Pharmaceutical Filtration Market Report Scope & Overview:

Get More Information on Pharmaceutical Filtration Market - Request Sample Report

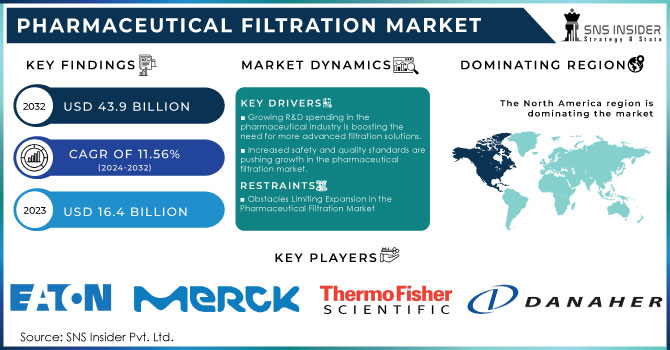

The Pharmaceutical Filtration Market Size was valued at USD 16.4 billion in 2023 and is expected to reach USD 43.9 billion by 2032 with a growing CAGR of 11.56 % over the forecast period 2024-2032.

The pharmaceutical filtration Market, an important part of the pharmaceutical sector, is seeing strong growth as there is a growing need for top-notch and contaminant-free pharmaceutical products. Filtration is crucial to maintaining the cleanliness and safety of pharmaceuticals by eliminating particles, bacteria, and other impurities in the manufacturing of drugs. This market includes different types of filtration technologies like membrane filtration, depth filtration, and air filtration, each fulfilling specific roles in the pharmaceutical manufacturing process. Membrane filtration, such as microfiltration, ultrafiltration, and Nano filtration, is commonly utilized for separating particles by size and enhancing the transparency and safety of pharmaceutical solutions. Depth filtration is essential for bulk fluid applications and the removal of larger particulates, as it involves the use of filter media like filter pads and cartridges. Air filtration is essential for keeping manufacturing facilities clean, aiding in the prevention of contamination from airborne particles. Advancements in filtration technology, strict regulatory requirements, and the increasing focus on biopharmaceuticals and personalized medicine are the main driving factors of the market. The market growth is further boosted by greater investments in research and development, as well as the increasing presence of biologics and biosimilars which demand more advanced filtration processes. Moreover, the increase in pharmaceutical production in developing economies also drives the need for high-performing filtration technologies. Top companies in the industry, such as Merck KGaA, Pall Corporation, and Sartorius AG, are consistently creating new filtration products and services to stay ahead. The pharmaceutical filtration sector is expected to keep growing thanks to technological advancements and improving worldwide health norms.

The increase in the pharmaceutical filtration industry is strongly tied to the FDA's regulatory measures and safety requirements for products like sunscreens and infant formulas. In September 2021, the FDA suggested new sunscreen requirements, moving from the 2019 proposed rule to a new administrative order process outlined in the CARES Act. This action is intended to improve sunscreens' quality, safety, and effectiveness, demonstrating the agency's dedication to strict standards in consumer health products. In the same way, the FDA's supervision of baby formula manufacturing highlights the crucial need to guarantee that these items are both safe and nutritionally sufficient for infants, who are the most vulnerable population. With the FDA enhancing its regulatory framework, the pharmaceutical filtration market is seeing significant growth due to the rising demand for efficient filtration technologies to comply with these changing standards. There is a direct correlation between regulatory requirements and the expansion of the market. The increased attention to enhancing product safety, demonstrated through the FDA's revised sunscreen guidelines and emphasis on infant formula, highlights the need for innovative filtration solutions in the pharmaceutical sector. This connection emphasizes how filtration plays a crucial role in maintaining product purity and meeting strict safety regulations, which drives market growth and encourages innovation.

The increasing focus on minimizing nitrosamine contamination in medications is leading to the growth of the pharmaceutical filtration market. Substances such as N-nitrosodimethylamine (NDMA) and N-nitrosodiethylamine (NDEA) are known to be carcinogenic and pose significant risks, leading to stringent regulatory measures. Both the FDA and the European Medicines Agency have issued instructions for controlling nitrosamine impurities, mandating that pharmaceutical companies implement rigorous risk assessment and mitigation strategies. The market for pharmaceutical filtration is experiencing substantial growth as a result of the new draft guidance from the WHO that increases these standards. The demand for advanced filtration solutions that can efficiently address the risks of nitrosamine contamination is a key driver of this expansion. Enhanced filtration systems are necessary to ensure the quality of products because regulations now emphasize comprehensive risk evaluations that involve pinpointing nitrosamine sources from impurities, manufacturing water, and packaging. Utilizing advanced filtration techniques such as membrane and depth filtration is crucial to meet these stringent requirements. The alignment of regulatory demands and market expansion emphasizes the critical role of filtration in maintaining the safety and efficacy of drugs.

