B2b laptop and PC market Report Scope & Overview:

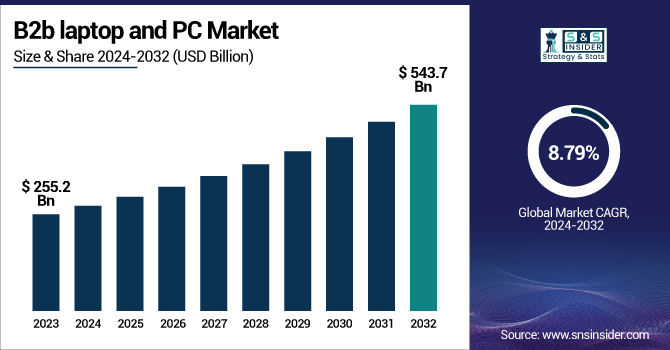

The B2b laptop and PC Market was valued at USD 255.2 billion in 2023 and is expected to reach USD 543.7 billion by 2032, growing at a CAGR of 8.79% from 2024-2032.

To Get more information on B2b laptop and PC Market - Request Free Sample Report

This report provides key statistical insights into the B2B Laptop & PC Market, focusing on trends from 2020 to 2024. It includes data on enterprise laptop and PC purchase volumes by industry, highlighting shifts in demand. Additionally, adoption rates of business-class laptops versus desktops by region reveal regional preferences and evolving IT infrastructure. Insights on remote work-optimized devices by company size indicate a clear trend toward higher adoption by large enterprises compared to SMEs. Furthermore, the report examines investments in endpoint security solutions for B2B devices, with growth projected in the 2021-2024 period as companies prioritize cybersecurity. Key trends show the continued rise of remote work and security investments.

The U.S. B2B Laptop & PC market is projected to reach USD 36.8 billion in 2023 and grow to USD 84.7 billion by 2032, with a CAGR of 9.71%. Key growth drivers include the aging of pre-pandemic PCs, the upcoming end-of-life for Windows 10 in 2025, and the increasing adoption of AI-enabled devices. Additionally, the shift toward hybrid and remote work models is fueling demand for portable and secure computing solutions. The market is also benefiting from improving economic conditions and a significant PC refresh cycle.

B2b laptop and PC Market Dynamics

Drivers

-

Demand for laptops and PCs surged due to the shift to remote and hybrid work models, fueling growth in business-class devices.

Many businesses have made the permanent leap to hybrid and remote work models due to the COVID-19 pandemic. As a result, there has been an increased demand for laptops and PCs that are suited for work-from-home environments. From business-class laptops, portable devices and solutions that facilitate seamless collaboration and communication, enterprises are investing heavily. The increasing dependence on remote work as part of the corporate culture will continue to drive demand for robust, mobile, and secure computing devices, contributing to growth in the B2B laptop and PC market.

Restraints

-

Supply chain issues and rising costs, including chip shortages, could limit market expansion, particularly for SMEs.

Despite this strong demand, the B2B laptop and PC market is not without its challenges. Supply chain disruptions, including chip shortages, have caused price increases and product availability delays. These create pressure on companies , especially small and medium scale enterprises having financial constraints. The high costs of advanced business laptops and accessories, layered over the rising inflation rates, might prove as a barrier to growth in the near term — especially for companies that are budget-focused. The market growth-rate momentum may slow down in the near term as businesses navigate these challenges.

Opportunities

-

AI, machine learning, and cloud integration offer new growth prospects, enhancing productivity and performance in business laptops.

With more integration of AI, machine learning & automation in laptops and PCs helps to create ample opportunity for the market. With AI applications in the background, Business laptops are adding enhanced performance, security, and user experience as standard features. The batteries last longer, the displays are better and higher-quality, and devices can tap into cloud computing, so companies want more computing power on their PCs, but still energy-efficient. Together, they create new opportunities for manufacturers in terms of productivity, efficiency, and the longevity of devices, enabling them to target certain business needs and generate further demand in the sector.

Challenges

-

The fast-paced innovation cycle and need for frequent device upgrades due to technological obsolescence create a challenge for businesses managing device lifecycles.

Technological obsolescence is one of the biggest challenges faced by the B2B laptop and PC market. Devices quickly become outdated due to rapid technological advancements, forcing businesses to frequently upgrade or replace their equipment. While companies aim to maximize device longevity, changing operating system requirements, security protocols, and performance demands require regular device upgrades. This results in increased capital expenditures for businesses, particularly those in industries with tight budgets. Managing the lifecycle of laptops and PCs in such a fast-evolving market is crucial for long-term sustainability and cost-effectiveness.

B2b laptop and PC Market Segmentation Analysis

By Product

The laptops segment dominated the market and accounted for 32% of revenue share in 2023, as they are portable, flexible, and increasingly being used for remote work. With organizations highly reliant on mobile workforces and hybrid workforce models, the reservations are growing to get laptops — the flexibility is indispensable for 21st-century operations. The business-class laptop demand is increasing due to various factors, including security features, long battery life, and cloud connectivity.

The workstations segment is anticipated to be the fastest-growing segment during the forecast period due to the increasing need for high-performance computing in sectors like engineering, architecture, and media. These devices are also important for use in resource-hungry applications as well as for large data sets. Even with the popularity of AI, machine learning, and big data analytics, the demand for more prominent workstations would also grow for complex tasks.

