Artificial Cornea and Corneal Implant Market Report Scope & Overview:

To Get More Information on Artificial Cornea and Corneal Implant Market - Request Sample Report

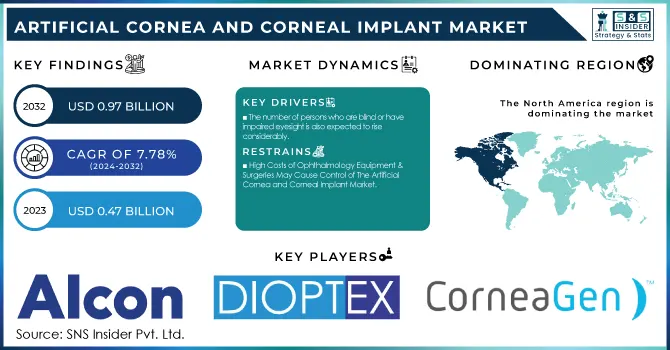

The Artificial Cornea and Corneal Implant Market was valued at USD 478.73 million in 2023 and is expected to reach USD 910.85 million by 2032, growing at a CAGR of 7.45% from 2024-2032.

The artificial Cornea and Corneal Implants market report provides information in regards to the incidents and prevalence of corneal issues prosthetics in the worldwide household of the challenges-interfacing processes, e.g., keratoconus and corneal dystrophies. The report also analyzes the trends of corneal transplant and implantation for each region and highlights the advancement in surgical techniques and the acceptance of artificial cornea. It also highlights corneal treatment expenditure across government, commercial, private, or out-of-pocket regions (2023). Another major trend described is the emergence of bioengineered corneas and 3D-printed implants that are reshaping transplantation with improved biocompatibility, decreased dependency on donors, and superior visual outcomes.

Market dynamics

Drivers

-

Rising Prevalence of Corneal Blindness and Eye Disorders Propelling the Artificial Cornea and Corneal Implant Market

The rise in cases of corneal diseases, infections, and injuries is the major contributing factor to the growth of the artificial cornea and corneal implant market. Keratoconus, Fuchs' endothelial dystrophy, corneal scarring following trauma, and Sjogren's syndrome-related severe dry eye disease represent some of the most common causes of visual impairment across the globe, and thus the greatest need for corneal transplantation. Despite advances, donor cornea shortages remain a major challenge, with reports indicating that only one in 70 transplant patients can access a donor cornea. This shortfall has catalyzed the research and implementation of artificial corneas and bioengineered implants that offer long-term viability for patients not qualified for corneal transplants. In addition, the increasing aging population — which is a key demographic group affected by corneal diseases is anticipated to also drive demand. According to the World Health Organization (WHO) 2022 report of 2.2 billion vision impairment patients around the world, a notable percentage of them are categorized as corneal patients, adding to the requirement for corneal implant innovations.

-

Technological Advancements in Corneal Implants Benefiting Market Growth

Innovations in nanotechnology, biomaterials, and regenerative medicine are transforming the effectiveness and durability of artificial corneas. Innovative treatments such as hydrogel-based corneal implants, bio-printed corneas, and stem cell-derived therapies for corneal regeneration are paving the way for cutting-edge solutions with enhanced biocompatibility, lower rejection rates, and superior optical clarity for patients. In addition, the advent of non-invasive surgical procedures is reducing post-surgical complications and boosting patient acceptance of artificial cornea implants. Many clinical trials are reporting success: patients receiving bioengineered corneas have consistently regained over 80% vision after the procedure. Companies are also adopting AI-driven surgical planning tools and robot-assisted corneal transplants to optimize precision and surgical outcomes. Uhlig said it's these innovations that are expanding treatment options, enabling artificial corneas to serve as an alternative to traditional donor grafts, and positioning the market for rapid development in the next few years.

