Industrial Cooling System Market Report Scope & Overview:

The Industrial Cooling System Market Size was estimated at USD 21.07 billion in 2023 and is expected to arrive at USD 34.15 billion by 2032 with a growing CAGR of 5.51% over the forecast period 2024-2032. This report offers unique insights into cooling capacity utilization trends across key regions, highlighting efficiency benchmarks and energy consumption metrics for industrial cooling systems. It provides a comparative analysis of downtime and maintenance costs by region, helping businesses optimize operational performance. The study also explores technological adoption trends, such as AI-driven cooling optimization and hybrid cooling systems. Additionally, it presents export/import trade data, offering a global perspective on supply chain dynamics. To enhance the report's uniqueness, it includes sustainability trends in industrial cooling, such as the rise of low-GWP refrigerants and carbon-neutral cooling solutions, along with a breakdown of regulatory impacts on system efficiency and emissions compliance.

To Get more information on Industrial Cooling System Market - Request Free Sample Report

Industrial Cooling System Market Dynamics

Drivers

-

The Industrial Cooling System Market is growing rapidly due to industrial expansion, rising data centers, energy-efficient cooling adoption, and increasing regulatory compliance.

The Industrial Cooling System Market is experiencing significant growth, driven by rapid industrialization across manufacturing, power plants, and data centers. With the growth of industries, the demand for thermal management solutions has also increased to maintain efficient operations and to prolong the life of the equipment. The need for advanced cooling technologies has been greatly spurred in particular by the advent of hyperscale data centers and cloud computing. Moreover, enhanced implementation of energy-efficient cooling systems like hybrid cooling, adiabatic cooling, exhibits a sustainability trend and lower energy consumption. There is a drive within industries to transition to eco-friendly and water-saving cooling technologies as various governments worldwide reinforce tough environmental regulations. AI and IoT-enabled cooling systems are an emerging trend due to the flexibility in real-time monitoring and optimization. The robust growth of investments directed towards industrial structures, especially in developing countries, is expected to further fuel the extensive growth of this market, presenting abundant opportunities to prominent vendors operating in this market.

Restraint

-

The high initial investment and maintenance costs of industrial cooling systems hinder adoption due to expensive installation, upkeep, and regulatory compliance.

The high initial investment and maintenance costs of industrial cooling systems present a significant barrier to adoption, particularly for small and medium-sized enterprises. This entails significant upfront capital, including the purchase and setup of ice banks, as well as alterations to the existing infrastructure to accommodate robust cooling functions. Innovative cooling modalities, like evaporative and hybrid systems, also increase prices because of their more complex designs and efficient components. Furthermore, routine maintenance such as inspections, cleaning, and mechanical replacements also contribute to the overall ownership expense. Long-term costs also rise as skilled professionals are required to manage system operations and handle technical issues. Additionally, industries based in areas with stringent environmental policies may incur costs for complying with energy efficiency material and emission standards. Despite the future operational advantages of industrial cooling systems such as improved efficiency and reduced downtime, the initial and maintenance costs may discourage businesses from investing heavily in these crucial cooling solutions.

Opportunities

-

The growing renewable energy sector is driving demand for industrial cooling systems to enhance efficiency and reliability in solar and wind energy storage applications.

The expansion of the renewable energy sector is driving the demand for industrial cooling systems, particularly in solar and wind energy storage applications. With the ongoing hike of renewable energy generation in recent years, efficient thermal management for energy storage systems including lithium-ion and flow batteries is becoming extremely critical to their performance and longevity spanning the twofold concern around energy density and lifespan. Cooling systems ensure that photovoltaic panels, inverters and thermal storage units operate within their optimal temperature ranges, preventing overheating, thus leading to increased efficiency. In the same manner, transformers and power electronics in wind energy need cooling to ensure stable operation and avoid system failures. The increasing deployment of battery energy storage systems (BESS) to stabilize the grid is also driving the demand for advanced cooling technologies. To improve reliability and sustainability, more companies are adopting energy-efficient cooling solutions, including liquid cooling and phase-change materials. The increasing demand will further add to the growth of the industrial cooling system market as governments push for clean energy initiatives.

Challenges

-

The growth of advanced air-cooling and liquid cooling solutions is limiting the adoption of traditional industrial cooling systems by offering higher efficiency, lower costs, and improved sustainability.

