Bevacizumab Biosimilars Market Report Size Analysis:

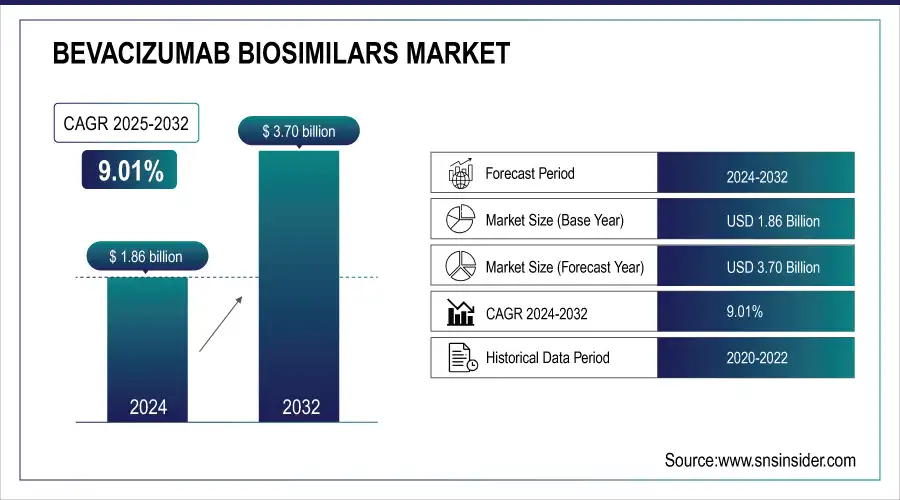

The Bevacizumab Biosimilars Market size was valued at USD 1.86 billion in 2024 and is expected to reach USD 3.70 billion by 2032, growing at a CAGR of 9.01% over 2025-2032.

The bevacizumab biosimilars market is expected to grow in the coming years owing to the high prevalence of cancer, such as colorectal, lung, glioblastoma, and renal cell carcinomas globally. The World Health Organization estimates that by 2050, cancer cases will rise by 77%, raising the need for affordable treatment. Despite the affordability of originator biologics, demand for high-efficacy products at lower costs continues to drive the growth in the Bevacizumab Biosimilars market. FDA statistics show that biosimilars are generally 15%–30% lower in cost, and U.S. sales of biosimilars are expected to double between 2021 and 2023.

To Get more information on Bevacizumab Biosimilars Market - Request Free Sample Report

The market share of Bevacizumab Biosimilars has significantly increased in countries with biosimilar substitution laws, and over 80% of oncology biosimilars in the European Union (EU) are at parity with their originator products. In the U.S. bevacizumab biosimilars market, payers are favoring biosimilars for formulary placement, along with support from the AHRQ, and greater Medicare reimbursement parity.

For instance, ASCO 2025 demonstrated that one bevacizumab biosimilar provided similar delaying of cancer progression in patients with metastatic colorectal cancer, proving it can be a proven treatment option and warranting its incorporation into additional treatment guidelines.

R&D investment keeps rising, with Biocon, Amgen, and Pfizer pouring resources into analytical characterization, immunogenicity, and real-world data collection. As of 2024, over USD 2.4 billion in global spending has been assigned to biosimilar R&D, and more than 20 Phase III biosimilar oncology trials are currently active. Regulatory agencies such as the FDA and EMA have similarly increased their biosimilar review teams by 25%, bringing approval times down by 40%.

The U.S. FDA has also published a process guiding interchangeability studies, which should provide additional confidence among prescribers and patients as to the accurate selection of biosimilars. Supply chain de-risking is also a driver, the firms are setting up regional biosimilars manufacturing centres in India, South Korea, and Eastern Europe, making drugs more accessible and lead times shorter. Bevacizumab Biosimilars, however, now presents a growing trend in licensing deals and alliances, such as those witnessed in Biocon-Mylan or Amgen-BeiGene.

For instance, Updates to the WHO Essential Medicines List in 2025 incorporated bevacizumab biosimilars as central to global efforts in oncology care. In addition, biosimilar bevacizumab was supported as a high-value intervention according to cost-effectiveness thresholds in a 2023 report of the ICER.

