Nuclear Medicine Market Size Analysis:

Get more information on Nuclear Medicine Market - Request Sample Report

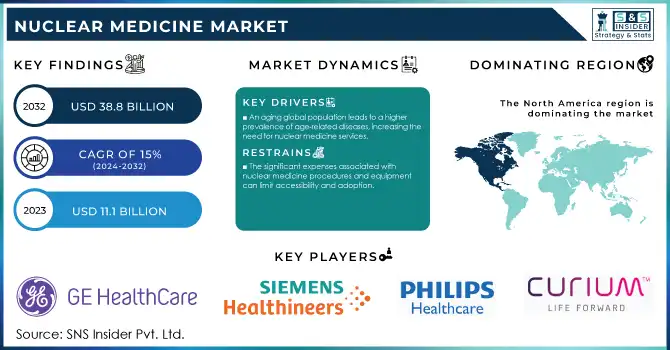

The Nuclear Medicine Market Size was valued at USD 11.1 billion in 2023 and is expected to reach USD 38.8 billion by 2032 and grow at a CAGR of 15% over the forecast period 2024-2032.

Rising cancer and cardiovascular diseases, an increase in preference toward non-invasive diagnostic methods, and the development of novel radiopharmaceuticals are accelerating the nuclear medicine market growth. The World Nuclear Association Analysis 2024 estimates around 50 million nuclear medicine procedures a year globally and the demand for radioisotopes increases by about 5% a year. An increase in the applications of nuclear medicine in diagnostics as well as therapeutics further accounts for the growth in demand primarily due to the substantial rise in chronic disease incidence. The speed of increase in the number of cancer cases across the US is exhibited in the American Cancer Society's news release, which states that the number of new cancer cases in the US was 1.95 million in 2023 but is 2 million this year (2024). Likewise, in Canada, the number of new cancer cases rose in 2023 to 239,000, up from 233,000 in 2022, according to Canadian Cancer Statistics. This increase in cancer will lead to an increased demand for more diagnostic and therapeutic nuclear medicine procedures.

In addition, the expansion of the market is being assisted by government programs and spending on healthcare infrastructure. As an example, the National Institutes of Health (NIH) in the US has steadily increased funding for nuclear medicine research, recognizing it as a complementary avenue for advancing personalized medicine approaches. Innovations in radioligand design have led to the creation of agents that selectively bind to cancer markers, optimizing treatment efficacy while minimizing side effects. Furthermore, the incorporation of artificial intelligence and machine learning in nuclear medicine imaging is increasing the efficiency and accuracy of these medical images which in turn boosting the growth of the nuclear medicine market.

Market Dynamics

Drivers

-

The increasing incidence of conditions such as cancer and cardiovascular diseases drives the demand for nuclear medicine diagnostics and treatments.

-

Innovations in imaging technologies and radiopharmaceuticals enhance the effectiveness and adoption of nuclear medicine procedures.

-

An aging global population leads to a higher prevalence of age-related diseases, increasing the need for nuclear medicine services.

The nuclear medicine market is primarily being driven by the rising incidence of chronic diseases, especially cancer and cardiovascular diseases. The World Health Organization (WHO) reported that in 2023, nearly 10 million people died of cancer worldwide, with lung, colorectal, and breast cancers being the most common. These alarming statistics highlight the urgent need for better diagnostic and therapeutic tools like nuclear medicine. Radiopharmaceuticals are used in nuclear medicine for diagnosis and treatment of diseases at the molecular level. For example, imaging with positron emission tomography (PET) and single-photon emission computed tomography (SPECT) is commonly used for detecting the site of tumors, tracking tumor progression, and assessing treatment response for cancer treatment. For example, an FDG PET scan can identify tumors that are consuming more glucose than normal, indicating that they are likely becoming active malignancies, helping oncologists tailor the treatment plan.

