Asthma and COPD Drugs Market Report Scope & Overview:

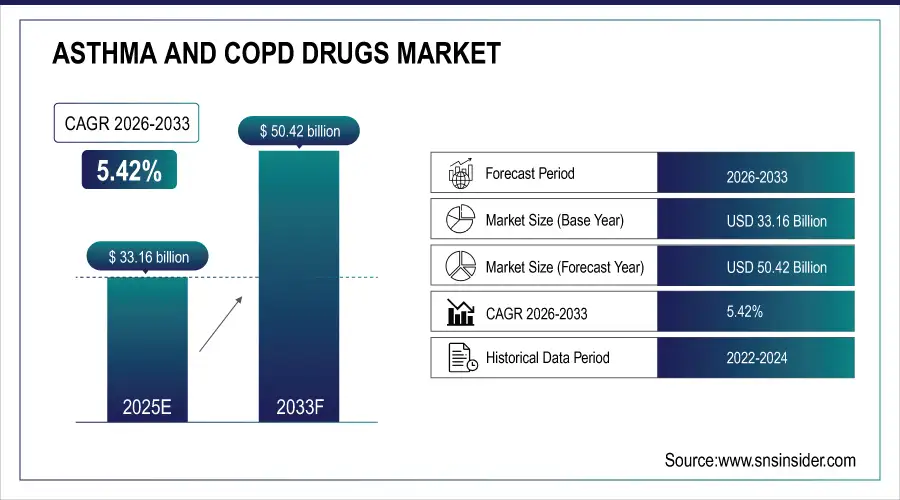

The Asthma and COPD Drugs Market size is valued at USD 33.16 Billion in 2025E and is projected to reach USD 50.42 Billion by 2033, growing at a CAGR of 5.42% during 2026-2033.

The Asthma and COPD Drugs Market analysis highlights the growing prevalence of respiratory diseases and the rising demand for effective long-term treatments. Increasing adoption of inhaled corticosteroids and biologics is driving significant market expansion.

COPD is the third-leading cause of death worldwide (WHO 2024), responsible for over 3.2 million deaths annually, intensifying the need for long-acting bronchodilators and combination inhalers.

Market Size and Forecast:

-

Market Size in 2025E: USD 33.16 Billion

-

Market Size by 2033: USD 50.42 Billion

-

CAGR: 5.42% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Asthma and COPD Drugs Market - Request Free Sample Report

Asthma and COPD Drugs Market Trends

-

Rising demand for combination inhalers integrating corticosteroids and bronchodilators to improve patient adherence and therapeutic efficiency.

-

Increasing adoption of biologics targeting specific inflammatory pathways in severe asthma and advanced COPD management.

-

Growth in digital and smart inhalers offering real-time monitoring and improved patient compliance with treatment regimens.

-

Expanding R&D investment in next-generation therapies focusing on personalized and precision medicine for respiratory conditions.

-

Surge in prevalence of asthma and COPD due to urban pollution, aging population, and smoking-related health issues.

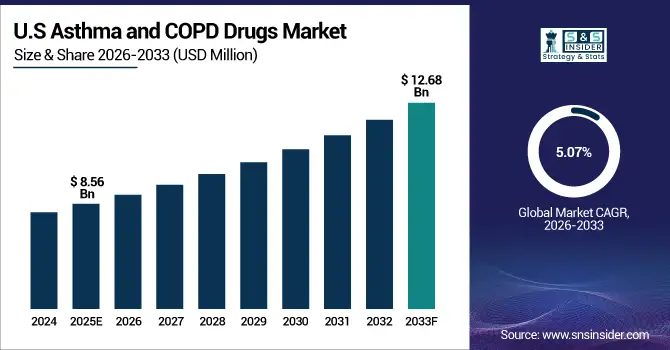

The U.S. Asthma and COPD Drugs Market size is valued at USD 8.56 Billion in 2025E and is projected to reach USD 12.68 Billion by 2033, growing at a CAGR of 5.07% during 2026-2033. Asthma and COPD Drugs Market growth is driven by rising respiratory disease prevalence and increasing biologics adoption. Growing demand for combination inhalers and smart inhalation devices enhances patient outcomes.

