RFID Tags Market Size & Trends:

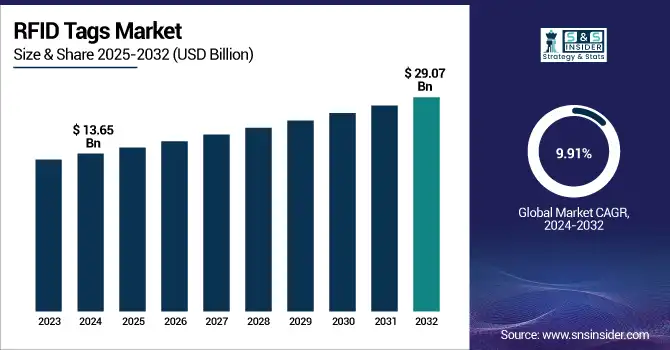

The RFID Tags Market Size was valued at USD 13.65 Billion in 2024 and is expected to grow at a CAGR of 9.91% to reach USD 29.07 Billion by 2032.

The RFID tags market analysis highlights how Radio Frequency Identification Tags are becoming more popular globally due to introduction of new technologies, more sectors using them, and government laws that help them. In 2023, governments all over the world focused on digital transformation. This created new potential for RFID technologies in many fields, including retail, logistics, healthcare, and manufacturing.

Get more information on RFID Tags Market - Request Sample Report

For instance, the U.S. Congress has made it necessary for RFID to be used in the food and pharmaceutical supply chain to improve traceability. In Europe, the goal is to make logistics more efficient, which has led to more widespread use. In Asia-Pacific, plans including "Digital India" of India and "Made in China 2025" in China have actively promoted the RFID technology usage, initially in the e-commerce and manufacturing sectors.

The year 2023 witnessed thin-film flexible RFID tags, especially for wearable device applications, while other advancements included energy-harvesting, passive RFID tags with better data accuracy and networking with IoT systems. In that regard, RFID solutions are still getting more within reach and cost-effective.

In November 2024, Phenix Label has launched a recyclable packaging design for liquid-filled bottles that includes a tear-off radio-frequency identification (RFID) label tab. The label above the fill levels incorporates a RAIN RFID inlay from Tageos within the packaging.

By the year 2024, launches, such as battery-less RFID sensors for industrial environments brought out the concern of the RFID tags market toward sustainability and efficiency. These innovations are transforming operations in industries including automotive, where RFID is increasingly used for smart toll systems and vehicle tracking.

In the European Union, laws on combating counterfeiting and supply chain transparency have speeded up RFID usage in key industries. Similarly, in the U.S., the government has initiatives to enhance traceability in health care and agriculture, thus widening the usage of RFID applications. Even the developing world has accepted RFID as an instrument to enhance the efficiency of public sectors, and for instance, the Southeast Asian countries have developed RFID-based public transport systems.

The agricultural department shall make optimum use of RFID technologies in livestock management and crop monitoring. The retail sector is expected to make a much deeper use of it in inventory and loss prevention. In the healthcare sector, it shall make much more use of RFID for the real-time tracking of equipment and medical supplies. As the world continues to push for automation and digitalization, RFID tags are poised to become an essential part of the industries that want efficiency, accuracy, and cost savings.

RFID Tags Market Dynamics

Key Drivers:

-

RFID Technology Revolutionizes Inventory Management with Enhanced Accuracy and Efficiency

Global industries increasingly rely on RFID tags for real-time inventory tracking, reducing losses by 30%. RFID in supply chain management has transformed the way inventory tracking and operational efficiency are carried out. In retail, RFID technology enabled brands like Walmart to achieve inventory accuracy rates exceeding 95% in 2023, according to research. Governments worldwide have also promoted RFID usage in food and pharmaceutical sectors for traceability, reducing counterfeit risks.

The report by the U.S. National Library of Medicine states that through RFID implementations in pharmaceuticals, recall efficiency increased by 40%. The demand is furthered due to cost-cutting and increased visibility in logistics ecosystems, ensuring proper delivery and optimizing warehouse operations.

-

IoT Integration with RFID Drives Automation and Expands Applications Across Industries

The integration of IoT with RFID fosters automation, enhances the operational efficiency. RFID technology has become an essential part of IoT ecosystems, where it facilitates seamless communication between devices.