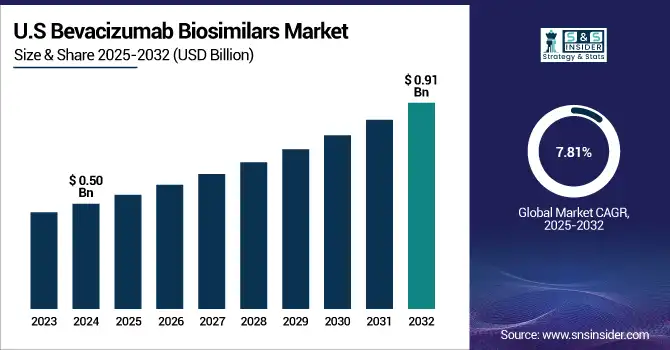

The U.S. bevacizumab biosimilars market size was valued at USD 0.50 billion in 2024 and is expected to reach USD 0.91 billion by 2032, growing at a CAGR of 7.81% from 2025 to 2032.

Bevacizumab Biosimilars Market Dynamics:

Drivers:

-

Increasing Cancer Prevalence, Surging Demand for Cost-Effective Biologics, And A Strong Push from Regulatory Bodies to Enhance Biosimilar Adoption

More than 10 million new cases of cancers amenable to anti-VEGF treatment are expected each year, and the demand for biosimilars is increasing. Big Pharma has brought down spending on R&D Samsung Bioepis spent more than USD 300 million towards expanding its biosimilar pipeline in 2024. Finally, accelerated review programs such as the FDA’s Biosimilar Action Plan and EMA’s have cut review time to as little as 10 months, accelerating time to market. In addition, biosimilars are being integrated within treatment practices by healthcare payers and hospitals, with a 65% penetration rate for Medicare oncology treatment in the U.S. reported by CMS for the use of biosimilars in 2023. Greater commitment to the real-world evidence (RWE) and head-to-head clinical equivalence studies, as demonstrated by the investment by Innovent and Coherus, only adds to clinicians’ confidence. Improved manufacturing facilities worldwide also guarantee greater availability of biosimilars on the supply side. The increasing focus on mitigating the financial toxicity of cancer care, coupled with reforms to global health policy, is driving biosimilars integration, thereby increasing access and affordability within oncology.

In March 2024, Dr. Reddy’s Laboratories launched Versavo, its bevacizumab biosimilar, in the UK, aiming to improve oncology care affordability and expand its market presence in Europe.

Restraints:

-

Physician Hesitancy, Patent Barriers, and Interchangeability Challenges Hinder the Market Growth

Physician and patient reluctance based on fears related to biosimilar efficacy and immunogenicity is one key obstacle. In a 2023 poll of American Society of Clinical Oncology (ASCO) members, 38% of oncologists reported hesitance to transition stable patients to biosimilars. Another barrier is the legal and regulatory intricacies of biologic IP litigation – originator companies often clog up the courts with ‘patent thickets’ that lead to lengthy legal battles, only resulting in a prolonged biosimilar launch, costing biosimilar developers millions in legal fees.

As of 2024, only four biosimilars have been designated as interchangeable by the FDA, and none of the four are bevacizumab variants, which would make it difficult for pharmacies to substitute those versions automatically. In addition, variability in reimbursement between payers and countries adds another layer of complexity to the adoption challenge. Biosimilar education programs, although increasing, are not consistently required, so many healthcare providers are undereducated.

Even with the initial cost of biosimilar investment estimated to be only USD 100–250 million, small companies are also inhibited from entering the industry, artificially reducing the competitive mix. Finally, disparate pharmacovigilance infrastructure in some countries undermines trust in long-term safety data and impedes broader adoption. These issues highlight the necessity of stronger, standardized guidelines for the integration of biosimilars globally.

