Psychedelic Drugs Market Size Analysis

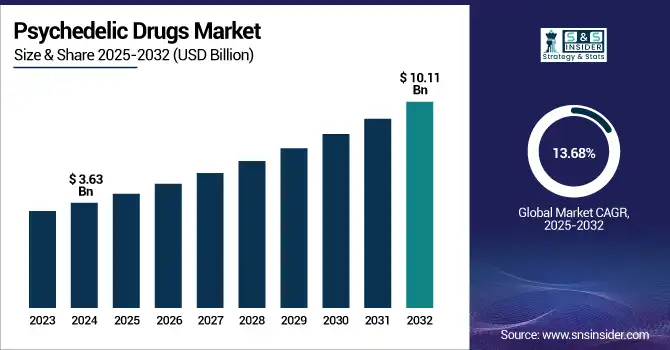

The Psychedelic Drugs Market size was valued at USD 3.63 billion in 2024 and is expected to reach USD 10.11 billion by 2032, growing at a CAGR of 13.68% over 2025-2032.

The Psychedelic drugs market is experiencing strong growth due to a combination of scientific discoveries, regulation, and emerging cultural trends. There are more than 400 ongoing clinical trials on psychedelics globally (WHO) examining their potential in treating mental health disorders, including treatment-resistant depression, PTSD, anxiety, addiction, and schizophrenia. A TIFR study revealed a unique brain area that is activated by psychedelic drugs that also suppresses anxiety, an exciting development for precision-targeted therapy. In a Phase II trial for the company Gilgamesh, 90% of participants experienced remission of depressive symptoms, demonstrating significant medical benefits. Cybin, with its CYB003 and CYB004 programs, is moving forward under the guidance of the FDA, and Lykos Therapeutics will be tweaking its protocols following regulatory scrutiny, all signs of growing up in terms of trial design standards.

To Get more information on Psychedelic Drugs Market - Request Free Sample Report

For instance, Researchers at UC Davis designed a next-generation LSD analog, which mitigates psychotic side effects at the time of maintaining therapeutic effects, which suggests that it might be possible to develop safer treatments to treat schizophrenia.

Psychedelic biotech is scaling quickly with USD 60 million Series A for Reunion Neuroscience, while MindMed, Atai Life Sciences, and Compass Pathways continue their aggressive R&D spend. The FDA has released recommendations for psychedelic trial design and has awarded breakthrough therapy designation to several interventions (MAPS' MDMA-assisted therapy). Studies are also being funded by the U.S. NIH and European agencies and countries, including Australia and Canada, which will also provide the drug under special programs.

Supply chains are being built to meet surging demand driven by synthetic drug innovation (the Cleveland Clinic’s work on non-hallucinogenic analogues) and legal reforms in states such as Oregon and Colorado. Texas approved funding for psychedelic research, and international academic-industry collaborations (Psylo-Sydney University) are growing early-stage pipelines.

For instance, a naturalistic trial in the survivors of the Nova Music Festival shooting showed that psychedelic use reduced PTSD symptoms so significantly that it is worth considering for post-traumatic use in such severe cases.

Psychedelic Drugs Market Dynamics

Drivers:

-

Rising Clinical Evidence, R&D, and Shifting Public Policy Fueling Demand

A growing body of evidence, increasing R&D funding, and favorable regulatory and legislative reforms are the key aspects that are driving the demand for the psychedelic drugs market. Recent clinical trials, conducted at Johns Hopkins and Imperial College London, have shown how psilocybin can produce a marked reduction in depression and anxiety symptoms in patients up to six months after treatment. The NIH funded more than USD 80 million in psychedelic studies in 2020.

MindBio Therapeutics and Beckley PsyTech are among industry players expanding their pipelines, and the former is doing the first research employing microdoses of LSD to treat bipolar depression. Clinical access has also been given legitimacy by regulatory benchmarks, including Australia's reclassification of psilocybin and MDMA for medicinal use in 2023 and Health Canada's Special Access Program.

Rapidly increasing demand, often in the face of unmet needs for mental health care, has been reported (especially in treatment-resistant populations). As psychedelic R&D goes more mainstream, academia and Big Pharma are coming on board. Then there is the legal loosening, Colorado and Oregon have legalized supervised psilocybin use, prompting systems for commercial and therapeutic support. Integrating all these, it paints the picture of a seismic shift in the drug development paradigm for mental health, with psychedelics at the vanguard of that change.

