Antiseptic and Disinfectant Market Report Scope & Overview:

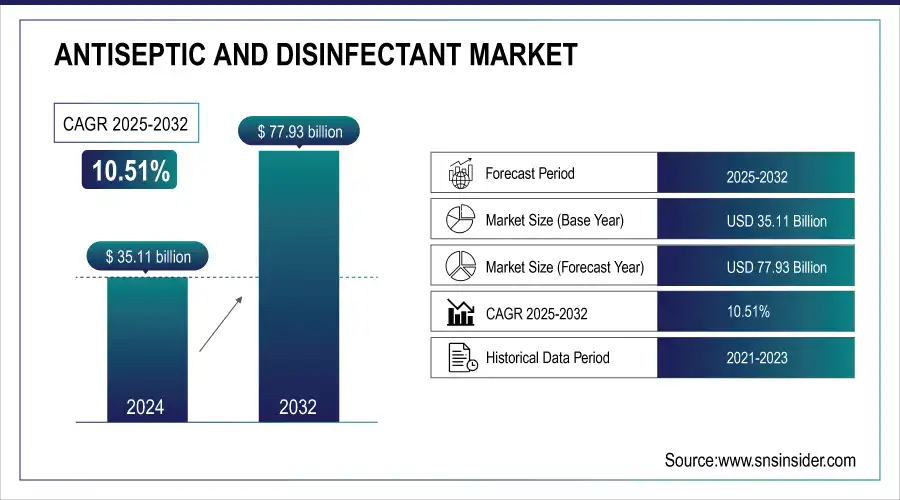

The antiseptic and disinfectant market was valued at USD 35.11 billion in 2024 and is expected to reach USD 77.93 billion by 2032, growing at a CAGR of 10.51% over the forecast period of 2025-2032.

One of the key antiseptic and disinfectant market trends is the increasing preference for eco-friendly disinfectants, further driving the global market for antiseptics and disinfectants. Health-conscious consumers, environmental concerns, and tightened regulations are catalyzing this trend. Non-toxic, biodegradable, and naturally fragrant with sustainable packaging are emerging as popular features on products. The market represents a demand for safer, more natural, and inventive alternatives that are harmonious with people and the planet.

To Get more information on Antiseptic and Disinfectant Market - Request Free Sample Report

For instance, in May 2025, 61% of the U.S. consumers preferred eco-labeled disinfectants, a 14% rise since 2022, highlighting growing demand for non-toxic, sustainable cleaning products.

For instance, in February 2025, 68% of the U.S. consumers preferred antiseptic products with natural or non-toxic ingredients, reflecting strong demand for safer, eco-conscious formulations in the market.

Key Antiseptic and Disinfectant Market Trends

-

Rising incorporation of smart sensors in disinfectant dispensers for real-time monitoring of surface contamination and usage patterns.

-

Development of bio-based and plant-derived antiseptic formulations to meet increasing consumer preference for natural and eco-friendly products.

-

Expansion of automated sterilization units in healthcare and public spaces for consistent and efficient microbial control.

-

Implementation of predictive analytics to forecast infection hotspots and optimize cleaning schedules in institutional environments.

-

Growth in portable disinfection technologies, including UV-C and electrostatic misting systems, for rapid deployment in diverse settings.

-

Enhancement of formulation stability and long-lasting antimicrobial activity for extended protection across surfaces and materials.

Antiseptic and Disinfectant Market Growth Drivers:

-

COVID-19 Pandemic Drove the Antiseptic and Disinfectant Market Growth

The outbreak of COVID-19 has arisen as a key push for the antiseptic and disinfectant market, resulting in growing demand, panic buying, and hygiene awareness that has lasted long. It sped up e-commerce expansion, institutional buys, and product development. These changes led to a massive increase in the antiseptic and disinfectant market, changed consumption behavior, and triggered long-term growth, forming new household, health care, and public demand.