Restraint

-

High Costs of Artificial Cornea and Corneal Implant Procedures Restrict Market Growth in Developing Economies

With continuous technological developments, the elevated prices for artificial cornea implants and associated surgical procedures act as a notable restraint for market growth, especially in developing regions. In low- and middle-income countries, many patients are unable to pay for these treatments due to limited healthcare coverage and inadequate reimbursement policies. In addition, it requires specialized surgical expertise and infrastructure, which adds to the cost. This gap in access translates into adoption rates of less than 1%, with millions of corneal blindness cases remaining untreated. Solutions to these constraint challenges (e.g., government subsidies, improvements in insurance coverage for MDIs, and generally more affordable product offerings) may break this constraint and increase this market penetration worldwide.

Opportunities

-

Advancements in Bioengineered Corneas and 3D-printed Implants Create Lucrative Opportunities in the Artificial Cornea and Corneal Implant Market

The Artificial Cornea and Corneal Implant Market is esports on innovations like bioengineered corneas, 3D printing, etc. Such developments increase the biocompatibility of artificial implants, lowering rejection rates and improving long-term success, factors that could make artificial implants a suitable alternative to donor corneas, Dr. Schuman explained. 3D printing provides implants tailored to specific patient needs more accurately. Bioengineered approaches using stem cells and regenerative medicine are on the horizon for self-healing corneal implants. Market adoption will be further driven by investments in R&D, collaborations between biotech companies and healthcare providers, as well as regulatory approval that create new opportunities for innovation.

Challenges

-

Regulatory Challenges and Stringent Approval Processes Hinder the Artificial Cornea and Corneal Implant Market Expansion

Complex regulatory frameworks and stringent approval processes are other factors that can hamper the growth of the Artificial Cornea and Corneal Implant Market. The accompanying clinical testing and validation required by regulatory bodies for new implants take years to complete, adding costs for the manufacturers. Market entry and expansion are further complicated by differing regulatory requirements among countries. Further, there are operational burdens for companies from post-approval monitoring and compliance. The slow speed of product launches and restrictive reimbursement policies can affect adoption. Overcoming these hurdles requires a commitment to transparent clinical trial designs and strong regulatory approaches, as well as partnerships with healthcare authorities to develop clear approval pathways.

Segmentation Analysis

By Type

The human cornea segment dominated the market and accounted for the highest market share of 62.31% in 2023, owing to the persistence of human donor corneas in corneal transplantation. Human corneal grafts continue to be the gold standard despite the growing options for artificial alternatives due to their increased biocompatibility and lower rates of rejection. The demand is driven by rising cases of corneal blindness, trauma, and infections and also awareness campaigns to promote eye donations. A broad range of companies and organizations are trying to translate that into better access to donor corneas.

The expansion of eye banking services offered by Oversight enables a global cornea distribution system to maximize the availability of corneas for transplantation. CorneaGen has also worked on next-generation preservation technologies to improve corneal storage and transport.

The artificial cornea segment is anticipated to register the fastest CAGR over the projected period due to the rising demand for artificial corneas with human donor corneas. Various artificial corneas have been developed due to shortages of donor tissues and advances in biomaterials and regenerative medicine. As a result, companies are increasingly investing in innovative solutions aimed at improving biocompatibility and long-term success.

By Transplant Type

The penetrating keratoplasty (PK) segment dominated the market and accounted for the largest market share of 42.13%, making it one of the most established and popular corneal transplant procedures in 2023. Penetrating keratoplasty (PK) is still the gold standard for the management of advanced corneal disease, corneal scarring, keratoconus, and corneal decompensation. Its predominance was further enhanced by high success rates, long-term graft survival, and the continous improvements in corneal preservations methods. PK procedure has been sympathetically improved through the invention of new surgical instruments, preservation media, and better sewing techniques by various companies.

Moreover, bioengineered human corneas will make accessibility better in parts of the world with few donors. Nevertheless, challenges like immune rejection and extended recovery times have led to artificial corneas being investigated as alternative or adjunct solutions.

By Disease Indication

In 2023, the Fuchs' Dystrophy segment dominated the market with the largest market share attributed to the rising prevalence of the disease, especially in the elderly population. Fuchs' Endothelial Corneal Dystrophy [FECD] is a progressive loss-of-function degenerative condition that affects the specular microscopic corneal endothelial cell layer, resulting in corneal edema and loss of vision attributable to endothelial cell dysfunction And interest in advanced treatment options has exploded as it remains the main cause of corneal transplants globally.