Asthma and COPD Drugs Market Growth Drivers:

-

Rising Prevalence of Respiratory Disorders and Growing Adoption of Combination Therapies

The increasing global incidence of asthma and chronic obstructive pulmonary disease (COPD), driven by pollution, smoking, and aging populations, fuels market growth. Patients and healthcare providers increasingly prefer combination inhalers for convenience and improved efficacy. The shift toward maintenance therapies, along with greater disease awareness and early diagnosis, supports consistent drug demand across developed and emerging markets, strengthening pharmaceutical innovation and treatment accessibility.

In 2025, asthma and COPD affect over 600 million people worldwide, with COPD alone causing 3.2 million annual deaths (WHO, GOLD 2024).

Asthma and COPD Drugs Market Restraints:

-

Patent Expirations and High Cost of Biologic Therapies Limiting Market Accessibility

The expiration of patents for major branded respiratory drugs has led to generic competition, reducing revenues for key players. Additionally, biologic therapies, though highly effective, remain expensive and inaccessible to a large segment of patients, particularly in low-income regions. Limited insurance coverage, complex regulatory approvals, and lengthy clinical trials further delay market entry of innovative products, restraining the pace of overall market expansion and patient adoption globally.

Asthma and COPD Drugs Market Opportunities:

-

Advancements in Smart Inhalation Devices and Biologic-Based Respiratory Treatments

Technological progress in digital inhalers with dose-tracking and adherence monitoring features opens new growth avenues for pharmaceutical companies. Biologic therapies targeting specific inflammatory pathways provide personalized treatment options, improving efficacy for severe asthma and COPD patients. Expanding healthcare infrastructure in emerging economies and supportive regulatory frameworks also encourage global adoption, positioning innovation-led companies for significant market expansion.

In 2025, over 40% of new inhaler prescriptions in the U.S. and EU included digital adherence features, with connected devices shown to improve medication compliance by 30–50%

Asthma and COPD Drugs Market Segment Analysis

-

By Drug Type, bronchodilators accounted for the largest share of 44.80% in 2025, while combined therapies emerged as the fastest-growing segment, registering a CAGR of 10.60%.

-

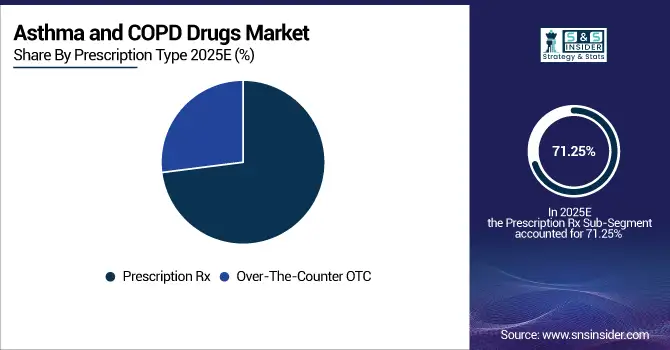

By Prescription Type, prescription (Rx) drugs dominated the market with a 71.25% share in 2025, whereas over-the-counter (OTC) drugs exhibited the fastest growth at a CAGR of 9.20%.

-

By Disease Type, COPD led the market with a 58.40% share in 2025, while asthma showed the highest growth potential, expanding at a CAGR of 8.90%.

-

By Distribution Channel, retail pharmacies held the leading share of 48.75% in 2025, with online pharmacies witnessing the fastest growth at a CAGR of 11.10%.

By Prescription Type, Prescription Rx Dominate While Over-The-Counter OTC Shows Rapid Growth

Prescription Rx segment dominates the market owing to the chronic nature of the diseases and the need for continuous physician monitoring. Most advanced therapies, including biologics and combination inhalers, require prescriptions. However, the Over-The-Counter OTC segment is growing rapidly as patients seek quick, accessible relief for mild respiratory symptoms. Increasing awareness, self-medication trends, and availability of effective OTC bronchodilators and antihistamines are further propelling growth in this segment across developed and emerging markets.

By Drug Type, Bronchodilators Leads Market While Combined Therapies Registers Fastest Growth

Bronchodilators hold the largest share in the Asthma and COPD Drugs Market due to their widespread use in relieving airway obstruction and improving breathing efficiency. These drugs remain the primary treatment for immediate symptom relief in both diseases. However, combined therapies, which integrate bronchodilators and corticosteroids, are witnessing the fastest growth, driven by enhanced efficacy, long-term management benefits, and rising adoption of single-inhaler combinations for improved patient compliance and treatment outcomes.