The rise of advanced air-cooling and liquid cooling technologies poses a significant challenge to traditional industrial cooling systems. Evaporative and adiabatic technology, being air-cooling solutions, are energy-efficient alternatives, especially with lower water consumption, making them attractive options for industries looking to save on operational costs and improve their carbon footprint. On the other hand, liquid cooling, especially for data centers and high-performance computing, offers better thermal management than traditional cooling towers and chillers. These technologies are becoming popular because of their capacity to improve effectiveness, reduce space needs, and lower maintenance costs. As sectors pursue opportunities to become more sustainable, subject to tight environmental regulations, the implementation of these alternative cooling solutions is gaining momentum. This transition challenges traditional manufacturers of industrial cooling systems to innovate and to incorporate energy-efficient capabilities and hybrid cooling technologies to compete in a changing marketplace. Traditional cooling technologies that cannot adapt may find their market share declining.

Industrial Cooling System Market Segmentation Analysis

By Products Type

Evaporative cooling segment dominated with a market share of over 32% in 2023, due to their superior efficiency, affordability, and extensive applications across industries. These systems leverage the natural mechanism of evaporation to release heat, they are particularly effective at cooling industrial plants, power plants, and HVAC systems on large commercial sites. As a result, evaporative cooling provides enormous energy savings and lower operation costs compared to traditional air- or water-cooling methods, causing it to be a popular option for industry, as thermal management could be improved while minimizing environmental footprint. They are also able to perform well in hotter climates, which adds to their appeal. Evaporative cooling remains the leading segment in the market with a wide area of adoption due to increasing industrialisation and energy efficiency measures.

By Function

The Transport Cooling segment dominated with a market share of over 68% in 2023, due to its essential role in preserving temperature-sensitive goods across various industries. Refrigerated transport helps keep food & beverage products fresh and preserves quality, and cold chain logistics helps ensure vaccines and medicines remain effective in the pharmaceutical sector. The chemical industry, on the other hand, needed accuracy in cooling due to its sensitivity to compounds. The resurgence of globalized trade, the growing need for e-commerce delivery of perishables and stringent regulations on temperature-controlled shipping around the world are all expanding this segment's dominance in the market. Advancements in refrigeration technology coupled with the growing adoption of energy-efficient transport cooling solutions are expected to sustain its leadership in the market.

By End-User

The Utility and Power segment dominated with a market share of over 34% in 2023, due to its critical need for efficient heat dissipation in power plants. Thermal and nuclear power generation involves a significant amount of heat generation while producing electricity, leading to the need for large-scale cooling techniques such as cooling towers, air-cooled condensers, and heat exchangers. Rising global energy demand and increasing the power generation facilities are stimulating the adoption of industrial cooling systems. Furthermore, strict environment regulations compel power plants to use energy-efficient and eco-friendly cooling technology. The global utility power market is experiencing steady growth as renewable energy projects, including concentrated solar power, continue to increase, thus the requirement for advanced cooling solutions in this sector is expected to remain significant, thus enhancing its dominance in the market, but over the forecast period.

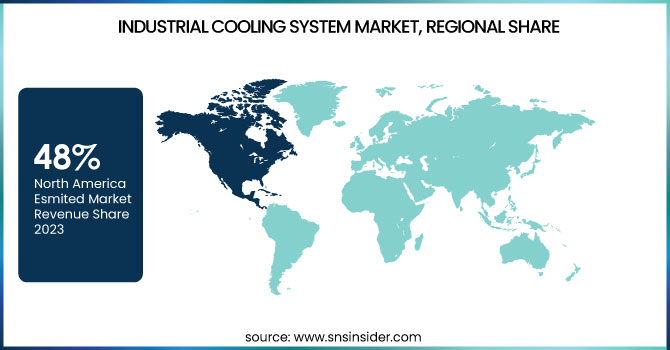

Industrial Cooling System Market Regional Outlook

North America region dominated with a market share of over 48% in 2023, owing to the highly industrialized economy coupled with a significant demand for such systems from essential application sectors like power generation, data center, and HVAC applications. The region contains a large number of manufacturing units, oil & gas refineries, and thermal power plants, all of which require effective cooling. The fast-growing hyperscale data centers have also started the emerging requirement of technologies for advanced cooling solutions, due to growth from cloud computing and AI enhancements. Strict government regulations on energy efficiency and environmental sustainability have led industries to adopt innovative and eco-friendly cooling systems as well. North America is the dominant market for industrial cooling systems due to continuous technological progress and huge investments in industrial infrastructure.