Bevacizumab Biosimilars Market Segmentation Analysis:

By Product

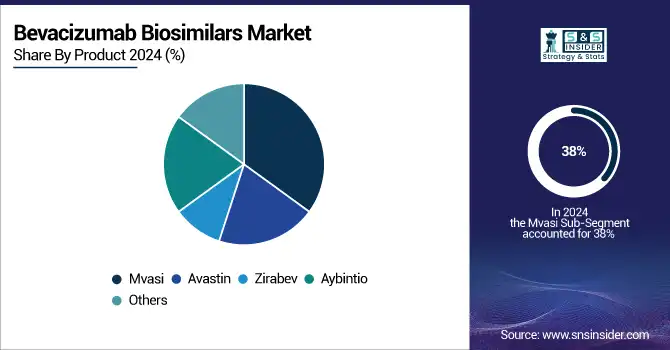

Mvasi, developed by Amgen, received the US FDA clearance in 2017 and accounted for a 38% share in the Bevacizumab Biosimilars market in 2024. First-mover advantage, powerful clinical equivalency data, and aggressive commercial strategies led to its adoption in oncology practices. In addition, it was listed in the hospital formularies and covered by insurance across the U.S., Europe, and Asia, strengthening its leading position. Amgen’s international licensing approaches and successful partnership with BeiGene in the launch of the product in China and other Asian markets also boosted its position.

Zirabev is anticipated to be the fastest-growing product, capturing attention with its wide international launch size and aggressive pricing. Pfizer’s penetration into understaffed oncology markets with global tenders and distribution networks facilitated rapid penetration into health systems, particularly in Latin America and Southeast Asia. Zirabev in 2024 witnessed high double-digit growth, driven by growing oncologist preference and patient demand in public and private places of service.

By Application

In 2024, colorectal cancer still accounted for the highest market share, nearly 32% of the Bevacizumab Biosimilars market. This is due to the colossal global colorectal cancer burden approaching 1.9 million new cases every year. Bevacizumab biosimilars delivered superior clinical results in metastatic colorectal cancer in conjunction with chemotherapy, leading to their quick approval in the standardized therapy regimens. In addition, the NCCN and ESMO principal oncology guidelines specifically recommend biosimilar application in colorectal cancer to try to control costs.

The fastest-growing application was non-small cell lung cancer (NSCLC), considering that emerging clinical data and further regulatory approvals supported the use of biosimilars in combination with immunotherapeutics and platinum-based chemotherapy. The publication of real-world evidence (RWE) studies, which demonstrate that biosimilars perform equally to original drugs in NSCLC, substantially improved physicians’ confidence in these therapeutics. When factoring in the rising incidence of lung cancer and barriers to cost and subsidy with branded Avastin, this early introduction of a biosimilar into the treatment of NSCLC occurred in 2024.

By Distribution Channel

In 2024, hospital pharmacies were the leading distribution channel in the bevacizumab biosimilars market with a strong 54% of market share, due to the centralized nature of oncology treatment. The majority of biosimilar utilization takes place in a hospital-based infusion center, which is subject to payer reimbursement models, such as bundled payments and formulary preference. Institutional purchasing contracts and GPOs preferentially favor biosimilars as a means to lower the cost of treatment, which has resulted in high hospital-level uptake. In addition, the requirement for monitoring and intravenous (IV) treatment typically leads to inpatient delivery of anti-VEGF treatments as dictated by clinical protocols.

The fastest channel was online pharmacies due to an increase in digital healthcare infrastructure, patient preference for home delivery options, and telehealth follow-ups. With a growing number of oncology clinics online for biosimilars, this also eases patient logistics. Online pharmacies, especially in urban markets in Asia and North America, experienced high double-digit growth in 2024. This is likely to persist as biosimilar administration models transition to outpatient and homecare delivery.