By Disease Type, COPD Lead While Asthma Registers Fastest Growth

Chronic Obstructive Pulmonary Disease (COPD) accounts for the dominant market share due to its higher global prevalence, especially among aging and smoking populations. Growing air pollution and occupational exposure further fuel its treatment demand. Meanwhile, asthma is projected to record the fastest growth rate, driven by increasing cases among children and young adults, improved diagnostic practices, and growing access to advanced inhalation therapies, particularly in developing regions with rising respiratory health awareness.

By Distribution Channel, Retail Pharmacies Lead While Online Pharmacies Grow Fastest

Retail pharmacies dominate the Asthma and COPD Drugs Market as the primary point of sale for both prescription and OTC drugs, providing convenience and immediate availability. Their strong presence across urban and rural regions supports consistent access to respiratory medications. While, online pharmacies are growing at the fastest pace, driven by increasing digitalization, telemedicine adoption, and home-delivery preferences. The trend is further accelerated by e-commerce expansion and supportive regulatory measures encouraging online prescription fulfillment.

Asthma and COPD Drugs Market Regional Analysis:

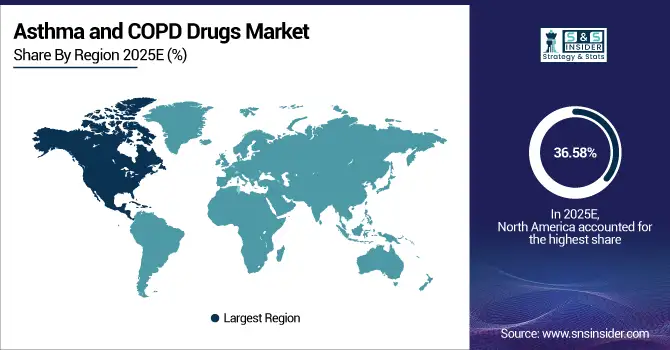

North America Asthma and COPD Drugs Market Insights

In 2025 North America dominated the Asthma and COPD Drugs Market and accounted for 36.58% of revenue share, this leadership is due to high disease prevalence, advanced healthcare systems, and strong presence of key pharmaceutical players. The region benefits from widespread use of biologics, digital inhalers, and combination therapies. Favorable reimbursement structures and growing emphasis on early diagnosis support continued adoption. Ongoing clinical research and FDA approvals for innovative respiratory treatments further strengthen market growth, particularly in the U.S. and Canada.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Asthma and COPD Drugs Market Insights

The U.S. leads the Asthma and COPD Drugs Market globally, driven by high patient awareness, robust healthcare infrastructure, and strong R&D activities. Increasing use of biologics and smart inhalers for personalized treatment is a key trend. The presence of major companies like GSK, AstraZeneca, and Pfizer fuels innovation.

Asia-pacific Asthma and COPD Drugs Market Insights

Asia-pacific is expected to witness the fastest growth in the Asthma and COPD Drugs Market over 2026-2033, with a projected CAGR of 5.96% due to increasing pollution levels, smoking rates, and urbanization. Rising healthcare awareness and improving access to advanced inhalation therapies are boosting adoption. Governments across India, Japan, and South Korea are enhancing respiratory healthcare programs. The region’s expanding elderly population further drives chronic respiratory disease treatment demand, supported by growing pharmaceutical investments and generic drug production capabilities.

India Asthma and COPD Drugs Market Insights

The India Asthma and COPD Drugs Market is witnessing significant growth due to rising air pollution, smoking prevalence, and increasing urbanization. Growing awareness about respiratory diseases and better access to healthcare facilities are driving medication adoption. The market is further supported by the availability of affordable generics and locally manufactured inhalation therapies.

Europe Asthma and COPD Drugs Market Insights

In 2025, Europe emerged as a promising region in the Asthma and COPD Drugs Market, due to advanced healthcare systems and increasing adoption of combination and biologic therapies. Rising pollution and aging populations are major contributing factors. Countries such as the U.K., France, and Italy show high drug uptake. Regulatory support for biosimilars, ongoing clinical studies, and strategic collaborations among pharma firms enhance growth, while cost-containment policies promote affordable treatment availability across the region.

Germany Asthma and COPD Drugs Market Insights

Germany holds a leading position within Europe’s Asthma and COPD Drugs Market due to its strong pharmaceutical sector and extensive healthcare access. The country has a high adoption rate for inhalation therapies and biologics. Continuous investments in R&D, patient-centered care initiatives, and environmental policies addressing air quality drive growth.