By Enterprise Size

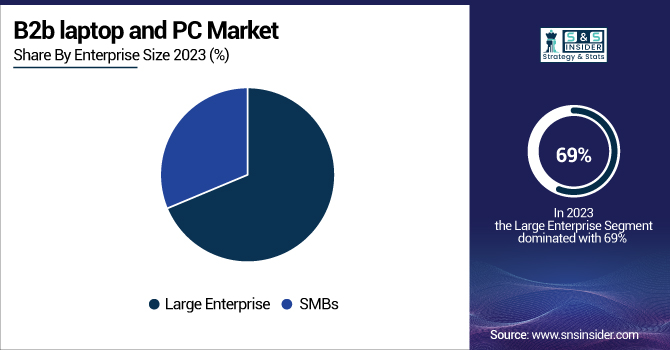

The large enterprise segment dominated the market and accounted for 69% of revenue share in 2023, owing to its immense purchasing power and significant IT infrastructure requirements. Their operation at such a large scale, along with the sensitive nature of data being handled and applications critical for business operations, necessitates advanced devices. Increasing demand for high-performance devices, mainly laptops and workstations, with the growing adoption of remote work models, along with cloud computing and rapid dependence on secure endpoints, is giving rise to the expansion of the market.

The SMBs segment is projected to observe the fastest CAGR as digital transformation is now a top priority among smaller enterprises. SMBs are progressively adopting cloud-based solutions, which is driving the demand for low-cost laptops, desktops, and tablets. To remain competitive, SMBs have been encouraged to invest in business-class devices as IT needs to scale with the new normal of remote work.

By Vertical

IT and telecommunications segments dominated the market and accounted for a significant revenue share in 2023, owing to the strong demand for advanced devices within these technology-oriented industries. As the digital transformation within organizations accelerates, IT departments and support services within organizations, remote communications, and enterprise collaboration require robust computing devices. This segment leverages high investments in cloud computing, network infrastructure, and cybersecurity. With the renewed demand for high-performance laptops and PCs to support cloud services and collaborative tools, this sector will continue to prevail well into 2024 and beyond.

The healthcare sector is projected to witness the fastest CAGR on account of the increasing digitization of healthcare services. It also highlights that the increase in the adoption of electronic health records, telemedicine, and patient monitoring systems call for portable, secure, and high-performance devices that can be found in healthcare professionals' hands. The pandemic accelerated the push for telehealth services, while the demand for mobile computing continues to grow.

Regional Landscape

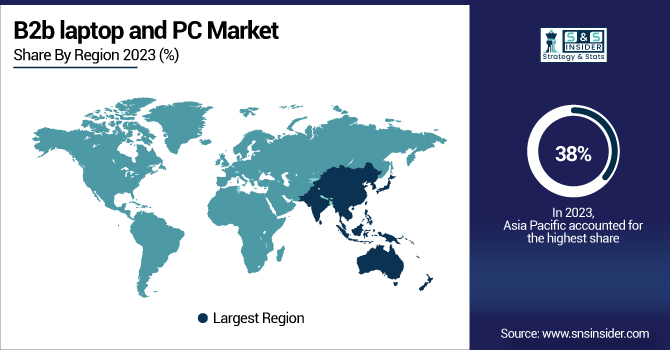

In 2023, Asia-Pacific dominated the market and accounted for 38% of the revenue share. This dominance is due to the region’s extensive enterprise workforce, swift uptake of digital infrastructure, and increasing need for business-grade computing devices in manufacturing, IT services, healthcare, and education. The large-scale procurement of laptops, workstations, and PCs in countries like China, India, Japan, and South Korea has been spurred on by growing remote and hybrid working trends.

The B2B Laptop & PC Market in North America is expected to grow at the fastest CAGR during the forecast period of 2024-2032. Key drivers behind this growth are fast-paced enterprise digital transformation, increased allocation of budget toward cybersecurity solutions for endpoint devices, and growing need for high-performance, AI-ready laptops and workstations designed to meet the requirements for hybrid and remote workforces. The U.S., especially, is a leading engine due to its burgeoning IT budgets and rapid adoption of mobile and cloud-based enterprise solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

HP Inc. – HP EliteBook

-

Dell Technologies – Dell Latitude

-

Lenovo Group – ThinkPad X1 Carbon

-

Apple Inc. – MacBook Pro

-

ASUS – ASUS ExpertBook

-

Acer Inc. – Acer TravelMate

-

Microsoft Corporation – Surface Laptop 5

-

Samsung Electronics – Samsung Galaxy Book3 Business

-

Panasonic Corporation – Panasonic Toughbook 40

-

MSI (Micro-Star International) – MSI Summit Series

-

LG Electronics – LG Gram for Business

-

Huawei – Huawei MateBook X Pro

-

Razer Inc. – Razer Blade 18 (Business Creator Edition)

-

Fujitsu – Fujitsu LIFEBOOK U Series

-

Toshiba (Dynabook) – Dynabook Tecra A50-K

Recent Developments

-

October 2024: Apple launched new 14-inch and 16-inch MacBook Pro models equipped with M4, M4 Pro, and M4 Max chips. These laptops feature enhanced performance, up to 24-hour battery life, and optional nano-textured displays for reduced glare.

-

May 2024: Huawei introduced the MateBook X Pro 2024 globally, featuring Intel Core Ultra processors, a 14.2-inch 3.1K OLED display with a 120Hz refresh rate, and a lightweight design at 980 grams.

-

March 2024: Microsoft announced the Surface Laptop 6, targeting business customers with Intel Core Ultra CPUs and AI capabilities.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 255.2 Billion |

|

Market Size by 2032 |

US$ 543.7 Billion |

|

CAGR |

CAGR of 8.79 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Laptop, Desktop PCs, Workstations, Netbooks, Tablet PC, Handheld Computers) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

HP Inc., Dell Technologies, Lenovo Group, Apple Inc., ASUS, Acer Inc., Microsoft Corporation, Samsung Electronics, Panasonic Corporation, MSI, LG Electronics, Huawei, Razer Inc., Fujitsu, Toshiba (Dynabook) |