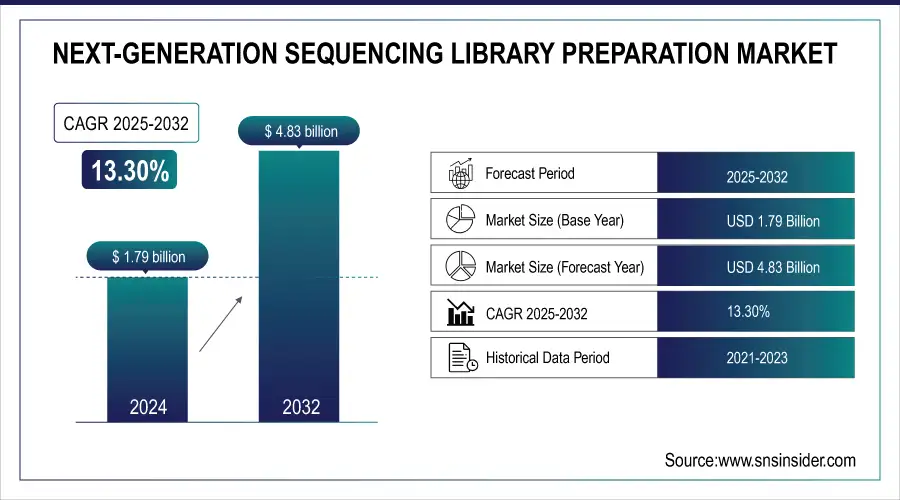

Next-generation Sequencing Library Preparation Market Size:

The Next-generation Sequencing Library Preparation Market size was valued at USD 1.79 billion in 2024 and is expected to reach USD 4.83 billion by 2032, growing at a CAGR of 13.30% over the forecast period of 2025-2032.

The global next-generation sequencing library preparation market is witnessing robust growth due to the growing demand for genomic research, personalized medicine, and targeted sequencing applications. Improved multimode kits, automated process compatibility, and low-input methods are providing for increased efficiency and scalability. The use of NGS in clinical diagnostics, drug discovery, and cancer genomics is additionally driving growth in the market.

To Get more information on Next-generation Sequencing Library Preparation Market - Request Free Sample Report

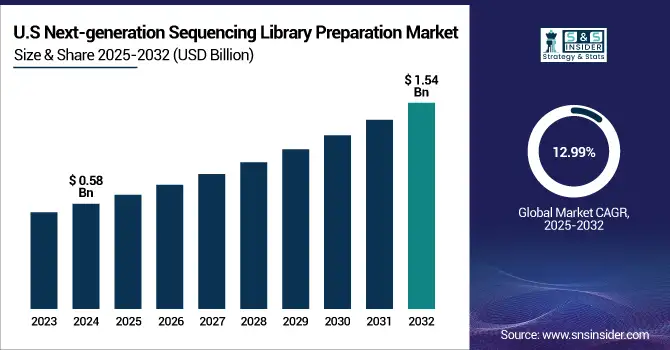

The U.S. next-generation sequencing library preparation market size was valued at USD 0.58 billion in 2024 and is expected to reach USD 1.54 billion by 2032, growing at a CAGR of 12.99% over the forecast period of 2025-2032.

The U.S. dominates the North American next-generation sequencing library preparation market due to it possesses state-of-the-art genomics infrastructure, high investment in precision medicine, and industry leaders in NGS. Public and private support for genomics research also maintains its dominance in the region.

April 2025, BioSkryb Genomics and Tecan's novel high-efficiency single-cell multiomics workflow offers revolutionary library prep time reduction, marking a giant step for precision medicine and drug development.

Next-generation Sequencing Library Preparation Market Dynamics:

Drivers:

-

Increasing Adoption of Precision Medicine is Driving the Market Growth

The growing interest in precision medicine, where therapeutics are tailored based on the genetic identity of a patient, is a major driver of the NGS library preparation market growth. NGS facilitates genomic characterization to a great extent to identify specific mutations or biomarkers associated with diseases, such as cancer, cardiovascular diseases, and rare genetic disorders. To make precision medicine work, DNA/RNA libraries of high quality and accuracy are pre-prepared before sequencing. As healthcare systems and pharmaceutical companies increasingly incorporate genomics into treatment planning, the demand for accurate, reproducible library preparation instrumentation just keeps increasing.

