Antimicrobial Susceptibility Testing Market Report Scope & Overview:

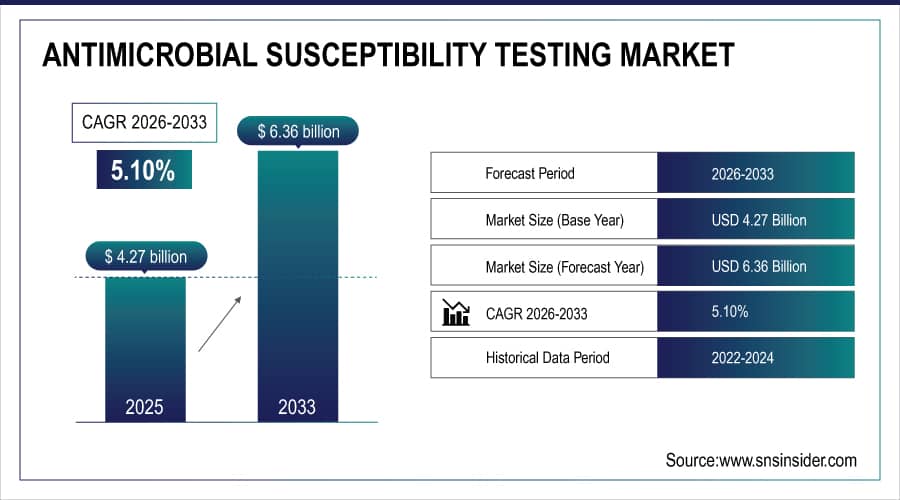

The Antimicrobial Susceptibility Testing Market size is estimated at USD 4.27 billion in 2025 and is expected to reach USD 6.36 billion by 2033, growing at a CAGR of 5.10% over 2026-2033.

The global antimicrobial susceptibility testing market trend is driven by the rising prevalence of antimicrobial resistance (AMR), which includes illnesses that are resistant to multiple drugs, infections that are acquired in hospitals, and microorganisms that are resistant to antibiotics in the community. This is happening because antibiotics are being overused, infection management is inadequate, and diagnostic access is limited. This trend is also supported by more awareness and faster diagnosis, as healthcare providers actively look for effective treatments and use modern testing methods. This is driving growth in both the global and domestic markets for automated and manual AST systems.

For instance, in March 2025, growing awareness of antimicrobial resistance and improved diagnostic capabilities drove a 12% increase in AST test volumes in North American hospitals, boosting early detection and adoption of rapid testing platforms.

Antimicrobial Susceptibility Testing Market Size and Forecast:

-

Market Size in 2025E: USD 4.27 billion

-

Market Size by 2033: USD 6.36 billion

-

CAGR: 5.10% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Antimicrobial Susceptibility Testing Market - Request Free Sample Report

Antimicrobial Susceptibility Testing Market Trends:

-

Rising antimicrobial resistance, hospital infections, and multidrug pathogens drive demand for rapid, accurate testing.

-

Patient-specific therapies based on pathogen ID, resistance, and infection history improve treatment efficacy.

-

Automated systems, molecular diagnostics, and AI analytics speed up testing and reduce turnaround times.

-

Lab management systems, telemedicine, and remote diagnostics aid early detection, stewardship, and treatment adherence.

-

Demand grows for rapid AST platforms, point-of-care devices, and high-throughput automated systems for clinical efficiency.

-

Partnerships among diagnostics, pharma, and research improve testing methods and clinical trial efficiency.

-

FDA, EMA, and local authorities promote standardized AST guidelines and public awareness of stewardship programs.

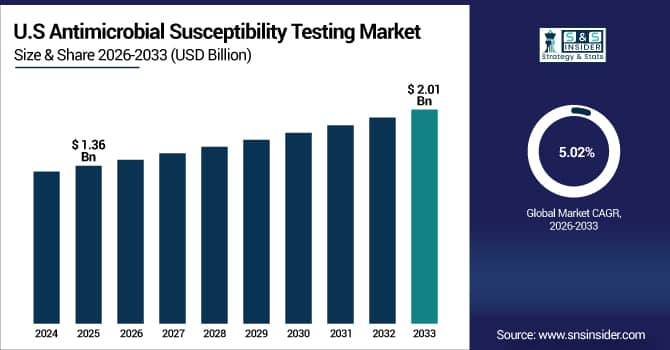

The U.S. Antimicrobial Susceptibility Testing Market is estimated at USD 1.36 billion in 2025 and is expected to reach USD 2.01 billion by 2033, growing at a CAGR of 5.02% from 2026-2033.

