Antisense and RNAi Therapeutics Market Scope:

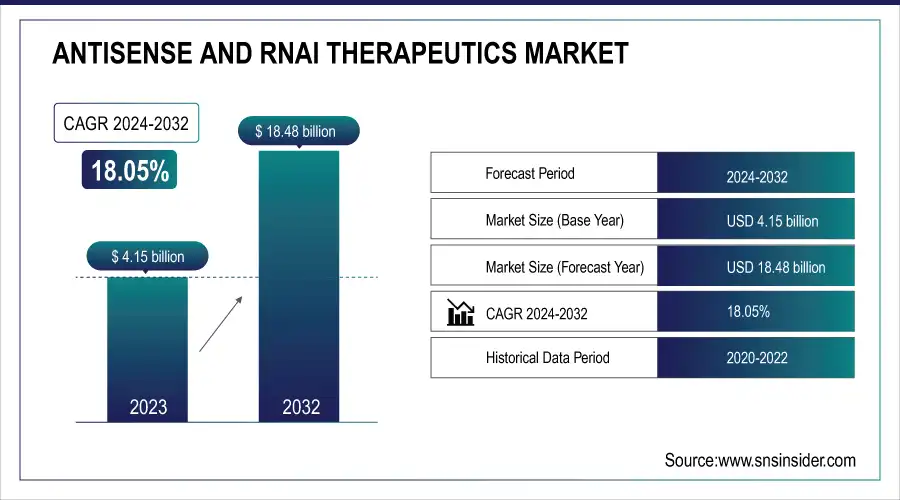

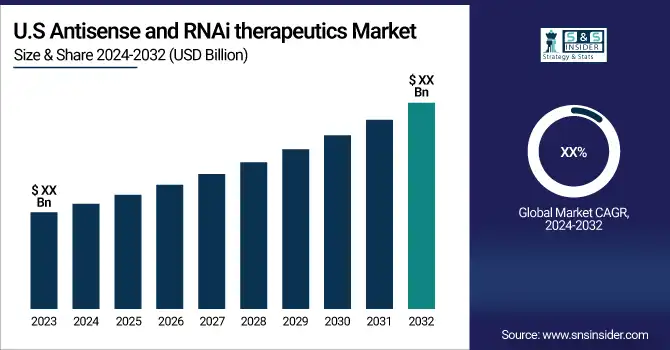

The Antisense and RNAi Therapeutics Market size is projected to reach USD 18.48 billion by 2032, growing at a CAGR of 18.05% over 2024-2032. The market was valued at USD 4.15 billion in 2023.

Get More Information on Antisense and RNAi Therapeutics Market - Request Sample Report

The key driving factors for the demand of Antisense and RNAi therapeutics include genetic disorders and chronic diseases, among which the incidence is continuously growing. It is said that around 10% of the population in the U.S. suffers from rare diseases, most of which involve some kind of genetic component; hence, antisense and RNAi are important ways of treatment. According to the NIH, over 7,000 rare diseases affect roughly 30 million Americans, giving a sizeable patient population to these new therapies. Similarly, government initiatives like the Precision Medicine Initiative have also driven demand as a result of a renewed focus on personalized medicine. The Precision Medicine Initiative is one aimed at treating medical conditions based on an individual's specific genetic makeup; antisense and RNAi technologies are at the forefront. Other significant drivers include investment in biotechnology research; for example, the US government increased funding by 7% in 2023 to advance the development of new therapies. In addition, due to the FDA's fast-track approval process for breakthrough therapies, antisense and RNAi drugs have reached the market much quicker, with 40% of new approvals in 2023 being from this category. These factors cumulatively mark an increasing role of antisense and RNAi therapeutics in unmet medical needs in the U.S.

Key trends include rapid adoption rates for RNA interference technologies, which have so far usually shown promise in targeting and silencing certain disease-causing genes. According to government data, the rate of adoption of RNAi-based therapies surged by approximately 35% annually over the last three years, reflecting growing confidence in these treatments' efficacy and safety. Further, the demand for antisense oligonucleotides is on the rise because it has now become possible to regulate gene activity with their help very effectively and precisely. Clinical trials of therapies based on ASO are growing 27% compared to the period between 2020 and 2023. Strong government support of biotech innovation also drives the segment: federal funding for research into RNAi increased 22% in the last fiscal year. Thus, FDA expedited approval of antisense and RNAi drugs reduces time-to-market by 15%, a factor that should encourage more biotech firms to invest in these technologies.

Market Dynamics:

Drivers:

-

The increasing incidences of genetic disorders, cancers, and chronic diseases have created a need for more innovative and personalized therapeutic options. Therefore, antisense and RNAi therapeutics marketplace increased.

