Argan Oil Market Analysis & Overview:

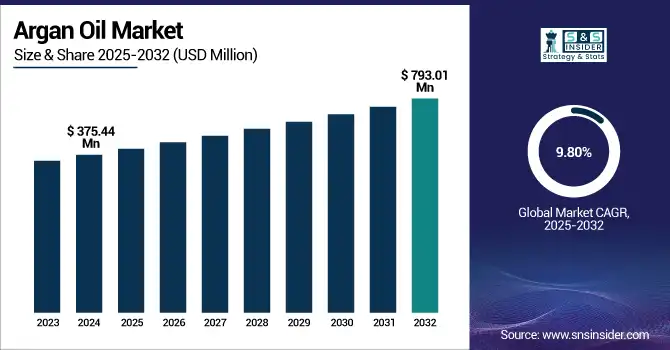

The Argan Oil Market size was valued at USD 375.44 million in 2024 and is expected to reach USD 793.01 million by 2032, growing at a CAGR of 9.80% over the forecast period of 2025-2032.

To Get more information on Argan Oil Market - Request Free Sample Report

The argan oil industry is growing at a rapid pace owing to the increasing demand for base oils for skincare and green beauty cosmetics. The argan oil market trends include clean-label beauty, antioxidant-packed formulas, and ethical sourcing. L’Occitane’s Argan Bees project, for instance, has set up 670 beehives to help biodiversity, and UCFA, a Moroccan cooperative union, has 22 women’s groups encouraging traceable sourcing. Cold-pressed producers and online companies are stretched with argan oil expanding into fine oils.

With the rise of international demand for Moroccan argan oil, makers are ramping up organic production and forest conservation. The argan tree has been a UNESCO biosphere reserve and an intangible cultural heritage. The argan oil market continues to grow, with this niche of the market supported by robust argan oil market growth and ethical buying. These forces make the argan oil market analysis one of the top lines for sustainable beauty and wellness innovation.

Argan Oil Market Dynamics:

Drivers:

-

Integration of Argan Oil into Functional Foods and Nutraceutical Products Accelerates Market Expansion

The increasing application of argan oil as functional foods and nutraceuticals is leading to the growing argan oil market size and scope. Packed with antioxidants, oleic acid, and tocopherols, it also taps into the health-conscious consumer and fits with clean-label, plant-based trends. Demand is being boosted by its inclusion in protein bars, drinks, and supplements. Initiatives, also lean on collaborations between food-tech companies, the 45% of the workforce in Moroccan co-operatives to encourage sustainable sourcing. Projects including UCFA, a federation of 22 women’s cooperatives, promote traceability and economic inclusion. This diversification leads to the increasing demand for argan oil in the food and health sectors.

-

Application of Advanced Cold-Pressing Extraction Methods Enhances the Yield and Quality of Argan Oil

The use of hydraulic presses and membrane filtration has increased the efficiency and the quality of the product within the argan oil industry. With cold-press technology, nutrients will not be lost, while making 10% more juice than normal juice machines. In the Moroccan argan oil sector, UNESCO’s Arganeraie Biosphere Reserve encourages sustainable harvesting, and programmes, such as RENFORUS are working to encourage the switch to solar-powered processing to slash emissions and bills. This is helping small producers and companies to meet rising global demand. Advancements in technology also grow the argan oil market size, creating a sustainable and environmentally-friendly supply chain that contributes to the overall growth of the market.

Restraints:

-

Seasonal Climate Variability and Drought Risks Constrain Sustainable Argan Oil Production Volumes

Extended drought cycles and irregular rainfall in the Arganeraie Biosphere have been adversely affecting argan tree flowering and production of nuts, endangering the expansion of the argan oil market. According to estimates, the number of trees has been reduced by an average of about 66% in 50 years in various regions of Morocco, thus decreasing the market range accordingly. However, small farmers and argan oil companies have been looking to irrigation and reforestation to maintain production, but it has not been easy to survive the pressures on traditional rain-fed agriculture. But these environmental pressures pose a threat to instability in long-term markets and exports, which emphasizes the urgency for the global argan oil market to grow consistently resilient to sustainability supply chains.

Argan Oil Market Segmentation Analysis:

By Grade

Cosmetic grade argan oil was leading the market with a 65.8% share in 2024. This growth is driven by its frequent use in beauty, personal care, and skin care products, driven by global consumer demand for natural and effective beauty ingredients. Moroccan cooperatives and companies including Melka Cosmetics have been benefiting from industrial certification of cosmetic-grade argan oil, supported by the Moroccan government, to guarantee the quality of argan oil and the safety of the people producing it. This cosmetic focus also ensures the segment’s continued supremacy, and skin care firms globally are using argan oil for its hydration and anti-aging properties.

