Midline Catheter Market Report Scope & Overview:

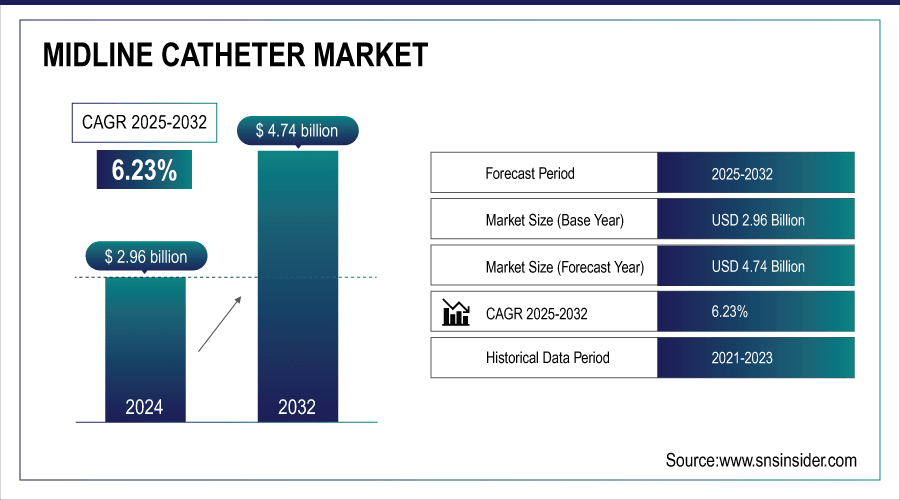

The Midline Catheter Market was valued at USD 2.96 billion in 2024 and is expected to reach USD 4.74 billion by 2032, growing at a CAGR of 6.23% over the forecast period of 2025-2032.

The global midline catheter market is expanding because of the increasing incidence of chronic diseases, including diabetes, cancer, and cardiovascular diseases, that need repeated or extended IV therapy. Midline catheters provide a safer medium-term solution and pose less risk of infection, notably in the outpatient and home care settings. One of the key midline catheters market trends is the growing demand for cost-effective and infection-preventing vascular access, driven by the aging population and economic developments in the APAC region.

For instance, in March 2025, the WHO reported that chronic diseases cause over 74% of global deaths, highlighting increased demand for midline catheters to support long-term intravenous therapy needs.

To Get More Information On Midline Catheter Market - Request Free Sample Report

Key Midline Catheter Market Trends

-

Ultrasound-guided midline catheter placement is becoming the standard of care. It minimizes insertion errors, reduces infection risks, and supports broader adoption in both acute and outpatient settings.

-

Disposable and antimicrobial-coated midline catheters are in high demand. These innovations lower catheter-related bloodstream infections (CRBSIs) and align with hospital infection-control mandates.

-

Rising home infusion therapy adoption increases the need for midline catheters as safer alternatives to PICCs. They support antibiotics, hydration, and pain management without the risks of central lines.

-

Rapid healthcare infrastructure expansion in Asia-Pacific, Latin America, and the Middle East fuels market growth. Government investments in infection prevention and localized manufacturing are accelerating the adoption of midline catheters.

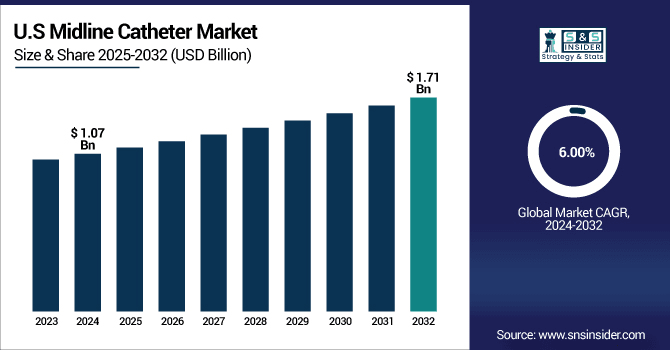

The U.S. Midline Catheter Market was valued at USD 1.07 billion in 2024 and is expected to reach USD 1.71 billion by 2032, growing at a CAGR of 6.00% over 2025-2032.

