QR Code Payments Market Size & Overview:

Get more information on QR Code Payments Market - Request Free Sample Report

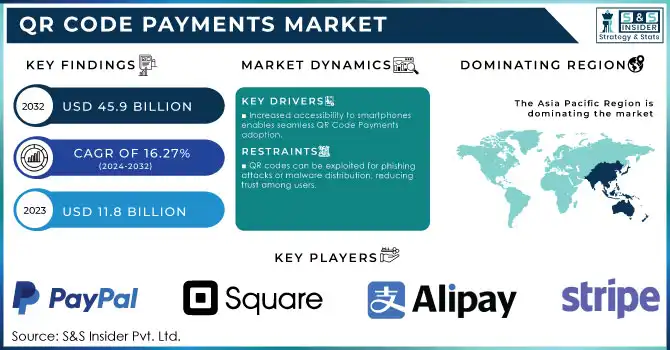

The QR Code Payments Market was valued at USD 11.8 billion in 2023 and is expected to reach USD 45.9 billion by 2032, growing at a CAGR of 16.27% over 2024-2032.

The QR Code Payments Market is rapidly expanding, driven by technological advancements and evolving consumer preferences. QR payments enable users to scan a code with their smartphone to complete secure and fast transactions. Due to its convenience and cost-effectiveness, this technology has seen widespread adoption across industries, including retail, dining, e-commerce, and transportation. the increasing adoption of digital wallets and smartphones as primary drivers for QR Code Payments growth. In 2023, approximately 30% of global in-store transactions utilized mobile payment methods, including QR codes, with projections indicating this figure could reach 42% by 2025. Additionally, over 85% of consumers in China already use QR codes for payments, primarily through platforms like WeChat Pay and Alipay, setting a benchmark for global adoption trends. Smartphone penetration has also facilitated QR code usage, with nearly 80% of digital wallet users in the U.S. preferring mobile payments due to their speed and convenience. Globally, mobile wallets accounted for 50% of online purchases in 2023, and this preference has spilled into physical retail, where businesses are integrating QR codes to reduce transaction friction and enhance customer experience.

A significant factor in the market's growth is the rising adoption of digital wallets and smartphones, which provide a seamless platform for QR code integration. Businesses benefit from reduced transaction costs and the ability to offer customers a convenient payment experience. For example, restaurants use QR codes for digital menus and payment options, streamlining operations and reducing the need for physical interaction. Similarly, retailers and e-commerce platforms employ QR codes for both in-store and remote purchases, enhancing customer engagement and satisfaction. The COVID-19 pandemic played a pivotal role in accelerating the demand for contactless payment solutions, making QR codes a preferred choice for businesses and consumers. Static QR codes, which are easy to generate and implement, are popular among small businesses, while dynamic QR codes offer enhanced security and customization, making them suitable for larger enterprises. These codes are also being used in innovative ways, such as loyalty programs, subscription services, and identity verification processes. Push payments, where consumers initiate the transaction by scanning the code, are particularly favored for their fraud-resistant nature and enhanced security. Pull payments, initiated by merchants for recurring transactions, are also gaining popularity for their seamless user experience.

The continued innovation in QR code technology, such as the development of dynamic devices that integrate with payment systems, is further driving adoption. By offering a simple, secure, and scalable solution, QR codes are transforming the payment landscape, allowing businesses to cater to a tech-savvy, cashless consumer base. This ongoing evolution signals strong future growth potential for the QR Code Payments Market.

Additionally, alternatives to QR codes for payment and data transfer include technologies like Near Field Communication (NFC), Bluetooth Low Energy (BLE), and RFID. NFC enables secure, contactless communication between devices, allowing for mobile payments and data exchange without needing to scan a code. BLE is used for proximity-based applications, providing short-range communication between devices with minimal energy consumption, making it ideal for customer engagement in retail. RFID, often used in inventory and payment systems, operates with tags that can be read without physical contact, offering efficiency in managing assets. These alternatives provide more flexibility and security compared to QR codes, enhancing user experiences in various industries, from finance to retail and logistics.