Market Dynamics

Drivers

- Growing R&D spending in the pharmaceutical industry is boosting the need for more advanced filtration solutions.

The increase in investment in research and development (R&D) in the pharmaceutical and biotechnology sectors is a major factor influencing the pharmaceutical filtration market. As companies place a greater emphasis on creating innovative and top-notch pharmaceutical products, their spending on research and development has significantly risen. This significant rise demonstrates the industry's dedication to improving drug development procedures and guaranteeing high product quality. Pharmaceutical filtration products, such as single-use and reusable filtration systems, membrane filters, depth filters, and filtration assemblies, are crucial in this situation. These filtration solutions are essential for purifying and separating molecules in R&D and pilot-scale operations. They make sure experimental and developmental drugs are free from contaminants and impurities to maintain the integrity and safety of new pharmaceuticals. The changing regulatory environment increases the importance of strong filtration systems. Entities like the FDA and EMA implement strict filtration criteria to maintain the quality and effectiveness of drugs. With the increasing stringency of regulatory requirements, the pharmaceutical filtration market is set to expand. The increased need for advanced filtration technologies is correlated with higher R&D investments and the requirement to adhere to changing regulations.Pfizer's strategic changes and patent expirations emphasize the significance of effective filtration in maintaining innovation and confronting market obstacles within the competitive environment. Pharmaceutical companies are investing a lot in developing new drugs, which is leading to an increased need for advanced filtration systems to maintain high levels of product purity and safety, driving market growth.

- Increased safety and quality standards are pushing growth in the pharmaceutical filtration market.

The growing focus on safety criteria and quality in the pharmaceutical sector has greatly increased the need for more advanced filtration technologies. The increasing demand for elevated standards in drug production and research is mainly responsible for this change. In September 2022, Pall Corporation increased its selection of single-use filtration products by introducing three new Allegro Connect Systems. These systems aim to streamline control processes and reduce risks, leading to improved safety and efficiency in the production of therapeutic drugs and vaccines. In spite of the progress made, the pharmaceutical filtration sector encountered difficulties like supply chain interruptions leading to production delays and impeding the introduction of new drugs. The increasing biopharmaceutical sector has also driven the need for filtration systems. Membrane separation is crucial in the production of large-molecule pharmaceuticals, as it contributes to their important therapeutic advantages. The increase in FDA approvals of large molecules and biologics in the years 2021 and 2022 indicate a rising demand for efficient pharmaceutical filtration solutions. The need for advanced filtration products has been fueled by regulatory requirements. The U.S. FDA's cGMP regulations require strict compliance with safety and quality standards, leading to a demand for specific filtration systems. As an example, in February 2023, RoslinCT and Lykan Bioscience both increased the size of their facilities to add six cGMP-approved suites, showing the need for a variety of filtration methods like depth filtration, sterile filtration, and tangential flow filtration (TFF).

Restraints

- Obstacles Limiting Expansion in the Pharmaceutical Filtration Market

Several limitations affect the growth and progress of the pharmaceutical filtration market. A major limitation is the expensive nature of advanced filtration technologies. The cost of advanced filtration systems like single-use and reusable systems, membrane filters, and depth filters can put financial strain on smaller pharmaceutical companies who face significant initial investments. Furthermore, the fast-paced development of regulatory requirements and the necessity to adhere to strict guidelines, like those set forth by the U.S. FDA and European Medicines Agency, result in extra expenses for validation, certification, and consistent upgrades of filtration systems. This set of regulations requires companies to invest in regular updates and thorough testing to meet changing criteria, leading to an increase in operational costs.Challenges are also presented by supply chain disruptions, affecting the availability and on-time delivery of filtration products. These interruptions may cause setbacks in the production and release of drugs, impacting the overall effectiveness of pharmaceutical manufacturing. Furthermore, the maintenance and calibration of filtration technologies are complicated due to their complexity. Sophisticated systems demand specific expertise and knowledge for effective management, leading to resource constraints and reduced operational efficiency.

Necessity for large financial investments in new production facilities.

