Sterile Bioprocess Filtration Market Report Scope & Overview:

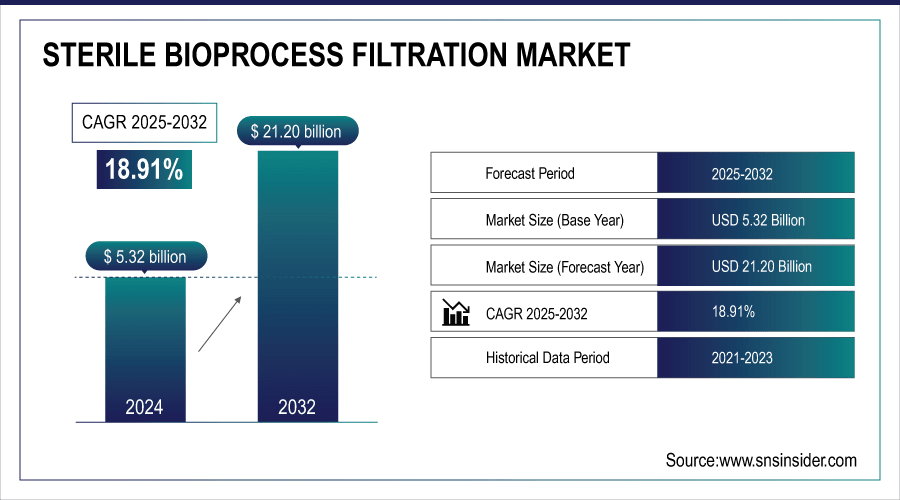

The Sterile Bioprocess Filtration Market was valued at USD 5.32 billion in 2024 and is expected to reach USD 21.20 billion by 2032, growing at a CAGR of 18.91% over the forecast period of 2025-2032.

The global sterile bioprocess filtration market is expanding at a rapid pace as a result of increased utilization of single-use filtration systems that improve feedstock efficiency, minimize the risk of contamination, reduce operational expenses, and enable flexible, scalable production. This sterile bioprocess filtration market trend is being propelled by the need for personalized medicines, adherence to regulations, and striving for more sustainable practices. With faster batch rotation, no cleaning issues, and an operation that is smooth, such systems become indispensable to the modern biopharmaceutical facility.

For instance, in April 2025, Merck KGaA reported an 18% year-over-year increase in single-use sterile filtration sales, driven by strong biologics demand in North America and Asia.

To Get More Information On Sterile Bioprocess Filtration Market - Request Free Sample Report

Sterile Bioprocess Filtration Market Trends

-

Technological advancements drive adoption. Modern single-use and automated filtration systems with IoT-enabled monitoring improve sterility assurance, process efficiency, and scalability in biopharmaceutical production.

-

Material and device innovations. Advanced filter membranes, low-protein binding polymers, and integrity-testing features enhance yield, reduce contamination, and support complex biologics manufacturing.

-

Customized and modular approaches. Tailored filter assemblies, modular skid systems, and hybrid disposable–stainless steel setups enable flexible bioprocessing and integration with continuous bioprocess platforms.

-

Rising demand from global biopharma growth. Increasing production of monoclonal antibodies, vaccines, biosimilars, and novel modalities (mRNA, viral vectors) drives the need for sterile filtration solutions.

-

Emerging regional infrastructure. Asia-Pacific, Latin America, and the Middle East are expanding GMP-compliant biomanufacturing facilities, training programs, and supply chains, accelerating sterile filtration adoption.

-

Focus on cost-effectiveness and regulatory compliance. Single-use systems, rapid integrity testing, reduced downtime, and alignment with FDA/EMA/ICH guidelines enhance efficiency, safety, and affordability for clinical and commercial production.

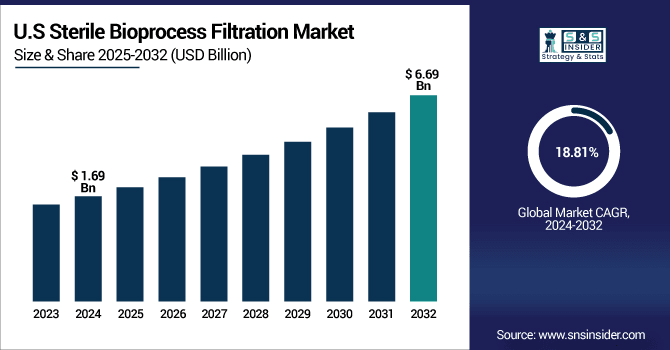

The U.S. Sterile Bioprocess Filtration Market was valued at USD 1.69 billion in 2024 and is expected to reach USD 6.69 billion by 2032, growing at a CAGR of 18.81% over 2025-2032.

