Automated Material Handling (AMH) Equipment Market Report Scope & Overview:

To get more information on Automated Material Handling (AMH) Equipment Market - Request Free Sample Report

The Automated Material Handling (AMH) Equipment Market Size was esteemed at USD 25.88 billion in 2023 and is supposed to arrive at USD 57.94 billion by 2031 and develop at a CAGR of 10.6% over the forecast period 2024-2031.

Automated materials dealing with (AMH) alludes to any mechanization that lessens or kills the requirement for people to register, look at, sort material, or move sacks and receptacles containing library material.

Automated materials dealing with (AMH) alludes to any mechanization that lessens or kills the requirement for people to register, look at, sort material, or move sacks and receptacles containing library material. The mechanical hardware utilized in AMH frameworks remembers check-for machines, sorters, transports, singulation, stackers and unstacks, totes, receptacles, streetcars, and sack transporters. Some place in the process there should be a scanner to peruse the standardized identification or a per-user to peruse the RFID tag. Various belts, pulleys, chutes, slides, and laser radiates are utilized to guarantee receptacles don't spill over and to get everything focused accurately and pushed or conveyed into the right sack or container. Automated machines are in some cases lumped into the AMH classification since they remove the look-at from the hands of staff.

Since the manufacturing sector in United States is huge, there is a huge demand for the Automated Material Handling (AMH) Equipment in the region. U.S. manufacturers contribute over 10.7% of the country's total output, employing 8.41% of the workforce. Also, the For U.S. belt manufacturers, easy cleaning and hygiene have become top priorities. For instance, the FDA Food Safety Modernization Act (FSMA) changes food companies by placing emphasis on preventing foodborne illness and foreign material contamination instead of just responding to them. This in return will create demand for the Automated Material Handling equipment’s within the region.

Automated material dealing with hardware play taken a critical part in various assembling enterprises all through the globe. Enterprises are persistently stressing their all under one rooftop strategy while improving the creation limit. This material taking care of hardware is great for dissemination, and capacity, squander dealing with.

Automated material dealing with gear will be utilized for the handling, directing, getting, and movement of items. These instruments are exceptionally simple to be utilized all through the creation, utilization, and capacity strategy. Mechanized material dealing with gear works on the technique and is utilized in contemporary day areas.

On July 2, 2024: A notable rise in the windfall tax on domestically extracted crude oil was declared by the Indian government, elevating it from Rs 3,250 per metric ton to Rs 6,000.

Windfall tax hike: A multi-faceted blow to the automated material handling (AMH) equipment market on the day an increase in tax is affected, it benefits crude oil and they start to require a higher amount of fuel due to its increased costs. This, leads to increased transportation and logistics costs (core functionality of material handling operations). Most companies, compelled by increasing operational expenses are increasingly focused on turning to automated solutions that can neutralize these costs. As firms struggle to maintain margins in the face of escalating fuel prices, automation such as that provided by material handling equipment gains appeal for driving efficiencies and reducing reliance on labor.

Market Dynamics

Drivers

Rising Labor Costs and Safety Concerns AMH equipment mitigates physical strain and injury risks of manual handling, cutting labor expenses.

Rising labor costs manual material handling creates significant hazards such as physical stress and injury, the cost of which is borne through healthcare expenses and productivity loss. This problem is easily rectified with Automated Material Handling (AMH) equipment, thus reducing the dependency on manpower. By executing heavy manual lifting, carrying and moving of loads without human effort may result to physical hazards like back injuries Austrian courier go here with other work-related claims in particular sprain injury. Secondly, businesses can cut labor costs further by using fewer heads to handle repetitive tasks and free up resources for other business areas or invest in more automation technologies.

Growth of E-commerce and Omnichannel Retailing AMH systems enhance warehouse speed and efficiency to meet rising demands for quick order fulfilment.

E-commerce and Omnichannel Retailing the exceptional growth of e-Commerce, along with the adoption of omni-channel retail models severely exacerbates demand for warehousing capable not only to deal with a very high volume at high speed - but also margins intolerance to errors. In this scenario, AMH systems have a lead role to play in the warehousing landscape assisting warehouse processes. They allow for quicker pick, packing and shipping of orders by employing automated sortation technologies, conveyor systems and robotics. This feature is necessity not only for the speed and efficiency of an online retail but increases customer satisfaction by delivering on time with minimum errors in orders.

Increasing Automation in Manufacturing AMH equipment integrates into manufacturing automation, optimizing material flow and boosting overall productivity.

More automation in manufacturing automation is becoming more and more common for manufacturers due to the impact it can have on production efficiency and output. The AMH equipment can be readily incorporated into automated manufacturing processes for efficient material handling workflows The collaborative integration features automated guided vehicles (AGVs), robotic arms, and conveyor systems that enable an uninterrupted material flow on production lines. AMH systems increase throughput and reduce downtime as well as manual intervention, thereby supporting just-in-time manufacturing. In essence, they help facilities that utilise automation to produce more at a low cost & of improved quality.

