Global Next-Generation ICT Market Report Scope & Overview:

To Get More Information on Next-Generation ICT Market - Request Sample Report

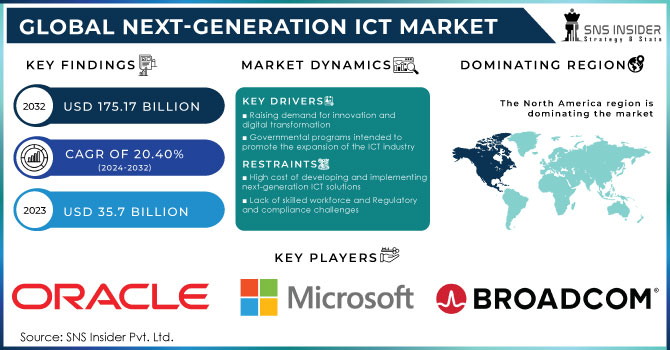

The Global Next-Generation ICT Market Size value was USD 35.7 Billion in 2023 and is anticipated to develop to USD 175.17 Billion in 2032 with a CAGR of 20.40% from 2024 to 2032.

The global next-generation ICT market is expected to grow rapidly in the coming years, driven by the adoption of emerging technologies. The metaverse, cybersecurity, blockchain, AI, and software are all key areas of growth for the ICT market. ICT companies are investing heavily in these emerging technologies to develop new products and services that will meet the needs of businesses and individuals in the digital age. The next-generation ICT market is expected to offer significant opportunities for growth and innovation.

Blockchain is an innovative distributed ledger technology with the immense potential to revolutionize numerous industries. The Blockchain Market was growing with the Rapid compound annual growth rate of 87.7% from 2023 to 2032. ICT companies are developing blockchain-based solutions for a variety of applications, including supply chain management, financial services, and voting. Artificial intelligence (AI) are powerful technology that is being used to develop new and innovative ICT solutions. ICT companies are using AI and ML to improve the performance and efficiency of their products and services, as well as to develop new features and capabilities. The metaverse is a virtual world that is still under development, but it has the potential to revolutionize the way we interact with each other and with the digital world. ICT companies are investing heavily in the metaverse, developing new hardware, software, and services to support this emerging platform. Cybersecurity is a growing concern as businesses and individuals become increasingly reliant on digital technologies. ICT companies are developing new cybersecurity solutions to protect against cyberattacks, including intrusion detection and prevention systems, data encryption, and security awareness training. Software is essential for the operation of all ICT systems. ICT companies are developing new software solutions to support the emerging technologies mentioned above, as well as to meet the evolving needs of businesses and individuals.

Next-Generation ICT Market Dynamics

Drivers:

-

Raising demand for innovation and digital transformation

-

Rising concerns about cybersecurity and privacy

-

Governmental programs intended to promote the expansion of the ICT industry

-

Increasing adoption of emerging technologies such as AI, blockchain, and the metaverse

The growing adoption of cutting-edge technologies, including Artificial Intelligence (AI), Blockchain, and the Metaverse, has become increasingly prevalent in recent years. These innovative advancements have revolutionized various industries, offering immense potential for businesses and individuals like. AI, with its ability to simulate human intelligence, has paved the way for groundbreaking applications across numerous sectors. ML, a subset of AI, enables systems to learn and improve from experience without explicit programming, enhancing efficiency and accuracy in data analysis and decision-making processes. Blockchain technology, on the other hand, has emerged as a secure and transparent system for recording and verifying transactions. Its decentralized nature eliminates the need for intermediaries, ensuring trust and immutability in various domains, such as finance, supply chain management, and healthcare.

Restraints:

-

High cost of developing and implementing next-generation ICT solutions

-

Lack of skilled workforce and Regulatory and compliance challenges

-

Cybersecurity risks

The cost of developing and implementing next-generation ICT solutions can be high. This is a barrier for small and medium-sized businesses. And there is a shortage of skilled workers in the ICT sector. This makes it difficult for businesses to find the talent they need to implement next-generation ICT solutions. There is a lack of clear regulation for some emerging technologies, such as the metaverse and blockchain. This also create uncertainty for businesses and investors.

