Polyolefin Pipes Market Report Scope & Overview:

Get more information on Polyolefin Pipes Market - Request Sample Report

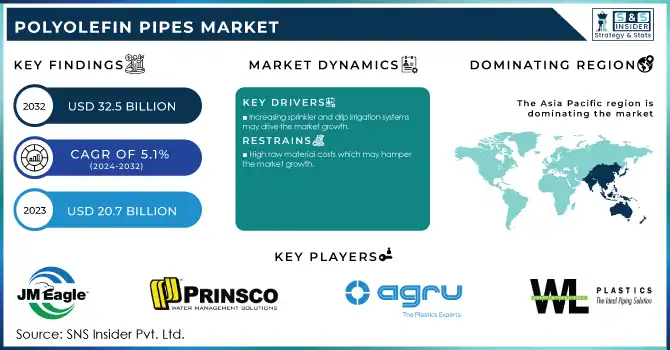

The Polyolefin Pipes Market Size was USD 20.7 billion in 2023 and is expected to reach USD 32.5 billion by 2032 and grow at a CAGR of 5.1% over the forecast period of 2024-2032.

Polyolefin pipes, especially high-density polyethylene (HDPE) pipes, are increasingly being adopted in water supply and sewage systems due to their exceptional performance in challenging environments. HDPE pipes can be utilized for water and wastewater management solutions despite the massive number of corrosive substances they are exposed to. The HDPE pipes can withstand many extreme weather conditions, such as sudden changes in temperature and ground movement and so, but the quality of the product never gets spoiled. These pipes are much lighter than the conventional medium like metal pipe, which increases ease during installation. Being lighter than other fittings available, HDPE reduces labor costs and installation time, allowing more efficiency and better economy of projects. In addition, the flexibility of the HDPE pipes means fewer joints, which reduces the chances of leakages and enhances the reliability of water and sewage systems. The combination of these three factors durability, reduction in cost, lightweight, and easy-to-install reason is making polyolefin pipes a modern engineering solution for water supply and sewage.

The U.S. Department of Energy (DOE) has reported that HDPE pipe installation costs are often 30-50% lower than those for traditional materials like concrete or metal pipes, primarily due to easier handling and faster installation times.

The polyolefin pipes market growth is rising due to the increased use in the agricultural sector. These pipes are becoming more popular for use in irrigation applications owing to their efficiency in maintaining an effective as well as economical water management system. The availability of water is limited in some areas, and knowing how to manage and distribute water correctly is vital to getting as much production as possible out of agriculture. Further, polyolefin pipes are immune to corrosion and exposure; hence, they are durable in extreme conditions and will keep supply systems operational despite hot sun, fluctuating temperatures, or contamination from chemicals in the soil or fertilizers. Moreover, their ability and ease of installation make them perfect for virtually every agricultural application, whether they are used for drip irrigation or sprinkler systems. Their abrasion resistance and low maintenance needs further lower long-term costs for farmers, making agriculture more sustainable. With water conservation now being the number one priority, a substantial fraction of polyolefin pipes is coming forward as a necessary element for efficient & sustainable agricultural water management.

According to the USDA, irrigation systems cover about 18% of U.S. cropped lands but contribute to 49% of the country's crop market value, underscoring their importance in agricultural productivity.

Drivers

-

Increasing sprinkler and drip irrigation systems may drive the market growth.

Increasing the usage of sprinkler and drip irrigation systems in water-scarce agricultural areas drives growth for polyolefin pipes. Such systems help to empower a wider range of irrigation methods to deliver water, minimize wastage, and increase cropping efficiency. Sprinkler and drip irrigation systems are increasingly preferred for better water use efficiency, particularly in arid and semi-arid regions. Subsurface drip irrigation (SDI) is an example of new irrigation technology that has been shown to increase water use efficiency by as much as 46% relative to traditional irrigation methods. This has resulted in increasing demand for pipes that are highly durable and resistant to corrosion, like those made of polyolefins like HDPE, which are preferable for such systems. Polyolefin pipes, their flexible nature, ease of installation, resistance to environmental conditions, and suitability in drip and sprinkler systems have garnered their application in agriculture.