The pharmaceutical filtration market is marked by its need for large investments, making it difficult for new companies to enter. Setting up manufacturing plants for high-tech filtration systems, like tangential flow filtration (TFF) systems, necessitates a significant investment of money. For example, a large TFF system can cost more than USD 200,000, while establishing a complete production facility with both upstream and downstream processes could exceed USD 200 million. These strict capital requirements include not just the expense of equipment, but also the investment in technical expertise and trained staff needed for running and upkeep. Small companies or new players with limited resources may find it hard to afford advanced technology and expertise, resulting in a financial challenge. Therefore, the industry's increased capital requirements could constrain competition and hinder smaller companies' ability to enter or grow in the market. The consolidation of resources among existing companies may strengthen their control over the market and hinder innovation, affecting the dynamics and accessibility of the pharmaceutical filtration market.

Segment Analysis

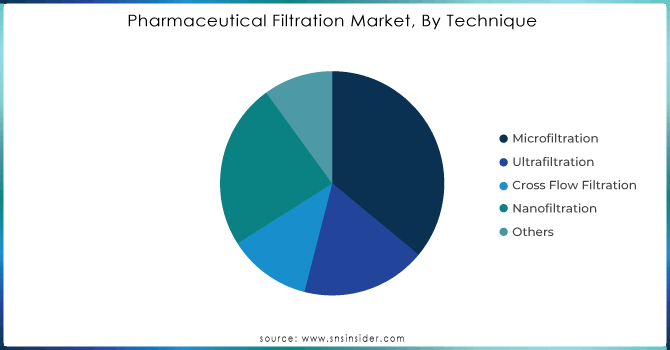

By Technique

Based on Technique, in 2023 the microfiltration segment dominated with a 36% share, primarily because of its versatile and effective technique in eliminating various impurities like particles and microorganisms, while maintaining the biological activity and stability of the filtered substance. Microfiltration is highly appreciated for its capacity to achieve high purity levels without compromising the integrity of delicate biological substances. Continued strategic investments and innovations are also driving the growth of the segment. In April 2023, Meissner Corporation revealed plans to invest USD 250 million in a new U.S. manufacturing facility to enhance microfiltration and therapeutics manufacturing systems. This investment showcases the industry's dedication to innovation and improving filtration technologies. Moreover, new innovative products like single-use microfiltration systems and advanced membrane filters have been introduced to the market, providing better performance and operational efficiency. These advancements cater to the growing need for top-notch filtration options in biopharmaceutical procedures, leading to more market growth. As microfiltration technologies advance and improve, they are projected to stay at the forefront of the pharmaceutical filtration market by meeting the changing industry demands and aiding in the manufacturing of high-quality biopharmaceuticals.

Need any customization research on Pharmaceutical Filtration Market - Enquiry Now

By Type

Based on Type, in 2023 the sterile filtration sector dominated 58% of the pharmaceutical filtration market, showing its essential role in maintaining the safety and effectiveness of pharmaceutical products. Sterile filtration is essential in making injectable drugs and vaccines, acting as a crucial barrier against contaminants that could harm product quality. This technique efficiently eliminates tiny organisms and particles, protecting the end product from pollution and guaranteeing its adherence to strict safety requirements. Continuous innovations and strategic partnerships help strengthen the segment's dominance by improving sterile filtration processes. In February 2019, there was a significant development as GlaxoSmithKline joined forces with Suncombe to incorporate automation into sterile filtration systems. This partnership led to the creation of automated solutions that simplify the filtration process, while also preserving the sterile boundary for filter integrity testing. These advancements not just boost operational effectiveness but also elevate the dependability of sterile filtration, which is essential for complying with regulatory standards.

