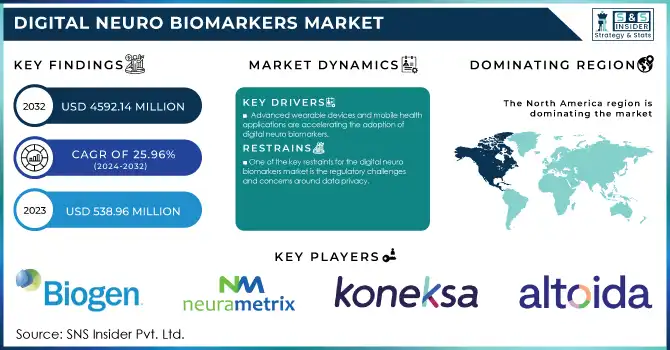

Digital Neuro Biomarkers Market Size & Overview:

The Digital Neuro Biomarkers Market was valued at USD 538.96 million in 2023 and is projected to reach USD 4592.14 million by 2032, growing at a CAGR of 25.96% from 2024-2032. The market for digital neuro biomarkers is growing exponentially as a result of increasing neurological disorders, advancements in technology, and the growing demand for personalized healthcare solutions. These are essentially used for the diagnosis, monitoring, and tracking of the progression of various neurological conditions such as Parkinson's disease, Alzheimer's disease, multiple sclerosis, and epilepsy. Furthermore, real-time data as well as deeper insights into a patient's health condition are fuelling the adoption of digital neuro biomarkers across health care settings.

To get more information on Digital Neuro Biomarkers Market - Request Free Sample Report

The main cause that is driving market growth is due to the rise in neurological disorders. According to the World Health Organization, diseases related to this area are one of the highest causes of disablement in people worldwide. The World Health Organization (WHO) reports that approximately 24 million people globally are diagnosed with Alzheimer's disease and other forms of dementia. However, the total number of individuals affected by dementia is believed to be significantly higher, with over 55 million people impacted worldwide.

Advances in wearables, mobile applications, and artificial intelligence also play a huge role in driving market expansion. Wearables, such as smartwatches and fitness bands, integrated with digital neuro biomarkers, track neurological conditions in real time. A good example would be Revibe Technologies' wearable reminder system has improved attention span and on-task behavior among children suffering from ADHD to a great extent.

Mobile-based applications are also anticipated to grow in leaps and bounds as a result of increased usage of smartphones, health-oriented applications, and the ability to collect high-frequency data inexpensively, allowing patients to easily monitor the disease's progression from home and reduce symptoms. Among the main recent developments are collaborations and partnerships among key players in advancing digital biomarker solutions. For instance, in May 2024, RCSI teamed up with Head Diagnostics for clinical trials that aim to improve how multiple sclerosis is judged through digital biomarkers. Therefore, all these developments and updates are anticipated to continue driving the growth of the market over the following years.

Digital Neuro Biomarkers Market Dynamics

Drivers

-

The rising prevalence of neurological disorders is the key driver expected to drive the growth of the digital neuro biomarker market.

Conditions like Alzheimer's and Parkinson's disease are increasingly common as the global population ages, and neurological disease claims nearly 6.8 million lives each year, according to the World Health Organization (WHO). For example, a 2022 report from the Parkinson’s Foundation found that roughly 90,000 new cases of Parkinson’s disease are diagnosed each year in the U.S. That’s roughly a 50 percent jump from prior estimates. The incidence of these diseases is increasing, leading to a growing demand for early diagnosis, monitoring, and management, which could be solved by digital neuro biomarkers. The downstream biomarkers have the added benefit of teaching us more continuous data points, giving us live analytics on their health status, and are instrumental for individualized medication regimes and preemptive treatments.

-

Advanced wearable devices and mobile health applications are accelerating the adoption of digital neuro biomarkers.

Wearables, such as smartwatches and fitness trackers, are increasingly integrated with neuro biomarkers to monitor cognitive and neurological conditions in real time. Mobile applications that enable real-time monitoring of neurological health also play a key role in the growth of this market. These apps collect high-frequency data at a lower cost and are easily accessible to patients. For example, the virtual reality platform NeuroTrainer has improved concentration and cognitive function, which has already had positive effects on at-risk students. Integration of wearables with mobile applications has made the management and monitoring of neurological conditions more accessible and outside traditional clinical settings, increasing market demand further.

Restraint

-

One of the key restraints for the digital neuro biomarkers market is the regulatory challenges and concerns around data privacy.

The particular biomarker essentially collects health-related data from an individual which happens to include their cognitive as well as neurological profile, appropriate compliance with certain norms in almost every region has become inevitable. The regulatory approval process for medical devices and digital health technologies is quite complex and time-consuming, hence delaying product development and market entry. For instance, in the U.S., medical devices like those with a digital biomarker have to go through FDA approval, which calls for extensive clinical trials and proof of safety and efficacy.