Automotive industries use IoT-powered RFID for smart tolling and vehicle tracking. In addition, smart city projects in the Asia-Pacific region use RFID in traffic management and utility monitoring. The synergy between RFID and IoT drives innovation in automation, real-time monitoring, and predictive maintenance and therefore expands its application across various industries.

Restraints:

-

RFID system installation is expensive, thus restraining its application within small-sized companies.

While it has many benefits, the installation of an RFID system is cost-expensive to many firms, especially SMEs. It incurs a cost up to 20% more than that of traditional tracking. According to the International Trade Administration, a 2023 report indicated that small retailers in developing countries are not adopting RFID due to lack of budget. Furthermore, the cost of maintaining and replacing damaged tags increases the costs. This limitation prevents RFID adoption in areas where profit margins are thin, such as small-scale agriculture or low-cost retail. This barrier will be solved through subsidies, cost-sharing programs, or even cheaper solutions between governments and manufacturers for the widespread diffusion of RFID technology.

RFID Tags Market Segmentation Overview:

By Type

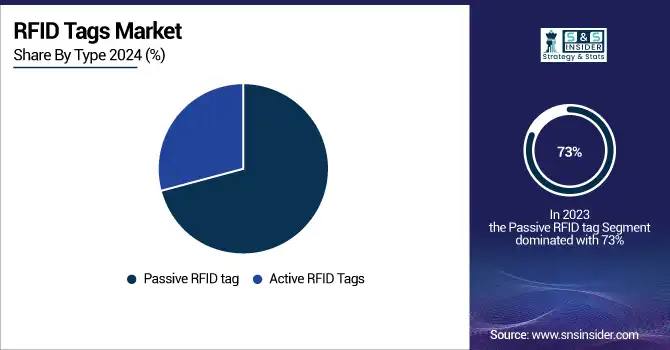

The Passive RFID tag segment held maximum RFID tags market share, which in 2023 reached 73%. This is mainly because it does not require any battery, rather, it absorbs electromagnetic energy from the reader for its working, and it has wide applicability in applications including retail inventory tracking, supply chain management, and library systems, among others, which do not require high-range active tags.

Passive RFID tag segment is expected to witness strong growth with a projected CAGR of 10.05% over 2024–2032 owing to the surging industry demand and emphasis on sustainability. Recent advancements have also made passive RFID tags, which ultimately makes it cost-effective and efficient. For instance, ultra-thin, flexible passive tags were recently introduced in 2023, designed for use in textiles and smart packaging.

By Frequency

In 2023, the Ultra-High Frequency (UHF) RFID tags accounted for 59% market share owing to its intensive usage in inventory management, logistics industries, and automotive sectors. UHF RFID tags have a long range and faster data transfer, making them the first preference for real-time tracking. Advances in UHF technology, including improved anti-collision features and read accuracy, are expected to drive further adoption in 2024.

The Ultra-High Frequency (UHF) RFID tags segment is likely to grow with the fastest CAGR of 10.07% over 2024-2032, supported by increasing demand for efficient supply chain solutions and IoT integration. HF RFID tags, mostly used in access control and payment systems, and LF RFID tags, used for animal tagging, also contribute to the RFID tags market growth but at a slower growth rate.

RFID Tags Market Regional Analysis:

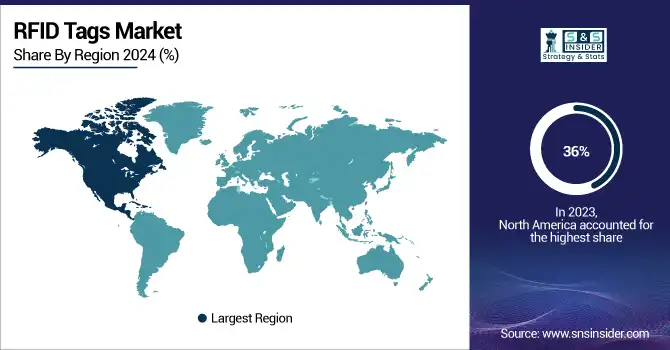

North America region dominated in 2023 accounting for 36% of the RFID tags market share. The region's dominance is driven by the surging number of adoption levels in healthcare, retail, and logistics, which is supported by strict government regulations for safety and traceability. Initiatives including the U.S. FDA's drug supply chain security program and Walmart's RFID mandate in retail have also boosted the RFID tags market expansion in North America.