The sterile bioprocess filtration market in the U.S. is led by high use of membrane filters that provide accuracy, compliance with regulations, and broad applicability across the biopharma industry. Supported by innovation, single-use tech, and tough FDA policies, the country is at a technology forefront through demand. This is further evidence of this trend, after recent sterile bioprocess filtration market analysis demonstrated significant growth and revenue leadership.

Sterile Bioprocess Filtration Market Growth Drivers:

-

Expansion of Biologics Manufacturing is Driving the Sterile Bioprocess Filtration Market Growth

The increasing manufacturing of Biologics is one of the vital factors that are anticipated to drive the sterile bioprocess filtration market. The higher demand for difficult therapies, coupled with outsourcing and personalized medicine, drives towards an advanced, scalable, contaminant-free filter system. Efficiency is further enhanced by innovations including single-use technologies. It is this trend that has resulted in an increase in the sterile bioprocess filtration market share globally.

For instance, in January 2025, the FDA approved a record 72 biologics and biosimilars in 2024, boosting demand for sterile filtration in large-scale biopharmaceutical manufacturing.

Sterile Bioprocess Filtration Market Restraints:

-

Strict Validation Procedures are Hampering the Sterile Bioprocess Filtration Market Growth

Strict validation processes impede the sterile bioprocess filtration market growth with their time-consuming, expensive, and complex functionality. High levels of documentation, regulation, and multiple global validations hinder innovation and market access. SMBs have cash flow issues and less operational flexibility. These are important processes we cannot bypass, but they hinder scaling and slow adoption beyond gradually growing markets.

Sterile Bioprocess Filtration Market Opportunities:

-

Integration With Digital and Automated Systems Creates Lucrative Opportunities for Innovative Testing Equipment

Sterile bioprocess filtration has the potential for substantial advancement involving digital and automated systems. Filters IoT-featured, real-time monitoring and AI process control help manufacturers to identify contamination early, enhance throughput, and ensure product quality. These advancements contribute to better compliance with regulations, prevent human error, and are aimed at increasing overall process efficiency, making biopharma manufacturing safer, faster, and more cost-effective.

For instance, in June 2024, over 65% of new biopharma facilities in North America and Europe adopted single-use sterile filtration systems, enhancing cost-efficiency and minimizing contamination risks.

Sterile Bioprocess Filtration Market Segment Analysis

-

By product, membrane filters led the sterile bioprocess filtration market with a 33.94% share in 2024, while cartridge filters are the fastest-growing segment with a CAGR of 19.56%.

-

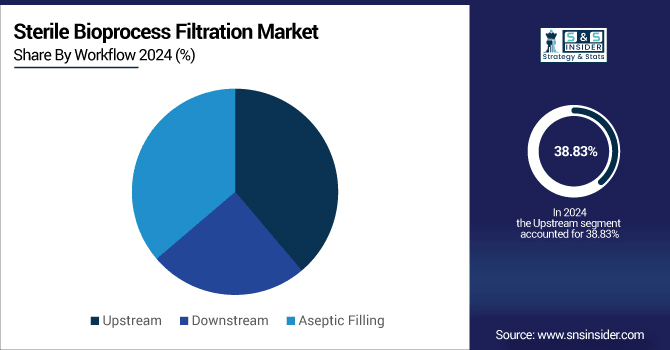

By workflow, the upstream dominated the market with a 38.83% share in 2024, whereas the aseptic filling segment is expected to grow fastest with a CAGR of 19.41%.

-

By material, polyether sulfone (PES) led the market with 37.34% share in 2024, while polyvinylidene fluoride (PVDF) is registering the fastest growth with a CAGR of 19.50%.

-

By end user, biopharmaceutical & biotechnology companies held a 50.71% share in 2024, while CMOS & CROS are growing the fastest with a CAGR of 20.19%.

By Workflow, Upstream Dominates, While the Aseptic Filling Shows Rapid Growth

By workflow, the upstream dominates the sterile bioprocess filtration market, as it is being used in cell culture, media preparation, and contamination prevention. Membrane and depth filters are in demand due to the requirement for pure feeds and aseptic conditions used during early-stage biomanufacturing. The Aseptic Filling is showing rapid growth fueled by the growing need for end drug products free of contamination, particularly biologics and injectables. Regulatory focus on sterility, rise in personalized medicine, and use of pre-sterilized single-use systems are propelling it up.