Restraints

The high forthright expense for the establishment of the material dealing with hardware.

There are a few reasons why the initial cost of implementing material handling equipment (MHE) can be quite high. This expense encompasses the acquisition of machinery as well as systems that are customized to the nature of a business which can make it extremely variant from business type-to-business type such as in terms of scale and complexity. Installation Costs - Should include costs associated with deploying the equipment, compatible or integrating into existing infrastructure as well installing it in accordance to safety and regulatory requirements. There can be an extra cost to pay when training employees on how to use the new equipment safely and effectively. For companies, especially SMEs that have a budget to comply with these initial expenses could be quite taxing. But really, purchasing MHE is usually a smart move as well because it can provide long-term benefits like higher productivity, lower labor cost or better workplace safety - ultimately turning into strategic investments for many companies aiming to improve their operational efficiency.

High Initial Investment implementing AMH systems requires significant upfront costs, potentially deterring SMEs.

There are large financial penalties that come with the implementation of Automated Material Handling (AMH) systems. Included in these costs is the expense of acquiring and installing equipment, as well as potential infrastructure changes. This is a major expense to any business and especially for SMEs that lack the capital-comprising finance expensive. However, as with any other technology of this sort - it comes at a price and requires enormous upfront financial resources which might force even small enterprises not to implement such tech despite the actions turning into an investment for long-term efficiency output.

Technical Complexity integrating AMH equipment with existing setups is complex, needing specialized expertise and causing operational disruptions.

Integrating AMH equipment with operational setups already in existence constitutes a technically complex work. It is not trivial; it requires expert knowledge in robotics, automation and system integration This complexity gives rise to issues such the downtime during implementation for instance, and due to inactionable workflows or process changes. When we make a transition, businesses will experience some disruptions in the operations since they need to recalibrate their processes around this new technology. This level of complexity is why engineers and technicians need to have the installation under control, getting it up properly so integration will run smooth with almost no interruption.

Return on Investment (ROI) Uncertainty quantifying the ROI of AMH systems upfront is challenging, complicating investment justification for businesses.

The ROI of AMH systems is a little more nuanced. The cost savings, improved efficiency and quality will take time to fully materialize. It is also difficult to predict the modifications in operations and market conditions which affect ROI. This uncertainty - as a rule, one way or another affects company's ability to justify the initial outlay on AMH systems. Although businesses can face challenges in learning to operate their AMH systems effectively, once these are ironed out and the new technology is fully integrated with any necessary process changes that accompany it, many find long-term productive and competitive advantages.

Key Segmentation Analysis

By Product

-

Robot

-

Traditional robot

-

Cobot Palletizer

-

Autonomous Mobile robot

-

Automated Storage and Retrieval Systems (ASRS)

-

Unit Load ASRS

-

Mini Load ASRS

-

Vertical Lift Module (VLM)

-

Carousel

-

Mid Load ASRS

-

Conveyor and Sortation Systems

-

Belt Conveyor

-

Roller Conveyor

-

Overhead Conveyor

-

Screw Conveyor

-

Crane.

-

Automated Guided Vehicle (AGV)

-

Tow Vehicle

-

Unit Load carrier

-

Pallet Truck

-

Assembly Line Vehicle

-

Forklift Truck

-

Other AGVs

-

Warehouse management system (WMS)

-

On Premises

-

Cloud

-

Real Time Location Systems (RLTS)

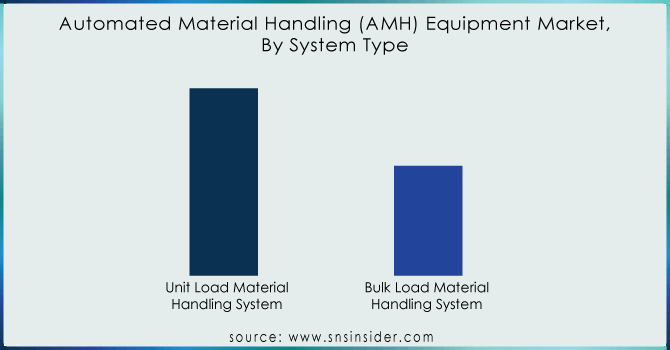

By System Type

-

Unit Load Material Handling System

-

Bulk Load Material Handling System

The unit load material handling in automated material handling equipment is expected to capture the largest market share between 2024-2031 This category includes equipment such as pallets, containers and totes which are used for handling of loads either by individual units or combined loads. Unit load material handling solutions plays a crucial role in optimizing warehouse operations and to capture the benefits of increased storage capacity, lower stocking cost with effective product transit across manufacturing & distribution centers. Examples are diverse and include palletizers, conveyors, automated storage and retrieval systems (ASRS), robotic systems that cater to the needs of many different industries Demand for unit load material handling equipment depends heavily on automation applications as companies seek ways to reduce labor costs in response to rising wages; increase throughput rates using better technology; enhance overall operational efficiency.

