Antibody Production Market Report Scope & Overview:

Get more information on Antibody Production Market - Request Sample Report

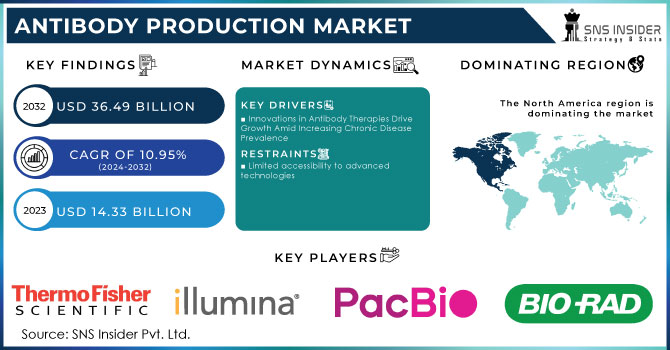

The Antibody Production Market size was estimated at USD 14.33 billion in 2023 and is expected to reach USD 36.49 billion by 2032 at a CAGR of 10.95% during the forecast period of 2024-2032.

The antibody production is experiencing a surge in demand which is driven by factors like the rising prevalence of chronic diseases like cancer, autoimmune disorders, increasing adoption of targeted therapies, and a growing focus on R&D in the pharmaceutical and biotechnology sectors. The process of antibody production can take eight weeks or more due to numerous steps with potential delays and challenges. From outsourcing gene synthesis to subcloning, transfection, cell culture, and purification, each stage introduces roadblocks. Choosing the right cell line and optimizing purification based on specific antibody properties add further complexity. This time-consuming process creates a gap between demand and efficient supply. Doctors need faster and more reliable methods for antibody production. With an estimated 1.9 million new cancer cases diagnosed in the United States alone in 2022 and projections of millions more worldwide by 2040, the need for effective therapies is critical. Monoclonal antibodies, precision-engineered to target specific cancer cells, have emerged as a cornerstone in cancer treatment. This escalating demand is fueling rapid growth in the antibody production industry. Although Autoimmune diseases affect a staggering 8% of the U.S. population, with over 24 million people impacted.

Technological advancements such as advanced cell culture, automation, and computational design can significantly enhance efficiency and yield. Simultaneously, government support through increased research funding, tax incentives, and streamlined regulations can foster innovation and industry growth. By harmonizing these elements, the antibody production process can be transformed into a rapid, cost-effective, and accessible platform, propelling scientific discovery and therapeutic development.

Companies like Biointron offer a solution by integrating gene synthesis and antibody production under one roof. This eliminates outsourcing delays and safeguards seamless communication between stages. Their optimized approach using efficient cell lines and methods can deliver antibodies within 1-2 weeks, significantly reducing research timelines.

The antibody production market demands faster turnaround times. Companies like Biointron demonstrate the potential for optimizing and integrating the process. Further innovations and potentially government support could lead to even more efficient and streamlined antibody production, ultimately benefiting scientific research and drug development.

MARKET DYNAMICS

Drivers

- Innovations in Antibody Therapies Drive Growth Amid Increasing Chronic Disease Prevalence

The escalating prevalence of chronic diseases, such as cancer and autoimmune disorders, has created a pressing need for targeted therapies. Antibodies, with their high specificity and efficacy, have emerged as a cornerstone in treating these complex conditions. Moreover, advancements in biotechnology, including recombinant DNA technology and high-throughput screening, have significantly enhanced antibody development and production efficiency, driving down costs and accelerating time-to-market. The growing emphasis on personalized medicine has also contributed to market expansion, as antibodies can be tailored to individual patient characteristics. Additionally, the therapeutic applications of antibodies are expanding beyond traditional indications, opening up new market opportunities. Substantial investments in research and development are fueling innovation and the discovery of novel antibody-based treatments. To meet the rising demand, contract manufacturing organizations (CDMOs) are playing a crucial role by providing specialized antibody production services, enabling companies to focus on research and development while outsourcing manufacturing complexities.

Restraints

- Limited accessibility to advanced technologies

Developing regions face challenges in adopting advance antibody production methods due to infrastructure and resource constraints.

Key Segmentation

By Product

In 2023, Consumables segment held the highest market share of 56.0%. Consumables encompass a wide range of goods utilized in the manufacturing of antibodies, such as reagents, kits, media, buffers, and other materials. As the demand for antibodies for research, diagnostics and therapies grow, so makes the demand for consumables. Furthermore, the growing use of automated systems for antibody production has aided the expansion of the consumables segment.

