U.S. Healthcare Payer Services Market Report Scope & Overview:

Get more information on U.S. Healthcare Payer Services Market - Request Free Sample Report

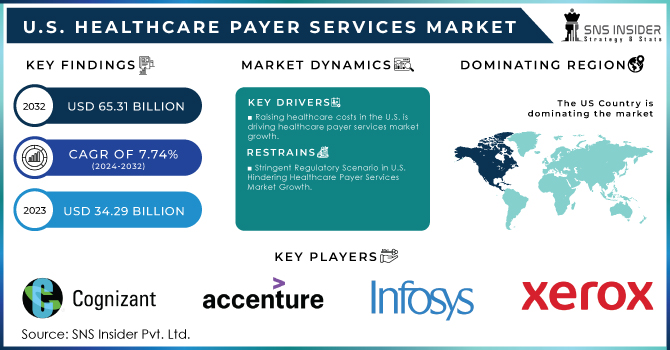

The U.S. Healthcare Payer Services Market Size was valued at USD 34.29 Billion in 2023 and is witness to reach USD 65.31 Billion by 2032 and grow at a CAGR of 7.74% over the forecast period 2024-2032.

Advanced data analytics and artificial intelligence (AI) integrations have emerged as key transformative forces in the U.S. healthcare payer services market, fostering significant growth opportunities and innovation through aggressive disruption across diverse segments of end users such as government-sponsored plans; commercial health insurers including regional group carriers, and national payers like Anthem United Health Group Cigna HCSC Humana Kaiser Permanent Aetna among others.

The U.S. Government Accountability Office (GAO) report stresses the immense benefits to be gained from adopting the Internet of Things (IoT) and blockchain technologies into healthcare through payer services, patient care specifically. For example, wearables like health monitors can provide this information to digital providers in real-time - helping streamline claims processing so the company has accurate and current patient data directly from patients. The claims processing process can additionally be improved through the utilization of blockchain technology, which creates an immutable audit trail that decreases fraud and increases transparency. IoT drives 24/7 health monitoring in patient care, providing opportunity for timely intervention and personalized treatment while blockchain facilitates the secure sharing of accurate medical records among providers thus enhancing coordination in the provision of care. By providing an audit trail and real-time data updating, blockchain can prove critical in guaranteeing the safety of patients during clinical outcome trials - ensuring that all parties adhere to stringent protocols; and monitoring drug authenticity throughout pharmaceutical supply chains by tracking storage conditions. In sum, these technologies are set to offer immediate and broad-based progress in healthcare functions from efficiency to effects on patients.

AI and data analytics have a way of ensuring that claims can be processed faster because they automate many routine tasks to require less manual intervention. This, of course, speeds up the payment process but also provides 100% accuracy and reduces errors, which can result in delayed payments or mismatches. This technology holds the potential to decrease processing times by 30%, according to The Centers for Medicare & Medicaid Services (CMS), which delivers significant operational efficiencies for healthcare payers.

Predictive analytics and AI are important in fraud detection. An increasing number of sophisticated algorithms are now able to detect potentially fraudulent claims and patterns before a claim is processed, as reported by the National Health Care Anti-Fraud Association (NHCAA). Taking this proactive approach reduces the financial risks considerably - by 20% according to some calculations; which would be possible with an AI fraud detection system. These systems flag exceptions in real time, which enables the prevention of financial abuse and minimizes the scope for erroneous claim settlements.

In addition to that, AI and data analysis help develop specialized medical care by using millions of patient healthcare information for developing customized treatment plans and providing early intervention. Personalized data analytics powered care results in better patient outcomes and increased value, states the Agency for Healthcare Research and Quality (AHRQ). For example, AI tools are equipped to analyze patient data and predict health risks accordingly suggesting precautionary steps that can minimize the chances of major ailments and providing a well-organized approach to taking care.

Moreover, integrating AI and data analytics into healthcare payer services not only improves claims processing outcomes in terms of speed and accuracy but also enhances fraud detection capabilities as well enables personalized patient care. As these technologies advance, they have the power to greatly improve healthcare quality and costs around goals that both government agencies and well industry see eye-to-eye on in this country.

MARKET DYNAMICS:

KEY DRIVERS:

-

Raising healthcare costs in the U.S. is driving healthcare payer services market growth.

-

The Increasing Prevalence of Chronic Diseases in the U.S. Increases the Volume of Healthcare Claims Boosting the Healthcare Payer Services Market Growth.

RESTRAINTS:

-

Stringent Regulatory Scenario in U.S. Hindering Healthcare Payer Services Market Growth.

-

High Incidence of Data Breaches and Loss of Confidentiality in the U.S. can Limit the Growth of Healthcare Payer Services.