Opportunities:

-

Development of new products and services based on emerging technologies

-

Expansion into new markets

-

Partnerships and joint ventures with other businesses and organizations

The next-generation ICT market is still in its early stages of development. This presents opportunities for businesses to develop new products and services and to expand into new markets. Also, Businesses can partner and collaborate with other companies and organizations to develop and implement next-generation ICT solutions. This can help to reduce the cost and complexity of implementation.

Challenges:

-

Ensuring the privacy and security of systems and data

-

Addressing the digital divide

-

Developing ethical and responsible AI

-

Regulating emerging technologies

One of the biggest challenges facing the next-generation ICT market is ensuring the security and privacy of data and systems. Businesses need to invest in robust cybersecurity solutions to protect their data and systems from attack.

Impact of the Russia-Ukraine

The war has led to increased costs for ICT companies, due to factors such as higher energy prices and disrupted supply chains. This has made it more expensive to develop and deploy next-generation ICT technologies. The war has also led to reduced investment in ICT by businesses and governments. This is due to a number of factors, including uncertainty about the future of the global economy and concerns about the security of ICT infrastructure. The reduced investment in ICT is likely to lead to slowed innovation in the next-generation ICT market. This is because businesses and governments will be less likely to invest in risky new technologies during a time of economic uncertainty. The war has also created new geopolitical tensions, which are likely to have a negative impact on the next-generation ICT market. For example, the war has led to increased scrutiny of Chinese ICT companies, which are major players in the next-generation ICT market. Investment in AI research and development may decline in some countries, due to the economic uncertainty caused by the war.

In a scenario of a short war, global ICT spending is projected to grow by 4.05% in 2022, which is a decrease from IDC's previous forecast of 4.75% in February 2022. In this situation, Russian ICT spending is expected to contract by 25% in 2022, while the rest of Europe is anticipated to experience a year-on-year increase of 3.38%. The rest of the world's ICT market is predicted to grow by 4.79% in 2022. IDC further reveals that in the event of a brief conflict, Europe would suffer a loss of $143 billion in ICT spending over the next three years. Despite this setback, European ICT spending is still expected to expand by 2.0% in constant currency terms, reaching $1,051 billion. However, this growth projection is lower than the pre-war estimate of 3.72%. The exception to this trend is the gadget markets, including PCs and mobile phones, which are predicted to decline by 6.1% year on year. During times of economic and corporate uncertainty, many businesses choose to reduce their capital spending. According to Google, Russia significantly escalated its cyber operations by 249% in 2022 compared to 2020, with a staggering 300% surge in attacks targeting NATO countries. Google has also described Russia's information operations, which aimed to undermine the Ukrainian government and fracture international support for Ukraine, while simultaneously bolstering domestic support for its invasion in Moscow.

Impact of Recession

The impact of a recession on the next-generation ICT market will depend on a number of factors, including the severity and duration of the recession, the specific next-generation ICT technologies involved, and the level of government and industry support for these technologies. a recession is likely to have a negative impact on the next-generation ICT market. This is because businesses are likely to be more cautious about investing in new technologies during a recession, and consumers may be less likely to afford new devices and services.

Businesses may reduce their investment in R&D during a recession, which could slow the development of new next-generation ICT technologies. Businesses may delay the deployment of new next-generation ICT technologies during a recession until economic conditions improve. Consumers may be less likely to afford new next-generation ICT devices and services during a recession. Investment in AI research and development may decline during a recession, but businesses may continue to invest in AI applications that can help them to reduce costs and improve efficiency. The cloud computing market is likely to continue to grow during a recession, as businesses look for ways to save money on IT costs. The IoT market is also likely to continue to grow during a recession, as businesses and consumers invest in IoT devices and applications that can help them to save money and improve efficiency.

