Industrial IoT (IIoT) Market Report Scope & Overview:

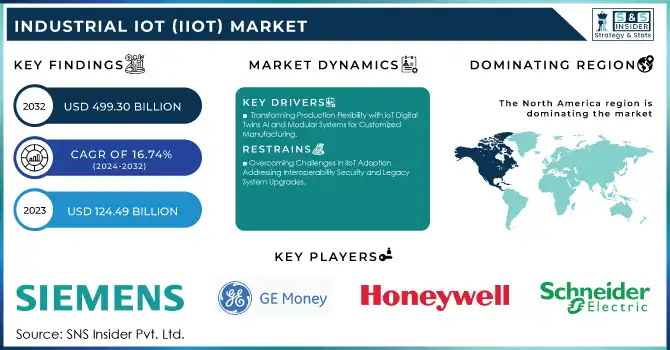

The Industrial IoT (IIoT) Market was valued at USD 124.49 billion in 2023 and is expected to reach USD 499.30 billion by 2032, growing at a CAGR of 16.74% over the forecast period 2024-2032.

To get more information on Industrial IoT (IIoT) Market - Request Free Sample Report

Increasing adoption of technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics to enhance processes, boost production, and cut operational costs will also drive the Industrial Internet of Things (IIoT) market growth. With sectors rapidly widening the scope of digital transformation, IoT solutions are enabling real-time surveillance, predictive maintenance, and asset monitoring for improved decision-making capabilities. The number of connected devices is on the rise, and this is being aided by advancements in both 5G and low-power wide-area networks (LPWAN), which are expanding IIoT usage in a broader set of industries ranging from manufacturing to healthcare to logistics. The IIoT adoption is also boosted by the heavy investments in smart infrastructure, Industry 4.0 initiatives, and automation technologies made by governments and enterprises. Around the globe, by 2024, there will be 3.5 billion 5G connections, adding the ability for even greater IIoT support. Real-time tracking and analytics improved supply chain efficiency by an estimated 20%, and automated quality control can reduce defects by an estimated 90%. Maintenance cost reductions of 20–30% and reductions in breakdowns of 70% through predictive maintenance. More than half of Fortune 500 companies will use IIoT for predictive maintenance.

In addition, the growing need for greater supply chain transparency, energy efficiency, and sustainability is driving IIoT deployment. Smart factories and automated production lines in manufacturing and automotive, as well as remote monitoring and diagnostics in healthcare, are some examples of industries using IIoT. IIoT has become more cost-effective, scalable, and secure due to the convergence of cloud computing and edge computing, which also motivates businesses to embrace this technology it has been able to integrate industrial IoT, with endless possibilities, and also a lot of confidence around big manufacturing industries, thanks to robust cybersecurity frameworks for IoT that supports its operational reliability, ultimately creating the disorder in the market. Over 74% of companies are deployed or developing an IIoT strategy in 2024, while 68% see their IoT progress growing and increasing the range of use cases. In addition, 60% of those surveyed have already switched or plan to switch over to MQTT as the protocol of choice for IIoT systems.

MARKET DYNAMICS

KEY DRIVERS:

-

Transforming Production Flexibility with IoT Digital Twins AI and Modular Systems for Customized Manufacturing

The move towards tailor and modular production is having a decisive effect on the take-up of IIoT. Consumers are demanding more customized products to be delivered to them in a shorter time, putting industries, against the wall, especially manufacturing and automobiles. Due to this necessity for flexibility, especially with production lines, it has created the IIOT through smart sensors, automated systems, and adapting technologies. Fiot modular production systems help manufacturers reconfigure processes quickly, maximizing useful resource use and reducing downtime while supported by IIoT platforms. Natively and in-house shows are the essence for corporations to stay ahead in a changing market. Further, IIoT-enabled digital twins and simulation tools help companies rapidly test and optimize production processes in virtual environments before implementing them in real production environments, saving time and costs. 29% of manufacturing companies have already developed digital twin strategies in which virtual simulations of the physical world are used to optimize production processes in 2024. Moreover, AI has become commonplace with more than 60% of manufacturers having implemented AI, AI applications in the automotive sector cut down production line downtime by 35%.

