Retinal Biologics Market Size Analysis:

The Retinal Biologics Market size was valued at USD 22.5 Billion in 2023 and is expected to reach USD 49.5 Billion by 2032 and grow at a CAGR of 9.2% over the forecast period 2024-2032.

Get More Information on Retinal Biologics Market - Request Sample Report

The increasing prevalence of retinal diseases is among the most important factors fuelling the need for potent biological treatments. In specific, age-related macular degeneration, diabetic retinopathy, and retinal vein occlusion are increasing due to the global aging process and a higher number of people living with diabetes. The World Health Organization maintains that the number of individuals aged 65 and older is likely to double by 2050, reaching more than 1.5 billion people. As a consequence, the incidence of AMD is also rising because the disease is estimated to affect around 8.7% of the population aged 50 and older. This may increase the demand for retinal biologics market.

Accordingly, diabetic retinopathy, which affects approximately 35% of the population living with diabetes, is becoming a highly prevalent condition. The rising needs are currently being addressed with the help of advanced biological treatments, such as the new class of anti-VEGF medications and gene and cell-based therapies that are entering the market. The increased accessibility of such products is likely to fuel market growth, further increasing the need for novel therapies for the growing population.

There have been significant advances in the sphere of biologic therapies for the treatment of retinal diseases. New treatment options have changed the existing landscape, provided better results for the patients, and expanded the possibilities for care. For example, newer anti-VEGF molecular agents, such as aflibercept and brolucizumab, help achieve better control of conditions like AMD or diabetic retinopathy. Compared to their predecessors, these agents are more effective in treating retinal edema and improving visual acuity.

Additionally, there are ongoing advances in applied therapies, including novel targeted approaches and options for gene or cell manipulation that have the potential to become highly beneficial. RGX-314, for example, is a promising gene therapy candidate that could reduce the need for frequent injections by establishing sustained production of the necessary protein. I believe that these innovational opportunities are beneficial both in terms of the quality of care and the treatment effectiveness.

In 2024, Regeneron received FDA approval for EYLEA (aflibercept) 8 mg, a higher dose of its flagship anti-VEGF therapy. This extended dosing interval option is designed to improve patient adherence and reduce the burden of frequent injections.

Retinal Biologics Market Dynamics

Drivers

- Growing awareness and screening programs driving the market's growth.

There is growing awareness of retinal diseases and comprehensive screening programs which are being conducted at regular intervals. Early detection and intervention are key factors that influence the demand for efficient retinal biologics. Public awareness and training programs conducted by hospitals and government health organizations highlight the need for regular eye examinations. With the detection of retinal disorders and degenerations in the early stages of development, individuals may be benefited by the timely intervention provided by clinics and treatment organizations. Therefore, it is reasonable to assume that public awareness and regular screening programs help spot retinal diseases responsible for affecting vision and promote the demand further. Early intervention programs also offset the progress of retinal disorders and prevent the occurrence of diseases such as diabetic retinopathy and age-related macular degeneration from taking place.

In 2024, the U.S. Food and Drug Administration will have approved Regeneron Pharmaceuticals’ EYLEA and Novartis’ Beovu as the new-generation anti-VEGF therapy. These retinal therapeutics differ from previous treatments in that they are more effective and have longer dosing intervals. The initiative to adopt the new-generation drugs became a timely response to the issue of patients’ needs because these eye drops are in high demand.

Additionally, the government-supported NEI campaigns to raise awareness and the funding of retinal research should contribute to the availability of biologic medications. These developments collectively enhance the demand for retinal biologics by fostering early diagnosis and ensuring more patients have access to advanced therapies.

Restrain

- Limited awareness and diagnostic capabilities hamper market growth.

Limited awareness and diagnostic capabilities are significant restraints in the retinal biologics market. Many regions, particularly those with less developed healthcare infrastructures, suffer from a lack of awareness about retinal diseases and their potential impact on vision health. This limited awareness often translates into delayed diagnosis, as individuals may not seek medical attention until the disease has progressed to an advanced stage. Furthermore, diagnostic capabilities in some areas may be inadequate, with insufficient access to advanced imaging technologies and specialized diagnostic tools.

Retinal Biologics Market Segmentation Analysis

By Drug Class

VEGF-A antagonists held the largest revenue share of 65.1% in 2023. Antagonists of vascular endothelial growth factor A (VEGF-A) are a group of drugs commonly used for the treatment of a broad range of retinal diseases, including, but not limited to age-related macular degeneration and diabetic retinopathy. Among them, ranibizumab and aflibercept are the factors currently belonging to the most widespread class of agents used, as they have been shown to work effectively in inhibiting VEGF-A, a protein responsible for the growth of the blood vessels inside the retina and their subsequent leakage. Both of the aforementioned factors have been extensively tested both in regards to their efficiency in reducing the level of edema within the retina and their effectiveness in improving the visual acuity in patients involved in the test. As a result, they have been adopted quite widely within the clinical practice, and their market has seen a substantial amount of growth.

By Indication

The macular degeneration held the largest revenue share of 35.1% in 2023. This is owing to the increasing launches of drugs for this condition and the rising prevalence of macular degeneration all over the world. For example, the research published by the National Library of Medicine in September 2022, reveals that by the year 2040, about 300 million people will be diagnosed with Age-related macular degeneration worldwide.

Moreover, VEGF-A antagonists have achieved significant market penetration, supported by favorable reimbursement policies in many regions. Their success has been bolstered by the strong clinical evidence backing their use, which has led to greater acceptance by healthcare providers and patients.