QR Code Payments Market Dynamics

Drivers

-

Increased accessibility to smartphones enables seamless QR Code Payments adoption.

-

Widespread use of apps like Google Pay and PayPal supports QR integration for faster transactions.

-

Online shopping drives QR code usage for secure and convenient remote payments.

As e-commerce has grown in popularity, there is also a larger demand for payment methods that are secure, efficient, and easy to use. This is where QR codes play a significant role as they allow fast and easy transactions with a simple scan, eliminating entering your complex card details or lengthy procedures. Payment security is still the biggest concern for online shoppers. QR codes resolve these issues; from encrypting transaction data to preventing fraud and unauthorized access. If users can authorize transactions via a scanned code, it helps to ensure that the person transacting has privacy and security, as well as control and knowledge during remote transactions.

Another reason QR Codes are so popular in e-commerce is the convenience factor. QR codes unlike other payment methods do not need some dedicated hardware with them. Instead, they are seamlessly integrated through mobile wallets and apps which allow payments from anywhere through smartphones. This ends up, naturally, reducing the operational costs for businesses while increasing the user experience during checkout, which leads to increased customer satisfaction and retention.

With a tech-savvy consumer base on the rise, global e-commerce giants including Amazon, Alibaba, and Shopify have introduced QR code payments. Apart from promotions, QR codes are extensively used to provide discounts and other incentives for customer adoption at work and also during the purchase. The growth in QR code use for e-commerce and online shopping goes hand in hand with the penetration of smartphones and better internet connectivity, along with rising digital literacy. While businesses are continuously innovating with QR codes to provide more secure and speedy payment solutions, it has become a consistent characteristic found in e-commerce platforms, thus making QR codes relevant to the market and providing solutions to the ever-changing digital economy.

| Year | Increase in QR Code Usage (%) | Key Drivers |

|---|---|---|

| 2019 | 15% | Early adoption in major markets |

| 2020 | 30% | Surge in contactless payments during COVID-19 |

| 2021 | 40% | Expansion of e-commerce and mobile wallet adoption |

| 2022 | 50% | Integration with loyalty programs and promotions |

| 2023 | 60% | Enhanced security features and dynamic QR codes |

| 2024 | 70% | Continued innovation and consumer trust |

Restraints

-

QR codes can be exploited for phishing attacks or malware distribution, reducing trust among users.

-

Reliable internet connectivity is essential, limiting adoption in areas with poor infrastructure.

-

Excessive use of QR codes in marketing and payments can lead to consumer fatigue and decreased engagement.

The growing prevalence of QR codes in marketing and payment systems could lead to consumer burnout, diminishing their engagement and ultimately resulting in reduced adoption rates. Since many businesses have now brought QR codes into their promotions, loyalty programs, and payment methods, customers can easily get overloaded with constant interactions. Too much saturation of this technology can lead to the user being a bit tired of QR codes or even getting bored of scanning them. It is counterintuitive, as consumers may get tired of seeing QR codes in ads, on product packaging, or other types of marketing materials, and as a result, they begin to think that QR code is just another tool to promote something instead of a useful convenience. This over-exposure often causes what is referred to as "QR code fatigue," and the excitement rapidly dissipates, leaving users feeling like they're not useful anymore or desirable.

Futher, businesses that rely too much on QR codes can under-deliver on incentives or in as much that QR code scanning is not an experience in itself, but a means to an end. If these codes do not immediately offer something tangible—for example, special promotions, interactive content, or a customized experience—there may be little motivation for consumers to scan them, and scan rates could plummet, resulting in further dampened interest in QR payment systems.

This increasingly common trend spells trouble for QR code payments, which thrive only when consumers maintain high engagement levels. Also, businesses have to deploy QR codes judiciously for people to continue using them, and not enough for them to be oversaturated. Adding value in terms of rewards, promotions or smoother payment processes will keep consumers engaged ahead of fatigue and drive repeat usage without exhausting consumers.