By Product, Membrane Filters Lead Market, While Cartridge Filters Register Fastest Growth

In 2024, membrane filters led the sterile bioprocess filtration market, holding the largest share, owing to their exact pore size, excellent filtration, and good regulation. They are used extensively in sterilising, virus-removing, and final fill applications, helping to ensure product quality time after time. Their diversity in offerings of biologics, vaccines, and biosimilars. Cartridge filters are registering the fastest growth, owing to their scalable nature, integration capability, and cost-effective processing for high-throughput applications. They deliver excellent results in final filtration, sterilizing, and prefiltration applications.

By Material, Polyether sulfone (PES) Lead, While Polyvinylidene Fluoride (PVDF) Registers Fastest Growth

By material, polyether sulfone (PES) leads the sterile bioprocess filtration market, due to its excellent thermal stability, high flow velocity, and low protein binding properties for biopharmaceuticals. PES membrane provides superior flow rates and throughputs, combined with long service life in sterilizing-grade filtrations. While polyvinylidene fluoride (PVDF) is registering the fastest growth, due to its excellent chemical resistance, large fluxes, and high temperature stability. PVDF membrane is the product of choice when filtration of high solvents and biologics is required.

By End User, Biopharmaceutical & Biotechnology Companies Lead While CMOs & CROs Grow Fastest

By end user, biopharmaceutical & biotechnology companies lead the sterile bioprocess filtration market, as they heavily apply filtration in the manufacturing of biologics, vaccines, and cell/gene therapy. They generate sterilizing filter demand in high volumes throughout both upstream and downstream processing. Whereas CMOs & CROs are growing the fastest, as biopharma companies look to reduce costs, drive scale, and speed to market with the practice. These companies need state-of-the-art sterile filtration to meet various customer needs, ranging over early-phase trials up through commercial production.

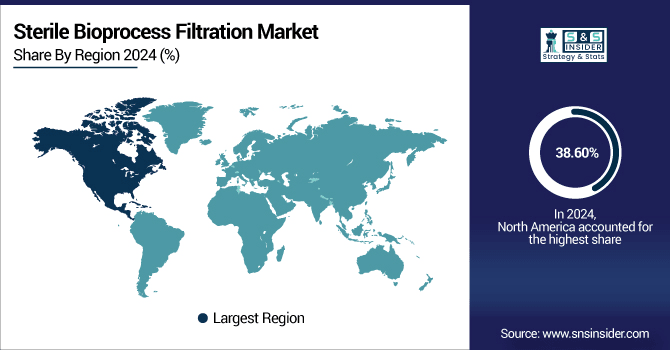

Sterile Bioprocess Filtration Market Regional Analysis:

North America Sterile Bioprocess Filtration Market Insights

In 2024, North America dominated the sterile bioprocess filtration market and accounted for 38.60% of the revenue share. owing to its robust biopharmaceutical base, high research and development (R&D) expenditures, and early implementation of next-generation bio-processing technologies. The US represents major industries, including Thermo Fisher, Merck Millipore, and Pall Corporation, which lead in innovation and supply. This company’s market leadership was also partly motivated by the friendly FDA regulations and a large volume of biologics and biosimilars approvals, in addition to increasing adoption of single-use filtration systems. Furthermore, the region’s focus on quality and regulatory compliance and investments in personal medicine and vaccine manufacturing are continuing to drive demand for sterile filtration solutions throughout upstream and downstream processes.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Sterile Bioprocess Filtration Market Insights

The sterile bioprocess filtration market in the U.S. is led by high use of membrane filters that provide accuracy, compliance with regulations, and broad applicability across the biopharma industry. Supported by innovation, single-use tech, and tough FDA policies, the country is at a technology forefront through demand.

Asia-Pacific Sterile Bioprocess Filtration Market Insights

Asia-Pacific is expected to witness the fastest growth in the sterile bioprocess filtration market over 2025-2032, with a projected CAGR of 19.66%, as a result of the rapid growth experienced in the biopharmaceutical market, increasing investment for healthcare establishments, and strong government initiatives to support local production of biosimilars. With countries including China, India, S.Korea and Japan stepping up production of biologics and biosimilars at a rapid pace, the need for sterile filtration technologies has only increased. Growing penetration of international CMOs and CROs, low manufacturing cost, and availability of a professional workforce encourage foreign investment and contract service outsourcing. Furthermore, the increasing frequency of chronic diseases and a growing middle class are driving demand for sophisticated biologic treatments.

China Sterile Bioprocess Filtration Market Insights

China is the largest market for sterile bioprocess filtration in the Asia-Pacific region and is the largest market globally. Local filter manufacturing, growing biologics and vaccine production, and a rise in investment in advanced therapies are promoting the adoption and bringing about market expansion in the country.

