoNous, Inc., HeartVista Inc., Exo Imaging, Inc, Nano-X Imaging Ltd. |