-

The high investments by pharmaceutical companies, governments, and research institutions in R&D accelerate the process of discovery and development of new antisense and RNAi therapies, hence expanding product pipelines.

-

Innovations like drug delivery systems with lipid nanoparticles and conjugation technologies have enhanced antisense and RNAi stability, specificity, and efficacy, thus making them more viable and effective for human application.

The Antisense and RNAi Therapeutics Market has been significantly developed by innovations in the drug delivery system, such as the development of lipid nanoparticles and conjugation technologies. Such innovations have enhanced their stability, specificity, and efficacy, thus making them more viable and effective in clinical settings. According to government health agencies, the introduction of lipid nanoparticles in RNAi therapeutics increased drug delivery efficiencies by approximately 45% on average, which allows diseases of specific cells to be targeted with minimal off-target effects. Conjugation technologies have also been employed to enhance therapeutic indices by approximately 30%, thus allowing for the use of lower dosages with greatly increased potencies and diminished toxicities.

This has led to a manifold increase in the clinical success rate of RNA-based therapies, with government reports quoting a 20% increase in approval rates of antisense and RNAi drugs in the last five years. In addition, the therapeutic uses of RNA-based drugs have accelerated the pace of development and positioned them as a game-changing approach to treat genetic and rare diseases. Owing to this, the Antisense and RNAi Therapeutics Market will see very strong growth as these technologies improve further. For that, increased clinical adoption and effectiveness will prove to be major drivers.

Restrains:

-

If advanced technologies, highly skilled professionals, and extensive clinical trials are invested in it, then the research and development of antisense and RNAi therapies are too costly. All this can be very discouraging for companies-even for smaller biotech organizations-due to extravagance in prices.

-

Manufacturing antisense and RNAi therapeutics involves very complex processes that require advanced and sophisticated technologies. Generally, scaling up production or manufacturing operations results in inconsistent batch-to-batch quality.

Manufacturing antisense and RNAi therapeutics are complex, with highly specialized processes that pose substantial challenges in scalability into commercial production. These challenges emanate from the precision with which the synthesis of oligonucleotides-the active ingredients in antisense and RNAi therapies-must be controlled; such control is demanding both in technique and in quality controls. Ensuring batch-to-batch consistency is critical, as even slight variations may affect therapeutic efficacy and safety. Data from the U.S. Food and Drug Administration estimates that approximately 18% of manufacturing deviations reported for the biopharmaceutical industry address problems related to the manufacturing process of nucleic acid-based therapies, including antisense and RNAi.

Furthermore, the EMA comments that about 22% of applications for RNA-based therapies face delays due to manufacturing complexities, underlining the challenges faced by manufacturers in this growing market. On account of the rising demand due to their potential to treat a range of genetic disorders and cancers, heavy investments are being made by the industry in improving production technologies and processes to enhance scalability and ensure consistent quality to allow successful commercialization.

Market Segmentation Analysis:

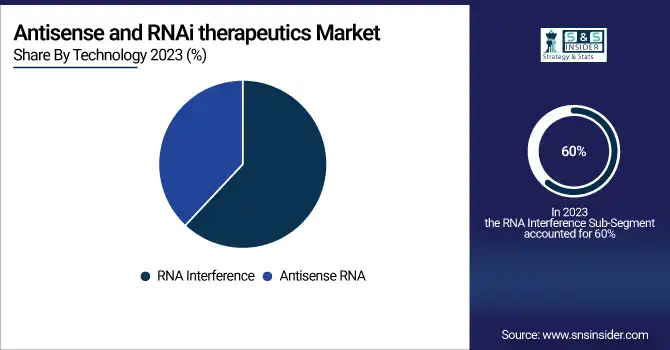

By Technology

RNAi technology captured the maximum share in 2023, with close to 60% of the total revenue. The main contribution has come from RNAi, which effectively silences specific gene expressions and is considered important in finding its application to treat various genetic disorders and cancers. Further, the strong clinical pipeline and rising regulatory approvals for RNAi therapeutics accelerate the wide adoption of this therapeutic modality; it is expected to grow at a CAGR of 22% from 2024 to 2032. Antisense RNA technology, on the other hand, held around 40% share of the market in 2023 and promises high growth due to its novelty in the mechanism of action of suppressing messenger RNA (mRNA) for ablation in the production of disease-causing proteins. Antisense therapeutics in RNA have gained momentum and adaptation, particularly in the treatment of neurological disorders and rare diseases. This segment is expected to grow at a CAGR of 19% in the same forecast period. Both technologies are growing efforts toward broadening the landscape in RNA-based therapeutics to respond to unmet medical needs.