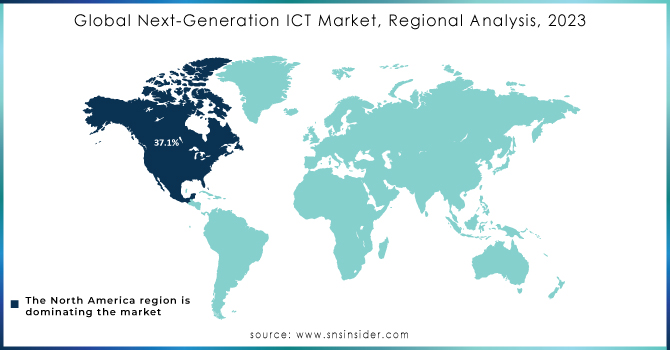

Next-Generation ICT Market Regional Analysis

The global next-generation ICT market is expected to grow significantly in the coming years, driven by the increasing adoption of emerging technologies such as artificial intelligence (AI), 5G, and cloud computing. The market is also being boosted by the growing demand for digital transformation and the need for businesses to improve their operational efficiency and customer experience. North America is currently the largest market for next-generation ICT, accounting for over 39% of the global revenue share, and North America dominated the Artificial Intelligence (AI) market and accounted for over 37.1% share of global revenue in 2022.

The NA region is the world's leading technology companies, such as Microsoft, Amazon, and Google, which are investing heavily in research and development of next-generation ICT technologies. North American businesses are also quick to adopt new technologies, which is driving the rapid growth of the market in the region. Asia Pacific is the second-largest market for next-generation ICT, and it is expected to grow at the fastest rate in the coming years. The region has a growing population, as well as a rapidly expanding middle class. This is driving the demand for a wide range of ICT services, including digital payments, e-commerce, and online entertainment. Governments in the region are also investing heavily in digital infrastructure, which is further fueling the growth of the next-generation ICT market.

Europe is another major market for next-generation ICT, and it is expected to grow steadily in the coming years. The region is home to some of the world's leading technology companies, such as SAP, Siemens, and Nokia. European businesses are also increasingly adopting next-generation ICT technologies to improve their efficiency and competitiveness. Latin America the Middle East and Africa are smaller markets for next-generation ICT, but they are expected to grow at a healthy rate in the coming years.

Do You Need any Customization Research on Next-Generation ICT Market - Enquire Now

Key Players

Key players in Blockchain Microsoft Corporation, Digital Asset Holdings, LLC, BTL Group Ltd., IBM Corporation, Global Arena Holding, Inc., The Linux Foundation, Chain, Inc., Ripple, Circle Internet Financial Limited, Monax, Deloitte Touche Tohmatsu Limited, and others.

Key players of Artificial Intelligence (AI) IBM, Microsoft, Intel, AWS, Google, Oracle, Salesforce, Cisco, SAP, Meta, OpenAI, HPE, Siemens, NVIDIA, Baidu, SAS Institute, Huawei, H2O.ai, Alibaba Cloud, Blackberry Limited, and others.

Key players in Metaverse Unity Technologies, Inc., Nvidia Corporation, Roblox Corporation, Tencent Holdings Ltd., Antier Solutions Pvt. Ltd., NetEase, Inc., Meta Platforms, Inc., Microsoft Corporation, Nextech AR Solutions Corp., ByteDance Ltd., Epic Games, Inc., and others.

Key players in Cybersecurity Cisco Systems, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Broadcom, Inc., FireEye, Inc., Centrify Corp., Lockheed Martin Corp, Check Point Software Technology Ltd., BAE Systems Plc, International Business Machines Corp., LogRhythm, Inc., McAfee, LLC., Proofpoint, Inc., and others.

Key players in Software’s SAP SE, VMware Inc., Oracle, Block, Inc., Adobe Inc., IBM Corp., Intuit Inc., McAfee Corp., Microsoft, Norton LifeLock Inc., and others.

Key players in IOT Cisco, IBM, Microsoft, GE Digital, AWS, Siemens, Oracle, Qualcomm, SAP, Google, Particle, Software AG, Intel, Hitachi, PTC, ARM, HQ Software, Ayla Networks, Hologram, Losant, Samsara, and others.

Recent Developments

In June 2023, IBM announced its acquisition of Apptio Inc., a financial and operational management software company. This strategic move aims to enhance IBM's IT automation capabilities and ensure the delivery of valuable business solutions.