Furthermore, regenerative medicine and cell-based therapies are under investigation as a potential means by which to restore endothelial function without the necessity of full corneal transplantation. Nonetheless, donor cornea scarcity is still a key limitation, hence the utilization of artificial corneal implants as an alternative solution for patients with advanced stages of disease. Emerging technologies such as synthetic endothelial implants and keratoprostheses are broadening treatment options and decreasing reliance on human donor tissues. The inclusion of artificial corneas in the Fuchs' Dystrophy treatment armamentarium will drive the growth of the Artificial Cornea and Corneal Implant Market as patients across the globe seek long-term vision restoration solutions.

By End User

The hospitals segment dominated the market and generated about 48.23% of the market share in 2023, owing to hospitals being the key players in providing specialized, comprehensive eye care. Hospitals have the latest surgical facilities, experienced ophthalmologists, and readily available advanced technologies to perform corneal transplants and artificial corneal implants.

For instance, femtosecond laser technology and better preservation techniques are enhancing the success rate of corneal transplants. Recent studies into the scarcity and availability of donor corneas to treat corneal disease have accelerated the development of artificial corneas as alternative solutions, with hospitals routinely treating patients who fail to qualify for donor corneal transplant procedures using keratoprosthetics.

The Specialty Clinics segment is projected to register the fastest growth with a CAGR of 9.27% during the forecast period, owing to the rising significance of these facilities in delivering specialized and personalized ophthalmic care. These small clinics deal with certain corneal illnesses, and they also provide vigorous diagnostic procedures and specific surgical management. The corneal implant demand is growing both for artificial corneas like the Avance as well as traditional donor corneal implants for patients with complex clinical conditions such as keratoconus, Fuchs’ dystrophy, or corneal scarring. The increased focus on specialized eye care in a more efficient, patient-oriented environment is driving the uptake of Next-generation corneal therapies.

Regional analysis

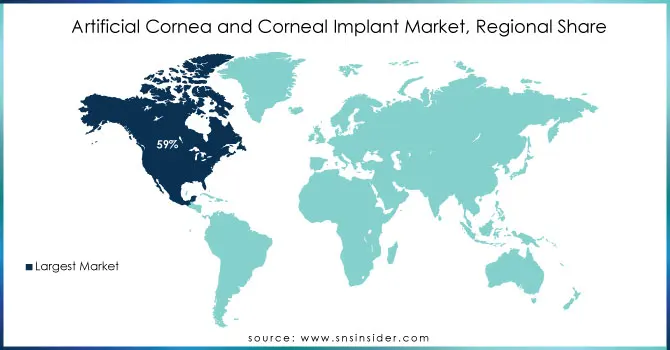

North America dominated the artificial cornea and corneal implant market in 2023, with an approximate share of 39%. The dominance of this region can be attributed to the region's advanced healthcare infrastructure, higher level of healthcare expenditure, and the presence of key vendors and research institutions in the field of ophthalmology. The established regulatory environment in North America, coupled with the availability of cutting-edge medical technology, facilitates the rapid adoption of artificial cornea and cornea implants.

The artificial cornea and corneal implant market in the Asia Pacific region is expected to be the fastest-growing in the forecast years, with an estimated CAGR of 8.9% during the forecast period. Entirely, the development is backed by the rising occurrence of corneal disorder & disease, along with a deficit of donor corneas in countries such as India, China, and Japan. Corneal blindness is increasing in these countries as a result of genetic conditions, trauma to the eye, and infection-related blindness. Moreover, the increasing population and better access to health care in Asia are other significant factors fueling the demand for corneal implants in the market. Healthcare access is also improving across the region, with rising investments in eye care infrastructure and surgical treatments.