The U.S. has the biggest market share as drug-resistant diseases are common, people are very aware of antimicrobial stewardship, and the healthcare system is well-developed. Advanced diagnostic facilities, easy access to both automated and manual testing systems, and significant healthcare spending on infection management all help growth. The U.S. is also the biggest regional market in the world because of legislative support and early adoption of fast and molecular diagnostic technologies.

Antimicrobial Susceptibility Testing Market Growth Drivers:

-

Innovation in Automated Testing Systems is Driving the Antimicrobial Susceptibility Testing Market Growth

The introduction of AI-powered analytics, high-throughput platforms, and rapid molecular diagnostics for better accuracy in choosing antimicrobial therapy and improving patient outcomes has made innovative automated testing systems the main driver of growth in the antimicrobial susceptibility testing market. These solutions for drug-resistant and complicated illnesses are driving the industry's growth, expanding into hospitals and diagnostic labs, and increasing the market share globally.

For instance, in April 2025, automated AST systems and rapid molecular diagnostics accounted for ~22% of the total U.S. antimicrobial susceptibility testing sales, reflecting growing laboratory preference and expanding market share.

Antimicrobial Susceptibility Testing Market Restraints:

-

High Cost of Automated Systems and Lack of Skilled Professionals are Hampering the Antimicrobial Susceptibility Testing Market Growth

The expansion of the antimicrobial susceptibility testing market is hampered by the high cost of automated equipment and a shortage of qualified personnel because many healthcare facilities, especially those in developing nations, have limited funding and staff. This could result in less-than-ideal antimicrobial stewardship, a prolonged dependence on manual techniques, and a delayed adoption of cutting-edge technologies. As a result, in areas with limited advanced infrastructure and a shortage of qualified microbiologists, patient outcomes deteriorate and market expansion is slowed.

Antimicrobial Susceptibility Testing Market Opportunities:

-

Integration of AI and Machine Learning Drive Future Growth Opportunities for the Antimicrobial Susceptibility Testing Market

Predictive analytics, automated result interpretation, and resistance pattern recognition platforms present opportunities for the integration of AI and machine learning in the antimicrobial susceptibility testing market. These systems offer real-time surveillance of antimicrobial resistance trends, personalized treatment recommendations, and early diagnosis of developing resistance. These technologies have the potential to improve outcomes, optimize antibiotic use, and expand the market through improved antimicrobial stewardship, decreased turnaround times, and increased diagnostic accuracy, especially in regions with increasing infection burdens.

For instance, in September 2024, the GRAM Project reported that 39 million deaths are projected from antimicrobial resistance between 2025 and 2050, highlighting rising AMR prevalence and increasing demand for effective susceptibility testing solutions.

Antimicrobial Susceptibility Testing Market Segment Analysis:

-

By product, manual tests held the largest share of 51.32% in 2025E; automated instruments are expected to grow fastest at 5.68% CAGR.

-

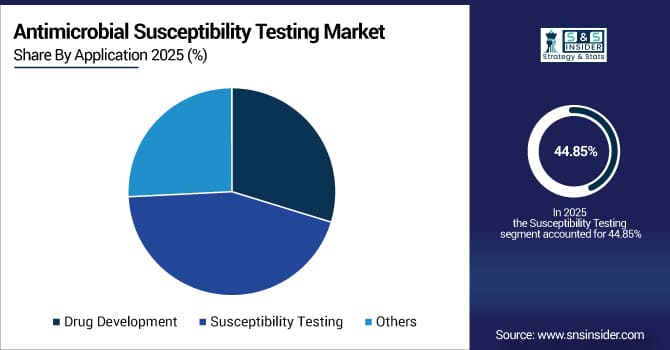

By application, susceptibility testing dominated with 44.85% share in 2025E; drug development is projected to grow fastest at 5.45% CAGR.

-

By technique, automated AST led with 38.12% share in 2025E; it is expected to grow fastest at 5.82% CAGR.

-

By end-use, hospitals led with 41.27% share in 2025E; diagnostic laboratories are forecasted to grow fastest at 5.38% CAGR.

By Product, Manual Tests Lead the Market, While Automated Instruments Register Fastest Growth

The manual tests segment held the highest revenue share of 51.32% in 2025, due to cost-effectiveness, ease of use, and wide adoption in resource-limited settings. Trends include growing use of MIC strips, susceptibility disks, and plates globally.