The culinary grade argan oil market is the fastest growing segment with a CAGR of 34.2%. The increase is being fueled by increasing consumer awareness of its nutritional qualities, such as its antioxidant content and heart-healthy fats. Groups including the Moroccan Ministry of Agriculture actively encourage sales of culinary argan oil into international markets based on its taste and potential health benefits, pressed in the traditional manner, which is least likely to experience quality degradation or be blended with fewer good nutrients. Demand for culinary-grade argan oil is stimulating growth, with specialty food retailers and distributors of organic products leading the way.

By Nature

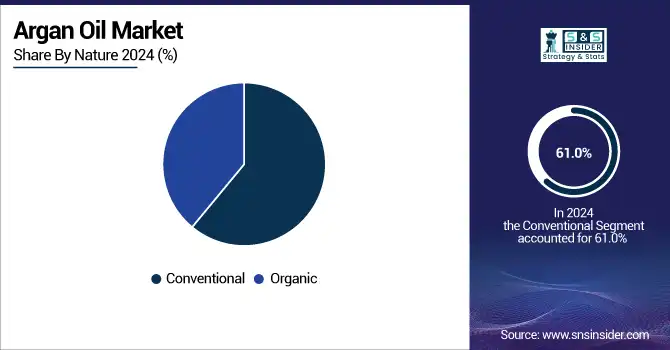

The conventional argan oil segment dominated the market with a 61.0% share in 2024. The popularity of conventional argan oil is due to its old supply networks and cheaper price to produce than the organic type. The Moroccan state is backing traditional production with regulated farming and harvesting to guarantee a sustained flow to the cosmetics and food industries. Traditional argan oil is commonly used for its ready availability and affordability on the domestic and international markets, which is why many argan oil companies and buyers opt for traditional argan oil.

The organic argan oil segment is the fastest growing, with a 10.01% CAGR in the forecast period of 2025-2032. The growth is fueled by growing consumer demand for natural, pesticide-free products. Market credibility is boosted by Organic certifications issued by Ecocert Morocco and government approval. The rise in social awareness about both zero waste and sustainable cosmetics is boosting the growth of organic argan oil across the globe. Consumers toward more healthy lifestyles and their increased willingness to pay a premium for organic products are favorable to the argan oil industry producing organic argan oil, which makes this category the growth category.

By Form

Absolute argan oil was the largest product type in 2024, accounting for a share of 48.0%, as it is pure, non-blended oil preferred for cosmetic and culinary applications. It’s the purest form of what’s in your bottle, and it is what manufacturers and lovers of real, high-grade argan oil do. Moroccan cooperatives and companies tout the purity of pure argan oil, with it being backed up by government quality controls and certification programmes, including those of the Moroccan Office National de l’Huile d’Argan. This authenticity is driving demand and securing the absolute segment the number one position in the market.

The blend form segment is the fastest growing, achieving a CAGR of 10.06%. Argan oil blends, usually with a carrier oil to essential oil ratio, serve those customers who have a specific need for skincare, haircare, etc. The growing trend of personalized beauty products & formulations further accelerates the overall growth of this market segment. Firms use the blends to go after niche markets, helped by innovation and advertising emphasizing superior performance. Morocco-based government-sponsored innovation centers are expected to accelerate market penetration through the development of blends of oils.

By Application

The personal care and cosmetics segment dominated the argan oil market in 2024 with a 57.0% share. Its supremacy is attributed to its use in moisturizing creams, hair oil, and anti-ageing products as a matter of practice globally and consumers favor natural and essential oils for skin care. Moroccan cooperatives and businesses provide certified cosmetic-grade argan oil to top international brands. Sustainable production public policies contribute to market stability. This sector is gaining from the growing consumer knowledge due to the wider use of argan oil in beauty products across the globe.

The medical sector is the segment with the highest growth rate, with a CAGR of 10.38%. This boom is being spurred by a wealth of research on argan oil’s anti-inflammatory and wound-healing qualities. Academic and governmental Moroccan research institutions and countries' institutions, are acknowledging their therapeutic value, which has led pharmaceutical companies to develop medicinal forms. Although health ministries have played a supporting role, clinical interest in natural products for dermatological application has led this category on its growth path. The rising preference for alternative medicine advances the use of argan oil in medicinal treatments.

By Distribution Channel

The B2B segment dominated the argan oil market in 2024 with an estimated 60.2% market share. This is mainly driven by the Moroccan cooperatives including the Union of Moroccan Women’s Cooperatives (UCFA), whose high-grade bulk argan oil for use in export is made available to manufacturers. Specialty stores in B2B serve as a vital intermediary to guarantee authenticity and compliance of the supply chain. Government backing through certification programs by the Moroccan Ministry of Agriculture also underpins the dominance of this segment by promoting sustainable harvesting and quality assurance.