QR Code Payments Market Segment Analysis

By offerings

In 2023, the solution segment dominated the market and represented revenue with more than 69.75% share in the market, dominating the larger market. QR Code Payments systems can often also be customized to fit specific requirements, such as integration with the current POS systems or online stores. The high level of flexibility and customizability has made solution-based offers highly attractive to small and mid-size enterprises who are looking for a payment solution that would follow them in their development. Additionally, they enable businesses to offer a payment experience customers desire helping businesses to drive sales & revenues.

The services segment is expected to register the highest CAGR during the forecast period. Professional and managed services fall under the services segment. The complexity of a QR Code Payments system requires specialized knowledge and expertise that is not available within most businesses. This compels them to outsource their QR Code Payments systems designing, implementation, and management to professional and managed service providers. Such services can include consulting, design, implementation, and customization, integration with other larger enterprise systems, testing, maintenance, and support. Further, an uptick in consumer and business adoption of QR Code Payments is creating demand for professional and managed services.

By Solution

In 2022, the dynamic QR code segment held the largest market share, over 66.00% in revenue generation. As Dynamic QR codes are generated at the moment the QR code can have variable data depending on the transaction. This flexibility enables companies to personalize payment experiences like providing discounts or promotional offers based on purchase history, or customer data of any form and dimension. Moreover, dynamic QR codes are more secure than static QR codes, as they may be protected with distinct transactional data and also prevent any type of deceitful activity from taking place. Security therefore has popularised the use of dynamic QR codes in business, especially in high-risk markets like e-commerce and finance.

Among QR code types, the static QR code segment is anticipated to grow at the highest CAGR over the forecast period. This segment has grown due to its simplicity, low cost, and ease of implementation. Since static QR codes can be created in seconds without the need for additional hardware or software, they represent a low-cost solution for small and medium-sized businesses.

In addition, static QR codes have simple implementations, as they may fulfil a wide range of purposes, such as being printed on receipts, displayed on different screens, etc. Static QR codes can be used for transactions from small retail purchases to bill payments, etc., which is why it is widely accepted in the diverse nature of businesses.

Payment Type

The push payment segment held the largest share of over 59.60% in revenue in 2023. In the case of push payments, it is the customer who initiates the transaction by scanning the QR code and approving the payment that gets pushed from his account to the merchant account.

As a result, the customer has total control over each transaction; and must approve each payment explicitly, limiting the possibility of fraudulent transactions or non-authorized charges at all. Moreover, push payments are frequently employed in one-off purchases like in-store retail purchases or online shopping, making this segment even less vulnerable to fraud and bolstering its growth prospects.

Pull payments are expected to grow significantly during the forecast period. With pull payments, merchants generate a QR code and show it to the customer who scans and approves the payment, pulling it from his account to the merchant account. This means the customer does not have to initiate every transaction and thus pull payments tend to be a popular significant solution for recurring payments, such as subscriptions or bill payments. In addition, pull payments allow customers a more native payment solution – faster transactions. In addition, pull payments can also help companies save money, especially those that process many repeat payments.

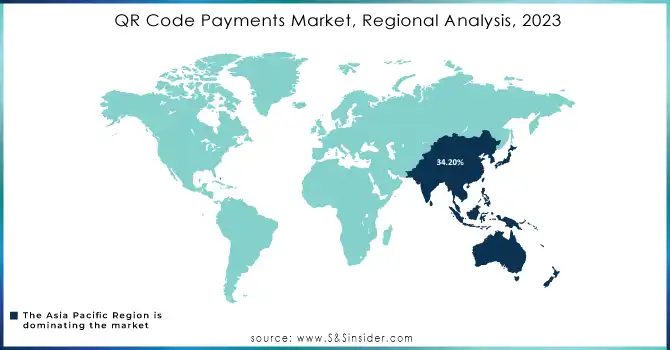

QR Code Payments Market Regional Analysis

The QR code payments market had the largest share for Asia Pacific in 2023 with a revenue share of more than 34.20%. This growth in the region can be due to multiple reasons—a rising and huge population, smartphone penetration, and a large unbanked population. The region encompasses a range of economies, with developed nations like Japan, Singapore, and South Korea, as well as emerging markets including India, Indonesia, and Vietnam. In several such markets, QR code payments turned out to be widely embraced as a convenient and common payment method among the youth and tech-friendly customers who prefer speed, convenience, and security when carrying out any payment transaction.