In October 2022, Oracle made a significant announcement regarding the launch of Oracle Alloy, a cutting-edge cloud platform. This innovative platform is designed to offer comprehensive cloud services to Oracle's esteemed customers while granting them complete operational control. Moreover, Oracle Alloy is specifically tailored to address regulatory requirements, ensuring compliance and peace of mind for businesses.

In June 2023, AMD revealed its AI Platform strategy by introducing the AMD Instinct MI300 Series accelerator family, which showcased the groundbreaking AMD Instinct MI300X accelerator. This accelerator has been specifically designed to facilitate large language model training and inference for generative AI workloads.

In September 2022, AiCure launched its clinical site services program, establishing partnerships with sponsors and sites throughout the research process. This program provides data-driven, actionable insights to mitigate study risks and enhance workflow optimization.

In April 2023, the German government, in accordance with the Future Finance Act, is set to implement regulations for startups involved in financial innovation. The primary objective of this legislation is to enhance the digitalization of capital markets by facilitating the issuance of e-securities on a blockchain platform.

In April 2023, Ava Labs, the pioneering force behind the Avalanche blockchain platform, unveiled new institutional deployments aimed at fostering the development and advancement of blockchain technology.

In January 2023, the World Economic Forum (WEF), an International Organization for Public-Private Cooperation based in Geneva, made an exciting announcement. They revealed a groundbreaking partnership with Microsoft and Accenture to establish the Global Collaboration Village, a virtual platform that represents the future of public-private cooperation. This innovative metaverse aims to foster virtual multistakeholder collaboration on a global scale.

Use Case - Next-Generation ICT Market

Use Case Of AI (Artificial Intelligence)

An online retailer is using AI to improve its product recommendation system. The retailer is using an AI model to predict which products customers are most likely to be interested in, based on their past purchase history and other factors. This has helped the retailer to increase its sales and improve its customer satisfaction. A financial services company is using AI to detect fraudulent transactions. The company is using an AI model to analyze customer behavior and identify patterns that are indicative of fraud. This has helped the company to reduce its losses due to fraud. A healthcare startup is using AI to develop a new diagnostic tool. The startup is using an AI model to analyze medical images and identify diseases. This tool could help doctors to diagnose diseases more accurately and efficiently. AI is a valuable resource for businesses of all sizes that are looking to use AI to improve their operations and bottom line.

Network Attached Storage Use Cases

Network-attached storage (NAS) serves a multitude of purposes across various settings, including enterprises, SMBs, and home offices. These devices provide an affordable storage solution, Enterprise Network Attached Storage (NAS) devices are centralized file servers that are ideal for business use. prices starting at around $1,000, Enterprise NAS solutions are beneficial for midsize and small businesses. In comparison, a Storage Area Network (SAN) solution typically starts at around $10,000. it's important to note that pricing is just one factor to consider when selecting a NAS solution for your business.

Improving File Sharing and Storage at Home

In today's technological era, an increasing number of users are opting for NAS systems in their homes to facilitate seamless file sharing and storage with their loved ones. Not only does this enhance convenience, but it also opens up possibilities for building enterprise applications that require efficient exchange of files and data. NAS, known for its exceptional elasticity, scalability, and durability, emerges as the ideal solution for such purposes. Primarily, network-attached storage finds its main application in mid-sized, SMB, and business remote offices. When equipped with a hard drive, a NAS device serves the crucial function of file storage. Typically, the most widely used NAS devices for home offices, small businesses, and enterprise workgroups are equipped with two to five hard drives.

| Report Attributes | Details |

| Market Size in 2023 | US$ 25.77 Billion |

| Market Size by 2032 | US$ 175.17 Billion |

| CAGR | CAGR of 20.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Blockchain • By Artificial Intelligence (AI) • By Metaverse • By Cybersecurity • By Software’s • By IOT (Internet of Things) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Drivers | • Raising demand for innovation and digital transformation • Rising concerns about cybersecurity and privacy • Governmental programs intended to promote the expansion of the ICT industry • Increasing adoption of emerging technologies such as AI, blockchain, and the metaverse |

| Market Restraints | • High cost of developing and implementing next-generation ICT solutions • Lack of skilled workforce and Regulatory and compliance challenges • Cybersecurity risks |