-

Enhancing Workforce Safety and Productivity with IIoT Wearables Robotics AI and Real-Time Analytics

Increased awareness or concern about the safety and productivity of the workforce is another significant driver. The industrial environment is filled with hidden dangers and IIoT provides ingenious ways to detect and avoid risks. IoT-based wearables can monitor workers' health records, environmental surroundings, and motion patterns and notify the workers and concerned supervisors of any imminent danger instantly. Likewise, connected safety tools, which include smart helmets and proximity sensors, help improve situational awareness and avoid accidents as well. Simultaneously, IIoT-enabled automation also minimizes human participation in hazardous processes, bolstering safety. In addition, real-time analytics and performance monitoring enhance productivity by establishing inefficiencies and offering actionable insights to enhance workflows. The combination of increased safety and optimized efficiency more than justifies deploying IIoT for industrial operations and continues to promote IIoT adoption industry-wide. There were about 1.11 billion connected wearable devices worldwide in 2022. The argument for robotics and AI, among many new technologies, to improve workplace safety through reduced exposure to hazardous tasks was supported by 45% of respondents in a survey of more than 9,000 workers across nine countries.

RESTRAIN:

-

Overcoming Challenges in IIoT Adoption Addressing Interoperability Security and Legacy System Upgrades

The communication protocol and interoperability standardization are the essential factors hindering the growth of the IIoT market. The IIoT ecosystem consists of many devices, platforms, and networks designed by various vendors, which leads to compatibility problems. The lack of interoperability and seamless communication between different platforms makes it difficult to exchange data and integrate systems on the shop floor, which slows down the adoption of different IIoT solutions. Besides, there is a significant impact on businesses in upgrading the legacy systems to close the loop on newer IIoT technologies, causing a bottleneck in implementations. Data safety and privacy is another large hurdle. With the interconnectivity of industrial operations comes a growing threat of cyberattacks and data breaches. Therefore, industries should focus on effective cybersecurity techniques to safeguard delicate data and stay up and running. Unfortunately, countless organizations do not have the experience or resources to tackle such threatening things. Inherently conservative industries are slow to change, and these issues are further contributing to making IIoT adoption difficult.

SEGMENTS ANALYSIS

BY COMPONENT

The hardware segment dominated the share of 46.7% of the total IIoT market in 2023 since the need for hardware with integrated software solutions serves as the primary layer that supports the implementation of IIoT solutions. Sensors, actuators, gateways, and industrial controllers are the connected devices used to collect and transport data to facilitate real-time monitoring and automation. This hardware-based segment continues to dominate the market due to the diverse applications and usage of these components in the manufacturing, automotive, and logistics industries. Moreover, the increasing use of edge devices and IoT-powered equipment in smart factories and interconnected systems has continued to support the requirement for IIoT hardware.

The service segment is projected to expand at the highest CAGR between 2024 and 2032. The consulting, system integration, and maintenance services market is growing as industries embrace technology. Service providers are essential to delivering IIoT solutions from implementation to scale, performance, and optimization. Moreover, the increase in the managed services' emphasis on real-time data analytics, intrusion, and remote monitoring will also boost the service demand. As such, the move to outcome-based business models and third-party expertise underlines the importance of the service segment within the growing IIoT market.

BY DEPLOYMENT

The IIoT market was dominated by on-premise solutions in 2023, accounting for more than half of the total market (58.2%), as industries seeking increased control, reliability, and security of data preferred to implement on-premise solutions. On-premise deployment is commonly preferred in sectors such as manufacturing, healthcare, and energy, wherein organizations want to manage sensitive information or data using their infrastructure to avoid risks like data breaches or unauthorized access. Moreover, the on-premise solutions boast high levels of customization and are cost-effective for latency-sensitive applications, where real-time data processing is essential. In 2023, on-premise solutions further continued their dominant market position, as on-premise offers better compatibility with legacy systems in many industrial setups.

On-cloud solutions are anticipated to witness the highest CAGR from 2024 to 2032, owing to their scalability, cost-effectiveness, and ease of deployment. Cloud-based IIoT Take advantage of the power of cloud-based IIoT platforms, where industries handling any extent of data can manage and analyze those remotely, which leads you to real-time management to deliver operational efficiency. The potential of cloud computing technologies is getting higher as the rise of 5G and edge computing are making it more attractive for industries that are ready to modernize their cloud solutions. In addition, subscription-based model adoptions, and multi-cloud approach adoptions are also driving the transition from on-premise to on-cloud deployments and are set to give a strong rise in the forthcoming years.