The North American regional market is estimated to register the highest growth rate over the forecast period. Key factors behind the growth of the region include high penetration of smartphones, increasing acceptance of digital payments, and well-organized financial infrastructure. North America, having a more developed and mature economy and a huge wealthy, convenience-oriented consumer class is most profitable for expedient payment. In response, the rising popularity of mobile payments and digital wallets in the region has also accelerated QR Code Payments use, with prominent players—including PayPal, Square, and Venmo—driving QR Code Payments offerings. In addition, the region has a competitive retail sector that has adopted QR code payments to provide customers with a quick and convenient payment experience.

Need any customization research on QR Code Payments Market - Enquiry Now

Key Players

The major key players along with one product are

-

PayPal - PayPal QR Code Payments Service

-

Square (Block Inc.) - Square Point of Sale (POS)

-

Alipay - Alipay QR Code Payments System

-

WeChat Pay - WeChat Pay QR Codes

-

Stripe - Stripe Terminal with QR Code Payments

-

Google Pay - Google Pay QR Code Payments Feature

-

Samsung Pay - Samsung Pay with QR Code Support

-

Venmo - Venmo QR Code Payment

-

MasterCard - MasterCard QR Code Payments Solutions

-

Visa - Visa QR Code Payments Acceptance

-

Shopify - Shopify Payments with QR Code Integration

-

Amazon Pay - Amazon Pay QR Code Payments

-

Zell - Zell QR Code Payments System

-

FIS Global - FIS QR Code Payments

-

Ayden - Ayden QR Code Payments Solutions

-

Karma - Karma QR Code Payments Integration

-

Pat - Pat QR Code Payments Service

-

Razor pay - Razor pay QR Code Payments Gateway

-

World pay - World pay QR Code Payments

-

Pine Labs - Pine Labs QR Code Payments Solution

Recent Developments in the QR Code Payments Market

-

PayPal is pushing forward with QR code enhancements in its mobile payment system. In March 2024, PayPal unveiled updates to its QR code technology, offering new functionalities for businesses to accept payments directly via QR codes, while also integrating loyalty programs and exclusive offers for customers who pay using this method.

-

In April 2024, Alipay expanded its smart payment services, introducing a unique QR code feature designed for international tourists. The new service offers easy, real-time currency conversion and discounted rates when tourists pay using QR codes at partner businesses globally.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.8 Bn |

| Market Size by 2032 | US$ 45.9 Bn |

| CAGR | CAGR of 16.27% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offerings (Solution, Services) • By Solution (Static QR code, Dynamic QR code) • By Payment Type (Push Payment, Pull Payment) • By Transaction Channel (Face-to-Face, Remote) • By End-user (Restaurant, Retail & E-commerce, E-ticket Booking, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PayPal, Square (Block Inc.), Alipay, WeChat Pay, Stripe, Google Pay, Samsung Pay, Venmo, MasterCard, Visa, Shopify, Amazon Pay, Zell |

| Key Drivers | • Increased accessibility to smartphones enables seamless QR Code Payments adoption. • Widespread use of apps like Google Pay and PayPal supports QR integration for faster transactions. • Online shopping drives QR code usage for secure and convenient remote payments. |

| Market Restraints | • QR codes can be exploited for phishing attacks or malware distribution, reducing trust among users. • Reliable internet connectivity is essential, limiting adoption in areas with poor infrastructure. • Excessive use of QR codes in marketing and payments can lead to consumer fatigue and decreased engagement. |