Viral Vectors and Plasmid DNA Manufacturing Market Report Scope & Overview:

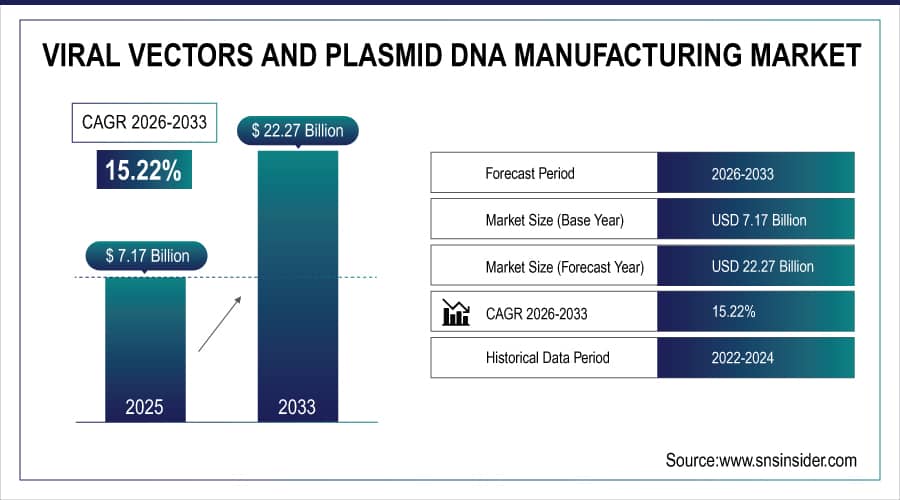

The Viral Vectors and Plasmid DNA Manufacturing Market Size was valued at USD 7.17 billion in 2025E and is expected to reach USD 22.27 billion by 2032 and grow at a CAGR of 15.22% over the forecast period 2026-2033.

A vector is a type of gene delivery device that is used to insert a transgene into a cell so that it can be reproduced and/or expressed. The vector is a DNA molecule with a transgene insert and a longer sequence that serves as the vector's pillar. The primary tasks of the vector in transmitting genetic information to another cell are the isolation, multiplication, or expression of the insert in the target cell.

Viral Vectors and Plasmid DNA Manufacturing Market Size and Forecast:

-

Market Size in 2025E: USD 7.17 Billion

-

Market Size by 2033: USD 22.27 Billion

-

CAGR: 15.22% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Viral Vectors and Plasmid DNA Manufacturing Market - Request Free Sample Report

Key trends in the Viral Vectors and Plasmid DNA Manufacturing Market:

-

Rising demand for gene therapies and personalized medicines is driving the need for large-scale viral vector and plasmid DNA production.

-

Increasing adoption of viral vectors, including AAV, lentivirus, and adenovirus, in cell and gene therapies.

-

Growing investments by biopharmaceutical companies and CDMOs in GMP-compliant manufacturing facilities.

-

Expansion of contract development and manufacturing services (CDMOs) to meet clinical and commercial-scale demand.

-

Advancements in upstream and downstream process technologies, including single-use bioreactors and chromatography, improving yields and reducing production costs.

-

Rising demand for plasmid DNA as a template for mRNA vaccines and gene therapy vectors.

-

Strategic partnerships and collaborations between pharmaceutical companies, biotech firms, and CMOs for technology transfer and manufacturing scale-up.

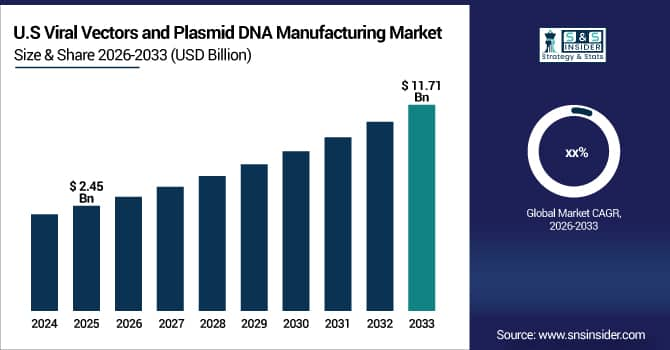

The U.S. Viral Vectors and Plasmid DNA Manufacturing Market was valued at USD 2.45 Billion in 2025E and is projected to reach USD 11.71 Billion by 2033. Market growth is fueled by increasing adoption of gene and cell therapies, rising clinical trials, and the growing need for high-quality, scalable manufacturing solutions for viral vectors and plasmid DNA.