Besides, collecting, storing, and transferring personal health data has also created critical concerns about data security and privacy. Due to stringent data protection regulations like GDPR in Europe and HIPAA in the United States, companies have to make sure that their digital solutions meet the criteria for not violating the regulation in any form. The complexities that will be associated with compliance with regulatory and privacy standards might delay the fast-paced adoption and scaling of neuro biomarkers in digital media across different geographical locations.

Digital Neuro Biomarkers Market Segmentation Insights

By Type

The wearable segment dominated the market with the largest market share of 38% in 2023. That's because consumers are demanding more wearables that enable them to monitor data on the go. The rise in the field of wearables and smart devices is thus consistently fueling the growth of the segment. The Wearable Reminder System, developed by Revibe Technologies, is designed specifically to improve focus in children with attention deficit hyperactivity disorder (ADHD) by tracking on-task behavior and providing coaching reminders when a child is inattentive. In one initial trial, results showed a 25-minute increase in attention span and a 19% increase in on-task behavior over three weeks of use.

The mobile-based application segment is projected to witness the fastest CAGR during the forecast period. The emergence of this segment is driven primarily by the rapid penetration of smartphones and the improvement of wearable technologies forming a perfect platform for health applications. These applications enable real-time monitoring of neurological conditions, providing an easy and cost-effective method to Attain high-frequency data critical for symptom management and disease progression monitoring. To illustrate, the virtual reality platform NeuroTrainer originally designed as a sports training tool will be adapted to improve focus and attention, and therefore academic performance, among at-risk middle and high school students.

By Clinical Practice

The Diagnostic Psychiatric Digital Biomarkers segment dominated the market with the largest market share of 28% in 2023. Diagnostic biomarkers are essential in the identification or confirmation of a disease and/or disease subtype, which is vital for diagnosis. The subtypes of the disease can be defined further by biomarkers by improving their classification, hence improving the diagnostics of the patients. The market presence of key players will increase with the launch of new products in this segment. For instance, in May 2024, RCSI collaborated with Head Diagnostics, a company based in Dublin, to conduct a clinical trial on improving the assessment and monitoring of multiple sclerosis. The study examines the possibility of new digital biomarkers in monitoring the disease. In June 2022, Rune Labs, a precision neurology company, announced that its StrivePD software platform for Parkinson's disease was granted 510(k) clearance by the U.S. FDA, which allows the collection of patient symptom data through Apple Watch measurements.

Monitoring Psychiatric Digital Biomarkers is expected to grow at the fastest rate during the forecast period due to monitoring digital biomarkers provides a real-time, all-encompassing view of a patient's health, which is crucial for delivering personalized healthcare. With the possibility of continuous monitoring of mobility and other health parameters beyond the walls of the clinics, digital biomarkers can reveal information that gives instantaneous insight into the patient's state of health.

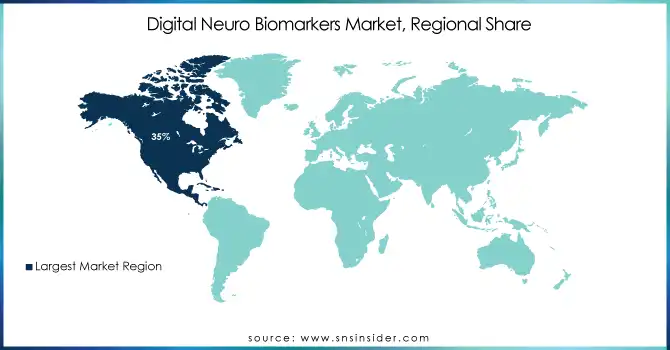

Digital Neuro Biomarkers Market Regional Analysis

In 2023, North America dominated the market for digital neuro biomarkers with a share of 35% of the total market. Rising demand for diagnosis of neurological conditions has been an important factor fueling this growth. The high prevalence of neuro disorders, a rapidly aging population, large expenditure on neurological treatment within healthcare settings, and a positive reimbursement policy toward neuro-diagnostic procedures.