Artificial intelligence-assisted genome analysis is transforming precision medicine by allowing for the quick discovery of disease-associated genetic mutations and targeted therapeutic recommendations. This speed in genomic data interpretation further bolsters demand for high-quality, consistent library prep processes that provide precise and reliable sequencing outputs.

-

Growth in the Market is Being Fueled by Advancements in Library Preparation Technologies

Innovation in library prep technology has improved the efficiency, accuracy, and scalability of NGS processes over the years. Recently, library prep kits have been launched to develop more automated, low-input samples, single-cell sequencing, and simple and rapid processing times. All these proficiencies decrease inherent human error, decrease turnaround time, and enable sequencing to be available for smaller lab and clinic environments. Bead-based purification techniques, optimization of enzymes, and multiplexing capability have also provided a new level of reproducibility for library preparation across an increasing number of sample types, enabling a larger usage of NGS in research and diagnostics.

In June 2024, Meridian Bioscience released the first lyophilized NGS library prep kit, dispelling cold chain logistics and facilitating ambient storage, streamlining workflows, and cutting costs.

Feb 2024, Takara Bio announced high-throughput single-cell RNA/DNA prep kits that can process up to 100,000 cells/run, with much reduced hands-on time and error rates.

Illumina has presented rapid single-cell multi-omic workflows that prep libraries in less than 10 hours, perfect for pharmaceutical and precision medicine use.

Restraints:

-

Technical Complexity and Workflow Variability are Limiting the Market Growth.

Library preparation for next-generation sequencing (NGS) is a sequence of complex and delicate steps, such as DNA/RNA extraction, fragmentation, end-repair, adapter ligation, and amplification, each of which needs to be executed with accuracy to produce high-quality sequencing output. Minor mistakes in any step can result in low data quality, failure to sequence, or loss of sample. Furthermore, distinct applications (whole genome vs. targeted sequencing) and platforms (Illumina and Oxford Nanopore) usually demand particular protocols and reagents. The absence of standardized workflows creates variability, which makes scaling operations reproducibly across the lab or incorporating them into automation systems difficult. Therefore, complexity and non-harmonization impede extended use, particularly in non-specialist or resource-limited settings.

Next-generation Sequencing Library Preparation Market Segmentation Analysis:

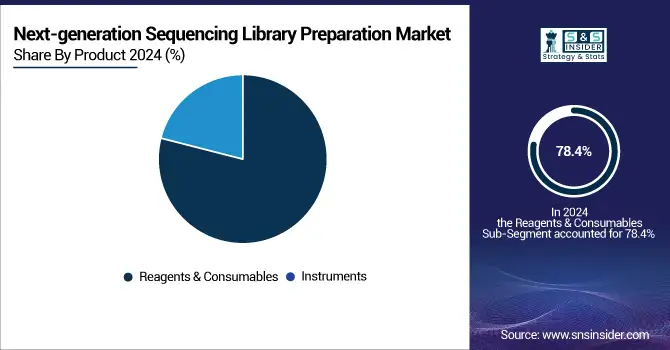

By Product

In 2024, the reagents & consumables segment dominated the next-generation sequencing library preparation market share with a 78.4%, as a result of its multiple uses in every sequencing process. They are enzymes, buffers, primers, and purification kits needed for the processing of samples and are therefore requisite to every run. With an increase in the usage of NGS in clinical diagnostics, research, and pharmaceutical discovery, the frequent repurchase of consumables creates consistent demand.

The instruments segment is expected to expand at the fastest growth rate within the forecast period, supported by greater automated library preparation and increased demand for systems for higher throughput. Advanced instruments, such as automated liquid handlers and combined library prep platforms are increasingly used by laboratories and hospitals to increase scalability and reduce manual errors for overall better workflow processes. As next-generation sequencing is emerging from the realm of research laboratories into clinics, larger imaging, smaller devices, and rapid results are paramount.