Cardiovascular diseases are still the leading cause of death in the world, with around 18 million deaths a year, according to the American Heart Association. Nuclear cardiology techniques, including myocardial perfusion imaging (MPI), assess blood flow to the heart muscle and detection of coronary artery disease to facilitate timely interventions. The increasing role of nuclear medicine is also evidenced by innovations in the field of radiopharmaceuticals, including the development of targeted alpha therapies (TATs) directed to metastatic cancers. Together with the increasing burden of diseases, these advancements are driving the adoption of nuclear medicine as one of the essential healthcare services.

Restraints:

-

The significant expenses associated with nuclear medicine procedures and equipment can limit accessibility and adoption.

-

Supply chain challenges and the short half-life of certain isotopes can hinder the consistent availability of necessary materials.

A major limitation of the nuclear medicine market is the depletion of radioisotopes necessary for diagnostic imaging and therapy. Several popular isotopes, including Technetium-99m, have short half-lives requiring continuous production and rapid transport to hospitals. These isotopes are produced in very few locations in North America and the rest of the world, often in nuclear reactors or cyclotrons. A disruption in reactor operations, maintenance schedules, or some geopolitical factor affecting the source can cause a supply shortage, causing a delay in patient treatments.

Moreover, stringent regulation on the transportation and handling of radioactive materials adds to and challenges the supply chain. The costs to establish new production facilities and the technical expertise are also significant hurdles. Such a limited supply tends to restrict the availability of nuclear medicine (NMI), especially in the developing part of this world with inadequate infrastructure which shows the need for investment in isotope production technologies and logistical aspects to serve the increasing demands of healthcare.

Nuclear Medicine Market Segmentation Analysis

By product

In 2023, the nuclear medicine market was dominated by the diagnostics segment with 74% of the share. The large share of the market can be attributed to a few factors, mostly because diagnostic nuclear medicine exams are performed in almost all medical specialties. In 2023, the Society of Nuclear Medicine & Nuclear Imaging estimated that more than 20 million nuclear medicine procedures were performed each year in the U.S. The large share of this segment is attributed to the rising number of chronic conditions that need advanced imaging methods for accurate diagnosis and treatment planning. For example, the World Nuclear Association Analysis 2024 stated radioisotope needed for diagnostics increases by approximately 5 percent every year. The increasing application of SPECT and PET in oncology, cardiology, and neurology are contributing to this growth. The growth can be attributed to the presence of a broad spectrum of radiotracers available for the diagnosis of tumors and developed imaging equipment. In addition, the non-invasiveness of nuclear medicine diagnostics is one of the main reasons for their preference among patients and doctors. The recurrent approval of novel diagnostic radiopharmaceuticals by the U.S. Food and Drug Administration (FDA) in turn will contribute majorly to expanding the segment of particularly diagnostic radiopharmaceuticals market share. In August 2024, a PET radiotracer for imaging patients with suspected or confirmed cardiac amyloidosis was designated by the FDA as a breakthrough therapy, reflecting rapid innovations in this area.

By Application

The Urology segment dominated the market with a market share of 22% in 2023. The largest share of this market is due to the high incidence of urological disorders, with prostate cancer being the most common cancer in men worldwide. According to the American Cancer Society, 1 in 5 new cancer diagnoses are prostate cancer diagnoses in men in the United States. The Role of Nuclear Medicine in the Diagnosis and Treatment of Prostate Cancer Nuclear medicine is integral to the detection and treatment of prostate cancer, especially in the era of PET/CT and targeted radionuclide therapy. Novel radiopharmaceuticals for prostate cancer, particularly the recent approvals by the U.S. Food and Drug Administration, including Pluvicto (lutetium Lu 177 vipivotide tetraxetan) in 2022 have greatly increased the application of nuclear medicine in the urology field. With this approval, there was a significant step forward to help improve outcomes for patients with metastatic castration-resistant prostate cancer, reinforcing the increasing role of nuclear medicine in urological oncology. In addition, the rising use of combination and the ranostic approaches in urology by the use of radiopharmaceuticals which has recipes for both diagnostic imaging and targeted therapy is expected to contribute considerably to the dominant share of the segment. The National Cancer Institute has noted an increasing trend of employing nuclear medicine modalities for the long-term care of urological malignancies, specifically for staging and treatment planning.

