Endoscopy Devices Market Overview:

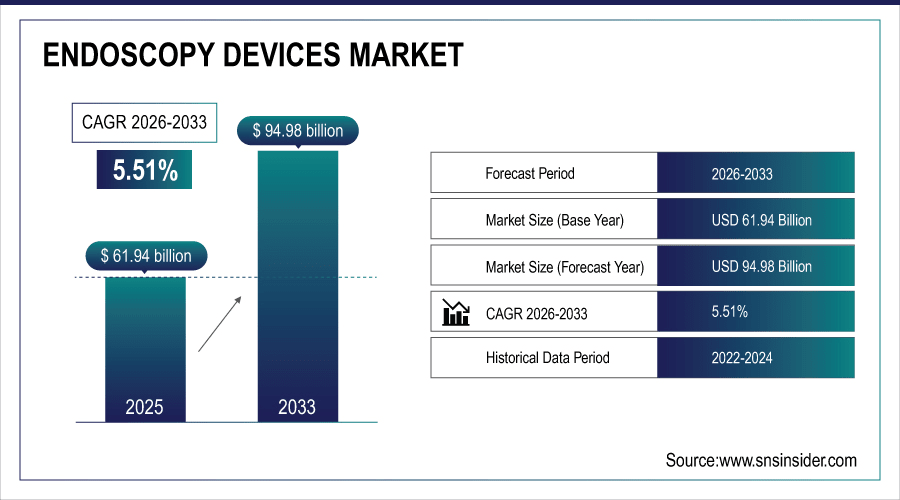

The global endoscopy devices market is estimated to be valued at USD 61.94 billion in 2025 and is projected to reach USD 94.98 billion by 2033, growing at a CAGR of 5.51% during the forecast period 2026–2033.

Endoscopic has been playing more important role in minimally invasive treatment and diagnosis for past 10 years. In 2025, more than 45 million endoscopic procedures were carried out worldwide with gastrointestinal endoscopy representing 40%. Endoscope and visualization systems account for 55% of market sales. Increasing incidence of GI diseases, transition from reusable devices to single-use devices and rising adoption in outpatient and specialty clinics prompts for G steady rise, as hospitals & ambulatory surgical centers represent the largest end-users globally.

Single-use endoscopy devices contributed to 25% of device adoption, reflecting growing hygiene awareness.

To Get More Information On Endoscopy Devices Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 61.94 Billion

-

Market Size by 2033: USD 94.98 Billion

-

CAGR: 5.51% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Endoscopy Devices Market Trends:

-

In 2025, more than 12 million GI endoscopies will be performed in the U.S., with colonoscopy and upper GI endoscopy driving most of the volume.

-

Germany performs around 850,000 endoscopic procedures a year and minimally invasive diagnostics and therapy continues to gain acceptance.

-

More than 450,000 endoscopic procedures performed annually in Latin America demonstrate increasing hospital and outpatient adoption.

-

Intermediate endoscopists (who performed between 200 and 499 procedures annually) represent just under 40% of practitioners and high-volume endoscopists (500-999 procedures) comprise over 30%.

-

More than 1,200 endoscopic procedures performed annually at major centers such as the Cleveland Clinic including therapeutic and advanced endoscopy.

U.S. Endoscopy Devices Insights:

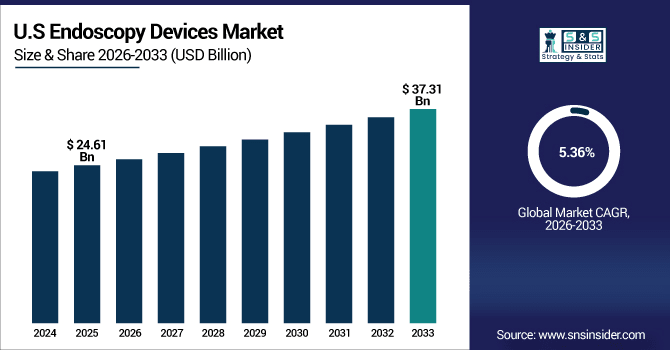

The U.S. Endoscopy Devices Market is estimated to be valued at USD 24.61 billion in 2025E and is projected to reach USD 37.31 billion by 2033 at a CAGR of 5.36%. Over 16.9 million procedures were performed in 2025, driven by advanced endoscopes, visualization systems, single-use devices, and growing demand for minimally invasive diagnostics.

Endoscopy Devices Market Growth Drivers:

-

Increasing Prevalence of Gastrointestinal Disorders and Advanced Endoscopic Technologies Drives Global Procedure Volumes and Device Adoption.

