Propylene Carbonate Market Report Scope & Overview:

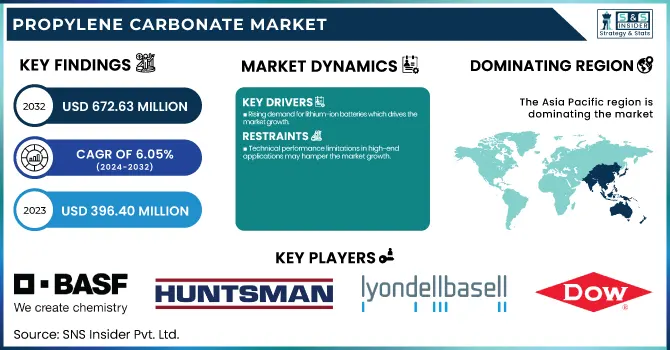

The Propylene Carbonate Market size was USD 396.40 Million in 2023 and is expected to reach USD 672.63 Million by 2032 and grow at a CAGR of 6.05 % over the forecast period of 2024-2032. The propylene carbonate market report provides a comprehensive analysis of production capacity and utilization rates across key countries, highlighting China and the U.S. as dominant producers. It examines feedstock price trends, particularly fluctuations in propylene oxide costs due to supply chain and energy market dynamics. The report also explores the regulatory landscape, including EU REACH compliance and U.S. EPA VOC restrictions, shaping market demand. Sustainability metrics, such as emission control and waste management initiatives, are assessed, with a focus on bio-based innovations in Asia-Pacific and Europe. Additionally, the report covers R&D advancements, emphasizing high-purity propylene carbonate for lithium-ion batteries and digital adoption trends in supply chain optimization.

To Get more information on Propylene Carbonate Market - Request Free Sample Report

Propylene Carbonate Market Dynamics

Drivers

-

Rising demand for lithium-ion batteries which drives the market growth.

An increase in Lithium-ion battery adoption is one of the key drivers for the propylene carbonate market since it is an essential electrolyte solvent in battery formulations. The swift growth of electric vehicles (EVs), portable electronics, and renewable energy storage systems has created an urgent need for fast and stable electrolyte solutions. Propylene carbonate is an ideal material for advanced lithium-ion batteries due to its unique properties that can promote battery performance, and improve thermal stability and ion conductivity. Also, support for clean energy and electric mobility through government incentives and regulations, especially in China, the US, and Europe, is having a positive impact on market growth. Taking into account the rising need for higher usage of propylene carbonate-based electrolytes for battery performance and lifespan improvements, major battery makers including LG Energy Solution and CATL are rapidly investing in high-purity propylene carbonate-based electrolytes, thus bolstering demand in the market.

Restraint

-

Technical performance limitations in high-end applications may hamper the market growth.

The high-end applications that propylene carbonate is equipped for tend to be limited by its technical performance, especially in lithium-ion batteries, high-performance coatings, and certain industrial processes. Although propylene carbonate is appreciated for low volatility, high solvency power, and environmentally friendly nature, it suffers from poor thermal stability and conductivity which are important in application areas such as energy storage and advanced coatings. Ignoring the common use of these electrolytes might lead to limited battery life, as we already know that lithium-ion batteries, for example, propylene carbonate can decompose at high voltages, destabilizing the electrodes and shortening the life of the battery. As stated, its evaporation rate is lower than ethylene carbonate, which can affect drying times and film uniformity in high-performance coatings and electronics.

Opportunity

-

Growing adoption of carbon capture technologies creates an opportunity in the market.

Increasing use of carbon capture technologies provides a huge opportunity for the propylene carbonate industry as the global industrial & government sector is currently focused on cutting greenhouse gas emissions. As a highly efficient solvent for CO₂ absorption and capture during the industrial process, propylene carbonate is a classic example of a solvent for carbon capture and utilization (CCU). As more and more carbon capture projects get implemented across sectors like power, cement, and chemicals, the need to have CO₂-absorbing solvents that are both efficient and stable will increase. Furthermore, government incentives and carbon tax regulations in Europe and North America are also stimulating investment in sustainable carbon sequestration methods that help bolster the growth of this market. Formulations based on propylene carbonate, the focus of much R&D, exhibit improved CO₂ absorption capacity as well, and might prove a contender for one of the latter generations that will work towards alleviating climate change.