For instance, in November 2024, the online sales of antiseptic and disinfectant products grew by 21.8% in 2024, reflecting strong post-COVID consumer preference for digital hygiene product purchases.Top of FormTop of Form

Antiseptic and Disinfectant Market Restraints:

-

Limited Availability and Price Volatility of Raw Chemicals are Hampering the Antiseptic and Disinfectant Market Growth

The market is also inhibited by its reliance on the availability and price volatility of raw chemicals, thus having an unpredictable impact on production stability and supply continuity. Sourcing becomes more challenging due to geopolitical risks and quality variability, along with stricter regulation that impacts product consistency and delivery. Despite growing demand globally, these challenges are limiting antiseptic and disinfectant market growth as they inhibit streamlined operations.

For instance, in October 2024, EU disinfectant producers faced a 19% rise in raw chemical procurement costs, driven by shortages and regulatory compliance, impacting production and pricing stability.Top of FormTop of Form

Antiseptic and Disinfectant Market Segment Analysis

-

By Sales Channel

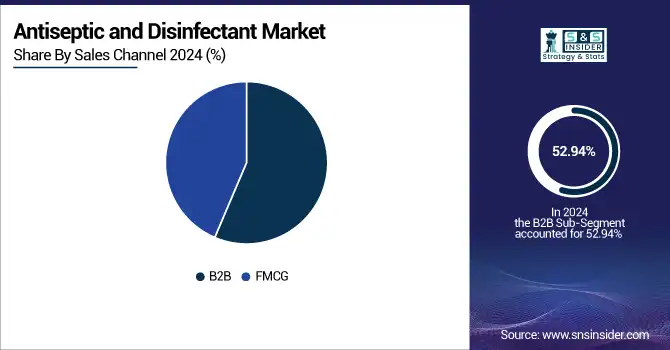

B2B held a dominant antiseptic and disinfectant market share of 52.94% in 2024, as hospitals, clinics, medical centers, and other industrial places had a high-volume need for it. The bleak procurement, long-term contracts, and strict hygiene criteria in the healthcare and food processing sectors help sales to remain constant. Moreover, the institutional emphasis on infection prevention and workplace safety drives robust demand, helping secure B2B's dominant market share.

FMCG is emerging as the fastest-growing segment in the global antiseptic and disinfectant market, registering a CAGR of 10.77% over the forecast period due to increased consumer interest in everyday hygiene items including hand sanitizers, sprays, and wipes. Growth of post-pandemic habits, brand marketing campaigns, and retail expansion. With the development of environmentally safe and skin-friendly formulations, as people become more conscious of personal hygiene, these have already increased in uptake within household and public areas.

-

By Type

Quaternary ammonium compounds are the dominant segment in the global antiseptic and disinfectant market, with a 32.94% market share in 2024, owing to their broad-spectrum antimicrobial action, rapid onset, and surface compatibility. QACs are no longer confined to hospitals, and they have been widely used in households and food processing because of their residual efficacy at low toxicity. Growing significance in healthcare & industrial disinfection applications, owing to their cost competitiveness and compatibility with multiple formulations, also drives the dominance of quaternary ammonium compounds.

The diagnostics segment is emerging as the fastest growing with a CAGR of 11.32% in the global antiseptic and disinfectant market, as the demand for eco-friendly and biodegradable solutions increases. Enzyme-based disinfection has highly specific, precise action on organic tissue, an invaluable trait in medical, food, and biotech environments. They are non-toxic, regulatory compliant, and utilization in eco-friendly green cleaning solutions is pushing rapid development in both healthcare and industrial applications.

-

By Product

In 2024, the medical device disinfectants dominated the antiseptic and disinfectant industry with a 45.94% market share, owing to strict guidelines on infection control in hospitals & surgical centers. Demand susceptible to stiff competition driven by rising surgical procedures, Increased use of reusable instruments, and regulatory mandates for sterilization. They are crucial due to their ability to decrease the incidence of healthcare-associated infections (HAIs), and hence, they maintain a high level of adoption across all healthcare facilities and labelling revenues as a key contributor in the overall market.

The enzymatic cleaner’s segment is the fastest-growing segment of the antiseptic and disinfectant market analysis, driven by its safety and effectiveness in organic residue digestion. Eco-friendly, non-corrosive cleaning with surgical, dental, and laboratory applications. The rising requirement for biodegradable and residue-free products, coupled with their growing adoption among infection control protocols, is expected to drive the market growth.