By Sequencing Type

The targeted genome sequencing segment of the next-generation sequencing library preparation market dominated in 2024 with a market share of 63.2%, with its cost-effectiveness, sensitivity, and targeted approach in identifying specific genetic variants. The process has widespread usage in research and clinical diagnostics for diagnosing conditions, such as cancer, genetic disorders, and infectious diseases. It enables researchers to concentrate on regions of interest within the genome, reducing sequencing time and data complexity. Growing demand for companion diagnostics and clinical use on a routine basis further solidified its role as the sequencing choice.

The whole exome sequencing segment is expected to grow at a considerable rate during the forecast period, with its ability to provide extensive information on all protein-coding parts of the genome at a decreased price compared to whole genome sequencing. WES finds increasing application in rare genetic variant identification, the mechanism of disease, and precision medicine assistance. Its growing use in clinical diagnostics, particularly for neurological, oncologic, and pediatric diseases, is fueling demand for specialized library preparation kits. Bioinformatics software advances and reducing sequencing costs are also fueling the growth of WES in developed and emerging economies.

By Application

In 2024, the drug & biomarker discovery segment led the next-generation sequencing library preparation market with a 65.12% share due to NGS finds broad application in the identification of genetic targets, the elucidation of disease mechanisms, and the validation of biomarkers for the discovery of drugs. Pharmaceutical and biotech companies are increasingly using NGS-based library preparation for high-throughput screening and transcriptome analysis to assist in faster therapeutic discovery. The accuracy, scalability, and ultimately data-hungry output associated with NGS workflows have established them as essential in translational research, particularly in clinical oncology and immunotherapy, and therefore, instilling the reliability of this application segment.

The disease diagnostics segment is poised to witness substantial growth during the forecast period, with the increasing adoption of NGS in clinical diagnostics for cancer, rare genetic conditions, infectious diseases, and prenatal screening. As healthcare infrastructures move toward precision medicine, NGS provides an unparalleled ability to identify mutations and structural variations with excellent accuracy. Growing regulatory approvals for NGS-based diagnostic tests, increased reimbursement policies, and enhanced turnaround times are fostering adoption in hospitals and diagnostic laboratories. In addition, the creation of easy-to-use, automated library prep kits designed specifically for clinical applications is driving market growth in this segment.

By End-Use

The hospitals and clinics segment led the NGS library preparation market in 2024 with a 35.4% market share. Due to the growing clinical use of next-generation sequencing (NGS) for diagnostics, particularly in oncology, genetic disorders, and infectious illnesses. In-house sequencing capabilities are being used more and more by hospitals and clinics to deliver more rapid, customized care supported by superior genetic data. Investment in automated systems and standardized kits has increased due to the availability of regulatory-approved NGS-based diagnostics and the need for rapid, high-throughput library preparation procedures. The segment's top-market position has been further reinforced by the expansion of precision medicine initiatives in healthcare facilities.

Growing reliance on NGS for drug development, biomarker discovery, and clinical trial stratification is predicted to propel the fastest growth in the pharmaceutical and biotechnology firms segment throughout the projected period. To handle extensive genomics projects and companion diagnostics development, these businesses require library preparation technologies that are extremely scalable, adaptable, and reproducible. The need for next-generation sequencing library prep solutions is also rising as a result of multi-omics initiatives, more R&D spending, and increased cooperation with genomics service providers.

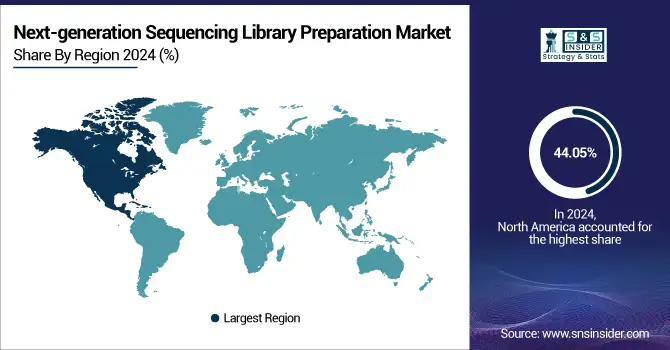

Regional Insights:

North America had the largest share of the next-generation sequencing library preparation market, 44.05% in 2024, due to strong genomic research infrastructure, established market presence of leading market players, and high adoption of NGS technologies across academic and clinical establishments. The region is equipped with good government investment in precision medicine programs, well-established R&D infrastructure for biotechnology, and early uptake of automation and AI into sequencing pipelines. Furthermore, the general application of NGS in disease diagnosis, drug development, and cancer continues to affirm North America's position as a global market leader.

