Toxoid Vaccine Market Report Scope & Overview:

Get More Information on Toxoid Vaccine Market - Request Sample Report

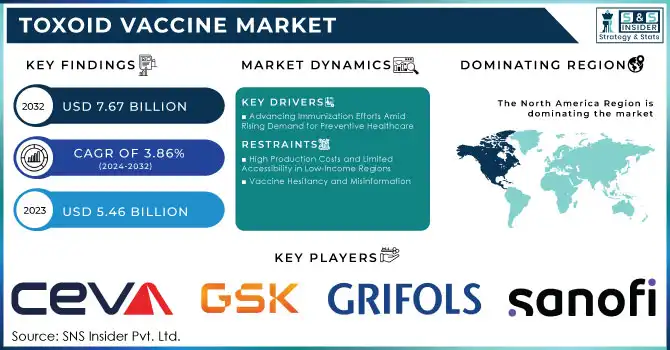

The Toxoid Vaccine Market size was worth US$ 5.46 billion in 2023 and is estimated to reach US$ 7.67 billion by 2032, growing at a CAGR of 3.86% during the forecast period 2024-2032.

The Toxoid Vaccine Market has been experiencing significant growth, driven by various global health initiatives, technological advancements, and increasing awareness about the importance of immunization in preventing infectious diseases. According to WHO, immunization prevents 2-3 million deaths every year from vaccine-preventable diseases, and the impact of toxoid vaccines in reducing these numbers is substantial.

The increasing prevalence of infectious diseases, along with the rise of public health initiatives, continues to drive demand for toxoid vaccines. Organizations like the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC) play a crucial role in supporting vaccination campaigns. For instance, the Global Vaccine Safety Initiative, launched by the WHO, emphasizes the need for continuous vaccination to reduce the global burden of vaccine-preventable diseases, especially in low- and middle-income countries.

Technological advancements in vaccine development have enhanced the safety, efficacy, and production capabilities of toxoid vaccines. The increase in government spending on healthcare and the shift toward preventive care are also key drivers. According to the CDC, tetanus vaccination rates have steadily remained above 90% in many developed countries, contributing to the decline in mortality from this disease. Routine childhood immunizations, which include toxoid vaccines, are becoming more widespread, contributing to the decline in vaccine-preventable diseases. Data from UNICEF shows that global immunization coverage reached 85% in 2022, with toxoid vaccines being a significant part of these programs. Additionally, studies published in PMC highlight that immunization programs have prevented over 30 million deaths in the last decade alone.

As healthcare systems continue to evolve and more innovative vaccination programs are introduced, the toxoid vaccine market is expected to continue its upward trajectory. The rising awareness of the long-term health benefits of immunization, alongside global health strategies focused on eradicating preventable diseases, will further propel market growth. Continued advancements in vaccine distribution and cold chain management will ensure broader access to toxoid vaccines, contributing to their increased adoption globally. Key trends such as the expansion of vaccine supply chains and the increasing focus on preventive healthcare are pivotal in shaping the future landscape of the toxoid vaccine market, making it a vital sector for improving public health outcomes worldwide.

Toxoid Vaccine Market Dynamics

Drivers

-

Advancing Immunization Efforts Amid Rising Demand for Preventive Healthcare

The Toxoid Vaccine Market is driven by several critical factors, including increasing investments in immunization infrastructure, advancements in vaccine research, and the growing emphasis on eradicating vaccine-preventable diseases globally. The rise of public-private partnerships, such as those facilitated by Gavi, the Vaccine Alliance, has enhanced vaccine accessibility in underserved regions, addressing immunization gaps in low-income countries. Additionally, governments across the globe are implementing mandatory vaccination policies and campaigns, particularly targeting newborns and school-age children, to reduce the incidence of diseases like tetanus and diphtheria.

Technological breakthroughs in biotechnology, such as recombinant DNA technology, have significantly improved the production and efficacy of toxoid vaccines. This has enabled the development of safer, more stable formulations with longer shelf lives, which are essential for distribution in remote areas. Furthermore, the growing focus on combination vaccines, which include toxoid components, reduces the number of injections needed, thereby improving compliance and coverage rates.

The increasing prevalence of antimicrobial resistance has heightened the importance of preventive measures like vaccination, positioning toxoid vaccines as a critical tool in combating bacterial infections. Rising awareness through initiatives such as World Immunization Week has also bolstered public understanding of vaccine benefits, driving higher adoption rates.

Moreover, the integration of advanced cold chain logistics has enhanced vaccine distribution efficiency, particularly in challenging environments. These factors collectively create a robust ecosystem for the toxoid vaccine market, ensuring its sustained growth and impact on global health.

Restraints

-

High Production Costs and Limited Accessibility in Low-Income Regions

The complex manufacturing processes of toxoid vaccines, including stringent quality control and cold chain requirements, contribute to high production costs. These factors, coupled with insufficient healthcare infrastructure in low-income countries, hinder vaccine distribution and accessibility.

-

Vaccine Hesitancy and Misinformation

Public resistance to vaccines, driven by misinformation and lack of awareness, continues to pose a significant challenge. Mistrust in healthcare systems and anti-vaccine movements further reduce immunization coverage, impacting the market's growth potential.

Key Segmentation

By Vaccine Type

In 2023, DTaP vaccines led the market with approximately 45.0% of the share, driven by their widespread use in routine childhood immunization programs. These vaccines are integral in protecting against three critical diseases—diphtheria, tetanus, and pertussis—making them a cornerstone of public health policies worldwide. Strong government support, high efficacy rates, and global efforts to curb infectious diseases contributed to their market dominance.