Europe is the fastest-growing region in the Industrial Cooling System Market, due to high demand for energy-efficient cooling solutions and stringent environmental regulations. Strict policies advancing carbon reduction are being implemented by various governments in the region, forcing industries to implement sustainable cooling tech like hybrid and adiabatic cooling solutions. Market growth is also fueled by accelerated investment in industrial and commercial infrastructure such as data centres, power plants, manufacturing plants, and so on. Moreover, increasing focus on renewable energy projects and technology improvement in cooling harness more opportunities in the sector. Robust investment activity in research and development has positioned European countries ahead of innovations in environmental-friendly solutions for cooling systems, thus propelling the region into the spotlight in the global industrial cooling market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Industrial Cooling System Market

-

Berg Chilling Systems Inc. (Cooling Towers, Chillers, Pumping Systems)

-

SPIG S.p.A. (Italy) (Cooling Towers, Air-Cooled Condensers)

-

Brentwood Industries Inc. (U.S.) (Cooling Tower Components, Fill Media, Drift Eliminators)

-

Thermal Care Inc. (Industrial Chillers, Process Cooling Systems)

-

Johnson Controls International PLC (HVAC Systems, Industrial Chillers)

-

Trane Technologies (Industrial Cooling Solutions, Chillers, HVAC Systems)

-

Hamon Group (Belgium) (Cooling Towers, Air-Cooled Condensers, Heat Exchangers)

-

Black Box Corporation (Data Center Cooling, Precision Cooling Solutions)

-

Airedale International Air Conditioning Ltd. (Precision Air Conditioning, Chillers)

-

SPX Corporation (U.S.) (Cooling Towers, Air-Cooled Heat Exchangers)

-

Paharpur Cooling Towers (India) (Cooling Towers, Air-Cooled Condensers)

-

Bell Cooling Tower (India) (FRP Cooling Towers, Wooden Cooling Towers)

-

Baltimore Aircoil Company Inc. (Cooling Towers, Fluid Coolers, Evaporative Condensers)

-

Baltimore Aircoil Company (U.S.) (Evaporative Cooling Systems, Hybrid Cooling Towers)

-

STULZ GmbH (Data Center Cooling, Precision Cooling Solutions)

-

Star Cooling Towers Pvt. Ltd. (Cooling Towers, Heat Exchangers)

-

Delta Cooling Towers, Inc. (HDPE Cooling Towers, Evaporative Cooling Solutions)

-

EVAPCO Inc. (Cooling Towers, Closed Circuit Coolers, Ice Thermal Storage Systems)

-

Daikin Applied (Industrial Cooling Systems, HVAC Chillers)

-

Munters Group (Adiabatic Cooling Systems, Humidification & Dehumidification Systems)

Suppliers for (Cooling towers, air-cooled condensers, and heat exchangers) on the Industrial Cooling System Market

-

Berg Chilling Systems Inc.

-

SPIG S.p.A. (Italy)

-

Brentwood Industries Inc. (U.S.)

-

Thermal Care Inc.

-

Johnson Controls International PLC

-

Trane Technologies

-

Hamon Group (Belgium)

-

Paharpur Cooling Towers (India)

-

EVAPCO Inc.

-

Baltimore Aircoil Company (U.S.)

Recent Development

In October 2023: ThermalWorks, a subsidiary of Endeavour specializing in sustainable data infrastructure, announced the global launch of its cutting-edge, waterless cooling system. Designed to address the evolving demands of the data center industry, this ultra-efficient, modular technology aims to revolutionize traditional data center operations by significantly reducing energy consumption and eliminating water usage for cooling.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 21.07 Billion |

| Market Size by 2032 | USD 34.15 Billion |

| CAGR | CAGR of 5.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Hybrid Cooling, Water Cooling, Air Cooling, Evaporative Cooling) • By Function (Transport Cooling, Stationary Cooling) • By End-User (Utility and Power, Chemical, Food & Beverage, Pharmaceutical, Oil and Gas, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Berg Chilling Systems Inc., SPIG S.p.A. (Italy), Brentwood Industries Inc. (U.S.), Thermal Care Inc., Johnson Controls International PLC, Trane Technologies, Hamon Group (Belgium), Black Box Corporation, Airedale International Air Conditioning Ltd., SPX Corporation (U.S.), Paharpur Cooling Towers (India), Bell Cooling Tower (India), Baltimore Aircoil Company Inc., Baltimore Aircoil Company (U.S.), STULZ GmbH, Star Cooling Towers Pvt. Ltd., Delta Cooling Towers, Inc., EVAPCO Inc., Daikin Applied, Munters Group. |