Viral Vectors and Plasmid DNA Manufacturing Market Drivers:

-

Rising Demand for Gene and Cell Therapies Drives Growth in Viral Vectors and Plasmid DNA Manufacturing Market

The increasing adoption of gene and cell therapies is a major driver fueling the growth of the Viral Vectors and Plasmid DNA Manufacturing Market. As personalized medicine gains traction, biopharmaceutical companies and research institutions require large-scale, high-quality viral vectors and plasmid DNA to support clinical trials and commercial therapies. This demand encourages investment in advanced production technologies such as single-use bioreactors, automated purification systems, and GMP-compliant facilities, improving efficiency and scalability. Furthermore, the rising prevalence of rare genetic disorders and oncology applications is driving the need for diverse vector types, including AAV, lentivirus, and adenovirus, which accelerates overall market expansion.

In June 2025, Lonza Group expanded its viral vector manufacturing facility in Houston, Texas, to increase production of AAV and lentiviral vectors, meeting growing demand from clinical and commercial gene therapy pipelines.

Viral Vectors and Plasmid DNA Manufacturing Market Restraints:

-

Stringent Regulatory Requirements and High Production Costs Limit Expansion of Viral Vectors and Plasmid DNA Manufacturing Market

The Viral Vectors and Plasmid DNA Manufacturing Market faces significant restraints due to strict regulatory requirements and high production costs. Manufacturing clinical- and commercial-grade vectors demands adherence to GMP standards, extensive safety testing, and analytical validation, which requires significant capital investments in specialized facilities, skilled workforce, and quality systems. Additionally, complex upstream and downstream processes, including transfection, purification, and fill-finish operations, increase operational expenses and create barriers for small- and mid-sized companies. The stringent regulatory landscape also slows time-to-market, particularly for novel therapies requiring new vector platforms or modifications.

In March 2024, a small biotech firm in California delayed the launch of its lentiviral therapy because it could not scale up purification processes while maintaining GMP compliance, highlighting the impact of regulatory and cost barriers.

Viral Vectors and Plasmid DNA Manufacturing Market Opportunities:

-

Expanding Use of mRNA and Gene Therapy Platforms Presents Strategic Opportunities in Viral Vectors and Plasmid DNA Manufacturing Market

The growing application of mRNA vaccines and gene therapy platforms presents a significant growth opportunity for the Viral Vectors and Plasmid DNA Manufacturing Market. Plasmid DNA and viral vectors serve as essential components for mRNA vaccine production and gene therapy delivery, creating increased demand for scalable, high-quality manufacturing solutions. Companies are investing in new plasmid production technologies, automated purification systems, and high-throughput viral vector platforms to support clinical and commercial pipelines. Strategic collaborations between pharmaceutical firms and CDMOs further strengthen supply chains and improve access to advanced manufacturing capacities. This trend enables market players to expand service offerings, innovate production technologies, and meet rising global demand for next-generation therapeutics, reinforcing long-term growth potential.

In September 2025, Catalent Inc. launched an expanded plasmid DNA manufacturing line in Madison, Wisconsin, specifically to support mRNA vaccine and gene therapy pipelines, increasing output and accelerating delivery for clinical programs worldwide.