-

By End-user

Hospitals are the largest segment of the antiseptic and disinfectant industry, as a result quantity of people treated, infection control policies, and the number of procedures conducted. High demand is predominantly achieved by lifelong usage of surface, instrument, and hand disinfectants. Increased hospital visits over regulatory compliance, healthcare-acquired infection (HAI) prevention initiatives, and awareness of anti-microbial resistance consolidate hospitals as the largest end-use segment globally.

The Others segment is witnessing the highest growth in the global antiseptic and disinfectant market, due to increasing needs of household, food processing, veterinary, and public services. Post coronavirus, greater awareness of hygiene and increased pet care, coupled with environment-friendly products in non-clinical settings, are making this space grow rapidly.

Antiseptic and Disinfectant Market Regional Analysis

North America Antiseptic and Disinfectant Market Insights

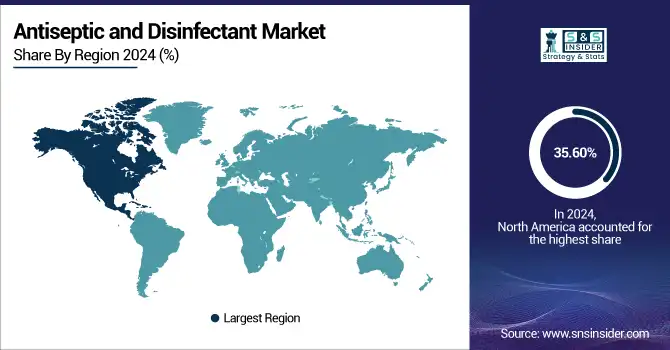

In 2024, the North American region holds a dominant market share of 35.60% of the global antiseptic and disinfectant market, owing to a well-developed medical system, hygiene awareness, and strict regulatory control. Due to stringent infection control standards and growing surgical volumes, disinfectants are widely used in hospitals, households, along industrial settings across the region. Key players in the market, including 3M, P&G, and GOJO, are based in the U.S., driving innovation and product availability. Growing preference for eco-friendly and skin-safe formulations, along with higher purchasing power further propels product penetration. This is propelling North America to the top spot in market share, as government-backed health awareness drives and post-COVID hygiene habits keep demand constant.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Antiseptic and Disinfectant Market Insights

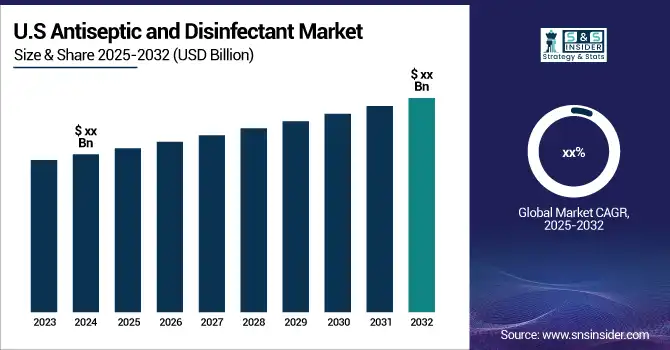

The U.S. antiseptic and disinfectant market was valued at USD 10.28 billion in 2024 and is expected to reach USD 22.53 billion by 2032, growing at a CAGR of 10.34% over 2025-2032. Increased health awareness and lifestyle-based hygiene behavior in the country, along with high demand for safe, eco-friendly, innovative products, have resulted in the dominance of the U.S. in the market for antiseptics and disinfectants. Growing consumer spending, public health messaging networks, and easy formats of sauces were further responsible for growth.

Europe Antiseptic and Disinfectant Market Insights

The second largest market is Europe, which holds a significant share due to strong regulatory bodies, high healthcare standards, and public health awareness. The megatrend-appropriate alignment of key players including PAUL HARTMANN, Schülke & Mayr, and B. Braun fosters innovation and supply. Moreover, the growing quest for eco-friendly non-toxic products and stringent infection control protocols in hospitals and public facilities drives the regional market growth.