The B2C market is growing more rapidly, with online outlets as the leading subsegment by channel, with the majority of sales growth. The growth of online retail is attributed to rising digital consumption, direct consumer involvement via social media, and growing understanding of the beauty and health properties of argan oil. The certified organic and pure argan oil products can easily be bought on E-commerce platforms and are facilitated by the Moroccan government programs, such as the Arganeraie Biosphere Reserve program, for a sustainable and genuine production. This confidence in product integrity and quality largely contributes to increased online sales being a major growth driver for B2C.

Argan Oil Market Regional Outlook:

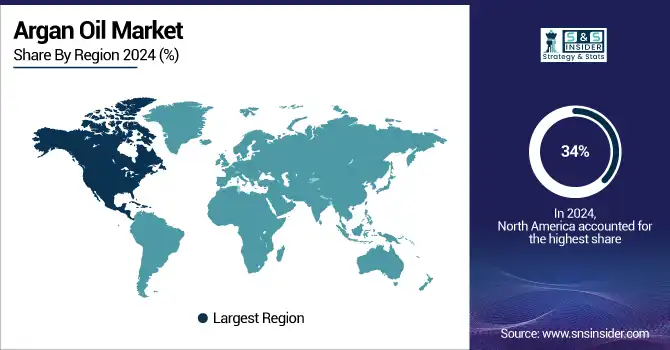

North America was the major region leading the market in 2024 and accounted for around 34% share of the overall market. Such products are increasingly generating consumer interest in natural and organic skin care in the country. Led by the FDA, the U.S. is backed by recommendations for certified organic oil, and the evolution of the e-commerce sector is witnessing a market size amounting to USD 88.84 million by 2024, with a share close to 70%. Influential players including Josie Maran and Shea Moisture capitalize on the clean beauty movement and wide distribution. These complex relationships between Moroccan exporters and North American importers, arranged by the Moroccan Export Promotion Center (MICE), are driving trade and consumer interest, which solidifies the region’s leading presence.

Asia Pacific is the second largest and fastest growing market, which holds the market share of around 27% and the highest CAGR of 10.19%. This can be associated with the growing cosmetic consciousness related to skin care, expanding disposable income, and increasing demand for online shopping across China, Japan, and India. Sales are being fueled by beauty trends on social media, Japanese companies promoting argan oil as anti-aging there, and Indians using it to care for their hair. Government programs that promote the use of natural products and partnerships between Moroccan cooperatives and Asian buyers contribute to market access, as well as an increase in imported amounts to the Moroccan Ministry of Trade data.

Europe holds the third dominating position with a 21.95% market share, led by France, Germany, and the U.K. Rise in demand for Moroccan argan oil on account of consumer inclination toward sustainable and ethical beauty drives the market. Strict import certifications of the EU, such as ECOCERT, raise authenticity and confidence. Argan oil is widely used for its moisturizing properties by the French cosmetics industry, with L’Oréal being one of the players. Pro-organic farming government policies and good Morocco-EU trade relations consolidate Europe's position worldwide as the principal market for argan.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major competitors in the argan oil market include OLVEA Morocco, Zineglob Ltd., Arganisme, Argane Aouzac, Organica Group Ltd., Arganfarm Sarl. Au., Biopur Sarl, Arganbulk, Malakbio, and Lipidine.

Recent Developments:

-

In April 2025, DSM-Firmenich formed a strategic partnership with Inscripta to drive biotech innovations in well-aging skincare, potentially expanding high-purity argan oil bioactive applications

-

In October 2024, L’OCCITANE Group unveiled an updated Biodiversity Strategy at COP16 in Cali, Colombia, pledging nature-positive value chains that include sustainably harvested Moroccan argan oil

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 375.44 million |

| Market Size by 2032 | USD 793.01 million |

| CAGR | CAGR of 9.80% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Culinary Grade, Cosmetic Grade) •By Nature (Conventional, Organic) •By Form (Absolute, Blend, Concentrate) •By Application (Personal Care and Cosmetics, Medical, Aromatherapy, Food) •By Distribution Channel (B2B, B2C [Supermarkets and Hypermarkets,Specialty Stores, Online Stores, Others]) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | OLVEA Morocco, Zineglob Ltd., ARGANisme, Argane Aouzac, Organica Group Ltd., Arganfarm sarl. au., Biopur Sarl, Arganbulk, Malakbio, and Lipidine |