The automated instruments segment is expected to achieve the highest CAGR of 5.68% during 2026–2033, driven by demand for high-throughput testing, standardized results, and reduced human error. Key drivers include rising antimicrobial stewardship awareness, need for rapid turnaround, and availability of advanced automated platforms in developed healthcare markets.

By Application, the Susceptibility Testing Segment Dominates the Market, while the Drug Development Segment Shows Rapid Growth

The susceptibility testing segment held the largest revenue share of 44.85% in 2025, due to the need for guiding antimicrobial therapy. Drivers include increased patient awareness, timely diagnosis, physician preference for evidence-based treatments, and rising hospital-acquired infections.

The drug development segment is projected to grow at the highest CAGR of 5.45% during 2026–2033, fueled by pharmaceutical research on novel antimicrobials and susceptibility profiling in trials. Key factors are collaboration between pharma and diagnostics firms, regulatory requirements for companion diagnostics, and targeted antibiotic programs.

By Technique, Automated AST Leads the Market, and Registers Fastest Growth Globally

Automated AST held the largest share of the antimicrobial susceptibility testing market at 38.12%, due to high accuracy, reproducibility, and efficient handling of large sample volumes. Growth drivers include rising laboratory workloads, demand for standardized protocols, and integration with laboratory information systems. It is expected to grow fastest, at a CAGR of 5.82% during 2026–2033, as automated platforms deliver quicker results, reduce manual labor, and minimize interpretation errors. Wider adoption in hospitals and reference labs, plus AI-driven analytics, enhances workflow efficiency compared to manual methods.

By End-use, Hospitals Segment Dominated the Market, While the Diagnostic Laboratories Segment Grows the Fastest Globally

Hospitals held the largest revenue share of 41.27% in the antimicrobial susceptibility testing market in 2025, handling high patient volumes, severe infections needing rapid AST results, and comprehensive microbiology labs. Drivers include rising hospital-acquired infections, critical care needs, and antimicrobial stewardship programs.

The diagnostic laboratories segment is projected to register the highest CAGR of 5.38% during 2026-2033, due to increased outsourcing of specialized tests and growth of independent lab networks. Key factors include greater access to advanced testing platforms, high-throughput automated systems, and growing demand for specialized microbiology services from smaller healthcare facilities.

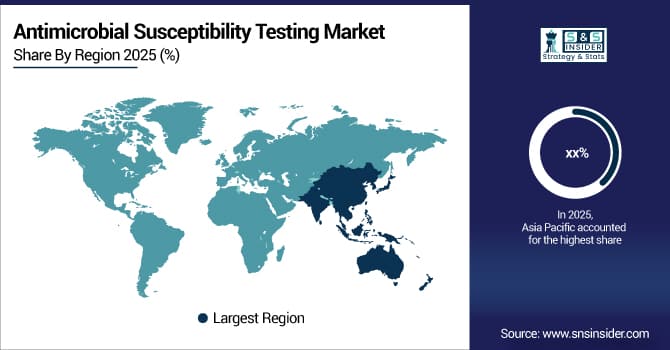

Antimicrobial Susceptibility Testing Market Regional Highlights:

Asia Pacific Antimicrobial Susceptibility Testing Market Insights:

Due to factors, such as growing awareness of antimicrobial resistance, the burden of infectious diseases, and the development of healthcare infrastructure in developing countries, the antimicrobial susceptibility testing market is expanding at the quickest rate in Asia Pacific, with a CAGR of 6.15%. Rapid urbanization, increased healthcare spending, and increased use of both automated and manual testing systems are some of the factors driving market expansion. Access to care has greatly improved as a result of the growth of telemedicine businesses and diagnostic laboratory networks, especially in rural and semi-urban areas. Early detection and adequate antibiotic therapy are also supported by government initiatives and infection control programs. Growth in the Asia Pacific region is also fueled by less testing expenses than in Western markets, as well as better accessibility and affordability of AST platforms.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Antimicrobial Susceptibility Testing Market Insights:

Due to high rates of antibiotic resistance, sophisticated healthcare infrastructure, and widespread stewardship program implementation, North America had the largest revenue share in the antimicrobial susceptibility testing market in 2025, at over 40.18%. Easy access to automated and manual testing systems, high diagnosis rates, robust insurance coverage, and the expanding use of molecular and fast diagnostics are some of the main motivators. Antimicrobial susceptibility testing products' market dominance and robust worldwide sales are also supported by government initiatives, CDC-led surveillance programs, and growing healthcare spending on infection prevention.