The U.S. midline catheter market is dominated by high clinical knowledge and robust product development. Recommendations over CDC and INS drive adoption, as do extras including anti-microbial linings and ultrasound-guided insertion, which are associated with improved outcomes. This combination creates growth and premium pricing. Key Players Based on the midline catheter market analysis, the U.S. is leading the market through innovation-driven competitive and institutional acceptance.

Midline Catheter Market Growth Drivers:

-

Hospitals are Driving the Midline Catheter Market Growth

A hospital is a major contributor to the midline catheter market share due to the high number of patients, critical care requirements, and emphasis on safety and ease during treatment. Midline catheters are used for medium-term IV therapy in oncology and surgical departments, providing fewer complications and procedural demands. Their clinical footprint and guideline-based nature make them widely applicable in inpatient practice.

For instance, in April 2024, the AHA reported that over 78% of hospitalized patients required IV therapy exceeding five days, increasing hospitals' reliance on midline catheters for safer access.

Midline Catheter Market Restraints:

-

Complication Risks are a Significant Restraint on the Midline Catheter Market Growth

Potential complications of midline catheters, including infections, thrombosis, and catheter dislodgement, hinder midline catheter market growth due to safety issues, high costs, and the need for specialized training. These are barriers to uptake, especially in low-resourced settings. However, such problems are being dealt with by newer solutions, including antimicrobial coatings and ultrasound-guided insertions, which are in turn instrumental in improving the prospects of safety and influencing the pattern of the midline catheter market growth.

Midline Catheter Market Opportunities:

-

Integration with Digital Health Creates Lucrative Opportunities for Innovative Testing Equipment

The convergence of midline catheters and digital health solutions creates robust growth potential. With the ability to monitor patient outcomes related to catheter function, dwell time, and complications in real-time, the healthcare team can increase patient safety, decrease the rate of infections, and improve care pathways. This digital connectivity also enables data-driven decision-making, predictive maintenance, and protocol compliance for the hospital, which makes midlines more appealing.

For instance, in October 2024, China reported a 28% rise in midline catheter use, driven by growth in home infusion and government initiatives aimed at preventing infections.

Midline Catheter Market Segment Analysis

-

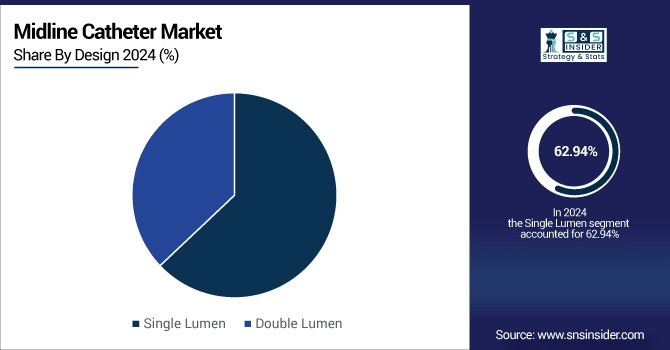

By design, single lumen led the midline catheter market with a 62.94% share in 2024, while double lumen is the fastest-growing segment with a CAGR of 6.35%.

-

By product type, the midline catheter dominated the market with 58.80% share in 2024, whereas the midline catheter kit segment is expected to grow fastest with a CAGR of 6.23%.

-

By material, polyurethane led the market with 84.94% share in 2024, while silicone is registering the fastest growth with a CAGR of 6.78%.

-

By end user, hospitals held a 37.86% share in 2024, while ambulatory surgical centers (ASCs) are growing the fastest with a CAGR of 6.75%.

By Design, Single Lumen Leads Market While Double Lumen Registers Fastest Growth

In 2024, single-lumen leads the midline catheter market, holding the largest share as they are less expensive, involve less infection risk, and are easily inserted and maintained. Commonly used for short to mid-term intravenous therapies, they are commonly used for outpatient and home therapies. Double Lumen is registering the fastest growth, driven by the increasing requirements for multiple drug infusions in parallel for intensive care and oncology. They are versatile and support all complex treatments and can be used repeatedly to avoid multiple insertions.

