Hot Runner Market Report Scope & Overview:

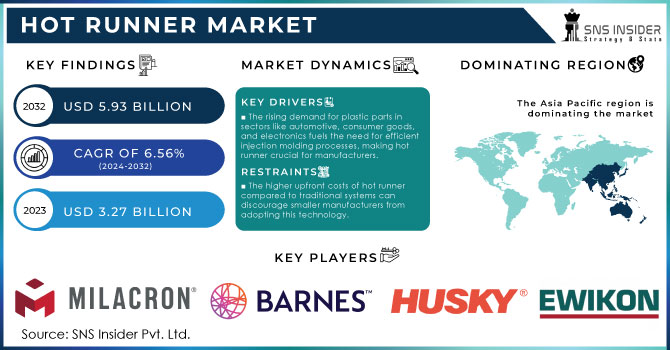

The Hot Runner Market Size was valued at USD 3.27 Billion in 2023 and is expected to reach USD 5.93 Billion by 2032 and grow at a CAGR of 6.56% over the forecast period 2024-2032.

To Get More Information on Hot Runner Market - Request Sample Report

Hot Runner has revolutionized the injection molding process, offering substantial improvements in several key areas. One notable advantage is the enhancement of injection molding cycle times by 20-50%, which is particularly crucial in fast-paced industries like automotive, where rapid production is essential. These systems also maintain consistent temperatures within a tight range of ±1°C, ensuring uniform flow of molten material and minimizing defects, thus significantly increasing product quality. Additionally, the adoption of multi-cavity molds with hot runners can boost production capacity by up to 50%, enabling manufacturers to produce multiple parts in a single cycle. The integration of smart technologies, such as IoT and data analytics, is becoming prevalent, with approximately 60% of manufacturers leveraging these advancements for real-time monitoring and predictive maintenance, which enhances overall operational efficiency. Hot runner also plays a crucial role in reducing scrap rates to below 2%, minimizing plastic waste and improving material utilization. Furthermore, modular hot runner designs allow for quicker maintenance, reducing downtime by up to 30% while modern systems are engineered to be more energy-efficient, consuming up to 25% less energy compared to older models. This efficiency not only lowers operational costs but also supports sustainability initiatives. Ultimately, the consistent temperature and material flow from hot runner systems can lead to a reduction in surface defects by 25-30%, ensuring that products meet stringent quality standards. As a testament to the importance of this technology, the injection molding industry is expected to invest over 15% of its revenue into research and development, aimed at further advancing hot runner technology and enhancing production efficiency.

Technological advancements have further propelled the evolution of hot runner. Innovations such as modular designs and advanced temperature control systems have enhanced the flexibility and efficiency of these systems. For instance, modular hot runner allows for easy customization and maintenance, enabling manufacturers to quickly adapt to changing production requirements. Additionally, sophisticated temperature control technologies help maintain optimal conditions throughout the injection process, reducing the risk of thermal degradation of the material and improving the overall quality of the molded parts.

MARKET DYNAMICS

DRIVERS

- The rising demand for plastic parts in sectors like automotive, consumer goods, and electronics fuels the need for efficient injection molding processes, making hot runner crucial for manufacturers.

The increased demand for plastic products across various industries, including automotive, consumer goods, and electronics, significantly drives the growth of the hot runner market. In the automotive sector, the shift towards lightweight materials for improved fuel efficiency and performance has led manufacturers to seek innovative solutions for producing complex plastic components. Hot Runner facilitates this by ensuring a consistent melt temperature, which is crucial for producing high-quality parts with minimal defects. This efficiency is also vital in the consumer goods industry, where rapid production cycles and high-volume outputs are essential for meeting consumer demands. Hot runners enable manufacturers to reduce cycle times and material waste, ultimately resulting in cost savings and increased productivity.

Moreover, the electronics industry is witnessing a surge in demand for intricate plastic components, such as housings and connectors, which require precise molding capabilities. Hot Runner excels in this area by allowing for uniform material flow and reduced cooling times, thus enhancing the overall manufacturing process. The trend towards customization in consumer products also necessitates flexible and efficient production methods, further emphasizing the role of hot runner technology. As industries continue to innovate and expand, the reliance on efficient injection molding processes, supported by Hot Runner, becomes increasingly critical. This growing dependency on plastics across diverse sectors ensures sustained demand for Hot Runner, driving market growth and development in this field.

- Technological advancements in hot runner, including enhanced temperature control and energy efficiency, optimize production processes and increase their appeal to manufacturers.