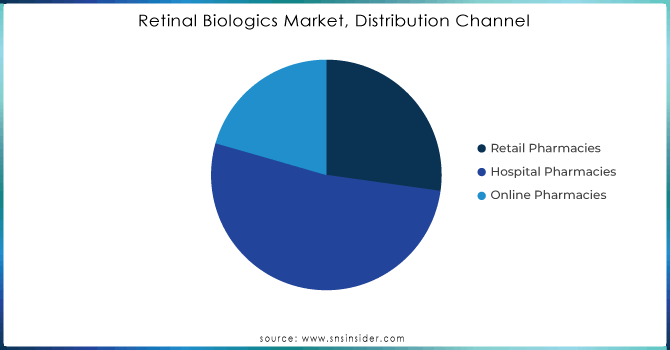

By Distribution Channel

Hospital Pharmacies dominated the market, with the highest share of 52.23% in 2023. This dominance is primarily due to the specialized nature of retinal biologics and the complex administration they often require. Retinal biologics, such as VEGF-A antagonists, are typically administered through intravitreal injections, a procedure that necessitates precise handling and administration by healthcare professionals. Hospital pharmacies are well-equipped to provide these specialized services, ensuring that patients receive the appropriate dosing and monitoring required for effective treatment.

Additionally, hospital pharmacies are often closely integrated with ophthalmology departments, which facilitates seamless patient management and treatment continuity. The availability of advanced diagnostic and treatment facilities within hospitals supports the use of these biologics, making hospital pharmacies the preferred channel for their distribution.

Need any customization research on Retinal Biologics Market - Enquiry Now

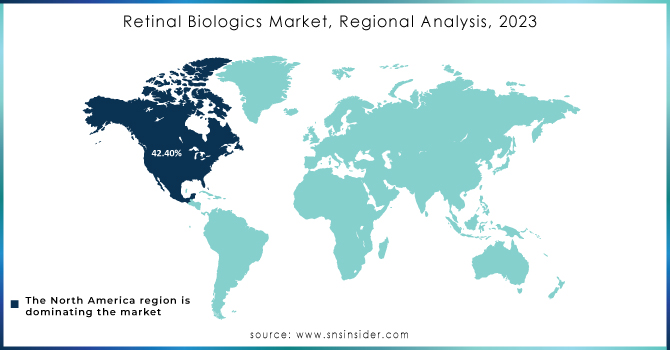

Regional Insights

North America held the largest share around 42.40% in 2023. The market in the region is projected to be further boosted by the presence of a number of the major players. In addition to this, the leading players present in the region are implementing strategies such as acquisitions, product launches, and partnerships, to reinforce their position in the region. For example, in June 2020, Novoatris revealed that the U.S. FDA approved a label update for Beovu. The update includes the addition of a sub-section that is reserved for retinal vasculitis or retinal vascular occlusion under ‘Warnings and Precautions. The FDA also stated that information on post-marketing cases of retinal vasculitis or retinal vascular occlusion has been added to the Adverse Reactions section. In addition to this, in September 2021, the U.S. FDA approved the first biosimilar, Byooviz positive for macular disease.

Retinal Biologics Market Key Players

-

Regeneron Pharmaceuticals, Inc. (EYLEA, Dupixent)

-

Novartis International AG (Lucentis, Beovu)

-

Roche Holding AG (Avastin, Susvimo)

-

Bausch + Lomb (Visudyne, Lumevoq)

-

Allergan plc (Ozurdex, Iluvien)

-

Pfizer Inc. (Ilaris, Xeljanz)

-

Boehringer Ingelheim (Vargatef, Ofev)

-

AbbVie Inc. (Humira, Rinvoq)

-

Sanofi S.A. (Lantus, Dupixent)

-

Bristol-Myers Squibb Company (Opdivo, Yervoy)

-

Johnson & Johnson (Stelara, Tremfya)

-

Amgen Inc. (Erenumab, Enbrel)

-

Eli Lilly and Company (Taltz, Cyramza)

-

AstraZeneca plc (Farxiga, Tagrisso)

-

Mylan N.V. (EpiPen, Xyrem)

-

Gilead Sciences, Inc. (Biktarvy, Veklury)

-

Merck & Co., Inc. (Keytruda, Januvia)

-

Teva Pharmaceutical Industries Ltd. (Ajovy, Copaxone)

-

Santen Pharmaceutical Co., Ltd. (Ikervis, Yasmin)

-

Shionogi & Co., Ltd. (Cresemba, Factive)

-

Others

Recent Developments in the Retinal Biologics Market:

-

In 2024, Avita Pharmacy announced a strategic collaboration with a leading research institution to develop cutting-edge compounding techniques. This partnership is focused on advancing research in personalized medicine and creating new compounded formulations that offer distinct advantages over standard pharmaceutical products.

-

In 2023, Medisca rolled out a series of new patient-centric formulations designed to cater to specific needs not addressed by standard pharmaceuticals. This included the development of innovative dosage forms and flavors to enhance patient compliance.

| Report Attributes | Details |

| Market Size in 2023 | US$ 22.5 Billion |

| Market Size by 2032 | US$ 49.5 Billion |

| CAGR | CAGR of 9.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (TNF-a Inhibitor, VEGF-A Antagonist) • By Indication (Macular Degeneration, Diabetic Retinopathy, Uveitis, And Others) • By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, and Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Novartis AG, Regeneron Pharmaceuticals, Inc., Roche Holding AG, Bayer AG, Santen Pharmaceutical Co., Ltd., Kodiak Sciences Inc., Zymeworks Inc., Hapten Pharmaceuticals Inc., Apellis Pharmaceuticals, Inc., Oculis SA, and other players. |

| Key Drivers | •Growing awareness and screening programs driving the market's growth. |

| RESTRAINTS | •Limited awareness and diagnostic capabilities hamper market growth. |