Application Management Services Market Analysis & Overview:

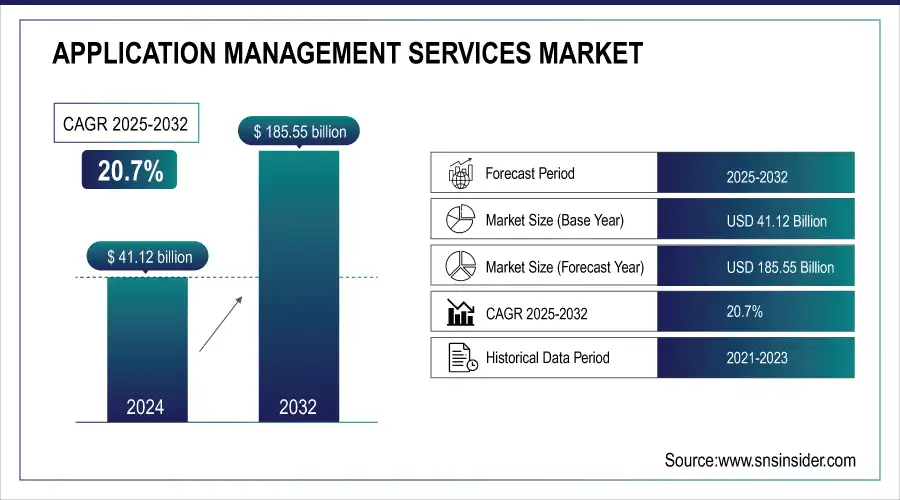

The Application Management Services Market Size was valued at USD 41.12 billion in 2024 and is expected to reach USD 185.55 billion by 2032 and grow at a CAGR of 20.7% over the forecast period of 2025-2032.

The market includes a wide array of services deployed to enhance, renew, or customize application software systems in a wide array of business applications, including in-house and pre-packaged applications. Nowadays, companies are investing more and more in the digital journey, driven by the need to manage applications and application security in a scalable, secure, and cost-effective manner. Offerings within AMS encompass application portfolio Management, modernization, cloud migration, and security management. The move to cloud-native designs and integration with AI and DevOps is changing how services are delivered.

To Get more information on Application Management Services Market - Request Free Sample Report

Approximately 60% of people working within the healthcare industry have a chronic condition, and 40% have more than one and which amounts to a USD3.3 trillion annual spend on healthcare. This increasing load demands that scalable application management services manage EHR and streamline workflow, and enable predictive analytics. With the increased clinical needs for real-time data processing and personalized treatment, AMS systems have been gradually being adopted into clinical decision-making and operational management in more complex healthcare systems.

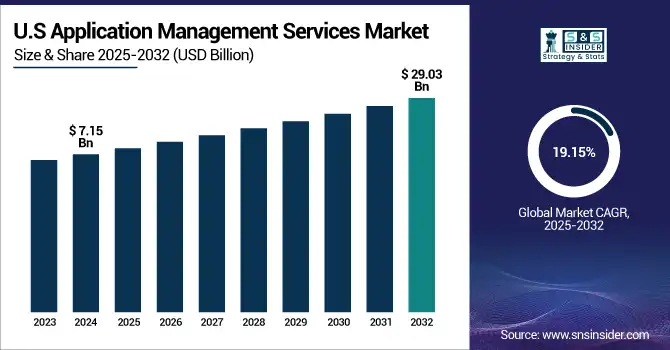

The U.S. Application Management Services Market size was USD 7.15 billion in 2024 and is expected to reach USD 29.03 billion by 2032, growing at a CAGR of 19.15% over the forecast period of 2025–2032. Rising digitalization, and maturity of healthcare IT infrastructure, and increased enterprise demand for cloud migration and modernization are leading the market. The U.S. dominates North America as it is a big investor in AI-driven solutions with a share of more than 75% of regional AMS spending and innovation lead.

Application Management Services Market Dynamics:

Key Drivers:

-

Rising Need for Cloud Application Modernization Across Enterprises Accelerates Application Management Services Market Growth

The Application Management Services market is witnessing a growing need for cloud application transformation. Businesses are moving at breakneck speed to modernize from legacy systems to cloud native architectures, which promise increased scale, efficiency, and cost savings. A mid-sized SaaS company cut its monthly cloud spend by 30%, decreasing it from USD 200,000 to USD 140,000, with the help of AMS-led initiatives, including resource optimization and architectural streamlining. This change resulted in an increasing demand for AMS providers, which can help support application reengineering, integration, and continuous delivery. Enterprises want to be more efficient, minimize downtime, and respond more quickly to business needs, according to Synergy, for which cloud modernization is therefore a key driver in the growth of the AMS market.