By Product Type, Midline Catheter Dominates While the Midline Catheter Kit Shows Rapid Growth

By product type, the midline catheter dominates the midline catheter market, as it provides an excellent combination of peripheral and central access, with a lower risk of infection and prolonged dwell times. They are extensively used for IV antibiotic therapy, hydration, and analgesia. The midline catheter kit is showing rapid growth driven by an increasing requirement for simplified, preassembled systems that minimize procedure time and the risk of infection. These packs enhance clinical productivity since they contain everything necessary for a safe insertion.

By Material, Polyurethane Leads While Silicone Registers Fastest Growth

By material, polyurethane leads the midline catheter market owing to its excellent biocompatibility, flexibility, and mechanical properties. Easy to insert and with low vein irritation, it is intended for medium-term vascular access. It is both strong and kink-resistant, which minimizes the risk of catheter failure for greater patient safety and clinician preference. While silicon is registering the fastest growth, owing to its good biocompatibility and low risk of allergic response or tissue irritation. Its softer composition is indicated for the patient who needs a catheter for longer periods. Increasing preference for patient comfort and increased treatments towards chronic diseases are propelling the use of silicone midline catheters in different healthcare facilities.

By End User, Hospitals Lead While Ambulatory Surgical Centers (ASCs) Grow Fastest

By End User, hospitals lead the midline catheter market, owing to high numbers of patients, sophisticated facilities, and qualified staff. These settings are most useful for monitoring, catheter placement, and complication intervention. Whereas ambulatory surgical centers (ASCs) are growing the fastest as a result of a trend towards outpatient treatment, cheaper forms of treatment, and shorter hospital stays. Advantages for ASCs include reduced infection risk, along with ease of insertion with midline catheters.

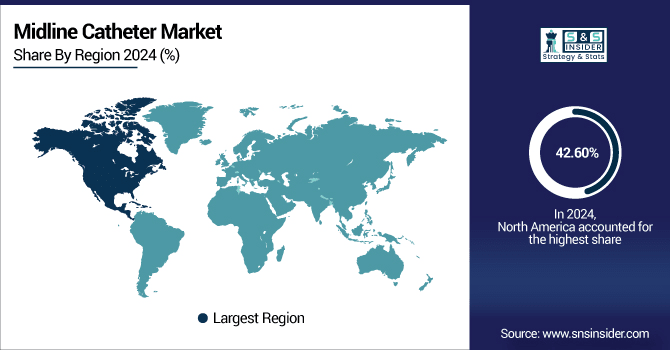

Midline Catheter Market Regional Analysis:

North America Midline Catheter Market Insights

In 2024, North America dominated the midline catheter market and accounted for 42.60% of the revenue share. owing to the well-established healthcare system, increasing utilization of vascular access products, and the presence of the major market players. The region is advantageously funded by the reimbursement system, with Strong awareness of clinicians and increasing demand for cost-effective, medium-term intravenous treatments. The growing incidence of chronic diseases and a higher number of hospital admissions that require smooth venous access are also fuelling the demand.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Midline Catheter Market Insights

The U.S. midline catheter market is dominated by high clinical knowledge and robust product development. Recommendations from the CDC and INS drive adoption, as do extras, including antimicrobial linings and ultrasound-guided insertion, which are associated with improved outcomes.

Asia-Pacific Midline Catheter Market Insights

Asia-Pacific is expected to witness the fastest growth in the midline catheter market over 2025-2032, with a projected CAGR of 6.12% owing to the growing healthcare sector, increasing awareness about patients, and an upsurge in the number of chronic diseases that demand IV therapies. Nations including China, India, and Japan are experiencing an increase in the number of hospital admissions and outpatient procedures, which is increasing the demand for more affordable and safer vascular access devices. The use of midline catheters is becoming more widespread as governments invest in public health and the use of minimally invasive methods increases.

China Midline Catheter Market Insights

China accounts for the largest share of the regional market due to growing healthcare infrastructure and increasing demand for affordable IV therapy products. Government efforts to promote infection control and local manufacturing have helped increase adoption. Midline catheters are increasingly being preferred over PICCs for intermediate therapies by hospitals.