OPPORTUNITY:

-

The integration of advanced data analytics AI offers significant opportunities for enhancing claims processing, fraud detection, and patient care management Offering a Lucrative Growth Opportunity for Healthcare Payer Services Market.

-

Rising demand for private health insurance, driven by increased consumer awareness and healthcare needs, creates opportunities for payer services to cater to a broader market.

KEY MARKET SEGMENTATION:

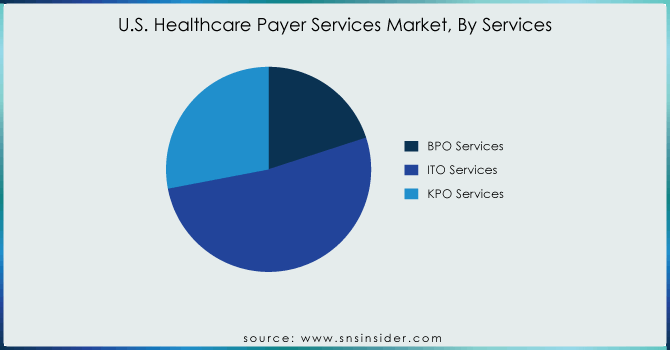

By Services

Service Segment ITO Services was the largest segment with a market share of 52 % in 2023. The growth of the market can be attributed to increasing demand for AI technology, availability of massive amounts of data growing capital investments in the healthcare industry during manual workload, and limited access to medical information among patients living in remote areas. Apart from that, escalating costs coupled with complex compliance requirements and a mushrooming customer base are the factors expected to further motivate healthcare providers to outsource or use integrated services.

Growing demand for super-specialists along with cost savings related to outsourcing of high-end processes from developed markets have collectively fueled the growth zone in the KPO healthcare payer services segment retaining a higher CAGR, which is about 10.8%. Additionally, the increasing demand in developing economies to provide low-cost & highly skilled talent for domain-specific core and noncore areas of the payer vertical is one of the significant elements likely to have a positive impact on the industry over the next seven years.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End-Use

The private payers’ segment was the largest revenue-generating end user with a share of 59% in 2023. This is mainly due to the growing private investment in the healthcare payer vertical and rising government support for increasing the relevance of private investments across the healthcare industry.

The public healthcare payers either federal or state government provide payments to ensure financial accessibility for patients accessing health & medical services. They protect patients from high OOP (out-of-pocket) healthcare expenses in an era of largely unregulated free markets, as reflected by the absence of any health-related financial risk-mitigating measure. Medicare, Medicaid, and the Children's Health Insurance Program (CHIP) are all examples of public-funded insurance.

KEY PLAYERS

The key market players include Cognizant Technology Solutions, Accenture PLC, Infosys, Xerox Corporation, Iqvia, Flatworld Solutions, Orion Healthcorp, Medisys Data Solutions, Inc., Wipro Ltd., Promantra & other players.

RECENT DEVELOPMENTS

-

The article, which was published by the Congressional Research Service titled the United States Health Care Coverage and Spending and updated in April 2022, mentions that most people had private health insurance or were covered by a government program, such as Medicare or Medicaid in 2020.

-

Furthermore, the same source reports that in 2020, individuals, including the uninsured, health insurers, and federal and state governments spent USD 3.9 trillion on various types of health consumption expenditures. This is 18.8 percent of the country’s gross domestic product. Such a large investment in healthcare consumption in this region will result in driving the growth of this market in this region due to the need to introduce healthcare payer services through which people will be claiming insurance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 34.29 Billion |

| Market Size by 2032 | USD 65.31 Billion |

| CAGR | CAGR of 7.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Services (BPO Services, ITO Services, KPO Services) •By Application (Claims Management Services, Integrated Front Office Service, and Back Office Operations, Member Management Services, Provider Management Services, Billing and Accounts Management Services, Analytics and Fraud Management Services & HR Services) •By End-use (Private Payers, Public Payers) |

| Company Profiles | Cognizant Technology Solutions, Accenture PLC, Infosys, Xerox Corporation, Iqvia, Flatworld Solutions, Orion Healthcorp, Medisys Data Solutions, Inc., Wipro Ltd., Promantra & other players |

| Key Drivers | •Raising Healthcare costs in the U.S. are Driving Healthcare Payer Services Market Growth. •The Increasing Prevalence of Chronic Diseases in the U.S. Increases the Volume of Healthcare Claims Boosting the Healthcare Payer Services Market Growth. |

| RESTRAINTS | •Stringent Regulatory Scenario in U.S. Hindering Healthcare Payer Services Market Growth. •High Incidence of Data Breaches and Loss of Confidentiality in the U.S. can Limit the Growth of Healthcare Payer Services. |