Restraints:

-

High Cost of Customized Application Services Limits Widespread Adoption of Application Management Services Market Trend Globally

The market is driven by the expensive nature of personalized and end-to-end application services. Some SMEs cannot afford the huge resources, technical knowledge, or infrastructure it takes to fully manage services. The costs tend to comprise service contracts covering several years, system integration, and continuous technical support. This, in turn, may lead to postponement or even to reduction of adoptions of AMS solutions by organizations, and accordingly may limit overall penetration of the market and slow down growth rates in cost-sensitive regions.

Opportunities:

-

Integration of AI in Predictive Application Monitoring Creates Major Opportunity in the AMS Market Globally

The incorporation of AI and ML into AMS platforms offers substantial growth prospects. With predictive analytics, you can take proactive control of your enterprise applications by detecting issues early, quickly managing incidents, and optimizing your performance in real time. These technologies can detect trends, predict failures, and trigger responses automatically to better enable uptime and to lower human touch. The trend toward intelligent AMS solutions optimizes user experience and reduces costs, improves service efficiency, and the development of AI-based application management is an important opportunity for market growth.

Challenges:

-

Lack of Skilled IT Professionals for Advanced Application Management Limits Market Scalability Across Regions

The lack of full-stack professionals who are adept at the market-standard management tools and patterns for modern applications can limit market expansion. As AMS matures and becomes more cloud and DevOps-centric/cybersecurity-centric, so does the need for the talent that can handle the operation and optimization of complex application ecosystems. Lack of capacity in personnel may lead to slower roll-out of projects, lower quality of service, and reduced available capacity, especially in developing markets. This skills deficit remains an obstacle that hinders the supply response of service providers to growing global demand.

Application Management Services Market Segmentation Analysis:

By Deployment

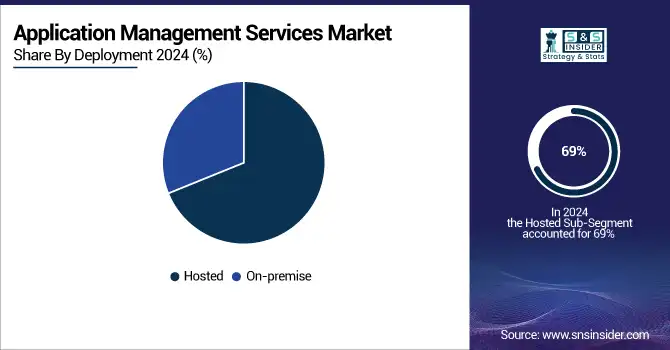

The Hosted deployment segment leads the market with a dominant revenue share of 69% in 2024. The increasing preference for outsourcing application operations to external service providers is accelerating the shift toward hosted models. Organizations benefit from scalability, continuous support, and reduced infrastructure costs. Application management services in this model offer enhanced uptime, remote monitoring, and quicker updates, which support business continuity and operational efficiency, making hosted deployment a vital contributor to market dominance.

The On-premise segment is expected to register the highest CAGR of 24.6% during the forecast period. Enterprises with strict regulatory requirements and data control needs continue to favor on-premise deployment. This approach allows for enhanced customization and security over application environments. Application management services tailored for on-premise systems offer ongoing support, optimization, and integration with legacy infrastructure, driving growth in this segment and reinforcing its relevance in highly regulated or security-sensitive industries.

By Services

The Application Security segment dominates the services category with the largest revenue share of 25% in 2024. This growth is attributed to the surge in demand to secure applications from vulnerabilities and attacks among enterprises. This is evident in the amount of investment going into security solution products folded under the application management strategy of companies. The emphasis on secure development, ongoing monitoring, and risk management directly aligns with the need for application management services, cementing security as a vital factor in the overall AMS adoption and execution.

The Mobile Application Security segment is projected to grow at the highest CAGR of 24.8% during the forecast period. The rise of mobile-first strategies across industries necessitates stringent security protocols to safeguard user data and application integrity. Application management service providers are integrating mobile-specific security features, enabling businesses to proactively address vulnerabilities and maintain compliance. This growing reliance on mobile applications further drives demand for advanced security measures, boosting the relevance and value of AMS in mobile environments.

By End-User

The BFSI segment holds the largest share of 23% in 2024 among end users, driven by the sector’s high dependence on secure, compliant, and efficient digital applications. Financial institutions rely on application management services to ensure uninterrupted operations, data security, and timely upgrades. The increasing complexity of digital banking platforms and regulatory requirements makes Application Management Services Market analysis essential for managing workloads, minimizing downtime, and improving the user experience across financial services.