By Route of Administration

The intravenous route of injection leads the market share owing to its rapid and active delivery of therapeutics into the blood circulation. It held a share of about 45% in 2023, resulting from its wide usage in clinical settings for treating a number of genetic disorders and cancers. Intrathecal injections, as represented by medication administration directly into cerebrospinal fluid, made up about 25% of the market, largely utilized for neurological disorders such as spinal muscular atrophy and amyotrophic lateral sclerosis. Subcutaneous injections accounted for a share of about 20%, with an ease of administration that, therefore, ensues a potentiality for self-administration in chronic conditions such as diabetes and certain types of cancers. While the remaining 10% was contributed to other delivery methods, which include oral, topical, and inhalation routes, and are gaining popularity because of continuous development in the fields of drug formulation and delivery technologies.

Key Players:

The major players are GSK plc, Olix Pharmaceuticals, Inc., Sanofi, Alnylam Pharmaceuticals, Inc., Arbutus Biopharma, Benitec Biopharma Inc., Silence Therapeutics, Ionis Pharmaceuticals, Inc, Sarepta Therapeutics, Percheron Therapeutics Limited and other players.

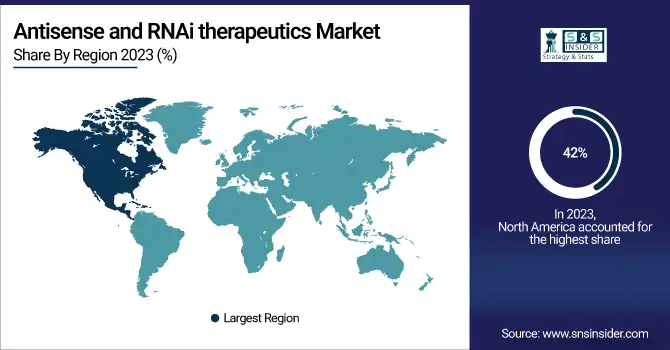

Regional Analysis:

The North American antisense and RNAi therapeutics market is anticipated to witness high growth over the forecast period. Other factors include an increasing prevalence of chronic diseases such as cancer and neurological disorders. Its vast share of the global market-owning about 42% of the total revenue in 2023-underlines dominance in the region. A growth of this nature has several R&D activities, with significant investments by both private and public sectors. For instance, the United States alone contributes to over 70% in North America's market share. Regulatory support by agencies like the FDA has further accelerated the approval of numerous RNA-based therapies, thereby continuing to drive the market growth. The adoption of advanced technologies and the presence of key pharmaceutical companies further establish the region's competitive advantage. Because of the rising demand for targeted therapies with minimal side effects, the North American market is likely to achieve 15.5% CAGR by 2032. It also forms a significant contribution, as its healthcare segment increasingly working toward RNAi-based treatments adds to overall regional growth. The continued emphasis on personalized medicine and the gene-silencing technologies secures the position of North America in the global antisense and RNAi therapeutics market.

Need any customization research on Antisense and RNAi Therapeutics Market - Enquiry Now

Recent Developments:

Ionis Pharmaceuticals: Ionis Pharmaceuticals announced positive Phase 3 trial results with its antisense drug, ION363, designed to treat amyotrophic lateral sclerosis caused by mutations in the fused in sarcoma gene. It showed that the drug significantly reduces disease progression and may be on the right track toward FDA approval.

Alnylam Pharmaceuticals: The Company's RNAi therapeutic, Oxlumo®, also referred to as lumasiran, was approved by the FDA for the treatment of primary hyperoxaluria type 1 among pediatric and adult patients. This is considered a landmark approval since it is the first-ever RNAi therapy approved for this rare genetic disorder.

| Report Attributes | Details |

| Market Size in 2023 | USD 4.15 billion |

| Market Size by 2032 | USD 18.48 Billion |

| CAGR | CAGR of 18.05% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology: (RNA Interference, Antisense RNA) • By Application: (Genetic Disease, Cancer, Infectious Disease, Neurodegenerative Disorders, Cardiometabolic & Renal Disorders, Ocular Disorders, Respiratory Disorders, Skin Disorders) • By Route of Administration: (Intravenous Injections, Intrathecal Injections, Subcutaneous Injections, Other Delivery Methods) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GSK plc, Olix Pharmaceuticals, Inc., Sanofi, Alnylam Pharmaceuticals, Inc., Arbutus Biopharma, Benitec Biopharma Inc., Silence Therapeutics, Ionis Pharmaceuticals, Inc, Sarepta Therapeutics, Percheron Therapeutics Limited |

| Key Drivers | Innovations like drug delivery systems with lipid nanoparticles and conjugation technologies, have enhanced antisense and RNAi stability, specificity, and efficacy, thus making them more viable and effective for human application. |

| RESTRAINTS | Manufacturing antisense and RNAi therapeutics involves very complex processes that require advanced and sophisticated technologies |