Do You Need any Customization Research on Artificial Cornea and Corneal Implant Market - Enquire Now

Some of the major key players in the Artificial Cornea and Corneal Implant Market

-

CorneaGen (Pre-Loaded DMEK Tissue, Keratoprosthesis Devices)

-

AJL Ophthalmic (KeraKlear Artificial Cornea, Corneal Inlays)

-

LinkoCare Life Sciences AB (LinkoCare Synthetic Cornea, Corneal Onlay)

-

Addition Technology, Inc. (Intacs Corneal Implants, KeraVision Ring Segments)

-

Mediphacos (AlphaCor Artificial Cornea, Corneal Shields)

-

Presbia PLC (Presbia Flexivue Microlens, Corneal Pocket Creation Devices)

-

Ocular Systems, Inc. (EndoSerter Endothelial Keratoplasty Delivery Instrument, Corneal Grafts)

-

EyeYon Medical (Hyper-CL Therapeutic Lens, EndoArt Artificial Endothelial Layer)

-

KeraMed, Inc. (KeraKlear Non-Penetrating Keratoprosthesis, KeraCor Keratoprosthesis)

-

ReVision Optics, Inc. (Raindrop Near Vision Inlay, Corneal Shape-Changing Implants)

-

HumanOptics AG (Artificial Iris, Keratoprosthesis)

-

Morcher GmbH (Artificial Iris, Capsular Tension Rings)

-

Peschke Meditrade GmbH (Corneal Cross-Linking Devices, Keratoprosthesis)

-

Ferentis (Bioengineered Corneal Implants, Corneal Scaffolds)

-

BrightOcular (Artificial Iris Implant, Corneal Tattooing Devices)

-

Vivior AG (Visual Behavior Monitor, Customized Corneal Implants)

-

Nidek Co., Ltd. (Excimer Laser Systems, Corneal Topography Devices)

-

Haag-Streit Group (Slit Lamps, Anterior Segment Imaging Devices)

-

Ziemer Ophthalmic Systems AG (Femtosecond Laser Systems, Corneal Dissection Devices)

-

DIOPTEX GmbH (Corneal Inlays, Keratoprosthesis)

Suppliers (These suppliers play a critical role in manufacturing and distributing artificial cornea and corneal implant products globally.)

-

CorneaGen

-

AJL Ophthalmic

-

LinkoCare Life Sciences AB

-

Addition Technology, Inc.

-

Mediphacos

-

EyeYon Medical

-

KeraMed, Inc.

-

HumanOptics AG

-

Peschke Meditrade GmbH

-

Ferentis

Recent development

-

In June 2024, CorneaGen officially launched Corneal Tissue Addition for Keratoplasty (CTAK), a groundbreaking solution designed to improve corneal contouring in patients with keratoconus. This innovative approach aims to enhance surgical outcomes and provide a more effective treatment for individuals with irregular corneal shapes, reinforcing CorneaGen’s commitment to advancing ophthalmic care.

-

In June 2024, EyeYon Medical introduced EndoArt, an advanced artificial corneal implant designed to serve as a flexible, thin endothelial layer replacement. Primarily developed for patients suffering from chronic corneal edema, EndoArt helps regulate intra-corneal fluid flow, significantly improving visual function and offering a promising alternative for individuals requiring corneal transplantation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 478.73 million |

| Market Size by 2032 | US$ 910.85 million |

| CAGR | CAGR of 7.45% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Artificial Cornea, Human Cornea) • By Transplant Type (Endothelial Keratoplasty, Penetrating Keratoplasty, Keratoprosthesis, Anterior Lamellar Keratoplasty) • By Disease Indication (Fungal Keratitis, Fuchs' Dystrophy, Keratoconus, Others) • By End User (Ambulatory Surgical Centers, Hospitals, Specialty Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CorneaGen, AJL Ophthalmic, LinkoCare Life Sciences AB, Addition Technology, Inc., Mediphacos, Presbia PLC, Ocular Systems, Inc., EyeYon Medical, KeraMed, Inc., ReVision Optics, Inc., HumanOptics AG, Morcher GmbH, Peschke Meditrade GmbH, Ferentis, BrightOcular, Vivior AG, Nidek Co., Ltd., Haag-Streit Group, Ziemer Ophthalmic Systems AG, DIOPTEX GmbH, and other players. |