The TDaP vaccine segment is growing rapidly due to its increasing use in adolescent and adult booster immunizations, including recommendations for pregnant women to prevent pertussis in newborns. Expanded immunization guidelines and rising awareness about pertussis outbreaks have further driven the demand for TDaP vaccines.

By End Use

Hospitals accounted for approximately 55.0% of the market share in 2023, serving as the primary centers for vaccine administration. Their dominance is attributed to their advanced infrastructure, trained healthcare personnel, and critical role in managing both routine and emergency vaccination programs.

Government organizations are emerging as the fastest-growing segment, owing to their pivotal role in executing mass immunization campaigns. Partnerships with global health bodies and increased funding for national immunization programs have enabled these organizations to expand vaccine access, particularly in remote and underserved regions.

Toxoid Vaccine Market Regional Analysis

North America emerged as the dominant region in the toxoid vaccine market in 2023, driven by a combination of advanced healthcare systems and extensive immunization programs. The region benefits from high healthcare expenditure, which ensures the availability of vaccines to a broad population. Programs such as the Vaccines for Children (VFC) initiative in the U.S. have played a pivotal role in maintaining high immunization rates. Additionally, strong public awareness campaigns, robust government support, and established cold chain infrastructure for vaccine storage and distribution further solidify the region’s leadership. The presence of leading pharmaceutical players actively involved in vaccine development and distribution also gives North America a significant competitive edge.

Europe followed closely, with strong governmental policies mandating immunizations across various countries. Countries like Germany, France, and Italy have implemented stringent vaccination schedules, ensuring high coverage rates. Public health initiatives, including targeted campaigns to prevent diphtheria and tetanus outbreaks, further fuel market demand. Moreover, advanced healthcare infrastructure and collaborations with global organizations like the WHO bolster the region's market position.

Asia-Pacific stands out as the fastest-growing region over the forecast period, primarily due to large-scale immunization campaigns in populous countries like India and China. These nations have made significant strides in improving vaccine accessibility, particularly in rural and underserved areas. Governmental and non-governmental organizations such as UNICEF and the WHO play an instrumental role in these efforts, providing funding and logistical support. The growing prevalence of infectious diseases, coupled with improving healthcare infrastructure and increased public awareness about the importance of booster vaccines, is accelerating adoption. Urban and semi-urban areas in Asia-Pacific have also seen rising demand for toxoid vaccines due to enhanced healthcare access and awareness initiatives.

Need any customization research on Toxoid Vaccine Market - Enquiry Now

Key Players and Their Offerings in the Toxoid Vaccine Market

-

-

Pentavalent Vaccine (DTP-HepB-Hib), Tetanus Toxoid (TT) Vaccine

-

-

Ceva

-

Veterinary Toxoid Vaccines for Clostridial Diseases

-

-

GlaxoSmithKline plc (GSK)

-

Boostrix (TDaP Vaccine), Infanrix (DTaP Vaccine)

-

-

Grifols, S.A.

-

Tetanus Antitoxin

-

-

Zoetis Services LLC

-

Clostridial Toxoid Vaccines (e.g., Ultrabac series for livestock)

-

-

-

Adacel (TDaP Vaccine), DT Polio Tetanus (DT Vaccine), Pentaxim

-

-

Merck & Co., Inc.

-

Vaqta (Hepatitis A Vaccine with Toxoid components), Recombivax HB (combination vaccines with toxoid adjuvants)

-

-

Emergent BioSolutions Inc.

-

Tetanus and Diphtheria Toxoid Vaccines, BioThrax (Anthrax Vaccine Adsorbed)

-

-

Integrated BioTherapeutics, Inc.

-

Preclinical toxoid-based vaccine candidates for toxin-mediated diseases

-

-

Abbott

-

Paediatric DTP Vaccines

-

-

Avalon Pharma Private Limited

-

DTP and TT Vaccines for routine immunizations

-

-

Haffkine Bio-Pharmaceutical Corporation Ltd.

-

Tetanus Toxoid Vaccine, DTP Vaccine

-

-

Pfizer Inc.

-

Trumenba (meningococcal vaccine with toxoid components), Prevenar 13 (with toxoid as a carrier protein)

-

-

Virbac

-

Veterinary Toxoid Vaccines for Livestock

-

Recent Development

-

In Jan 2024, The National Pharmaceutical Pricing Authority (NPPA) granted an extension to the Serum Institute of India (SII) to continue manufacturing its two tetanus toxoid formulations until December 31, 2024. This decision comes after SII submitted a request to discontinue these formulations, seeking approval from the drug price regulator.

-

In Aug 2024, Pfizer's toxoid vaccine candidate (PF-06425090) for Clostridioides difficile failed to meet expectations in the Phase III CLOVER trial. The vaccine showed a 31% efficacy in reducing infection in adults aged 50 and older, but the result was not statistically significant.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.46 Billion |

| Market Size by 2032 | US$ 7.67 Billion |

| CAGR | CAGR of 3.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vaccine Type (Diphtheria, Tetanus, and Pertussis (DTaP), Diphtheria and Tetanus (DT), Tetanus, Diphtheria, and Pertussis (TDaP), Others) • By End Use (Hospitals, Specialty Centre, Governments Organization, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bharat Biotech, Ceva, GlaxoSmithKline plc (GSK), Grifols S.A., Zoetis Services LLC, Sanofi, Merck & Co., Inc., Emergent BioSolutions Inc., Integrated BioTherapeutics Inc., Abbott, Avalon Pharma Private Limited, Haffkine Bio-Pharmaceutical Corporation Ltd., Pfizer Inc., and Virbac |

| Key Drivers | • Advancing Immunization Efforts Amid Rising Demand for Preventive Healthcare |

| Restraints | • High Production Costs and Limited Accessibility in Low-Income Regions • Vaccine Hesitancy and Misinformation |