The Asia-Pacific region is expected to witness the fastest growth, growing with a CAGR of 10.38% over 2024-2032. This dominance is driven by the rapid industrialization, surging e-commerce penetration, and government-supported digitalization programs in countries including India and China. For instance, India's "Digital India" initiative and China's "Made in China 2025" strategy focus heavily on RFID technology in manufacturing and logistics. It is also a great market in Europe, especially when considering transportation and public infrastructure, through smart city projects that integrate RFID.

Get Customized Report as per your Business Requirement - Request For Customized Report

RFID Tags Companies are:

-

Zebra Technologies (RFID printers, handheld readers)

-

Impinj, Inc. (RFID chips, RAIN RFID solutions)

-

Alien Technology (RFID inlays, tags)

-

Avery Dennison (RFID labels, tags)

-

NXP Semiconductors (RFID ICs, NFC chips)

-

HID Global (RFID cards, secure identity solutions)

-

Smartrac (RFID inlays, IoT solutions)

-

GEO RFID. (RFID readers, tags)

-

Omni-ID (RFID tags, asset management solutions)

-

Honeywell (RFID scanners, handheld devices)

-

Checkpoint Systems (RFID labels, inventory management solutions)

-

Invengo (RFID inlays, tags)

-

SATO Holdings (RFID printers, label solutions)

-

Confidex (RFID tags, industrial IoT solutions)

-

Idencia (asset tracking solutions, RFID tags)

-

RFID4U (RFID hardware, software)

-

Caen RFID (RFID readers, antennas)

-

ThingMagic (RFID modules, embedded readers)

-

Mojix (RFID middleware, IoT solutions)

-

Terso Solutions (RFID storage systems, asset tracking)

Major Suppliers (Components, Technologies)

-

Laird Connectivity (antennae, shielding materials)

-

3M (adhesives, conductive materials)

-

Dow Inc. (silicones, epoxies)

-

DuPont (high-performance polymers, conductive inks)

-

Rogers Corporation (dielectric materials, laminates)

-

Henkel (adhesives, conductive pastes)

-

BASF (polymers, specialty chemicals)

-

Murata Manufacturing Co. (electronic components, ceramic capacitors)

-

Texas Instruments (semiconductors, ICs)

-

TDK Corporation (inductors, ferrite cores)

Major Clients

-

Amazon

-

Walmart

-

FedEx

-

DHL

-

Siemens

-

BMW

-

GE Healthcare

-

Airbus

-

Nike

-

Target

Recent Development:

March 2024: Zebra Technologies Corporation, a premier digital solution provider that allows companies to smartly connect data, assets, and individuals, today declared its sponsorship of the NFL Health & Safety Summit taking place from March 25-28, alongside the NFL Annual Meeting in Orlando, Florida. The Summit unites representatives from all 32 Clubs, the League office, NFL partner organizations, as well as experts from medical, athletic training, and sports performance sectors.

October 2024: Avery Dennison has introduced AD Dura 2.0, a durable reusable label solution that provides protection against water, heat, vibration, and impact. Tailored for demanding conditions, the AD Dura 2.0 is compatible with various Avery Dennison RFID UHF and HF/NFC inlay designs for both dry and wet label types, such as the AD Circus NTAG213 and AD Dogbone M730. The new product promotes extended product lifespans and decreases waste.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 13.65 Billion |

| Market Size by 2032 | USD 29.07 Billion |

| CAGR | CAGR of 9.91% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (RFID Tags, RFID Readers, Middleware), • By Type (Passive RFID Tags, Active RFID Tags), • By Frequency (Low Frequency, High Frequency, and Ultra-high frequency), • By Application (Retail, Financial Services, Healthcare, Industrial, Government, Transport & Logistics, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zebra Technologies, Impinj, Inc., Alien Technology, Avery Dennison, NXP Semiconductors, HID Global, Smartrac, GAO RFID Inc., Omni-ID, Honeywell International, Checkpoint Systems, Invengo, SATO Holdings, Confidex, Idencia, RFID4U, Caen RFID, ThingMagic, Mojix, Terso Solutions. |

| Key Drivers | • RFID Technology Revolutionizes Inventory Management with Enhanced Accuracy and Efficiency. • IoT Integration with RFID Drives Automation and Expands Applications Across Industries. |

| Restraints | • RFID system installation is expensive, thus restraining its application within small-sized companies. |