Asia-Pacific Antiseptic and Disinfectant Market Insights

Asia Pacific emerges as the fastest-growing region with the highest CAGR of 11.21%, fuelled by the rapidly growing urbanization, high levels of healthcare spending, and growing hygiene and awareness about infection control. Rise in hospital infrastructure, surgeries, and public health initiatives in major countries, including China, India, and Japan. The rising concern for hygiene behaviour after the COVID-19 outbreak, high consumer focus on disinfectant products, and government sanitation drive have largely catapulted purchases.

Moreover, TOC for the expansion of e-commerce and retail channels is likely to increase the penetration of antiseptic and disinfectant products in both urban and rural areas. Growing disposable income, soaring pet ownership, and industry expansion have also enhanced the product demand in non-healthcare segments. This has not only helped in further fast-tracking product availability and market penetration but also driven the growth of the region as a whole with local manufacturing and foreign investments.

Middle East & Africa Antiseptic and Disinfectant Market Insights

The Middle East & Africa have the least share of global antiseptic and disinfectant markets due to limited healthcare infrastructure, lack of public health awareness, and economic constraints. Fluctuation in demand and supply of product, less strict regulations, and lesser penetration in rural areas are, at the time, hindering market growth. Slow recovery for more aggressive antibiotic markets. Urbanization, healthcare investment, and infection-control practices are slowly improving demand in certain markets.

Latin America Antiseptic and Disinfectant Market Insights

Latin America has a moderate share in the antiseptic and disinfectant market due to increasing healthcare investment, urbanization, and growing hygiene awareness. With the surge in hospital admissions and growing consumption of disinfectant products in countries including Brazil, Mexico, and Argentina. Still, broader market expansion is confined by challenges including economic uncertainty, varying access to healthcare, and gaps in regulations. Increasing need for ecological and cost-effective hygiene solutions offer avenues in APAC.

Antiseptic and Disinfectant Companies are:

Some of the Antiseptic and Disinfectant Market Companies

-

3M

-

Ecolab

-

GOJO

-

Schülke & Mayr

-

Metrex

-

Johnson & Johnson

-

Unilever

-

B. Braun

-

Clorox

-

Reckitt Benckiser

-

Procter & Gamble

-

Kimberly-Clark

-

SteriPro Inc.

-

Becton, Dickinson and Company

-

Medline Industries

-

Cardinal Health

-

PAUL HARTMANN AG

-

Diversey Holdings

-

Groupe Lépine

-

Laboratoires Anios

Recent Developments:

Ecolab, headquartered in Saint Paul, Minnesota, and founded in 1923, is a global leader in water, hygiene, and infection prevention solutions. The company offers cleaning, sanitizing, and disinfecting products and services across foodservice, healthcare, and industrial sectors, promoting safety, efficiency, and sustainability

-

In April 2024, Ecolab launched EcoSure Surface Defense, a biodegradable hospital-grade disinfectant designed for healthcare and food sectors, meeting EPA safety standards and supporting sustainability goals.

3M, founded in 1902 and based in St. Paul, Minnesota, is a diversified technology company delivering innovative products in healthcare, safety, consumer goods, and industrial sectors. Renowned for adhesives, abrasives, and personal protective equipment, 3M leverages research-driven solutions to improve productivity, safety, and overall quality of life globally

-

In January 2025, 3M upgraded its Surface Shield with advanced antiviral technology, offering up to 90 days of continuous protection against viruses, including RSV and norovirus, enhancing long-term surface hygiene.

|

Report Attributes |

Details |

|---|---|

| Market Size in 2024 | USD 35.11 billion |

| Market Size by 2032 | USD 77.93 billion |

| CAGR | CAGR of 10.51% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Quaternary Ammonium Compounds, Chlorine Compounds, Alcohols & Aldehyde Products, Enzyme, Others) • By Product (Enzymatic Cleaners, Medical Device Disinfectants, Surface Disinfectants) • By Sales Channel (B2B, FMCG) •By End User (Hospitals, Clinics, Others) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | 3M, Ecolab, GOJO, Schülke & Mayr, Metrex, Johnson & Johnson, Unilever, B. Braun, Clorox, Reckitt Benckiser, Procter & Gamble, Kimberly-Clark, SteriPro Inc., Becton, Dickinson and Company, Medline Industries, Cardinal Health, PAUL HARTMANN AG, Diversey Holdings, Groupe Lépine, Laboratoires Anios, and other players. |