Viral Vectors and Plasmid DNA Manufacturing Market Segmentation Analysis:

By Vector Type, Adeno-Associated Virus (AAV) Leads Market While Lentivirus Registers Fastest Growth

The Adeno-Associated Virus (AAV) segment dominates with 29% of revenue in 2025E. AAV’s high safety profile, low immunogenicity, and long-term gene expression capabilities drive its widespread adoption in gene and cell therapies. This increased demand stimulates investment in scalable AAV production technologies, advanced purification processes, and GMP-compliant manufacturing facilities. As a result, AAV leads market revenue, reinforcing the growth of the Viral Vectors and Plasmid DNA Manufacturing Market by enabling broader clinical and commercial applications.

The Lentivirus segment is growing at the fastest CAGR of 8.13% during the forecast period. Lentiviral vectors’ ability to transduce dividing and non-dividing cells makes them ideal for CAR-T and cell therapy pipelines. Rising clinical trials and approvals drive investment in high-efficiency lentiviral production platforms, automated purification, and process development. This accelerated adoption of lentivirus contributes to the overall growth of the Viral Vectors and Plasmid DNA Manufacturing Market by expanding therapeutic applications.

By Workflow, Downstream Purification Leads Market While Upstream Manufacturing Registers Fastest Growth

The Downstream Purification segment dominates with 44% of revenue in 2025E. Purification, polishing, and formulation processes ensure high-quality viral vectors and plasmid DNA, meeting GMP and regulatory standards. Increasing demand for clinical- and commercial-grade products drives investment in chromatography, filtration, and automated downstream platforms. These advancements enhance yield and safety, directly boosting the overall Viral Vectors and Plasmid DNA Manufacturing Market by enabling reliable delivery of therapeutics at scale.

The Upstream Manufacturing segment is growing at the fastest CAGR of 9.89% during the forecast period. Rising demand for viral vectors and plasmid DNA for clinical and commercial applications drives investment in scalable cell culture, transfection, and production technologies. Efficient upstream platforms reduce cost and time-to-market, while supporting process development. Consequently, growth in upstream manufacturing accelerates the overall Viral Vectors and Plasmid DNA Manufacturing Market by ensuring sufficient supply for gene therapy and vaccine production.

By Application, Vaccines Lead Market While Gene Therapy Registers Fastest Growth

The Vaccines segment dominates with 66% of revenue in 2025E. The urgent global need for viral-vector and mRNA-based vaccines drives large-scale plasmid DNA production, process optimization, and fill-finish operations. This high-volume demand strengthens investment in GMP-compliant vaccine manufacturing technologies. As a result, vaccine-focused applications significantly contribute to the Viral Vectors and Plasmid DNA Manufacturing Market by generating steady revenue streams and reinforcing the critical role of plasmid DNA and viral vectors in public health initiatives.

The Gene Therapy segment is growing at the fastest CAGR during the forecast period. Increasing approvals of AAV- and lentiviral-based therapies for rare genetic diseases and oncology expand demand for specialized viral vectors and GMP-grade plasmids. Investments in process development, automated production platforms, and scalable manufacturing enhance therapeutic accessibility. Consequently, the rapid expansion of gene therapy pipelines accelerates the overall Viral Vectors and Plasmid DNA Manufacturing Market by driving innovation and adoption across global clinical programs.

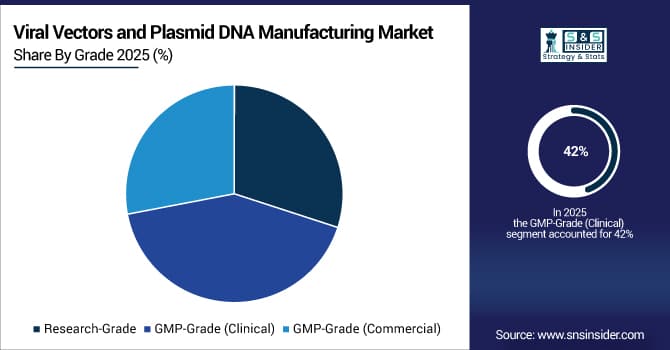

By Grade, GMP-Grade (Clinical) Leads Market While GMP-Grade (Commercial) Registers Fastest Growth