Challenges

-

Scaling up bio-based production may create a challenge for the market.

The difficulties in scaling up bio-based production with high production costs, limited raw material availability, and technical hurdles, are major restraints for its propylene carbonate market. Though the trend towards sustainable and bio-based chemicals has rapidly developed in recent years, bio-based propylene carbonate is still early in its commercial production. Catalytic processes with expensive and lower yield than petrochemical catalysts have been developed to convert biomass-derived glycerol or CO₂ to propylene carbonate. Besides, the variations in the availability of raw materials, especially in biodiesel-derived glycerol, influence the stability of the bio-based industry. The investment in research, infrastructure, and process improvement needed to scale these out to an industrial capability can be difficult for many small and mid-sized players to absorb. The transition to bio-based propylene carbonate will not make its commercial shift to high-volume markets without the influence of strong regulatory incentives, subsidies, or technological breakthroughs to drive it in the short term, but remains possible in the long term.

Propylene Carbonate Market Segmentation Analysis

By Application

The solvent held the largest market share around 32% in 2023. It is due to its high utilization in paints & coatings, lithium-ion batteries, pharmaceuticals, and personal care products. Propylene carbonates a green solvent with low toxicity, high solvency power, and high compatibility with many formulations, is a high-performance solvent. It is used in the paints & coatings industry and is favored for dissolving resins and pigments and low emissions of volatile organic compound (VOC) into the atmosphere, making it suitable for strict environmental regulations. Furthermore, propylene carbonate is known as a key electrolytic solvent used in lithium-ion batteries, and demand for this type is expected to increase with the expansion of electric vehicles (EVs) and renewable energy storage systems.

By End User

Paints & Coatings held the largest market share around 25% in 2023. As a high-demand solvent for industrial, automotive & architectural coatings, propylene carbonate is a green and high-performance solvent, this makes the segment a major contributor to the propylene carbonate market in terms of volume. Propylene carbonate has a well-established reputation for its low volatility, and extremely high solvency power to dissolve resins, pigments, and additives for both smooth application and enhanced overall coating performance. As regulations tighten on volatile organic compounds (VOCs) and environmental regulations become increasingly stringent, industries are opting for low-VOC and green solvents, which is driving the growth of propylene carbonate. Moreover, increasing infrastructural activities, urbanization, and industrialization in major economies, especially in the Asia-Pacific and North America, are driving the growth of demand for high-performance coatings in construction, automotive refinishing, and protective coatings.

Propylene Carbonate Market Regional Outlook

Asia Pacific held the largest market share around 42% in 2023. It is owing to the strong industry base and high urbanization and development of end-use industries such as paints & coatings, lithium-ion batteries, and personal care. This region contributes majorly to the global output of chemical manufacture with chemical manufacturing hubs established in the countries of China, India, Japan, and South Korea where propylene carbonate is a key solvent, electrolyte, and intermediate; hence, boosting the propylene carbonate market forward in the Asia Pacific region. Propylene carbonate is one of the most crucial solvents for electrolytes in Lithium-ion batteries, and thus the increasing demand from the flourishing electric vehicle (EV) sector, especially in China, has been a primary factor for propylene carbonate market growth. In addition, the booming construction and automotive sector in Asia pacific is generating a high demand for high-performance coatings and adhesives which propylene carbonate significantly fulfil. Coupled with moderate government policies as well as investors seeking low-cost production, it strengthens market growth in the region for profitable sustainable chemical solutions. Asia Pacific remains the top region in the global propylene carbonate market, driven by high consumption levels, rising industrial activities and technology innovations.