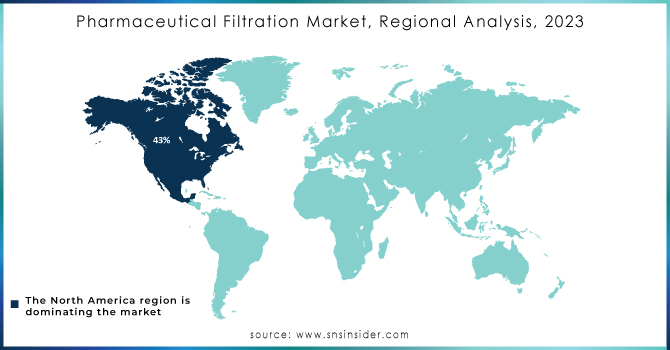

Regional Analysis

In 2023, North America led the pharmaceutical filtration market with the highest revenue share of 43%, influenced by key industry factors and strong healthcare infrastructure. The main reason for the region's leading position is the existence of top pharmaceutical and biopharmaceutical companies like Gilead Sciences, Inc.; Pfizer Inc.; Johnson & Johnson Services, Inc.; and Amgen Inc., which are at the forefront of drug development and manufacturing. These large companies create a high need for cutting-edge pharmaceutical filtration solutions to guarantee purity of products and meet strict regulations. North America's advanced healthcare system also aids in the market's growth. The area's ability to utilize advanced filtration techniques and incorporate them into pharmaceutical production processes improves the efficiency and effectiveness of drug manufacturing. In the U.S., there are inclusive healthcare coverage policies that work alongside this infrastructure to make it easier to get essential treatments and increase the need for new pharmaceutical products. As stated by the Congressional Research Service 2021, around 91.4% of Americans have health insurance, providing broad availability of medical treatments and increasing the demand for innovative filtration solutions. The significant financial commitments made towards research and development in North America by pharmaceutical companies and academic institutions are aiding in the expansion of the pharmaceutical filtration market. These investments prioritize the development of new drugs and therapies, leading to an increased need for advanced filtration systems to guarantee the safety and effectiveness of new pharmaceutical products. North America's industry leadership, advanced infrastructure, and supportive healthcare policies make it a key contributor to growth in the pharmaceutical filtration market.

In 2023, the Asia Pacific region became the second most rapidly developing region in the pharmaceutical filtration market due to increased biopharmaceutical manufacturing in countries like India and China. China and India are placed second and third in global pharmaceutical production capacities, as stated in the Bioprocessing International Article 2022, showcasing their important position in the worldwide drug manufacturing industry. The growing biopharmaceutical industry in these nations, along with progress in biosimilars and specialty drugs, is heightening the need for advanced filtration solutions. Companies such as Meissner Filtration Products and Pall Corporation have notably made strategic investments in the region. For instance, introduced specialized single-use filtration systems designed for the requirements of biopharmaceutical producers in the Asia Pacific region. Furthermore, Pall Corporation increased its range of products with advanced filtration technologies created to tackle the increasing challenges in pharmaceutical manufacturing. The fast growth of pharmaceutical infrastructure in nations such as India and China, along with these advancements, backs the increasing demand for effective and dependable filtration solutions. The growth in this area shows how Asia Pacific is becoming more important and central in the worldwide pharmaceutical filtration market.

Key Players

The Major Players are Eaton, Merck KGaA, Amazon Filters Ltd., Thermo Fisher Scientific Inc., Parker Hannifin Corp., 3M, Sartorius AG., Graver Technologies, Danaher Corporation., Meissner Filtration Products, Inc, Pall Corporation & others Players

Recent Development

-

In the beginning of 2023, Sartorius AG (Germany) and RoosterBio, Inc. (US) agreed to collaborate on providing purification solutions and creating scalable downstream manufacturing processes for exosome-based treatments. Sartorius will offer its scalable filtration equipment, including SartoflowSmart and Sartoflow Advanced, for the clarification, concentration, and formulation of exosomes in this partnership.

-

In June 2022, Donaldson Company Inc. from the United States completed the acquisition of Purilogics, LLC, also based in the United States, a biotechnology startup specialized in producing membrane chromatography products. By acquiring Purilogics, the company will gain access to a variety of purification tools for different biologics like mRNA, plasmid DNA, viral particles, monoclonal antibodies, and proteins.

| Report Attributes | Details |

| Market Size in 2023 | USD 16.4 Billion |

| Market Size by 2032 | USD 43.9 Billion |

| CAGR | CAGR of 11.56 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Membrane Filters ,Prefilters & Depth Media,Single-use Systems ,Cartridges & Capsules ,Filter Holders ,Filtration Accessories ,Others) • By Technique (Microfiltration,Ultrafiltration ,Cross Flow Filtration ,Nanofiltration,Others) • By Type (Sterile,Non-sterile) • By Application (Final Product Processing,Raw Material Filtration,Cell Separation,Water Purification,Air Purification) • By Scale of Operation (Manufacturing Scale ,Pilot Scale ,Research & Development Scale) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Eaton, Merck KGaA, Amazon Filters Ltd., Thermo Fisher Scientific Inc., Parker Hannifin Corp.,3M, Sartorius AG., Graver Technologies, Danaher Corporation., Meissner Filtration Products, Inc, Pall Corporation & others Players |

| Key Drivers | • Growing R&D spending in the pharmaceutical industry is boosting the need for more advanced filtration solutions. • Increased safety and quality standards are pushing growth in the pharmaceutical filtration market. |

| RESTRAINTS | • Obstacles Limiting Expansion in the Pharmaceutical Filtration Market • Necessity for large financial investments in new production facilities. |