Artificial Cervical Disc Market Report Scope & Overview:

Get more information on Artificial Cervical Disc Market - Request Sample Report

The Artificial Cervical Disc Market was valued at USD 2.43 billion in 2023 and is expected to reach USD 8.56 billion by 2032, growing at a CAGR of 15.10% from 2024-2032.

The artificial cervical disc market has experienced significant growth in recent years, largely driven by an increasing prevalence of cervical degenerative disc diseases and spinal disorders. According to the United States Spinal Cord Injury Statistics, approximately 18,000 new spinal cord injuries occur annually in the U.S., with the average age at the time of injury being 43 years. As the global population ages and the number of individuals suffering from chronic neck pain and herniated discs rises, there is a growing need for advanced treatment options that provide better outcomes than traditional methods. This shift has led to a growing adoption of artificial cervical disc replacements, which offer patients enhanced mobility, faster recovery times, and reduced pain compared to traditional spinal fusion surgeries.

As a result, the demand for these devices has been steadily increasing, with patients and healthcare providers alike recognizing the advantages of artificial discs in treating cervical spine issues. This demand is particularly strong in regions with advanced healthcare systems, where the prevalence of spinal disorders is higher due to sedentary lifestyles and longer life expectancies. Furthermore, the ongoing advancements in biomaterials and minimally invasive surgical techniques are making artificial cervical disc replacements even more attractive, as they offer improved patient outcomes and fewer post-operative complications.

Looking ahead, the artificial cervical disc market is set to continue its growth, fueled by the increasing demand for more effective solutions to manage degenerative spine conditions. Innovations in the design of artificial discs, such as improvements in durability, better tissue integration, and reduced complication rates, are expected to drive long-term expansion. In December 2024, ZimVie Inc. received FDA approval to test a hybrid approach for cervical disc replacement, combining the Mobi-C Artificial Disc at one level with traditional fusion at an adjacent level in a single surgery. This breakthrough could further enhance patient outcomes and drive the adoption of artificial cervical discs. Additionally, the integration of robotic-assisted surgeries and telemedicine has the potential to make these advanced treatments more accessible to a broader range of patients, accelerating market growth.

Artificial Cervical Disc Market Dynamics

DRIVERS

- Growing Incidence of Cervical Spine Disorders as a Key Driver for the Artificial Cervical Disc Market

The rising prevalence of cervical spine disorders, including cervical spondylosis, herniated discs, and degenerative disc disease, is a significant driver for the growth of the artificial cervical disc market. As the global population ages, the incidence of these conditions increases, particularly in older adults who are more susceptible to spinal degeneration. Additionally, lifestyle factors such as poor posture, prolonged sitting, and sedentary habits are contributing to the rise in these disorders, affecting younger individuals as well. This growing prevalence drives the demand for effective treatment solutions like artificial cervical discs, which offer a viable alternative to traditional fusion surgeries. As more patients seek non-fusion treatments for improved mobility and function, the market for artificial cervical discs is expected to expand significantly.

- Advances in Medical Technology Driving Growth in the Artificial Cervical Disc Market

Innovations in materials, such as polyethylene, titanium, and advanced composites, along with improved design features, have made artificial discs safer, more durable, and more effective in treating cervical spine disorders. These advancements have enhanced the performance of artificial discs, offering better outcomes for patients compared to traditional treatments like spinal fusion. Additionally, improved surgical techniques and a growing understanding of spinal biomechanics have led to better patient outcomes, further increasing the adoption of artificial disc replacement procedures. As these technologies continue to evolve, their increased reliability and effectiveness are expected to drive demand, making artificial cervical discs an increasingly popular option for treating conditions like herniated discs and degenerative disc disease.

RESTRAINTS

- Complications and Risks Limiting the Growth of the Artificial Cervical Disc Market

Although artificial cervical disc replacement is generally considered safe, several complications and risks can limit its adoption. These include potential issues such as infection, nerve damage, device failure, and other complications during surgery. While the procedure is minimally invasive compared to traditional spinal fusion, these risks still pose a concern for both patients and healthcare providers. The possibility of adverse outcomes, such as a need for revision surgery or long-term discomfort, may discourage some individuals from opting for this treatment. Additionally, the need for specialized surgical expertise and the risk of complications may make healthcare providers more cautious in recommending artificial cervical disc replacement over more established methods like spinal fusion, thereby slowing market growth.