North America held a significant market share in 2023. It is due to the presence of an established chemical industry in the region, coupled with the increasing demand for lithium-ion batteries and high environmental regulations for low-VOC solvents. Due to fast-growing demands in the electric vehicle (EV) market and energy storage systems in particular in the U.S. and Canada, the production of propylene carbonate, an important electrolyte solvent, is expected to increase in North America. On the other hand, the ongoing construction activities on top the regional paints & coatings industry which Islamic Provides good stimuli from construction, automotive refinishing and industrial also help to push up the consumption. Due to strict environmental policies in North America like that of the Environmental Protection Agency (EPA), a shift towards green and bio-degradable solvents is imminent which will favor propylene carbonate as a solvent of choice.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (PC Pure, Solvenon PC)

-

Huntsman Corporation (Jeffsol PC, Ultrapure PC)

-

LyondellBasell Industries (Propylene Carbonate Industrial, PC Ultra)

-

Dow Inc. (PC-100, UCON Solvent PC)

-

Lotte Chemical Corporation (Lotte PC, High-Purity PC)

-

Shandong Shida Shenghua Chemical Group Co., Ltd. (Shenghua PC, Shida Solvent PC)

-

Shandong Depu Chemical Industry Science & Technology Co., Ltd. (Depu PC-99, Industrial PC)

-

Hi-Tech Chemicals Co., Ltd. (Hi-Tech PC, Battery-Grade PC)

-

Shandong Haike Chemical Group (Haike PC, Ultra-Pure PC)

-

Lixing Chemical (Lixing PC, High-Purity PC Solvent)

-

Nippon Chemical Industrial Co., Ltd. (NCIC PC, Nippon Pure PC)

-

Eastman Chemical Company (Eastman PC, Technical Grade PC)

-

Mitsubishi Chemical Corporation (MCC PC, Battery-Grade Solvent PC)

-

Jiangsu Aoke Chemical Co., Ltd. (Aoke PC, Electronic Grade PC)

-

Repsol S.A. (Repsol PC, High-Performance PC)

-

Merck KGaA (Merck Solvent PC, Ultra-Pure Battery PC)

-

Shandong Wells Chemicals Co., Ltd. (Wells PC, High-Purity PC)

-

Hangzhou Dayangchem Co., Ltd. (Dayangchem PC, Chemical-Grade PC)

-

Iolitec Ionic Liquids Technologies GmbH (Iolitec PC, Ionic Solvent PC)

-

Haihang Industry Co., Ltd. (Haihang PC, Technical Solvent PC)

Recent Development:

-

In 2023, Tesla partnered with Eastman Chemical to enhance sustainable material adoption in its supply chain, focusing on low-carbon and recycled chemicals like propylene carbonate for battery applications. This collaboration aligns with Tesla’s goal of reducing its carbon footprint in EV production.

-

In 2022, Rare Beauty launched a new liquid blush collection, incorporating propylene carbonate as a key ingredient for its smooth texture and enhanced solubility. This ingredient helps improve product consistency and application, making the blush more blendable and long-lasting.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 396.40 Million |

| Market Size by 2032 | USD 672.63 Million |

| CAGR | CAGR of6.05% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Solvent, Electrolyte, Catalyst, Additives, Cleaners, Others) • By End-User (Paints & Coatings, Pharmaceuticals, Cosmetics & Personal Care, Textile, Energy & Power, Mining, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Huntsman Corporation, LyondellBasell Industries, Dow Inc., Lotte Chemical Corporation, Shandong Shida Shenghua Chemical Group Co., Ltd., Shandong Depu Chemical Industry Science & Technology Co., Ltd., Hi-Tech Chemicals Co., Ltd., Shandong Haike Chemical Group, Lixing Chemical, Nippon Chemical Industrial Co., Ltd., Eastman Chemical Company, Mitsubishi Chemical Corporation, Jiangsu Aoke Chemical Co., Ltd., Repsol S.A., Merck KGaA, Shandong Wells Chemicals Co., Ltd., Hangzhou Dayangchem Co., Ltd., Iolitec Ionic Liquids Technologies GmbH, Haihang Industry Co., Ltd. |