Furthermore, increasing focus on sustainable agriculture and government efforts to preserve water sources are also facilitating the migration toward advanced irrigation technologies. The rising prevalence of capital in water-saving agricultural practices is further driving the demand for polyolefin pipes in irrigation.

Restraint

-

High raw material costs which may hamper the market growth.

The growth of the polyolefin pipes market is hindered by the high costs of raw materials. The major raw materials used for making these pipes include essentially petrochemical products namely high-density polyethylene (HDPE), and polypropylene (PP) derived from oil and natural gas. When oil prices rise globally, it also affects polyolefin production thus increasing polyolefin cost, which in turn raises the cost of polyolefin pipes. For example, any rise in the price of crude oil translates into greater production costs which in turn raises the price of polyolefin pipes making them costlier for several industries to purchase. As a result, polyolefin pipes may be less appealing to purchase, which could have adverse effects in cost-sensitive markets or regions where more affordable alternatives like PVC or metal pipes can be found (PMI). Moreover, the related supply chain disruptors geopolitical issues, and raw material shortages cause the prices to rise further. Thus, the more expensive nature of polyolefin pipes could restrict their take-up in particularly in developing markets with tighter budgets.

Market segmentation

By Type

Polyethylene (PE), held the highest market share around 42% in 2023. PE is broadly favored because of the outstanding combination of strength, flexibility, and resistance to corrosion and environmental stress. Such property renders PE pipes suitable to be applied in water supply, sewage, and irrigation applications. HDPE, a sub-type of PE, is specifically predominant due to its highly durable and nutritious performance in harsh environments along with the fact that it is lightweight, which in turn makes it a cost-efficient option for installation purposes.

Polypropylene (PP), while also a popular choice for certain industrial and chemical applications, typically holds a smaller share of the polyolefin pipes market compared to PE. PP pipes are known for their higher temperature resistance, but they are more expensive and less flexible than PE pipes, which limits their adoption in some regions.

By Application

The irrigation sector held the largest market around 24% in 2023. This is because of efficient water management in agriculture to meet the growing demand. Polyolefin pipes (especially high-density polyethylene, HDPE) are most commonly used in drip and sprinkler irrigation systems due to their lightweight and long-lasting properties against environmental factors such as UV and chemicals. Driven by the issues of global water scarcity and sustainable farming, the implementation of high-tech irrigation systems has rapidly increased in the arid and semi-arid regions of the world. This segment has been supported further by government programs and subsidies to promote water-efficient irrigation technologies in countries such as India and the U.S. India’s PMKSY (Pradhan Mantri Krishi Sinchayee Yojana) is one such program that improves on-farm water-use efficiency and enhances the use of irrigation infrastructure that deploys polyolefin pipes.

By End-User Industry

Building & Construction held the largest market share around 38% in 2023. The prominence is attributed to the large-scale adoption of polyolefin pipes in the infrastructure construction of water supply networks, sewage systems, and gas pipelines. In particular, Polyethylene (PE) and polypropylene (PP) pipes are sought-after materials mainly in the construction industry due to their strength, low susceptibility to corrosion, and affordability compared to traditional materials (e.g., steel or copper). The increasing urbanization coupled with government investment in smart cities and infrastructure projects, particularly in developing regions are driving the demand for polyolefin pipes in building & construction on a significant level.

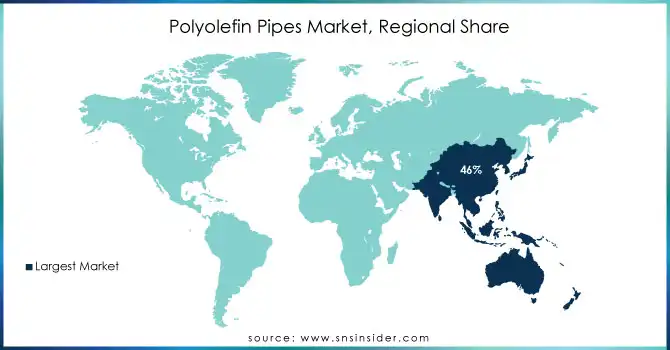

Regional Analysis

Asia Pacific held the highest market share around 46% in 2023 owing to rapid urbanization leading towards major infrastructure development and growing agricultural activities in this region. Appropriate investments in water supply and sewage systems in countries with 1 billion citizens & emerging industrial hubs e.g. China, India, South East Asia An example is China’s “14th Five-Year Plan,” which prioritizes infrastructure for water conservation and sustainability urban development; thereby initiating demand for long-lasting and cost-effective piping systems, particularly polyolefin pipes.