BY CONNECTIVITY

In 2023, the IoT market was dominated by Wired connectivity with a 54.7% share. Wired connectivity provides reliable and stable connections, making them highly sought-after in the industrial environment. However, industries including manufacturing, energy, and automotive heavily utilize wired connections, such as Ethernet and fiber optics, for low-latency applications, high-volume data transfer, and continuous operations. Wired networks provide a lower likelihood of suffering disruption, and higher levels of security, so they remain the preferred solution for critical infrastructure, where downtime or a data breach can have catastrophic consequences. Wired connectivity is also the backbone for many legacy systems we find in industrial settings, which reinforces its supremacy.

Wireless connectivity is projected to have the highest CAGR from 2024 to 2032 due to its scalable, flexibility, and lower cost. The use cases of wireless IIoT are becoming wider with the evolution of various new wireless technologies, e.g., 5G, Wi-Fi 6, and LPWAN (LoRa or NB-IoT). They allow for communication in dynamic and remote (hard to reach) environments where deploying wired networks is difficult or irrational, in real-time. Wireless comes into play also for mobile assets, including autonomous vehicles, drones, and a slew of wearable devices that are becoming embedded into industrial processes. With a focus on automation and remote monitoring, wireless Industrial IoT solutions will witness mass adoption leading to strong growth in this segment.

BY INDUSTRY VERTICAL

In 2023, the Manufacturing & Automotive sector led the Industrial IoT (IIoT) market, holding a market share of 38.2%, as the manufacturing industry had considerable advancement in IIoT-related technologies to be able to enhance efficiency, productivity, and competitiveness. IIoT in manufacturing is used for applications including predictive maintenance, real-time asset tracking, and quality control which collectively help in minimizing downtime and cost of operations. In addition, this sector is propelled to adopt IIoT by smart factories and Industry 4.0 initiatives. Likewise, in automotive IIoT is revolutionizing operations with automated production lines, robotics, and supply chain optimization. Some other major applications of IIoT, where the demand has recently seen a tremendous increase, include electric vehicles (EVs) and connected cars.

The Healthcare sector is anticipated to register the fastest CAGR from 2024 to 2032. From patients to profits, the IIoT is changing healthcare through better patient outcomes and improved operational efficiency via real-time data collection, predictive analytics, and automation. Connected devices smart wearables, and implantable sensors continuously monitor the health of an individual, paving the way for early diagnosis and treatment. An upsurge in value-based healthcare and personalized medicine, coupled with the emergence of digital health technologies like artificial intelligence-enabled diagnostic platforms and Internet of Things (IoT)-)-enabled surgical robots are also further stimulating growth in the sector. Moreover, the transition of the healthcare industry from the traditional model to value-based care and the increasing demand for the management of scarce resources in hospitals are forcing the adoption of IIoT solutions and hence fueling the growth of the same in the market.

REGIONAL ANALYSIS

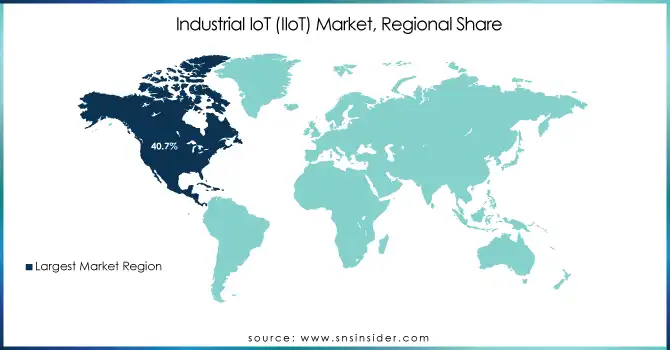

In 2023, the Industrial Internet of Things (IIoT) market is dominated by North America which holds approximately 40.7% share of the market owing to its well-established technological infrastructure, high level of Industry 4.0 adoption level, increasing investment in smart factories, and automation market. The region has many industries that are benefitting from the IIoT, such as manufacturing, automotive, and energy. North American firms have been the early adopters of IoT technologies with smart sensors, robotics, and connected devices that help optimize production, improve efficiency, and save costs. For instance, General Electric (GE) uses IIoT for smart manufacturing and predictive maintenance in diverse industries such as energy and aviation. Caterpillar employs IIoT for real-time tracking of heavy equipment, which helps them to better predict required maintenance on construction and mining tools and reduce downtime.