The GMP-Grade (Clinical) segment dominates with 42% of revenue in 2025E. Clinical-grade plasmid DNA and viral vectors are critical for preclinical and early-phase trials, ensuring product quality and regulatory compliance. Rising clinical studies and therapy pipelines drive investments in GMP manufacturing infrastructure, quality control, and analytical testing. This widespread adoption directly strengthens the Viral Vectors and Plasmid DNA Manufacturing Market by creating a stable revenue base from clinical-grade production.

The GMP-Grade (Commercial) segment is growing at the fastest CAGR during the forecast period. Increasing commercialization of gene therapies and viral-vector vaccines fuels demand for large-scale, regulatory-compliant production facilities. Investments in automated upstream and downstream platforms improve yield and reduce cost-of-goods, meeting commercial supply needs. Consequently, GMP-commercial-grade expansion accelerates the Viral Vectors and Plasmid DNA Manufacturing Market by supporting large-scale therapeutic deployment.

By End User, Academic & Research Institutes Lead Market While Biopharmaceutical & Biotechnology Companies Register Fastest Growth

The Academic & Research Institutes segment dominates with 42% of revenue in 2025E. Research institutions drive early-stage discovery, plasmid design, and viral vector development, generating significant demand for high-quality DNA and vectors. This demand fuels investments in specialized production and analytical services. As a result, academic and research use maintains a leading revenue share, supporting the Viral Vectors and Plasmid DNA Manufacturing Market by underpinning innovation and preclinical pipeline development.

The Biopharmaceutical & Biotechnology Companies segment is growing at the fastest CAGR during the forecast period. Expanding gene and cell therapy portfolios, mRNA vaccines, and commercial vector therapies drive large-scale, GMP-compliant production needs. Investments in CDMO partnerships, automation, and process development further accelerate capacity expansion. Consequently, growth in biopharmaceutical and biotech adoption boosts the Viral Vectors and Plasmid DNA Manufacturing Market by converting clinical pipelines into commercial-scale therapeutics.

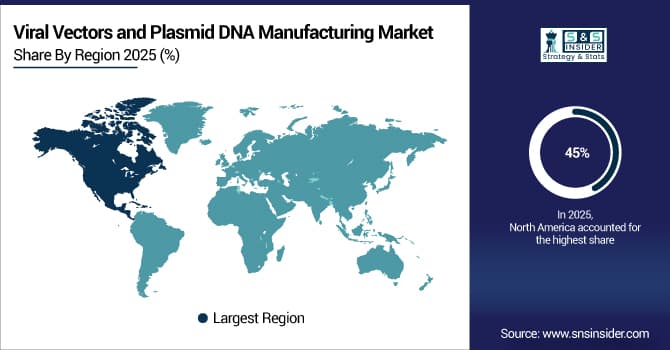

Viral Vectors and Plasmid DNA Manufacturing Market Regional Analysis:

North America Dominates Viral Vectors and Plasmid DNA Manufacturing Market in 2025E

In 2025E, North America commands an estimated 45% share of the Viral Vectors and Plasmid DNA Manufacturing Market, driven by advanced healthcare infrastructure, increasing gene and cell therapy approvals, and significant investments in biopharmaceutical manufacturing. The region benefits from top CDMOs and biopharma companies such as Lonza, Thermo Fisher Scientific, and Catalent, which expand production facilities to meet clinical and commercial demands. Strong government funding, collaborations with academic research institutions, and rapid vaccine and gene therapy development further strengthen North America’s market leadership.