Regional Analysis:

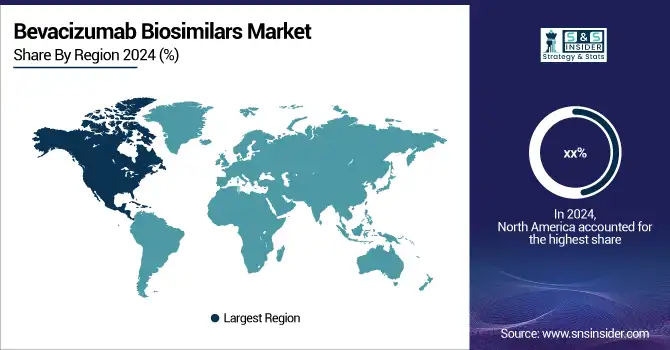

The North America region was the largest market for Bevacizumab Biosimilars in 2024, owing to early approvals and favorable reimbursement scenario of the market, growing awareness of biosimilars in oncology, and strong adoption of Bevacizumab Biosimilars in oncology practices. The U.S. again ranks as the top country, in part due to the high cancer burden, more than 1.9 million new cases in 2023, and widespread insurance coverage of biosimilars under Medicare and Medicaid. Our hospitals display high bevacizumab biosimilar adoption with Mvasi and Zirabev, both of which are approved by the U.S. FDA. Canada also does a lot with biosimilars through its pan-Canadian Pharmaceutical Alliance, which negotiates down drug prices. Mexico is emerging as a growth region, as it has regulations aligned with international standards and public procurement for low-cost cancer treatments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe is the second-largest market owing to centralized EMA approvals, national tendering procedures, and strong generic drug policies. The establishment of automatic substitution, as well as encouraging clinical support, is the main revenue driver in Germany. In France, the adoption of biosimilars in hospital prescription practices to control costs has meant that biosimilars represent more than 70% of bevacizumab use. Spain and Poland are among the countries seeing a strong increase in biosimilars penetration, supported by EU funding and new oncology guidelines. Biosimilars switching schemes and real-world evidence have added to both physician and patient confidence across the region.

In January 2024, the EMA approved Bio-Thera Solutions’ BAT1706 (Avzivi), a bevacizumab biosimilar, for multiple cancer indications across Europe, marking a key step in biosimilar expansion.

Asia Pacific became the fastest-growing region in 2024, as the region has witnessed growing cancer incidence, government initiatives, and healthcare infrastructure. The largest market is in China as a result of “4+7” volume procurement and the introduction to the National Reimbursement Drug List (NRDL) of multiple bevacizumab biosimilars. With cancer cases set to exceed 4.8 million cases per annum by 2030, the demand is showing no signs of slowing down.

India is also growing fast, with manufacturers there such as Biocon and Intas introducing affordable versions of biosimilars as cancer rates spike. Japan and South Korea are driving biosimilar uptake through expedited regulatory pathways and the expansion of hospital-based oncology services, while Singapore is pursuing biological cost containment by way of insurance reform and import-friendly policies.

Bevacizumab Biosimilars Market Key Players:

Leading bevacizumab biosimilars companies operating in the market comprise Amgen, AryoGen, Pharmed, Biothera, Boehringer Ingelheim, Centus Biotherapeutics, Henlius Biotech, Innovent Biologics, Mylan, mAbxience, Outlook Therapeutics, Pfizer, Prestige Biopharma, Roche, Samsung Bio, and TOT Biopharm.

Recent Developments in the Bevacizumab Biosimilars Market:

In May 2024, the FDA approved a bevacizumab biosimilar for multiple solid tumors, improving access to cost-effective treatments for cancers such as colorectal, lung, and brain tumors.

In May 2024, Biocon Biologics announced U.S. FDA approval for its bevacizumab biosimilar Jobevne, enhancing its oncology pipeline and boosting patient access to targeted cancer therapies.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.86 billion |

| Market Size by 2032 | USD 3.70 billion |

| CAGR | CAGR of 9.01% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Avastin, Mvasi, Zirabev, Aybintio, and Others) • By Application (Colorectal Cancer, Non-Small Cell Lung Cancer, Glioblastoma, Renal Cell Carcinoma, Cervical Cancer, and Ovarian Cancer) • By Distribution Channel (Hospital Pharmacy, Online Pharmacy, Retail Pharmacy, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Amgen, AryoGen, Pharmed, Biothera, Boehringer Ingelheim, Centus Biotherapeutics, Henlius Biotech, Innovent Biologics, Mylan, mAbxience, Outlook Therapeutics, Pfizer, Prestige Biopharma, Roche, Samsung Bio, and TOT Biopharm. |