Technological advancements in Hot Runner significantly enhance their efficiency and effectiveness in production processes, making them increasingly appealing to manufacturers across various industries. One of the most notable improvements is the enhanced temperature control. Modern Hot Runner employ sophisticated temperature regulation mechanisms that allow for precise adjustments during the injection molding process. This capability ensures consistent melt flow, reduces cycle times, and minimizes the risk of defects in molded parts, leading to higher quality products. Additionally, these systems often feature advanced monitoring and feedback systems that provide real-time data on temperature fluctuations, enabling operators to make informed adjustments instantly.

Energy efficiency is another critical advancement that benefits manufacturers. Contemporary Hot Runner are designed to consume less energy by optimizing heating elements and utilizing insulation technologies to retain heat. This reduction in energy consumption not only lowers operational costs but also aligns with the growing emphasis on sustainability within manufacturing practices. By minimizing energy usage, companies can significantly reduce their carbon footprint, appealing to environmentally conscious consumers and stakeholders.

Moreover, these technological advancements facilitate greater production flexibility. Manufacturers can easily adapt their processes to accommodate different materials and product designs without extensive downtime or reconfiguration. As a result, Hot Runner have become integral to modern manufacturing, providing significant competitive advantages in terms of productivity, quality, and sustainability. This combination of enhanced temperature control, energy efficiency, and adaptability ultimately makes hot runner technology an attractive investment for manufacturers seeking to optimize their production processes.

RESTRAIN

- The higher upfront costs of hot runner compared to traditional systems can discourage smaller manufacturers from adopting this technology.

One of the primary challenges facing the hot runner market is the high initial investment required for implementing hot runner compared to traditional cold runner systems. These advanced systems, which provide significant benefits such as reduced cycle times, minimized material waste, and improved energy efficiency, often come with a steep price tag. For smaller manufacturers, the upfront costs associated with purchasing and installing hot runner technology can be prohibitively high, making it difficult for them to justify the investment.

This financial barrier is compounded by the fact that many small to medium-sized enterprises (SMEs) operate on tighter budgets and may prioritize essential operational expenses over advanced manufacturing technologies. As a result, these companies might opt to stick with conventional cold runner systems, which, while less efficient, require a lower capital investment. Moreover, the complexities involved in retrofitting existing molds to accommodate hot runners can further discourage SMEs from making the switch. This reluctance to adopt hot runner technology may hinder their ability to compete with larger manufacturers that can afford the investment and leverage the advantages of faster production and lower material costs. Consequently, while hot runner offers substantial long-term benefits, the initial financial hurdle remains a significant constraint for many smaller players in the market, potentially limiting the overall growth and adoption of this technology across the manufacturing landscape.

KEY SEGMENTATION ANALYSIS

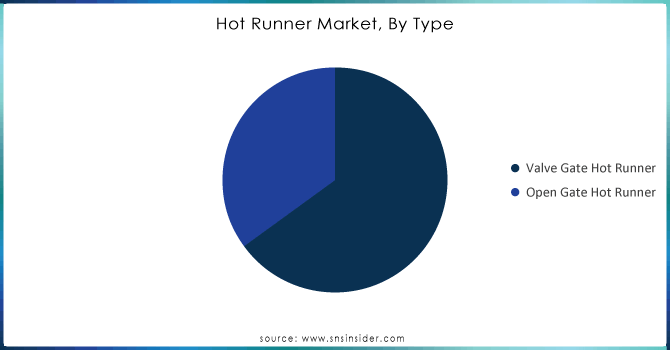

By Type

In 2023, the valve gate hot runner segment dominated the market share over 62.04%. A key factor is the valve gate capacity to provide better control of the injection molding process. Valve gate control the flow of molten plastic into the mold cavity with a precise valve mechanism, as opposed to open gates in conventional hot runners that can lead to drooling and stringing. This leads to cleaner, more precise gate residue and fewer part defects, which is important for industries needing top-quality parts like automotive, electronics, and medical sectors.

Do You Need any Customization Research on Hot Runner Market - Inquire Now

By Industry

In 2023, the automotive segment dominated the market share over 30.2%. High precision and consistent quality are required for vehicle plastic components in the automotive sector. Hot runner allows manufacturers to create intricate components with fewer imperfections and improved surface quality. Accurate management of temperature distribution and injection flow is crucial in ensuring that automotive parts meet high quality standards, which are essential for performance, safety, and appearance.