Europe Antimicrobial Susceptibility Testing Market Insights:

The growing incidence of multidrug-resistant illnesses, a strong healthcare system, and healthcare practitioners' increased knowledge of antimicrobial stewardship have made Europe the second-largest market for antimicrobial susceptibility testing after North America. The market is still growing steadily throughout important European nations due to increased use of automated and manual testing systems, sophisticated diagnostic technology, favorable reimbursement regulations, and EU-backed infection control programs.

Latin America (LATAM) and Middle East & Africa (MEA) Antimicrobial Susceptibility Testing Market Insights:

The growing incidence of drug-resistant illnesses and better access to diagnostic services, together with increased healthcare awareness, are driving the expansion of the antimicrobial susceptibility testing market in Latin America, the Middle East, and Africa. Early diagnosis and treatment are encouraged by the increasing use of point-of-care testing, laboratory expansion programs, and public health awareness campaigns. The market is still growing as a result of these areas' rapid urbanization and more government healthcare spending.

Antimicrobial Susceptibility Testing Market Competitive Landscape:

bioMérieux SA (est. 1963) is a global diagnostics leader focused on infectious disease management. It leverages R&D and strategic collaborations to develop advanced antimicrobial susceptibility testing platforms with automated and standardized capabilities.

-

In March 2025, bioMérieux received FDA 510(k) clearance for the VITEK® COMPACT PRO system, an integrated solution for microorganism identification and AST, improving lab efficiency and supporting antimicrobial stewardship.

Becton, Dickinson and Company (BD) (est. 1897) is a global medical technology company dedicated to enhancing healthcare through diagnostic systems. It invests in automated microbiology platforms to improve detection and management of drug-resistant infections with accurate and efficient results.

-

In April 2025, BD received FDA 510(k) clearance for the BD Phoenix M50 with the BDXpert System in the BD Synapsys Informatics suite, enabling faster clinical decisions through advanced data interpretation.

Thermo Fisher Scientific Inc. (est. 1956) is a global life sciences company with a strong focus on infectious disease diagnostics, including AST solutions. Its portfolio is supported by robust R&D and a strong presence across developed and emerging markets.

-

In June 2024, it expanded its Sensititre AST portfolio with new panels targeting multidrug-resistant pathogens, enhancing diagnostic strength and treatment guidance worldwide.

Antimicrobial Susceptibility Testing Market Key Players:

-

bioMérieux SA

-

Becton, Dickinson and Company (BD)

-

Thermo Fisher Scientific Inc.

-

Danaher Corporation

-

Bio-Rad Laboratories, Inc.

-

Bruker Corporation

-

F. Hoffmann-La Roche Ltd

-

Accelerate Diagnostics, Inc.

-

Merck KGaA

-

HiMedia Laboratories

-

Liofilchem S.r.l.

-

Alifax S.r.l.

-

Creative Diagnostics

-

Resistell AG

-

Sysmex Corporation

-

Copan Diagnostics Inc.

-

Qualigen Therapeutics, Inc.

-

Zhuhai DL Biotech Co., Ltd.

-

ELITechGroup

-

Nissui Pharmaceutical Co., Ltd.

-

Abbott Laboratories

-

Agilent Technologies, Inc.

-

Hologic, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 4.27 Billion |

| Market Size by 2033 | USD 6.36 Billion |

| CAGR | CAGR of 5.10% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Manual Tests, Automated Instruments, Consumables & Media) • By Application (Drug Development, Susceptibility Testing, Others) • By Technique (Automated AST, Etest Method, Dilution, Disk Diffusion, Others) • By End-use (Hospitals, Diagnostic Laboratories, Antimicrobial Susceptibility Testing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | bioMérieux SA, Becton, Dickinson and Company (BD), Thermo Fisher Scientific Inc., Danaher Corporation, Bio-Rad Laboratories, Inc., Bruker Corporation, F. Hoffmann-La Roche Ltd, Accelerate Diagnostics, Inc., Merck KGaA, HiMedia Laboratories, Liofilchem S.r.l., Alifax S.r.l., Creative Diagnostics, Resistell AG, Sysmex Corporation, Copan Diagnostics Inc., Qualigen Therapeutics, Inc., Zhuhai DL Biotech Co., Ltd., ELITechGroup, Nissui Pharmaceutical Co., Ltd., Abbott Laboratories, Agilent Technologies, Inc., Hologic, Inc. |