Get Customized Report as Per Your Business Requirement - Enquiry Now

United States is the Dominating Country in North America

The United States is the dominating country in North America, with robust R&D investment, leading biopharmaceutical firms, and extensive GMP-compliant manufacturing infrastructure. U.S. regulatory frameworks accelerate therapy approvals, while large-scale clinical trials and commercial programs reinforce demand for viral vectors and plasmid DNA. Strategic partnerships between CDMOs, biotech companies, and academic centers ensure consistent supply and innovation, making the U.S. the central driver of market growth in the region.

Asia Pacific Registers Fastest Growth in Viral Vectors and Plasmid DNA Manufacturing Market in 2025E

Asia Pacific is projected to grow at an estimated CAGR of 12.63%, fueled by expanding biotechnology investment, emerging gene therapy research, and increasing local CDMO capacities. Rising demand for viral vectors and plasmid DNA for mRNA vaccines and gene therapy pipelines accelerates market growth, while strategic collaborations between global and regional players support technology transfer and scaling production efficiently.

China is the Dominating Country in Asia Pacific

China dominates the Asia Pacific region, driven by government incentives, strong biotech hubs, and rapid adoption of gene and cell therapy pipelines. Large-scale clinical trial approvals, investments in plasmid DNA and viral vector production, and growing vaccine demand contribute to China’s leadership. Collaborations with multinational CDMOs and expansion of local manufacturing facilities strengthen the supply chain, positioning China as the key growth engine of Asia Pacific’s viral vector and plasmid DNA market.

Europe Viral Vectors and Plasmid DNA Manufacturing Market Insights, 2025

Europe held a significant portion of the Viral Vectors and Plasmid DNA Manufacturing Market in 2025, driven by strong demand for gene therapies and viral-vector-based vaccines. Advanced biopharmaceutical infrastructure, strict regulatory compliance, and increasing clinical trial activity contribute to sustained growth.

Germany is the Dominating Country in Europe

Germany leads Europe’s market due to its extensive biotech ecosystem, government funding for gene therapy, and strong CDMO presence. The country’s emphasis on clinical innovation, high-quality manufacturing, and research collaborations reinforces its dominance, driving market growth across the continent.

Middle East & Africa and Latin America Viral Vectors and Plasmid DNA Manufacturing Market Insights, 2025

In 2025, Middle East & Africa showed steady growth driven by rising healthcare investments, biotechnology initiatives, and the expansion of clinical research infrastructure. South Africa leads the region with investments in GMP facilities and partnerships for gene therapy pipelines. Latin America experienced growth led by Brazil and Mexico, supported by local CDMO collaborations, increasing clinical trials, and government initiatives to strengthen vaccine and gene therapy production. Both regions remain emerging markets, gradually expanding their share of the global viral vectors and plasmid DNA market.

competitive landscape for the Viral Vectors and Plasmid DNA Manufacturing Market:

Thermo Fisher Scientific

Thermo Fisher Scientific is a U.S.-based global leader in life sciences, providing comprehensive solutions for viral vector and plasmid DNA manufacturing. The company specializes in upstream and downstream production, GMP-compliant plasmid DNA, purification systems, and analytical services. Thermo Fisher operates extensive manufacturing and service networks, supporting biopharmaceutical and biotechnology companies in clinical and commercial-scale production. Its role in the market is critical, as it delivers scalable, high-quality viral vector and plasmid DNA solutions that accelerate gene therapy, cell therapy, and vaccine development pipelines globally.

-

In 2025, Thermo Fisher expanded its plasmid DNA production capacity in the U.S., introducing enhanced single-use bioreactors and automated purification platforms to support large-scale gene therapy and mRNA vaccine manufacturing.

Lonza Group

Lonza Group is a Switzerland-based biopharmaceutical contract development and manufacturing organization (CDMO), offering end-to-end viral vector and plasmid DNA manufacturing solutions. The company focuses on upstream and downstream production, process development, and GMP-grade product supply for gene and cell therapy pipelines. Lonza collaborates with global biotech and pharmaceutical firms to deliver scalable, reliable, and compliant manufacturing solutions. Its role in the market is vital, providing advanced manufacturing technologies and strategic support that enable clients to accelerate clinical and commercial launches worldwide.