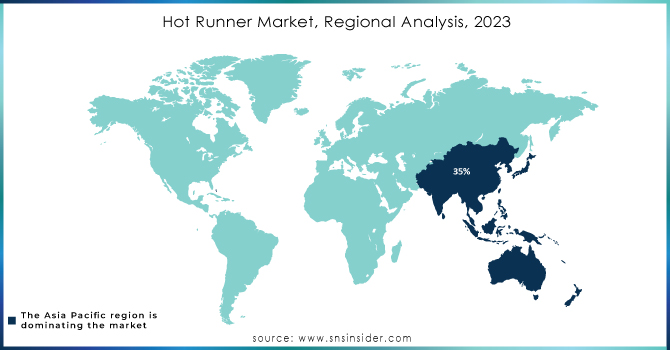

REGIONAL ANALYSIS

In 2023, Asia Pacific region dominated the market share over 40.4%. The area is undergoing fast industrial development and urban growth, resulting in a rising need for consumer products, vehicle parts, and packaging options. China and India have emerged as key manufacturing centers due to favorable economic policies, ample workforce, and expanding local markets. It is projected that the hot runner market in China will experience substantial growth at a significant CAGR in the upcoming period. The car industry in China is among the biggest globally, experiencing ongoing increases in both vehicle manufacturing and sales.

North American region anticipated to witness significant growth from 2024 to 2032. The packaging and consumer goods sectors in North America also play a significant role in driving market growth. These industries require fast production speeds and the capability to create intricate, visually appealing plastic items.

KEY PLAYERS

Some of the major key players of Hot Runner Market

-

Milacron (Hot runner systems, Injection molding equipment)

-

Barnes Group (Mold-Masters hot runner systems, temperature controllers)

-

Husky Injection Molding Systems Ltd (Hot runners, controllers, injection molding systems)

-

Incoe (Hot runner systems, temperature control technology)

-

Seiki Corporation (Hot runner systems, precision molds)

-

Gunther (Hot runner systems, nozzles, control units)

-

EWIKON (Hot runner systems, valve gate systems)

-

Inglass S.p.A. (Hot runner systems, injection molding solutions)

-

Synventive (Hot runner systems, control technologies)

-

THERMOPLAY S.p.A. (Hot runner systems, nozzles, injection molding components)

-

YUDO (Hot runner systems, valve gate systems)

-

Oerlikon HRSflow (Hot runner systems, advanced flow control)

-

Fast Heat (Hot runner control systems, manifolds)

-

HASCO (Hot runner systems, injection molding components)

-

Athena Automation (Injection molding systems, hot runner solutions)

-

Caco Pacific (Hot runner systems, precision injection molding)

-

Meusburger (Hot runner systems, injection molding tools)

-

Polyshot (Hot runner systems, advanced manifold technology)

-

Mold Hotrunner Solutions (MHS) (Hot runner nozzles, temperature controllers)

-

HRSflow (Oerlikon) (Hot runner systems, flow control solutions)

RECENT DEVELOPMENTS

-

In 2024: Oerlikon HRSflow will showcase cutting-edge hot-runner innovations for medical and technical applications at Fakuma. Notable innovations include the multi-valve plate technology and new end rings for processing engineering polymers

-

In May 2023: Barnes Group Inc. purchased the assets of Hot Runner, Inc., a top supplier of Hot Runner for the plastics sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.27 Billion |

| Market Size by 2032 | USD 5.93 Billion |

| CAGR | CAGR of 6.56% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Valve Gate Hot Runner, Open Gate Hot Runner) • By Industry (Consumer Goods, Medical, Packaging, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Milacron, Barnes Group, Husky Injection Molding Systems Ltd, Incoe, Seiki Corporation, Gunther, EWIKON, Ingless S.p.A., Synventive, THERMOPLAY S.p.A., YUDO, Oerlikon HRSflow, Fast Heat, HASCO, Athena Automation, Caco Pacific, Meusburger, Polyshot, Mold Hotrunner Solutions (MHS), HRSflow (Oerlikon). |

| Key Drivers | • The rising demand for plastic parts in sectors like automotive, consumer goods, and electronics fuels the need for efficient injection molding processes, making hot runner crucial for manufacturers. • Technological advancements in hot runner, including enhanced temperature control and energy efficiency, optimize production processes and increase their appeal to manufacturers. |

| RESTRAINTS | • The higher upfront costs of hot runner compared to traditional systems can discourage smaller manufacturers from adopting this technology. |