By Process

In 2023, Downstream Processing segment held the dominated market share of 67.2% and is anticipated to expand with the faster CAGR during the forecast period. The procedure is involved in ensuring antibody quality, safety, efficacy, purity, and identification. Furthermore, numerous technology improvements assist the downstream process in maintaining efficiency, thus boosting innovations in bio-manufacturing. Single-use sensors, membrane chromatography technologies, remote monitoring and data analytics are among the most recent innovations in processing.

By Type

In 2023, the monoclonal antibody segment dominated the market growth of 23.5% and expected to have the higher CAGR of 13.6% during the forecast period due to increasing investments in research on monoclonal antibodies as well as the different novel launch of antibody-based pharmaceuticals. For example, Eli Lilly, a US-based pharmaceutical corporation, committed almost USD 1.0 billion in March 2023 for a monoclonal antibody (mAbs) manufacturing unit in Ireland, with the goal of producing novel clinical treatments by 2026.

By End User

In 2023, Pharmaceutical and Biotechnology Companies segment are expected to dominate the market growth of 55.1% during the forecast period owing to the expanding types of biopharmaceutical companies in the manufacture of antibodies. Pharmaceutical and biotechnology businesses have been at the forefront of the sector, with many of the market leaders investing considerably in R&D. These companies have access to enormous financial resources as well as cutting-edge technology, allowing them to develop novel solutions that address the changing needs of healthcare practitioners and patients.

Regional Analysis

North America held a significant market share growing with a CAGR of 38.5% in 2023 due to the existence of important biopharmaceutical and biotechnology businesses in the United States and Canada. Furthermore, increasing investments in medication development and research, as well as healthcare infrastructure, support market expansion throughout the region. Furthermore, biopharmaceutical adoption is increasing in North America, which is fuelling demand for antibody production. Because of their specificity, efficacy and safety, biopharmaceuticals are becoming increasingly popular, and antibodies are a type of biopharmaceutical that is used to treat a variety of disorders. Furthermore, according to a February 2023 article published by the American Chemical Society, pharmaceutical companies are making significant investments in developing their technology, such as AI technology, which will aid in accelerating the speed of the drug development process, lowering the cost of bringing new drugs to market.

Asia-Pacific is witness to expand fastest CAGR rate of 16.2% during the forecast period owing to the untapped opportunities in this region. Also, the factors such as increasing investment in research and development activities, growing demand for therapeutics and diagnostics, and a rising aging population drive the growth of the market. Moreover, the increasing prevalence of chronic diseases such as cancer, autoimmune disorders, and infectious diseases is driving the demand for antibody-based therapies and diagnostics.

Need any customization research on Antibody Production Market - Enquire Now

Key Players

The major players are Illumina, Inc., Thermo Fisher Scientific, Inc., Pacific Biosciences of California, Inc., Bio-Rad Laboratories, QIAGEN, Agilent Technologies, PerkinElmer, Inc., ProPhase Labs, Inc. (Nebula Genomics), Novartis, Psomagen, Azenta Inc., and Others.

RECENT DEVELOPMENTS

In February 2023, Thermo Fisher Scientific, Inc. established a partnership with Elektrofi to enhance biologics production capabilities for planned clinical trials of therapeutic proteins, monoclonal antibodies, and other large molecule drugs.

In December 2022, Bio-Rad Laboratories, Inc. introduced the first antibody discovery platform. This newly launched antibody discovery service is specifically designed to develop best-in-class biologic candidates. This strategy aided the organization in expanding its service offering and customer base.

| Report Attributes | Details |

| Market Size in 2023 | US$ 14.33 Billion |

| Market Size by 2032 | US$ 36.49 Billion |

| CAGR | CAGR of 10.95% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Consumables, Software) • By Process (Upstream Processing, Downstream Processing) • By Type (Monoclonal Antibody, Polyclonal Antibody) • By End User (Pharmaceutical and Biotechnology Companies, Research Laboratories, CROs and CDMOs) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Illumina, Inc., Thermo Fisher Scientific, Inc., Pacific Biosciences of California, Inc., Bio-Rad Laboratories, QIAGEN, Agilent Technologies, PerkinElmer, Inc., ProPhase Labs, Inc. (Nebula Genomics), Novartis, Psomagen, Azenta US, Inc. |

| Key Drivers | • Growing chronic disease along with an increasing elderly population |

| Market Opportunity | • Rising approvals for monoclonal antibodies |