- High Cost of Procedures Restricting Access to the Artificial Cervical Disc Market

Artificial cervical disc replacement surgeries are more expensive than traditional spinal fusion treatments. The cost of the surgery and artificial disc devices, which often use advanced materials, can limit access for many patients. For instance, the average prices for artificial cervical disc surgery in major U.S. cities in 2022 ranged from USD 21,126 in Las Vegas to USD 43,564 in Dallas and Fort Worth, Texas, with variations such as USD 39,993 in Seattle and USD 22,554 in San Diego. These high costs can be particularly challenging in developing regions with limited healthcare infrastructure, where affordability is a major issue. Additionally, limited reimbursement coverage in certain countries makes the procedure less accessible, especially for those with insufficient insurance or stricter healthcare policies. This limits broader adoption and accessibility, especially in areas where cost is a primary barrier

Artificial Cervical Disc Market Segment Analysis

BY MATERIAL

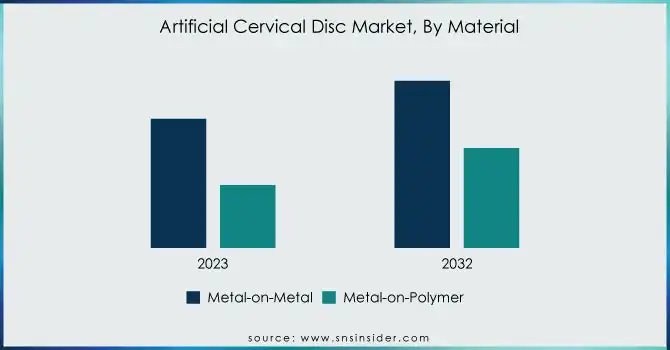

In 2023, the metal-on-metal segment captured the largest share of the artificial cervical disc market, holding about 64% of the revenue. This dominance stems from the material's proven durability, strength, and cost-effectiveness, making it a preferred choice in spinal surgeries. Its long-established use in orthopedic devices, coupled with its reliable mechanical properties, continues to drive its popularity among healthcare providers and patients alike.

The metal-on-polymer segment is expected to grow at the fastest CAGR of approximately 16.53% from 2024 to 2032. This growth is fueled by the rising demand for materials offering better flexibility, biocompatibility, and reduced wear. As surgical techniques advance and patient preferences shift towards less invasive procedures, metal-on-polymer discs, which provide more natural movement, are increasingly becoming the material of choice.

BY INDICATION

In 2023, the hospitals segment dominated the artificial cervical disc market, capturing approximately 55% of the revenue share. This dominance is largely due to hospitals being the primary setting for complex spinal surgeries, which require more extensive facilities and resources. The availability of advanced medical technology, specialized surgical teams, and post-operative care in hospitals drives the high volume of cervical disc procedures performed in these settings.

The ambulatory surgical centers (ASCs) segment is projected to grow at the fastest CAGR of 15.87% from 2024 to 2032. This rapid growth is driven by the increasing shift towards outpatient care, which offers cost-effective and less invasive procedures. ASCs provide faster recovery times and reduced patient costs, making them an attractive option for elective spinal surgeries like artificial cervical disc replacements, particularly as minimally invasive techniques gain traction

BY END USE

In 2023, the degenerative spine disease segment dominated the artificial cervical disc market, accounting for approximately 74% of the revenue share, and is expected to grow at the fastest CAGR of 15.68% from 2024 to 2032. The segment's dominance is driven by the increasing prevalence of degenerative disc diseases, especially among the aging population, which requires effective spinal treatments. As the demand for minimally invasive procedures rises, degenerative spine disease remains the leading indication for artificial cervical disc replacements. This trend is expected to continue as advancements in surgical techniques and implant materials further improve patient outcomes, fueling growth in the coming years.

Artificial Cervical Disc Market Regional Outlook

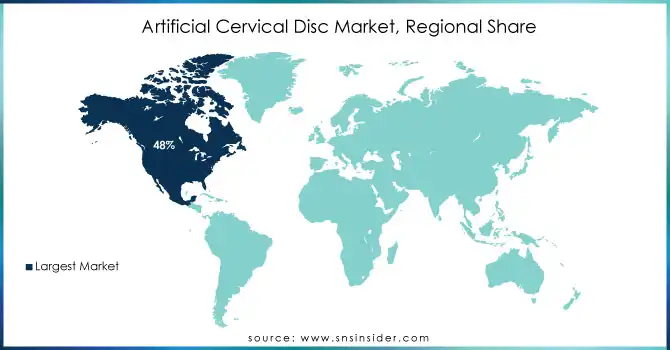

In 2023, North America dominated the artificial cervical disc market with the highest revenue share of approximately 48%. This dominance is largely attributed to the region's advanced healthcare infrastructure, high prevalence of spinal disorders, and strong adoption of cutting-edge medical technologies. The presence of leading medical device manufacturers, along with a well-established reimbursement system, further contributes to North America's position as the market leader.