Europe Sterile Bioprocess Filtration Market Insights

Europe holds the second-largest share in the global sterile bioprocess filtration market, owing to its robust bio-pharmaceutical community, developed manufacturing facilities, and regulatory backing from organisations including the EMA. Germany, Switzerland, and the UK are at the forefront of biologics/biosimilars and vaccine manufacturing. Europe’s stock in the global sterile filtration market is further bolstered by high R&D investment, uptake of single-use technologies, and partnering with global CMOs.

Germany Sterile Bioprocess Filtration Market Insights

The European sterile bioprocess filtration market is dominated by Germany, due to the stringent GMP regulations, high focus on product quality, and strong biopharmaceutical industry. Cutting Edge biologies manufacture & vaccine production features high-performance sterile filtration systems that enable the process with absolute sterility, regulatory reliability, and product quality, minimizing contamination risk when compared to the traditional or obsolete filtration techniques.

Latin America (LATAM) and Middle East & Africa (MEA) Sterile Bioprocess Filtration Market Insights

The Latin American and the Middle East & African markets are new revenue pockets in the sterile bioprocess filtration markets, with growth in biopharmaceutical manufacturing facilities, production of vaccines and biologics, and the government’s efforts to provide healthcare infrastructure. Suppliers of well-engineered filtration systems. Modern filtration systems for process sterility, regulatory compliance, and risk reduction.

Sterile Bioprocess Filtration Market Competitive Landscape:

Merck KGaA: As a global life science leader, Merck KGaA offers high-performance sterile filtration solutions, single-use systems, and membranes for biologics and vaccine manufacturing, with an emphasis on innovation, regulatory flexibility, and scalable bioprocessing from clinical to commercial scales.

-

In March 2025, In March 2025, Merck launched its XCell single-use sterile filtration system, designed for high-throughput biologics production, enhancing sterility assurance and reducing contamination risks.

Sartorius AG: Specialized in innovative filtration technology, single-use assemblies, and bioprocess equipment. Their products improve sterility, process control, and overall yields for biologics, vaccines, and cell & gene therapies, while reducing overall risk, facilitating rapid scale-up, and increasing productivity during the manufacture of these therapies.

-

In July 2024, Sartorius expanded its bioprocess filtration portfolio with modular single-use assemblies optimized for mRNA vaccine manufacturing, supporting rapid scale-up and regulatory compliance.

Danaher Corporation: Danaher provides complete sterile filtration capabilities through businesses, including Pall Corporation, focused on membrane innovation, single-use systems, and integrated process technology to provide contamination-free biomanufacturing, lower total cost of operations, and meet strict global quality standards.

-

In November 2024, Pall introduced advanced membrane filtration technology for viral vector production, improving process yield, sterility, and integration with continuous biomanufacturing platforms.

Sterile Bioprocess Filtration Market Key Players:

Some of the sterile bioprocess filtration market Companies are:

-

Merck KGaA

-

Sartorius AG

-

Danaher Corporation

-

Thermo Fisher Scientific

-

3M Company

-

GE HealthCare

-

Repligen Corporation

-

Parker Hannifin

-

Eaton Corporation

-

Amazon Filters Ltd.

-

Meissner Filtration Products

-

Cole-Parmer

-

Saint-Gobain Life Sciences

-

Graver Technologies

-

Asahi Kasei Medical

-

Porvair Filtration Group

-

Fujifilm Wako Chemicals

-

Microdyn-Nadir

-

CellGenix

-

GVS Group

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.32 billion |

| Market Size by 2032 | USD 21.20 billion |

| CAGR | CAGR of 18.91% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | "• By Product (Membrane Filters, Depth Filters, Cartridge Filters, Capsule Filters) • By Workflow (Upstream, Downstream, Aseptic Filling) • By Material (Polyether sulfone, Polyvinylidene Fluoride, Polytetrafluoroethylene) •By End User(Academic & Research Institutes, Biopharmaceutical & Biotechnology Companies, CMOs & CROs) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Merck KGaA, Sartorius AG, Danaher Corporation, Thermo Fisher Scientific, 3M Company, GE HealthCare, Repligen Corporation, Parker Hannifin, Eaton Corporation, Amazon Filters Ltd., Meissner Filtration Products, Cole-Parmer, Saint-Gobain Life Sciences, Graver Technologies, Asahi Kasei Medical, Porvair Filtration Group, Fujifilm Wako Chemicals, Microdyn-Nadir, CellGenix, GVS Group, and other players. |