Restraints:

-

Legal Ambiguities, Safety Concerns, and Infrastructure Gaps Slow Progress

The majority of psychedelics are still Schedule I drugs under international and U.S. federal law, making research logistics and commercialization pathways complicated. Such restrictions from the DEA restrict the development of the supply chain while adding red tape for researchers and biotech companies. There are also safety and ethical issues to consider, such as the FDA recently denying the NDA for Lykos Therapeutics’ MDMA therapy, explaining that it found implementation problems and stressing the importance of good trial design.

Adverse events, such as the death of an American tourist who had drunk ayahuasca in Peru (2025), serve to underpin fears about non-clinical usage. The shortage of trained therapists and certified clinics creates issues of scale, and MAPS estimates that the U.S. will require over 10,000 psychedelic-trained therapists to meet projected demand.

Small biotechs are also burdened by high costs and long timelines to develop new compounds. Lastly, insurance for psychedelic-assisted therapy is still almost nonexistent, further preventing access even in areas where it is legal. These multiple thorny challenges meet along the trajectory from eternal science to available therapy, putting the brake on a more widespread application of psychedelics in traditional medicine.

Psychedelic Drugs Market Segmentation Insights

By Drug Type

In 2024, Ketamine was the leading shareholder of 42% in the psychedelic drug market, owing to its existing medical applications for treatment-resistant depression and expedited approvals across several geographies. The widespread use of the drug in clinical and off-label situations, such as the opening of ketamine infusion clinics, also helped the drug to take the lead.

The fastest-growing drug is Psilocybin, spurred on by more and more successful clinical trials, loosening U.S. laws and classifications, and a recategorization in global regions, such as Australia. Its robust effectiveness in treating major depressive disorder and potential for fewer side effects are fueling adoption and investments.

By Source

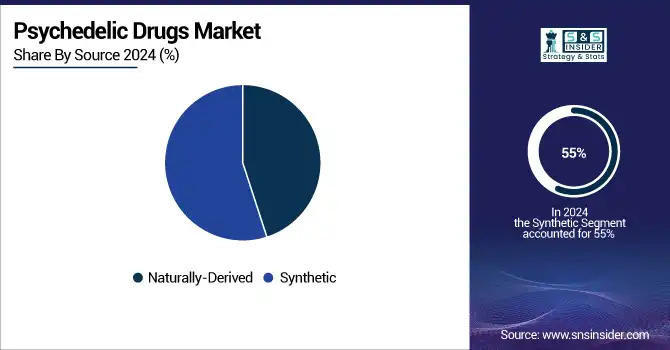

Synthetic compounds dominated in 2024 with a 55% share as they enable uniform quality, accessible scalability in production, and the potential to engineer analogues with better safety. Modified drugs won favor as well due to stiffer criteria for approval by regulators.

However, naturally derived psychedelics are the fastest-growing, spurred by the global user demand for plant-based therapies, traditional precedents in indigenous rituals, and the growing interest in the power of whole compounds rather than isolates.

By Application

In 2024, treatment-resistant depression accounted for the largest market share of 38%, due to the high unmet need for non-traditional depression drugs and solid clinical evidence of overarching results with ketamine and psilocybin in this indication. The fastest-growing portion is treatment for post-traumatic stress, driven by new evidence in favor of MDMA-assisted therapy and increasing prevalence among veterans and trauma survivors. A momentum from the regulation side (for instance, with an MDMA’s FDA breakthrough designation) is speeding up the process.

By Route of Administration

Intravenous (IV) was the leading route of administration in 2024 at 40%, accounting for widespread usage in clinical practice, specifically for ketamine infusion. Intravenous administration allows for a quick onset of action and exact dosing, which are both important in the treatment of acute depressive episodes. Conversely, Intranasal is the fastest growing route, due in large part to commercial esketamine nasal spray (Spravato). The convenience, non-intrusiveness, and growing popularity of the technology in the outpatient setting are driving demand at a rapid pace.

Psychedelic Drugs Market Regional Trends

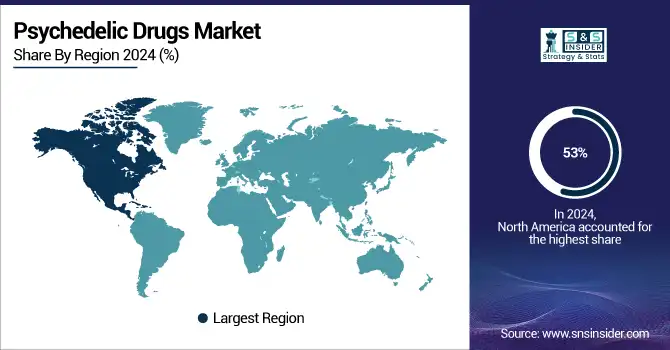

The psychedelic drugs market in North America was the largest in 2024, contributing over 53% of the global market share, owing to high R&D funding, conducive regulatory pathways, and increasing mental health knowledge.