Need any customization research on Automated Material Handling (AMH) Equipment Market - Enquiry Now

By Industry

-

Automotive

-

Chemical

-

Aviation

-

Semiconductor & Electronics

-

E-Commerce

-

Food & Beverage

-

Healthcare

-

Metals & Heavy Machinery

-

Third party logistics (3PL)

-

Others

Regional Analysis

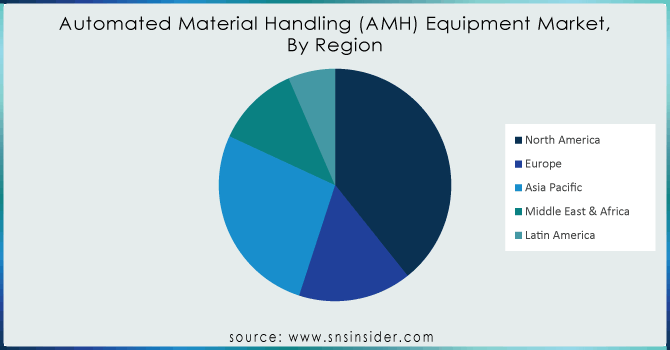

North America utilizes the most of the AMH equipment technology which makes it largest market. The industry is researching and developing to come up with efficiency, flexible intelligent systems in this area hence companies involved are those that exist within these domains.

Asia Pacific holds the largest market share due to the growing demand for AMH solutions in the e-commerce, automotive, and food & beverage industries. Government initiatives supporting infrastructure development are also propelling market growth. The region's rapidly expanding manufacturing sector is a significant contributor to the demand for AMH equipment.

Europe is forecast to register substantial growth, driven by the rising need for automation across manufacturing and warehousing/ logistics. These companies operating in the region are particular about adapting to sustainable practises and new technologies which will increase their operational efficiency.

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players are Daifuku Co. Ltd., Siemens AG, Bosch Rexroth, Murata Machinery Ltd., Swisslog Holding AG, SSI Schaefer AG, Dematic Group S.A.R.L, Toyota Industries Corporation, JBT Corporation, and Bastian Solutions, Inc. and Other.

Recent Development

In March 2024, SSI SCHAEFER introduced a new software solution called LOGIONE dedicated exclusively to independent operation of the SSI LOGIMAT Vertical Lift Module. It is a simple software that offers an easy-to-use storage place and article management system. Intuitive UI makes them simple from an operator standpoint and does not require heavy training.

In March 2024: Rockwell automation's OTTO Motors announced that it was deploying driverless transportation systems for its first-of-its-type manufacturing innovation in autonomous production logistics. By adding the OTTO Motors in to its group, Rockwell Automation expanded it is own internal material-handling competencies - offering a full-stack value proposition of solutions across entire facilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 25.88 Billion |

| Market Size by 2031 | US$ 57.94 Billion |

| CAGR | CAGR of 10.6% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Operation (Assembly, Waste Management, Packaging And Distribution, Storage And Transportation) • By Application (Healthcare, Chemicals, Automotive, Foods And Beverages, Aviation, Electronics, E-Commerce, Semiconductors) • By Software And Services (Warehouse Management System (Wms), Transportation Management System (TMS), Maintenance And Repairs, Training And Software Up-Gradation) • By Automated Equipment (Automated Storage And Retrieval System, Robotics System, Conveyors, Automated Guided Vehicles, Automated Cranes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Daifuku Co. Ltd., Siemens AG, Bosch Rexroth, Murata Machinery Ltd., Swisslog Holding AG, SSI Schaefer AG, Dematic Group S.A.R.L, Toyota Industries Corporation, JBT Corporation, and Bastian Solutions, Inc. |

| Key Drivers | • Rising Labor Costs and Safety Concerns AMH equipment mitigates physical strain and injury risks of manual handling, cutting labor expenses. • Growth of E-commerce and Omnichannel Retailing AMH systems enhance warehouse speed and efficiency to meet rising demands for quick order fulfilment. • Increasing Automation in Manufacturing AMH equipment integrates into manufacturing automation, optimizing material flow and boosting overall productivity. |

| RESTRAINTS | • The high forthright expense for the establishment of the material dealing with hardware. • High Initial Investment implementing AMH systems requires significant upfront costs, potentially deterring SMEs. • Technical Complexity integrating AMH equipment with existing setups is complex, needing specialized expertise and causing operational disruptions. • Return on Investment (ROI) Uncertainty quantifying the ROI of AMH systems upfront is challenging, complicating investment justification for businesses. |