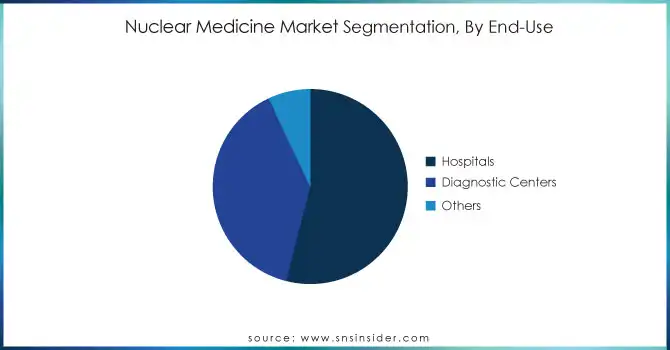

By End Use

In 2023, the hospital's segment accounted for the largest market 54% of the market. The leading position is mainly driven by several factors, primarily by the comprehensive nature of hospital facilities that can provide a complete variety of nuclear medicine services. The Society of Nuclear Medicine & Nuclear Imaging has historical data showing hospitals have traditionally been the site of nuclear medicine procedures. More than 50% of all nuclear medicine procedures are performed in hospitals in the USA as of 2020. Hospitals remained the market's top player and this trend continued. The market share of hospitals is also high due to developed infrastructure facilities of hospitals for the processing of complex nuclear medicine equipment and radioactive materials. In addition, hospitals have a more comprehensive infrastructure to deal with the entire range of patient care from diagnosis to treatment to follow-up, which is particularly vital in nuclear medicine applications. Nuclear medicine is typically performed in a hospital but is also done in some outpatient settings, which was reflected in data from the U.S. Nuclear Regulatory Commission for years before 1995, which suggested that most licensed facilities for nuclear medicine were associated with hospitals. Moreover, with growing focus on centralization of the healthcare delivery system, particularly for complicated procedures incorporating radiopharmaceuticals, is continuing to consolidate the hospital's position in the nuclear medicine market.

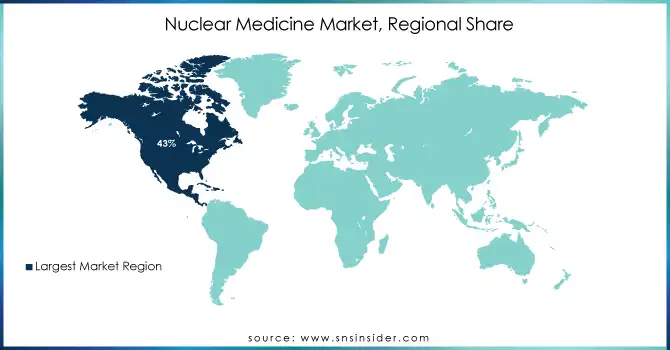

Regional Analysis

The nuclear medicine market was dominated by North America with a market share of nearly 43% in 2023. The regional growth is due to the presence of advanced healthcare infrastructure, with high adoption rates for nuclear medicine technologies and significant investments in research and development. Nuclear medicine applications and innovation in particular have been a leading area for the United States. The Nation produces or uses around fifty percent of the world's supply of medical isotopes, according to the U.S. Department of Energy's National Nuclear Security Administration. This strong production capability integrated with a sound regulatory framework has made North America a leader in the global market.

Asia Pacific remains the fastest-growing region with a high CAGR expected during the forecast period. The growth is likely to follow a strong trajectory owing to factors such as increasing healthcare spending, rising awareness of the applications of nuclear medicine, and increasing prevalence of cancer and cardiovascular diseases in China and India. As an example, in the context of the ongoing healthcare reform in China, the Chinese government has been promoting the development of nuclear medicine. The number of nuclear medicine departments in Chinese hospitals has been increasing by approximately 10% annually recently, according to the National Health Commission of the People's Republic of China. This upsurge is backed by the rampant development of healthcare infrastructure, rising government expenditures in nuclear medicine facilities, and an increased demand for more advanced diagnostic and therapeutic procedures. As an example; Japan is one of the most important countries in the Asia Pacific nuclear medicine market, which has been focusing on the development of novel radiopharmaceuticals and imaging techniques. Owing to Japanese government initiatives encouraging nuclear medicine R&D, the market share in the region is increasing.