The U.S. psychedelic drugs market size was valued at USD 1.45 billion in 2024 and is expected to reach USD 3.60 billion by 2032, growing at a CAGR of 12.06% over 2025-2032. The U.S. has taken the lead in the region, with early FDA breakthrough designations for MDMA and psilocybin and a heavy load of ongoing clinical trials (over 65 ongoing trials as of 2024).

Ketamine-assisted therapy clinics have spread quickly in states including California, Texas, and New York. Canada has quickly followed suit, with Health Canada’s Special Access Program permitting medical use of psilocybin and MDMA, which in turn paves the way for the nation’s growing the rapist network. Mexico is a contender, both because plant-based psychedelics have so thoroughly integrated into the country’s cultural and pharmacological identity and because of ongoing legalization efforts. The U.S. is currently in the lead due to strong biotech ecosystems, a surfeit of regulatory innovation, and more than USD 50 million in 2023 federal research funding.

Europe is the second-largest psychedelic drugs market owing to the progressive decriminalization efforts, robust clinical trial activity, and growing mental health burden. The region's share of the market was around 28% in 2024. The U.K. leads the way through an early commitment to psychedelic research, with facilities such as Imperial College London spearheading global psilocybin studies and private businesses, including Small Pharma, pioneering DMT-based trials. The Netherlands is becoming the medical tourism caravan for legal psilocybin retreats. Germany and France are broadening the use of ketamine infusions in their clinics and funding regulatory conversations around MDMA and psilocybin.

The Asia Pacific region is expected to be the fastest-growing region in the psychedelic drugs market during the review period, due to rapid regulatory transformation, rising awareness about mental health, and growing investment in clinical facilities. The region saw year-on-year growth of more than 18%, better than other global markets. Leading this charge is Australia, which, in July 2023, became the first country in the world to legalize both MDMA and psilocybin for psychiatric use under regulated medical models. There are more than 20 clinical trials underway, led by institutions such as Monash University and government-authorized prescribers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Psychedelic Drugs Market

Major psychedelic drugs companies in the market include Johnson & Johnson, Jazz Pharmaceuticals, COMPASS Pathways, MindMed Inc., Cybin Inc., Atai Life Sciences, GH Research PLC, Seelos Therapeutics, Beckley Psytech, and Field Trip Health.

Recent Developments in the Psychedelic Drugs Market

In April 2025, researchers at the Cleveland Clinic initiated a Phase I clinical trial examining a novel synthetic psychedelic compound, designed to minimize hallucinogenic effects, for treating postpartum depression. This approach aims to offer rapid relief with fewer side effects, opening safe treatment options for new mothers.

In March 2025, industry leaders published revamped guidelines in Clinical Trials Arena aimed at improving psychedelic study designs. These include standardized dosing schedules, enriched safety monitoring, and adaptive trial structures, developed in response to earlier setbacks like the Lykos MDMA trials to streamline regulatory approval and enhance data quality.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.63 billion |

| Market Size by 2032 | USD 10.11 billion |

| CAGR | CAGR of 13.68% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Type (Gamma-Hydroxybutyric Acid (GHB), Ketamine, Psilocybin, Lysergic Acid Diethylamide (LSD), 3,4-Methylenedioxymethamphetamine (MDMA), Dimethyltryptamine (DMT), Ibogaine, Mescaline, and Other Drug Types) By Source (Naturally-Derived, Synthetic) • By Application (Treatment-Resistant Depression, Major Depressive Disorder, Post-Traumatic Stress Disorder (PTSD), Substance & Opiate Addiction, Anxiety & Panic Disorders, Narcolepsy & Sleep Disorders, Alcohol Use Disorder, and Other Applications) • By Route of Administration (Oral, Intranasal, Intravenous, Sublingual / Buccal, and Transdermal & Others) • By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online & Telehealth Platforms, and Other Distribution Channels) • By End-use Setting (Specialized Psychedelic Clinics, Hospitals, Research & Academic Institutes, and Homecare Settings) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Johnson & Johnson, Jazz Pharmaceuticals, COMPASS Pathways, MindMed Inc., Cybin Inc., Atai Life Sciences, GH Research PLC, Seelos Therapeutics, Beckley Psytech, and Field Trip Health. |