The Asia Pacific digital neuro biomarkers market is expected to show the fastest growth throughout the forecast period. The market is growing due to various strategies adopted by key players, such as launching products for neurological conditions, forming partnerships, and engaging in mergers and acquisitions. For instance, Lumos Labs is using a massive dataset from tens of millions of adults who have completed billions of cognitive tasks on its Lumosity platform to enhance cognitive performance through digital interventions. This data is being used to develop digital biomarkers that are meant to predict, diagnose, and monitor cognitive issues related to conditions such as ADHD, multiple sclerosis, and many others.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

-

Altoida Inc. (Neuro Motor Index, Digital Cognitive Assessment Platform)

-

Koneksa (Koneksa Compare, Mobile Neurocognitive Tests)

-

Biogen Inc (MS Performance Test, CogEval)

-

Roche (Navify Algorithm Suite, Remote Patient Monitoring)

-

NeuraMetrix (Typing Biometrics, NeuraMetrix Dashboard)

-

Merck KGaA (Syntropy, Digital Biomarker Discovery)

-

Linus Health (Digital Cognitive Assessment, Brain Health Platform)

-

Neurotrack Technologies, Inc. (Memory Health Program, Eye Tracking Assessment)

-

Empatica Inc. (EmbracePlus, Aura)

-

Eyenuk (EyeArt AI System, EyeMark)

-

BioSensics (PAMSys, LEGSys)

-

ActiGraph LLC (CentrePoint Insight Watch, ActiLife Software)

-

Aural Analytics (Speech Vitals, A2E Platform)

-

Sonde Health, Inc. (Sonde Mental Fitness, Sonde Respiratory

-

Quibim (QP-Brain, QP-Prostate)

-

IXICO plc (TrialTracker, Assessa)

-

Huma (Disease Agnostic Platform, Digital Biomarker Discovery)

-

Feel Therapeutics (Feel Emotion Sensor, Digital Therapeutics Platform)

-

Brainomix (e-Stroke Suite, e-CTA)

-

Kinsa Inc. (Kinsa Smart Thermometers, HealthWeather)

Key suppliers

These suppliers enable the manufacturing, functionality, and scalability of innovative digital neuro biomarker solutions.

-

Intel Corporation Suppliers

-

Texas Instruments Suppliers

-

STMicroelectronics Suppliers

-

Qualcomm Technologies, Inc. Suppliers

-

Bosch Sensortec Suppliers

-

Honeywell International Inc. Suppliers

-

Medidata Solutions Suppliers

-

Flex Ltd. Suppliers

-

Garmin Health Suppliers

-

Analog Devices, Inc. Suppliers

Recent Developments

-

March 2024: Indivi, a leading MedTech company based in Basel, Switzerland, announced a strategic collaboration with Biogen to drive innovation in digital health technologies and develop advanced digital biomarkers for Parkinson’s disease. As part of this agreement, Biogen has licensed its Konectom platform to Indivi. Konectom, a cutting-edge smartphone-based digital biomarker system, facilitates remote neurological function assessments, enabling precise and frequent tracking of disease progression.

-

March 2024: Merck has joined the LEARNS observational study, aimed at exploring the role of digital biomarkers in assessing and predicting the progression of Parkinson’s disease. The partnership, led by healthcare technology company Koneksa, grants Merck real-time access to comprehensive data and results throughout the study. This initiative underscores Merck’s commitment to advancing research in neurodegenerative diseases.

-

February 2024: Koneksa, a leader in digital biomarker technology, announced the enrollment of the first patient in the LEARNS study, an observational research initiative. The study aims to evaluate the reliability and responsiveness of digital biomarkers over time using mobile and wearable-based assessments. By improving signal detection, the study seeks to support the development of disease-modifying therapies for neurodegenerative conditions, including Parkinson’s disease.

-

July 2023: Linus Health, a pioneer in digital health solutions for the early detection of Alzheimer’s and other dementias, shared results from eight new studies at the 2023 Alzheimer’s Association International Conference. The findings validate the company’s AI-enhanced digital cognitive assessment technology, demonstrating its superior accuracy compared to traditional paper-based tests in detecting mild cognitive impairment (MCI) and dementia. Additionally, the studies highlight the seamless transition of Linus Health’s solutions from research settings to clinical practice, reinforcing their practical application in real-world healthcare.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 538.96 million |

| Market Size by 2032 | US$ 4592.14 million |

| CAGR | CAGR of 25.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Mobile-based Applications, Wearable, Sensors, Others) • By Clinical Practice (Diagnostic Psychiatric Digital Biomarkers, Monitoring Psychiatric Digital Biomarkers, Predictive and Prognostic Psychiatric Digital Biomarkers, Others) • By End Use (Healthcare Companies, Healthcare Providers, Payers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Altoida Inc., Koneksa, Biogen Inc., Roche, NeuraMetrix, Merck KGaA, Linus Health, Neurotrack Technologies, Inc., Empatica Inc., Eyenuk, BioSensics, ActiGraph LLC, Aural Analytics, Sonde Health, Inc., Quibim, IXICO plc, Huma, Feel Therapeutics, Brainomix, Kinsa Inc., and other players. |

| Key Drivers | •The rising prevalence of neurological disorders is the key driver expected to drive the growth of the digital neuro biomarker market. •Advanced wearable devices and mobile health applications are accelerating the adoption of digital neuro biomarkers. |

| Restraints | •One of the key restraints for the digital neuro biomarkers market is the regulatory challenges and concerns around data privacy. |