Furthermore, as agriculture is a key industry in the region, efficient irrigation systems like drip irrigation and sprinkler irrigation are becoming more common in agricultural practices, creating demand for high-performance pipes. In addition, industrial growth in Asia Pacific, along with rising manufacturing and chemical segment, will boost polyolefin pipes utilization in transferring chemicals and for industrial applications.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

JM Eagle (HDPE Water/Sewer Pipe, Polyethylene Gas Pipe)

-

Prinsco (GOLDFLO Corrugated HDPE Pipe, ECOFLO 100)

-

AGRU (AGRULINE HDPE Pipes, PE 100-RC Piping Systems)

-

WL Plastics (HDPE Pressure Pipe, PE4710 HDPE Pipe)

-

Advanced Drainage Systems (ADS) (N-12 HDPE Corrugated Pipe, Arc Chamber System)

-

Radius Systems (Polyethylene Barrier Pipe, ProFuse PE100 Pipe)

-

Thai-Asia P.E. Pipe Co., Ltd. (PE Pressure Pipe, HDPE Water Supply Pipe)

-

Future Pipe Industries (Wavistrong GRE Pipe, Fiberstrong Glassfiber Pipe)

-

GF Piping Systems (ELGEF Plus Polyethylene Fittings, PROGEF Standard PP Pipe)

-

Chevron Phillips Chemical Company (Marlex HDPE Pipe Resin, Polyethylene Piping Solutions)

-

Aliaxis (Friatec PE Fittings, Durapipe SuperFLO ABS Pipe)

-

United Poly Systems (High-Density PE Pipe, Conduit and Duct Pipe)

-

Aquatherm (Aquatherm Green Pipe, Aquatherm Blue Pipe)

-

Pipelife (PE Pressure Pipes, Stormwater Solutions Pipes)

-

Polyflow (FlexSteel Reinforced HDPE Pipe, ChemFlex Polyolefin Pipe)

-

Vinidex (PE Pressure Pipe, StormPRO Polyethylene Pipe)

-

KWH Pipe (Weholite HDPE Pipe, Polyethylene Gravity Pipe)

-

Simona AG (SIMONA PE 100 Pipes, SIMONA PP Pipes)

-

Uponor (PEX Piping Systems, Ecoflex Pre-insulated Pipe)

-

IPEX Group of Companies (Blue904 SDR9 HDPE Pipe, Sclairpipe HDPE)

Recent Development:

-

In 2023, Chevron Phillips Chemical Company launched enhanced high-density polyethylene (HDPE) pipes, which offer improved resistance to chemicals and corrosion, catering to the growing demand in industrial applications.

-

In 2023, JM Eagle expanded its product portfolio by investing in innovative polyethylene piping solutions, aimed at improving efficiency in water supply and plumbing systems. This aligns with growing infrastructure projects globally

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 20.7 Billion |

| Market Size by 2032 | USD 32.5 Billion |

| CAGR | CAGR of5.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (PE, PP, Plastomer, Others) • By Application (Irrigation, Potable & Plumbing, Wastewater Drainage, Power & communication, Industrial Application, Chemical Transportation, Others) • By End-use Industry (Building & Construction, Agriculture, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | JM Eagle, Prinsco, AGRU, WL Plastics, Advanced Drainage Systems, Radius Systems, Thai-Asia P.E. Pipe Co. Ltd., Future Pipe Industries, GF Piping Systems, Chevron Phillips Chemical Company, Aliaxis, United Poly Systems, Aquatherm, Pipelife, Polyflow, Vinidex, KWH Pipe, Simona AG, Uponor, IPEX Group of Companies |

| Key Drivers | • Increasing sprinkler and drip irrigation systems may drive the market growth. |

| RESTRAINTS | • High raw material costs which may hamper the market growth. |