Novel endoscopic and minimally invasive procedures bring advances in accuracy and patient wellbeing. In 2025, more than 45 million endoscopies were carried out worldwide, of which gastrointestinal procedures comprised around 40%. Use of disposable instruments is on the rise, minimised risk of infection and possible improvements in efficiency. These developments are promoting increasing numbers of hospitals, specialty clinics, and ambulatory surgery centers across the globe to extend their endoscopy services, with positive results for patients and market growth.

High-definition endoscopes and visualization systems accounted for the majority of global endoscopic procedures, with adoption rising rapidly in ambulatory surgical centers and specialty clinics.

Endoscopy Devices Market Restraints:

-

High Equipment Costs and Maintenance Requirements of Endoscopy Systems Hinder Adoption in Small Hospitals and Emerging Markets.

High prices of endoscopy systems and disposable instruments restrict usage, especially in smaller hospitals and developing economies. By 2025, fewer than 60% of hospitals worldwide had endoscopic suites adequately equipped with personnel trained to perform therapeutic interventions. The majority of outpatient services and specialized units are not equipped to carry out complex procedures safely. The repeat nature of procedures (e.g., therapeutic colonoscopies or ERCPs; average 1–2 per patient annually) put additional pressure on resources and market penetration despite the increasing prevalence of gastrointestinal disorders globally.

Endoscopy Devices Market Opportunities:

-

Expanding Adoption of Single-Use Endoscopes and Advanced Imaging Systems in Hospitals and Ambulatory Centers Drives Global Market Growth.

Increasing use of single-use endoscopes and high-resolution imaging systems are driving the global expansion of endoscopy services. In 2025, more than 45 million endoscopic interventions were carried out worldwide; of them gastrointestinal procedures comprised around 40%. Procedure volumes are projected to total over 70 million per year by 2033, spurred by minimally invasive methods and advanced imaging. Growing number of the hospitals, ambulatory surgical centers, and specialty clinics is investing in advance endoscopy so these have positive outlook for the global market.

Hospitals and ambulatory surgical centers are expected to perform an increasing share of endoscopic procedures globally by 2033.

Endoscopy Devices Market Segmentation Analysis:

-

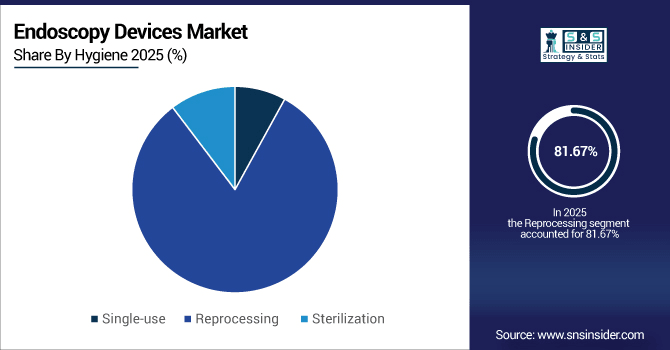

By Hygiene, Reprocessing Devices accounted for the largest market share of 81.67% in 2025, while Single-Use Devices are anticipated to expand at the fastest CAGR of 12.47%.

-

By Product Type, Endoscopes held the largest market share of 37.42% in 2025, while Visualization Systems are expected to grow at the highest CAGR of 12.53%.

-

By Application, Gastrointestinal Endoscopy contributed the highest market share of 55.23% in 2025, while Urology/Gynecology Endoscopy is projected to grow at the fastest CAGR of 7.24%.

-

By End User, Hospitals held the largest share of 48.56% in 2025, while Ambulatory Surgical Centers are expected to grow at the fastest CAGR of 7.84%.

By Hygiene, Reprocessing Devices Dominate While Single-Use Devices Grow Rapidly:

Repurposed equipment accounted for 81.67% of world endoscopy facilities in 2025, indicating widespread dependence on reusable systems. Single-use devices made up 12.48% of procedures, growing rapidly because of increased awareness around infection control and regulatory guidance. Hospitals and outpatient centers are making more use of disposable instruments on a parched-preservation night to reduce cross-contamination. This twofold rendition clarifies why reprocessing solutions are already competitive, and that single-use endoscopes grows so fast worldwide.

By Product Type, Endoscopes Dominate While Visualization Systems Grow Rapidly:

Endoscopes were the leading applications worldwide accounting for over 16.73 million procedures by 2025 which remained critical for diagnostic as well as therapy purpose. For Visualization Systems,15 procedures were supported by 14.87 million, as demand for high-definition imaging and superior optics gains traction quickly. Increasing prevalence of minimally invasive practices and acceptability in niche segments is accelerating demand for endoscopes and visualization systems, particularly for advanced GI/orthopedic endoscopic treatments across the globe.