Get Customized Report as per Your Business Requirement - Enquiry Now

The Asia Pacific region is the fastest-growing in the next-generation sequencing library preparation market analysis, growing at a CAGR of 14.42% on account of increased investment in healthcare infrastructure, expansion of genomic research programs, and increased awareness of personalized medicine. China, India, and Japan are driving the shift toward NGS technologies for population-level genomic research and clinical diagnosis. Government support, increasing availability of trained professionals, and collaborations with global biotech firms are fueling regional adoption. Increasing prevalence of genetic and chronic diseases is also triggering greater use of NGS in clinical settings, fueling rapid market growth.

Europe is witnessing strong next-generation sequencing library preparation market growth, driven by increased government funding for genomics research, increases in precision medicine programs, and increased uptake of NGS in the clinical diagnostics space. Germany, the U.K., and France are some of the leading countries for adoption, driven by genomic programs conducted on a national basis and strong academic–industry collaborations. In addition, the growing demand for high-throughput and automated library preparation processes is propelling the uptake of NGS and further driving it into healthcare and research institutions in the region.

The Middle East & Africa (MEA) and Latin America are showing modest growth in the next-generation sequencing library preparation market trends due to the incremental development of biotechnology infrastructure and increasing awareness of the use of genomes. In Latin America, increased government and academic attention to genomics for public health and cancer research is underpinning the adoption of NGS workflows. Similarly, in MEA, attempts at building precision medicine, with an emphasis on Saudi Arabia and the UAE, are driving a continued increase in demand for next-generation library preparation solutions market trends.

Next-generation Sequencing Library Preparation Market Key Players:

The next-generation sequencing library preparation companies are Illumina, Thermo Fisher Scientific, Agilent Technologies, F. Hoffmann-La Roche, QIAGEN, New England Biolabs, Pacific Biosciences, Oxford Nanopore Technologies, Beckman Coulter, Hamilton Company, and other players.

Recent Developments:

-

February 2025 – Roche launched its revolutionary Sequencing by Expansion (SBX) technology, ushering in a new class of next-generation sequencing. Roche's patented SBX chemistry, when combined with Roche's sensor module, facilitates ultra-fast, high-throughput sequencing that is flexible and scalable, addressing a broad spectrum of genomic applications.

-

May 2024 – QIAGEN introduced the QIAseq Multimodal DNA/RNA Library Kit, which simplifies preparing both DNA and RNA libraries from one sample. The kit is compatible with several next-generation sequencing (NGS) applications, such as whole-genome sequencing (WGS), whole-transcriptome sequencing (WTS), and hybrid-capture-based target enrichment.

Next-generation Sequencing Library Preparation Market Report Scope:

Report Attributes Details Market Size in 2024 USD 1.79 Billion Market Size by 2032 USD 4.83 Billion CAGR CAGR of 13.30 % From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Sequencing Type (Targeted Genome Sequencing, Whole Genome Sequencing, Whole Exome Sequencing, Other Sequencing Types)

• By Product (Reagents & Consumables, Instruments)

• By Application (Drug & Biomarker Discovery, Disease Diagnostics, Others)

• By End Use (Hospitals and Clinics, Academic and Research Institutions, Pharmaceutical and Biotechnology Companies, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Illumina, Thermo Fisher Scientific, Agilent Technologies, F. Hoffmann-La Roche, QIAGEN, New England Biolabs, Pacific Biosciences, Oxford Nanopore Technologies, Beckman Coulter, Hamilton Company, and other players.