Latin America (LATAM) and Middle East & Africa (MEA) Asthma and COPD Drugs Market Insights

The Asthma and COPD Drugs Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the growing respiratory disease burden and improving healthcare accessibility. Urbanization, smoking habits, and environmental challenges are major contributors to disease incidence. Increasing government investments in healthcare infrastructure, rising awareness campaigns, and availability of cost-effective generic drugs are boosting market growth.

Asthma and COPD Drugs Market Competitive Landscape:

AstraZeneca PLC is a global leader in respiratory medicines, offering innovative therapies for asthma and COPD. Its portfolio includes biologics and inhalation treatments like Symbicort and Fasenra. The company emphasizes precision medicine, investing heavily in research to develop next-generation respiratory treatments and improve patient outcomes worldwide.

-

In March 2024, AstraZeneca partnered with Mankind Pharma in India to expand access to its inhaled corticosteroid-LABA combination therapy, improving asthma treatment availability and patient reach nationwide.

Boehringer Ingelheim GmbH specializes in respiratory therapies, focusing on long-acting bronchodilators and combination inhalers for asthma and COPD. Its key products, including Spiriva and Ofev, are globally recognized. The company continues investing in R&D to advance digital respiratory management and personalized treatment approaches for chronic lung conditions.

-

In March 2024, Boehringer Ingelheim launched an out-of-pocket cap initiative, limiting inhaler costs to $35 monthly for eligible asthma and COPD patients, improving affordability and treatment adherence across the U.S.

GlaxoSmithKline PLC (GSK) is a major player in the asthma and COPD drug market, known for its blockbuster inhalers like Advair and Trelegy Ellipta. The company integrates digital inhalation technology, improving adherence and patient monitoring, while expanding its biologics pipeline for severe asthma management.

-

In March 2025, GSK received FDA acceptance for Depemokimab, a biologic targeting severe asthma and chronic rhinosinusitis, marking significant advancement in GSK’s respiratory care innovation pipeline. The approval reinforces GSK’s leadership in biologics and highlights its ongoing focus on precision therapies for chronic respiratory conditions

Novartis AG provides a strong respiratory portfolio, featuring therapies such as Ultibro Breezhaler and Enerzair Breezhaler for asthma and COPD. The company focuses on innovative inhalation technologies, patient-centric solutions, and strategic collaborations to enhance treatment efficacy and expand its presence in global respiratory drug markets.

-

In July 2025, Novartis secured European Commission approval for Enerzair Breezhaler, a smart inhaler therapy with digital companion, designed for adults with uncontrolled asthma, strengthening its connected respiratory solutions.

Asthma and COPD Drugs Market Key Players:

Some of the Asthma and COPD Drugs Market Companies are:

-

AstraZeneca PLC

-

Boehringer Ingelheim GmbH

-

GlaxoSmithKline PLC

-

Novartis AG

-

F. Hoffmann-La Roche Ltd

-

Pfizer Inc.

-

Sanofi SA

-

Merck & Co. Inc.

-

Teva Pharmaceutical Industries Ltd

-

Chiesi Farmaceutici SpA

-

Azurity Pharmaceuticals Inc.

-

Grifols SA

-

Viatris Inc.

-

Cipla Ltd

-

Orion Corporation

-

Regeneron Pharmaceuticals Inc.

-

Amgen Inc.

-

Sun Pharmaceutical Industries Limited

-

Theravance Biopharma Inc.

-

Verona Pharma PLC

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 33.16 Billion |

| Market Size by 2033 | USD 50.42 Billion |

| CAGR | CAGR of 5.42% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Type (Bronchodilators, Anti-Inflammatories, and Combined Therapies) • By Prescription Type (Prescription Rx and Over-The-Counter OTC) • By Disease Type (Asthma and COPD) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AstraZeneca PLC, Boehringer Ingelheim GmbH, GlaxoSmithKline PLC, Novartis AG, F. Hoffmann-La Roche Ltd, Pfizer Inc., Sanofi SA, Merck & Co., Inc., Teva Pharmaceutical Industries Ltd, Chiesi Farmaceutici SpA, Azurity Pharmaceuticals, Inc., Grifols SA, Viatris Inc., Cipla Ltd, Orion Corporation, Regeneron Pharmaceuticals Inc., Amgen Inc., Sun Pharmaceutical Industries Limited, Theravance Biopharma Inc., Verona Pharma PLC |