By Application, Gastrointestinal Endoscopy Dominates While Urology/Gynecology Grows Rapidly:

In 2025, there was an estimated total of 24.91 million GI procedure cases worldwide with colonoscopy, endoscopic polyp removal and upper gastrointestinal diagnostic procedures representing a large proportion of these procedures. Urology/Gynecology endoscopy was 6.87 million, rising rapidly with less invasive treatments and outpatient use. Increasing GI disorder rates, increasing adoption of advanced imaging and increasing procedural capacity explain the lion’s share of GI endoscopy and rapid growth in urology/gynecology procedures worldwide.

By End User, Hospitals Dominate While Ambulatory Surgical Centers Grow Rapidly:

In 2020 hospitals worldwide carried out 29.94 million endoscopic procedures using state-of-the-art rooms and trained personnel. There were 10.12 million ASC procedures, new as a result of convenience, cost saving and increased outpatient use. Rising ASC investments and minimally invasive procedures power this growth, which is why hospitals continue to account for the majority of procedure volumes but ASCs are grabbing an increasing piece of pie in the worldwide endoscopy market.

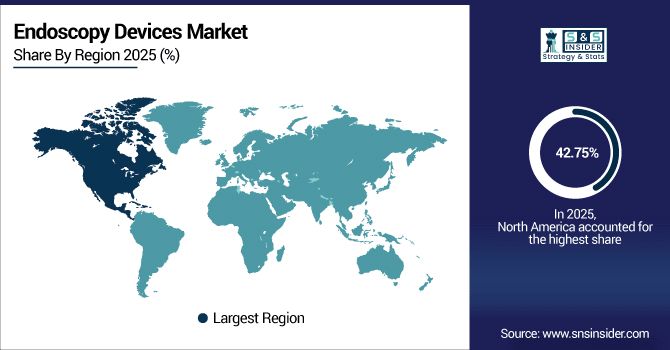

Endoscopy Devices Market Regional Analysis:

North America Market Insights:

North America dominates the global endoscopy devices market with a 42.75% share in 2025, driven by advanced healthcare infrastructure and high adoption of minimally invasive procedures. In 2025, hospitals and ambulatory surgical centers performed more than 18.2 million endoscopic procedures in the region. Growing demand for single-use instruments, HD visualization systems and escalating focus on GI & urology diagnostics are major growth boosters. Technology developments and continued investments in healthcare will support market growth through 2033. A total of more than 1,200 U.S. hospital and ambulatory surgical centers conducted endoscopy procedures in 2025 with a high-definition visualization system poster monitor and flexible‐endoscope. Increased R&D investment and increasing acceptance of single-use device, and minimally invasive technology are the key factors accelerating the growth of the market which further propelling the penetration of next generation endoscopy solution across US.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-Pacific Market Insights:

The Asia-Pacific endoscopy devices market is projected to grow at a CAGR of 6.73% during 2026–2033, emerging as the fastest-growing region globally. More than 11.3 million endoscopic procedures were done at hospitals and ambulatory surgical centers in 2025. The market is fuelled by increasing incidence of gastrointestinal and urology diseases, growing healthcare market in emerging countries, demand for high-definition visualization systems & xenon light source technologies, and growing number of hospitals and ambulatory surgery centers (ASCs).

China Market Insights:

In 2025, Endoscopy Devices market in China was the largest in Asia-Pacific with over 5.2 million endoscopic procedures conducted throughout hospitals and ASCs. Rising investment in healthcare infrastructure, increasing incidence of gastrointestinal and urology disorders, growing adoption of high-definition visualization systems and flexible endoscopes, single-use endoscopes are some market trends fuelling the market growth.

Europe Market Insights:

In 2025, Europe had over 950 hospitals and ambulatory surgical centers performing approximately 7.4 million endoscopic procedures across Germany, France, and the UK. The market is led by the high-definition visualization systems, flexible & disposable scopes, and minimally invasive procedures. Growing incidences of gastrointestinal and urology diseases, government healthcare programs, and focus on investment in developing high endoscopy infrastructure are factors contributing to market growth and making Europe a hub for new diagnostic technologies.