Europe Midline Catheter Market Insights

The midline catheter market in Europe is growing significantly due to high healthcare expenditure, a growing number of hospital admissions, and increased knowledge of safer options for vascular access. Increased demand is driven by a move toward minimally invasive procedures, an aging population, and a greater incidence of chronic diseases. Moreover, EU-wide work to prevent CLABSIs favours the use of midline devices. Continuing technological developments and better training processes continue to drive market penetration rates within European hospitals.

Germany Midline Catheter Market Insights

The German market is the largest for midlines in Europe due to its high standard of healthcare and heavy emphasis on prevention of infection. Midline catheters are being more widely used as a safer, more cost-effective substitute for PICCs in intermediate therapies. Stringent regulations for hospital-acquired infection control and increasing need for outpatient and home-infusion therapies.

Latin America (LATAM) and Middle East & Africa (MEA) Midline Catheter Market Insights

The midline catheter market in Latin America is projected to grow at a relatively low rate, owing to increasing hospital expenditure and growing prevalence of home infusion therapy in countries including Brazil and Mexico. Adoption in the Middle East & Africa region is slow-paced, but it is growing and is being promoted in government healthcare modernization programs, infection control plans, and the rising appeal of cost-effective alternatives to central venous catheters.

Midline catheter market for Competitive Landscape:

BD is a world leader in vascular access, providing a range of advanced midline catheters featuring antimicrobial coatings and safety technology. The company focuses on infection prevention, clinician efficiency, and system adoption in hospitals, clinics, and home health.

-

In March 2024, BD launched an AI-assisted midline catheter system, enhancing placement accuracy and reducing bloodstream infections in hospitals and outpatient care settings.

Teleflex offers advanced vascular access devices, such as midline catheters, that are intended for longer dwell times and fewer complications. The company specialises in ultrasound-guided insertion, infection control technologies and international expansion, specifically in the emerging markets, where there is a rising demand for infusion therapy.

-

In January 2025, Teleflex introduced antimicrobial-coated midline catheters with longer dwell times, lowering infection risks and supporting home infusion therapy expansion in Europe and Asia-Pacific.

Smiths Medical, a division of ICU Medical, provides top-performing midlines for intravenous therapy. Dover Medical & Scientific carries both high-quality reusable cabinets and premium disposables, providing all of your vascular access needs.

-

In July 2024, Smiths Medical released ultrasound-guided midline catheters, enabling safer, faster insertions and wider adoption for intermediate intravenous therapies in acute and outpatient facilities.

Midline Catheter Market Key Players:

Some of the midline catheter market Companies

-

Becton, Dickinson and Company

-

Teleflex Incorporated

-

Smiths Medical

-

Medical Components Inc.

-

AngioDynamics Inc.

-

Vygon Group

-

Argon Medical Devices

-

Access Vascular Inc.

-

Cook Medical

-

B. Braun Melsungen AG

-

Tangent Medical Technologies

-

Pajunk GmbH

-

Nipro Corporation

-

Greiner Bio-One

-

Ameco Medical Industries

-

PerSys Medical

-

Merit Medical Systems

-

Samtronic

-

Amsino International, Inc.

-

NewTech Medical Devices

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.96 billion |

| Market Size by 2032 | USD 4.47 billion |

| CAGR | CAGR of 6.07% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | "• By Design (Single Lumen, Double Lumen) • By Product Type (Midline Catheter, Midline Catheter Kit) • By Material(Polyurethane, Silicone) •By End User (Hospitals, Ambulatory Surgical Centers (ASCs), Speciality Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company, Teleflex Incorporated, Smiths Medical, Medical Components Inc., AngioDynamics Inc., Vygon Group, Argon Medical Devices, Access Vascular Inc., Cook Medical, B. Braun Melsungen AG, Tangent Medical Technologies, Pajunk GmbH, Nipro Corporation, Greiner Bio-One, Ameco Medical Industries, PerSys Medical, Merit Medical Systems, Samtronic, Amsino International, Inc., NewTech Medical Devices, and other players. |