-

In June 2025, Lonza inaugurated a new viral vector manufacturing facility in Houston, Texas, designed to increase AAV and lentiviral vector output for clinical and commercial applications, leveraging advanced purification and automated analytics.

Catalent Inc.

Catalent Inc. is a U.S.-based biopharmaceutical CDMO specializing in viral vector and plasmid DNA manufacturing for gene therapies, vaccines, and cell therapies. The company offers GMP-compliant upstream and downstream production, fill-finish, and quality control services. Catalent supports global biopharmaceutical clients with scalable solutions, process development, and rapid time-to-market for advanced therapies. Its role in the market is significant, providing end-to-end manufacturing capabilities that ensure regulatory compliance, high yield, and product quality across viral vector and plasmid DNA pipelines.

-

In September 2025, Catalent expanded its Madison, Wisconsin facility with a dedicated plasmid DNA production line to support mRNA vaccine and gene therapy pipelines, enabling higher capacity and faster delivery for clinical programs.

FUJIFILM Diosynth Biotechnologies

FUJIFILM Diosynth Biotechnologies is a U.S.-headquartered global CDMO specializing in viral vector and plasmid DNA manufacturing for gene therapy, cell therapy, and vaccine applications. The company focuses on upstream production, downstream purification, process development, and GMP-grade delivery. FUJIFILM Diosynth partners with biotechnology and pharmaceutical companies to accelerate clinical and commercial-scale manufacturing. Its role in the market is central, offering advanced technologies, scalable processes, and regulatory-compliant production platforms that enable efficient, high-quality viral vector and plasmid DNA supply for global therapeutics.

-

In August 2025, FUJIFILM Diosynth expanded its viral vector production capacity in the U.S., incorporating single-use bioreactors and automated chromatography systems to meet growing global gene therapy and vaccine demand.

Viral Vectors and Plasmid DNA Manufacturing Market key Players:

-

Thermo Fisher Scientific

-

Lonza Group

-

Catalent Inc.

-

FUJIFILM Diosynth Biotechnologies

-

Oxford Biomedica

-

Aldevron (Danaher-owned)

-

WuXi Advanced Therapies (WuXi AppTec)

-

Charles River Laboratories

-

VGXI Inc.

-

Cobra Biologics

-

SIRION Biotech GmbH

-

PlasmidFactory GmbH

-

AGC Biologics

-

Yposkesi

-

Takara Bio Inc.

-

UniQure N.V.

-

Virovek Incorporation

-

RegenxBio, Inc.

-

BioMarin Pharmaceutical

-

MassBiologics

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 7.17 Billion |

| Market Size by 2033 | US$ 22.27 Billion |

| CAGR | CAGR of 15.22 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vector Type (Adenovirus, Adeno-Associated Virus (AAV), Lentivirus, Retrovirus, Plasmids, Others) • By Workflow (Upstream Manufacturing, Downstream Purification, Fill-Finish, Quality Control & Testing, Process Development) • By Application (Gene Therapy, Cell Therapy, Vaccines, Oncology/Oncolytic Viruses, Research Use) • By Grade / Quality (Research-Grade, GMP-Grade (Clinical), GMP-Grade (Commercial)) • By End User (Biopharmaceutical & Biotechnology Companies, CDMOs/CMOs, Academic & Research Institutes, Vaccine Manufacturers, Government/Public Health Agencies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Thermo Fisher Scientific, Lonza Group, Catalent Inc., FUJIFILM Diosynth Biotechnologies, Oxford Biomedica, Aldevron, WuXi Advanced Therapies, Charles River Laboratories, VGXI Inc., Cobra Biologics, SIRION Biotech GmbH, PlasmidFactory GmbH, AGC Biologics, Yposkesi, Takara Bio Inc., UniQure N.V., Virovek Incorporation, RegenxBio, BioMarin Pharmaceutical, MassBiologics. |