Germany Market Insights:

Germany is regarded as the largest market for endoscopy devices in Europe, and there were more than 420 hospitals and ambulatory surgical centers that conducted around 3.2 million of these procedures for the year 2025. Market growth is driven by advanced high-definition visualization systems, flexible and disposable endoscopes, minimally invasive techniques, and substantial investments in endoscopy infrastructure, establishing Germany as Europe’s market leader.

Latin America Market Insights:

The Latin America endoscopy devices market is growing steadily, led by Brazil with over 180 hospitals and surgical centers performing approximately 1.1 million endoscopic procedures in 2025. A similar trend is seen in Mexico and Argentina due to the increasing use of minimally invasive surgery, high-definition cameras, toroscopes. Development of healthcare infrastructure, increased awareness for GI and urology disorders, and investment in new endoscopy technologies are driving regional expansion.

Middle East and Africa Market Insights:

The Middle East & Africa endoscopy devices market is growing steadily, with over 150 hospitals and surgical centers performing approximately 0.85 million endoscopic procedures in 2025. Adoption of advanced endoscopy infrastructure is highest in Saudi Arabia and South Africa. This growth is attributed to the increasing number of hospitals, diagnostic and imaging centers in developing countries, awareness about GI and urology disorders, and availability of medical reimbursements.

Competitive Landscape:

Olympus Corporation leads the global endoscopy devices market, with its endoscopes and visualization systems used in over 16.5 million procedures worldwide in 2025. It is further strengthened by the leadership of high-definition imaging technology, flexible and single-use endoscopes, and through a strong presence in more than 80 countries. By the consistent investment into R&D, physician education programs and bold acquisitions, Olympus continues to gain leadership in endoscopic diagnostic service and groundbreaking treatment procedures.

-

In July 2025, Olympus co-founded Swan Endo Surgical to develop endoluminal gastrointestinal robotics for minimally invasive surgeries.

Medtronic’s endoscopy portfolio, including advanced visualization systems and endotherapy devices, was utilized in over 12.8 million procedures globally in 2025. The company is the leader due to its leading focus on minimally invasive treatments, AI-enabled imaging and robust clinical support programs. With presence in over 75 countries, Medtronic stimulates the adoption of advanced endoscopic procedures as well as enhances procedure efficiency and patient outcomes for GI, pulmonary, and urology applications.

-

In February 2025, Medtronic partnered with Dragonfly Endoscopy to introduce the Dragonfly™ system across U.S. clinical centers.

Johnson & Johnson’s Ethicon Endo-Surgery division achieved usage in over 10.7 million endoscopic procedures globally in 2025, leading with advanced endotherapy devices and high-definition visualization systems. It is the leader for a reason, with private surgical training programs, multiple hospital partnerships, and advancements in minimally-invasive expendable endoscope tools. Operating in 70 countries, the company markets products to improve patient outcomes, minimize procedure-related complications, and reduce endoscopic infection risk.

-

In July 2025, Ethicon issued a correction for certain Endopath Echelon Vascular White Reload lots due to potential malfunctions.

Electrophysiology Market Key Players:

Some of the Electrophysiology Market Companies are:

-

Olympus Corporation

-

Johnson & Johnson (Ethicon Endo-Surgery)

-

Stryker Corporation

-

Karl Storz SE & Co. KG

-

Smith & Nephew plc

-

Pentax Medical (Hoya Corporation)

-

Ambu A/S

-

Conmed Corporation

-

B. Braun Melsungen AG

-

Richard Wolf GmbH

-

Machida Endoscope Co., Ltd.

-

3NT Medical Ltd.

-

NEC Corporation

-

Hologic, Inc.

-

Coloplast A/S

-

Cook Medical

-

Bayer AG

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 61.94 Billion |

| Market Size by 2033 | USD 94.98 Billion |

| CAGR | CAGR of 5.51% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Endoscopes, Visualization Systems, Endoscopic Ultrasound, Insufflators, Endotherapy Devices, Others) • By Hygiene (Single-use, Reprocessing, Sterilization) • By Application (Gastrointestinal, Pulmonology, Urology/Gynecology, ENT, Orthopedic, Others) • By End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Research & Academic Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Olympus Corporation, Medtronic plc, Johnson & Johnson (Ethicon Endo-Surgery), Boston Scientific Corporation, Fujifilm Holdings Corporation, Stryker Corporation, Karl Storz SE & Co. KG, Smith & Nephew plc, Pentax Medical (Hoya Corporation), Ambu A/S, Conmed Corporation, B. Braun Melsungen AG, Richard Wolf GmbH, Machida Endoscope Co., Ltd., 3NT Medical Ltd., NEC Corporation, Hologic, Inc., Coloplast A/S, Cook Medical, Bayer AG |