The Asia Pacific region is anticipated to exhibit the highest compound annual growth rate from 2024 to 2032, attributed to accelerated industrialization, growing manufacturing capabilities, and the emergence of smart cities in nations such as China, India, and Japan. With a growing emphasis on automation, robotics, and connected devices, Asia Pacific has witnessed rising investments to augment productivity and operational efficiencies. China is another example of this as they have been bringing IIoT into the manufacturing industry as part of their "Made in China 2025" program focused on high-tech industries like robotics and electronics. Toyota in Japan has implemented IIoT for greater accuracy in manufacturing and precision connected supply chain management for producing its automobiles. The IIoT trend is also in the air for India with the likes of Tata Steel adopting IIoT to monitor plant efficiency, optimize processes, and drive down energy consumption of its steel production plants.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Industrial IoT (IIoT) Market are:

-

Siemens (MindSphere, Industrial Edge)

-

GE Digital (Predix, Proficy)

-

Honeywell (Sentience, Connected Plant)

-

Schneider Electric (EcoStruxure, Modicon PLC)

-

Rockwell Automation (FactoryTalk, Allen-Bradley)

-

Cisco Systems (IoT Operations Platform, IoT Network Infrastructure)

-

IBM (Watson IoT, Maximo)

-

Microsoft (Azure IoT, Dynamics 365)

-

Bosch (Bosch IoT Suite, Connected Industry)

-

Intel (Intel IoT Platform, Edge Insights)

-

Qualcomm (IoT Connectivity Solutions, Snapdragon IoT)

-

ABB (ABB Ability, Smart Sensor)

-

PTC (ThingWorx, Vuforia)

-

Dell Technologies (Edge Gateway, Dell IoT Solutions)

-

Amazon Web Services (AWS) (AWS IoT Core, AWS Greengrass)

-

Honeywell (Connected Logistics, Industrial Cybersecurity)

-

Oracle (Oracle IoT Cloud, Oracle Autonomous Database)

-

Hitachi Vantara (Lumada IoT, Smart Spaces)

-

SAP (SAP Leonardo, SAP IoT)

-

Moxa (IoT Gateways, Moxa Edge Computing Solutions)

Some of the Raw Material Suppliers for Industrial IoT (IIoT) Companies:

-

3M

-

DuPont

-

Avery Dennison

-

Stanley Black & Decker

-

LG Chem

-

BASF

-

Samsung SDI

-

Nitto Denko

-

Honeywell International

-

Fujitsu

RECENT TRENDS

-

In January 2025, Siemens unveiled cutting-edge innovations in industrial AI and digital twin technology at CES 2025, including the Industrial Copilot for Operations and collaboration with JetZero to develop a zero-emission aircraft.

-

In October 2024, Honeywell and Google Cloud announced a collaboration to accelerate autonomous operations in the industrial sector by integrating AI agents with assets, people, and processes. This partnership aims to enhance operational efficiency, reduce maintenance costs, and upskill employees.

-

In November 2024, Rockwell Automation and Microsoft expanded their partnership to drive industrial transformation by integrating AI and cloud technologies, enhancing efficiency and innovation.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 124.49 Billion |

|

Market Size by 2032 |

USD 499.30 Billion |

|

CAGR |

CAGR of 16.74% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Hardware, Software, Service) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Siemens, GE Digital, Honeywell, Schneider Electric, Rockwell Automation, Cisco Systems, IBM, Microsoft, Bosch, Intel, Qualcomm, ABB, PTC, Dell Technologies, Amazon Web Services, Honeywell, Oracle, Hitachi Vantara, SAP, Moxa |

|

Key Drivers |

• Transforming Production Flexibility with IIoT Digital Twins AI and Modular Systems for Customized Manufacturing |

|

RESTRAINTS |

• Overcoming Challenges in IIoT Adoption Addressing Interoperability Security and Legacy System Upgrades |