The Manufacturing segment is projected to grow at the highest CAGR of 29.1% during the forecast period. The industry's transition to automation and smart manufacturing necessitates reliable application environments. Application management services provide ongoing support, system integration, and performance monitoring, helping manufacturers streamline operations. As industrial systems grow in complexity, AMS plays a critical role in ensuring stability, enabling real-time decision-making, and reducing operational disruptions, thereby driving accelerated growth in the manufacturing sector.

Application Management Services Market Regional Analysis:

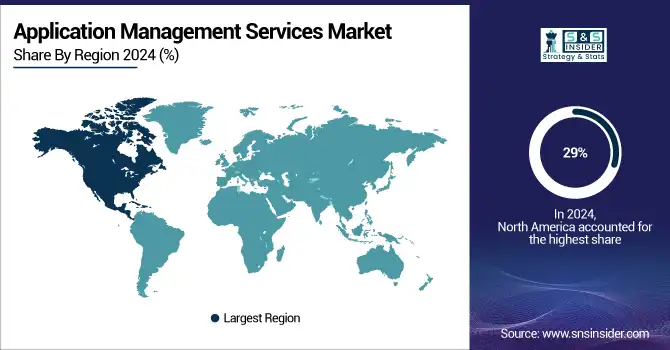

The North America region accounted for an estimated 29% Application Management Services Market share in 2024. High cloud adoption, digital transformation initiatives, and early enterprise IT maturity are accelerating AMS demand across major North American industries. The U.S. dominates the North American market due to its advanced IT infrastructure, widespread digitalization, and large presence of global AMS providers. Companies across the BFSI, healthcare, and retail sectors rely on AMS to enhance application performance, ensure compliance, and optimize operational efficiency.

Get Customized Report as per Your Business Requirement - Enquiry Now

The Asia Pacific region is the fastest-growing in 2024, with an estimated CAGR of 22.46%. Rapid digitalization, IT outsourcing, and cloud-based service expansion across SMEs are propelling AMS demand in Asia Pacific. India is the leading country in the region, owing to its thriving IT services ecosystem, skilled workforce, and cost-effective application development and management capabilities. Many global and regional companies are outsourcing their application management functions to Indian providers. Government-led initiatives supporting digital transformation and enterprise cloud adoption across industries also contribute to India’s growth in the regional AMS market.

In 2024, Europe maintained a strong position in the Application Management Services Market, driven by increasing enterprise software modernization and cloud adoption.

Strict data compliance, IT infrastructure modernization, and regional cloud integration are shaping Europe’s rising demand for application management services. Germany dominates the European AMS market, supported by its strong industrial base and large-scale digital transformation across the automotive, manufacturing, and finance sectors. German enterprises prioritize managed services to streamline operations, ensure application scalability, and comply with data protection regulations including GDPR, contributing to steady AMS market expansion across the continent.

In 2024, the Middle East & Africa region is experiencing growing demand for AMS due to increasing enterprise digitization and cloud service penetration. Countries in the Gulf Cooperation Council (GCC) are investing in managed services to enhance government and enterprise application performance. Similarly, Latin America is witnessing increased AMS adoption, particularly in Brazil and Mexico, driven by the rise of remote work models, infrastructure upgrades, and cost-efficient cloud-based application management across banking, retail, and telecom sectors.

Key Players:

The Application Management Services Market companies are Accenture, Amazon Web Services, Inc., Dell Inc., Google, HCL Technologies Limited, Infosys Limited, IBM, OpenText Corporation, Oracle, and SAP.

Recent Developments:

-

April 2025 – Accenture acquired deep-tech education firm TalentSprint to expand its LearnVantage capabilities, enhancing enterprise and government talent for application and systems services. This strengthens their capacity to deliver advanced AMS solutions.

-

June 2025 – AWS is consolidating its AI-led business tools into the “Q Business Suite” (QBS), combining services such as QuickSight and Q Business to streamline generative AI and BI capabilities for enterprise applications. This move reflects AWS’s strategy to manage and optimize cloud-based applications more holistically, core to AMS offerings.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 41.12 Billion |

| Market Size by 2032 | USD 185.55 Billion |

| CAGR | CAGR of 20.7% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Application Portfolio Assessment, Application Security, Web Application Security, Mobile Application Security, Application Modernization, Cloud Application Migration, and Others) • By Deployment Type (Hosted, On-premise) • By End-User Industry (BFSI, Telecom and IT, Government, Retail and E-commerce, Healthcare and Lifesciences, Manufacturing, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Accenture, Amazon Web Services, Inc., Dell Inc., Google, HCL Technologies Limited, Infosys Limited, IBM, OpenText Corporation, Oracle, and SAP. |