Asia Pacific is expected to grow at the fastest CAGR of 18.81% from 2024 to 2032. This rapid expansion is driven by improving healthcare infrastructure, rising awareness of advanced treatment options, and an increasing incidence of spinal conditions in the region. As disposable incomes rise and access to healthcare improves, Asia Pacific is set to become a major hub for artificial cervical disc procedures, with greater adoption of minimally invasive spine surgeries.

Need any customization research on Artificial Cervical Disc Market - Enquiry Now

LATEST NEWS -

- NGMedical presented its MOVE-C cervical artificial disc prosthesis at the NASS and EuroSpine 2024 conferences. The MOVE-C features a unique design combining an articulating surface with a viscoelastic core to maintain physiological motion and ensure progressive resistance to movement.

- Orthofix announced the publication of five-year clinical data for its M6-C artificial cervical disc in The Spine Journal. The data shows that patients with the M6-C disc achieved superior clinical success compared to those who underwent anterior cervical discectomy and fusion (ACDF).

KEY PLAYERS

- Medtronic (Mobi-C Cervical Disc, Bryan Cervical Disc)

- Orthofix Medical Inc. (M6-C Cervical Disc, Virtuos Cervical Disc)

- Globus Medical (Secure-C Cervical Disc, 7D Surgical Cervical Disc)

- Aesculap, Inc. (ProDisc-C, Mobi-C Cervical Disc)

- NuVasive, Inc. (Simplify Cervical Disc, NuVasive Cervical Disc)

- AxioMed LLC (AxioMed Cervical Disc, AxioMed Total Disc Replacement)

- Zimmer Biomet (Mobi-C Cervical Disc, ProDisc-C)

- SpineArt SA (Cervical Arthroplasty System, Discovery Cervical Disc)

- Synergy Spine Solutions Inc. (Synergy Cervical Disc, Synergy Total Disc Replacement)

- Centinel Spine (ProDisc-C, M6-C Cervical Disc)

- B Braun Melsungen (SpineArt Cervical Disc, B Braun Melsungen Cervical Disc)

- Evospine (Evospine Cervical Disc, Evolution Cervical Disc)

- Stryker Corporation (ProDisc-C, Mobi-C Cervical Disc)

- Alphatec Spine (NuVasive Simplify Cervical Disc, AlphaDisc Cervical Disc)

- Aditus Medical (Aditus Cervical Disc, Aditus Total Disc Replacement)

- Simplify Medical (Simplify Cervical Disc, Simplify Total Disc Replacement)

- Globus Medical (Secure-C Cervical Disc, 7D Surgical Cervical Disc)

- NuVasive, Inc. (Simplify Cervical Disc, NuVasive Cervical Disc)

- Stryker Corporation (ProDisc-C, Mobi-C Cervical Disc)

- Johnson & Johnson (BIOFLOW Cervical Disc, ProDisc-C)

- Zimmer Biomet (Mobi-C Cervical Disc, ProDisc-C)

- NGMedical (MOVE-C Cervical Disc)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.43 Billion |

| Market Size by 2032 | USD 8.56 Billion |

| CAGR | CAGR of 15.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Metal-on-metal, Metal-on-polymer) • By Indication (Spinal trauma, Degenerative spine disease) • By End Use (Hospitals, Ambulatory surgical centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Orthofix Medical Inc., Globus Medical, Aesculap, Inc., NuVasive, Inc., AxioMed LLC, Zimmer Biomet, SpineArt SA, Synergy Spine Solutions Inc., Centinel Spine, B Braun Melsungen, Evospine, Stryker Corporation, Alphatec Spine, Aditus Medical, Simplify Medical, Johnson & Johnson, NGMedical |

| Key Drivers | • Growing Incidence of Cervical Spine Disorders as a Key Driver for the Artificial Cervical Disc Market • Advances in Medical Technology Driving Growth in the Artificial Cervical Disc Market |

| RESTRAINTS |

• Complications and Risks Limiting the Growth of the Artificial Cervical Disc Market • High Cost of Procedures Restricting Access to the Artificial Cervical Disc Market |