Need any customization research on Nuclear Medicine Market - Enquiry Now

Recent developments

-

In March 2024, Serbia's Ministry of Health and Rosatom State Corporation signed a memorandum of understanding (MoU) to expand bilateral cooperation in the field of nuclear medicine, in a bid to stimulate market expansion.

-

Bristol Myers Squibb expanded its cancer therapies in December 2023, acquiring RayzeBio for $4.1 billion and its actinium-255 and lutetium-177 therapies.

Key Players

Key Service Providers/Manufacturers

-

GE HealthCare (Discovery NM/CT 670, Discovery PET/CT 710)

-

Siemens Healthineers (Biograph Vision PET/CT, Symbia Intevo SPECT/CT)

-

Philips Healthcare (Vereos Digital PET/CT, BrightView SPECT)

-

Canon Medical Systems Corporation (Celesteion PET/CT, Aquilion ONE/GENESIS Edition)

-

Lantheus Medical Imaging, Inc. (DEFINITY, TechneLite)

-

Bracco Imaging S.p.A (MultiHance, CardioGen-82)

-

Cardinal Health (Lymphoseek, Zevalin)

-

Curium (Sodium Iodide I-131, Thallium-201)

-

Eckert & Ziegler (GalliaPharm, Yttriga)

-

Nordion (Canada), Inc. (Cobalt-60, Molybdenum-99)

-

NTP Radioisotopes SOC Ltd. (Fluorodeoxyglucose (FDG), Iodine-131)

-

Advanced Accelerator Applications (a Novartis company) (Lutathera, NETSPOT)

-

Jubilant Life Sciences Ltd. (Iodine-131, Molybdenum-99)

-

Eczacıbaşı-Monrol (FDG, Gallium-68)

-

Australian Nuclear Science and Technology Organisation (ANSTO) (Technetium-99m, Molybdenum-99)

-

Shine Technologies (Molybdenum-99, Lutetium-177)

-

Telix Pharmaceuticals, Inc. (Illuccix, TLX591)

-

Nordic Nanovector (Betalutin, Humalutin)

-

Y-mAbs Therapeutics, Inc. (Omburtamab, Naxitamab)

-

Blue Earth Diagnostics (Axumin, Fluciclovine F-18)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.1 Billion |

| Market Size by 2032 | USD 38.8 Billion |

| CAGR | CAGR of 15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Diagnostics {SPECT, PET}, Therapeutics {Alpha Emitters, Beta Emitters, Brachytherapy}) • By Application (Cardiology, Neurology, Oncology, Thyroid, Lymphoma, Bone Metastasis, Endocrine Tumor, Pulmonary Scans, Urology, Other) • By End-use (Hospitals, Diagnostic Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE HealthCare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems Corporation, Lantheus Medical Imaging, Inc., Bracco Imaging S.p.A, Cardinal Health, Curium, Eckert & Ziegler, Nordion (Canada), Inc., NTP Radioisotopes SOC Ltd., Advanced Accelerator Applications, Jubilant Life Sciences Ltd., Eczacıbaşı-Monrol, Australian Nuclear Science and Technology Organisation (ANSTO), Shine Technologies, Telix Pharmaceuticals, Inc., Nordic Nanovector, Y-mAbs Therapeutics, Inc., Blue Earth Diagnostics |

| Key Drivers | • The increasing incidence of conditions such as cancer and cardiovascular diseases drives the demand for nuclear medicine diagnostics and treatments. • Innovations in imaging technologies and radiopharmaceuticals enhance the effectiveness and adoption of nuclear medicine procedures. |

| Restraints | • Establishing and maintaining cleanrooms involve significant expenses, including specialized HVAC systems and energy consumption, which can deter adoption. • Compliance with rigorous standards demands continuous monitoring and validation, posing challenges for manufacturers. |