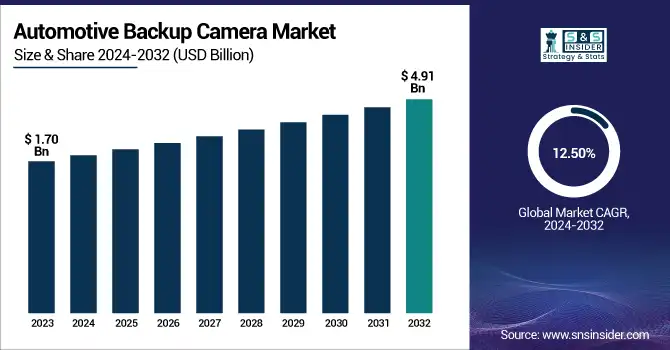

Automotive Backup Camera Market Size & Growth:

The Automotive Backup Camera Market was valued at USD 1.70 billion in 2023 and is expected to reach USD 4.91 billion by 2032, growing at a CAGR of 12.50% over the forecast period 2024-2032. The Market is rapidly evolving across multiple sectors. For this purpose, it comes equipped with AI-powered cameras, HD resolution, and night vision. Operational performance enhancements involve lower latency, improved in-vehicle display integration, and quicker processing of images. The expansion of wireless connectivity finally means the industry is moving and setting up wires anymore, and the camera is installed more flexibly with Wi-Fi and Bluetooth-enabled cameras. At the same time, smart cars and AI-based technologies help to detect objects around us, identify pedestrians, and provide automatic braking assistance to improve safety. Together, these advancements enable the transition of backup cameras from passive visibility systems to dynamic, ADAS-integrated safety systems in vehicles today.

To Get more information on Automotive Backup Camera Market - Request Free Sample Report

Automotive Backup Camera Market Dynamics

Key Drivers:

-

Rising Safety Regulations and Technological Advancements Driving Growth in the Automotive Backup Camera Market

The automotive backup camera market is largely attributed to the rising safety regulations on vehicles and the growing focus on accident avoidance. To enhance safety and minimize blind spots while driving, authorities across the world have made the installation of rearview cameras in passenger and commercial vehicles mandatory. Furthermore, increasing consumer awareness about the safety of vehicles and emerging technologies such as high-definition cameras, night vision, and 360-degree surround-view systems are also expected to contribute to the growth of the global automotive camera market. Additionally, growth in the electric vehicle (EV) sector and the advance of self-driving technologies are driving growth for backup cameras because ADAS become more common in these vehicles. As the automotive aftermarket sector continues to expand, car owners are looking to upgrade to high-performance backup camera devices, which is anticipated to further drive the market growth.

Restrain:

-

System Integration Complexity and Weather Challenges Hindering Growth in the Automotive Backup Camera Market

A key challenge plaguing the automotive backup camera market is the complexity of system integration and calibration. For example, advanced backup cameras must remain accurately aligned with other vehicle safety systems including parking sensors and AEB systems. Co-existence across vehicle models and manufacturers can be technically complex and introduce incompatibilities. Besides, backup cameras may suffer from a performance drop under adverse weather conditions including very heavy rain, fog, or very harsh temperatures, which affect visibility and decrease effectiveness.

Opportunity:

-

AI Sensor Fusion and Wireless Innovations Creating Lucrative Growth Opportunities in the Automotive Backup Camera Market

Market opportunities exist for the growing penetration of artificial intelligence (AI) and sensor fusion technologies used in automotive cameras. With the use of AI-based image recognition and machine learning, automakers can make backup cameras more accurate, resulting in fewer false alerts and improved driver confidence levels. Further, innovations in wireless and cloud-connected cameras are creating new growth opportunities, especially in the fleet management industry. Rapid urbanization, growing disposable income, and a rise in vehicle ownership in Asia-Pacific and Latin America are creating lucrative market opportunities for backup camera systems.

Challenges:

-

Cybersecurity Risks and Regulatory Hurdles Posing Challenges for the Automotive Backup Camera Market Expansion

The major challenge is the technology legacy data privacy concern against the new-age backup camera systems from a potential cybersecurity perspective. As more and more people are using wireless and cloud-connected cameras in vehicles, it is common for vehicles to be threatened by cyber-attacks such as hacking and video feed hacking. One challenge that automakers need to tackle along with consumers is the necessity of data security and user privacy protection. In addition to this, the lack of common standards and certification among regions is a challenge for manufacturers as it can be hard to comply with disparate safety regulations. Such regulatory hurdles can introduce delays in product launches while also increasing the complexity of the market expansion efforts, especially in emerging economies that have laws around automotive safety that are still evolving.

Automotive Backup Camera Market Segment Analysis

By Vehicle Type

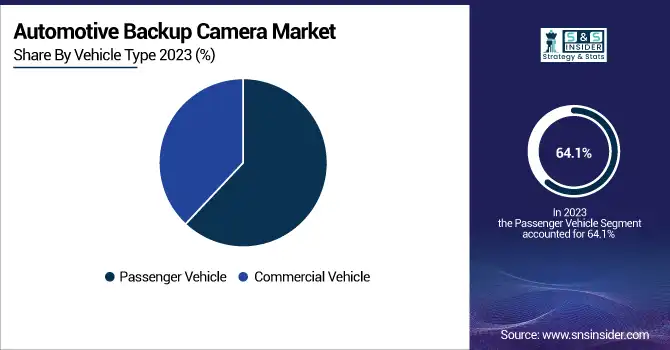

The passenger vehicle segment of the automotive backup camera market held the largest market share of 64.1% in 2023. The dominance can be attributed to the high penetration of backup cameras in sedans, SUVs, and hatchbacks due to government safety regulations and increasing consumer demand for advanced driver assistance systems (ADAS). Increasing production of passenger vehicles, especially in developing economies, was another factor responsible for the segment’s lead.

The commercial vehicle category is projected to rise at the fastest CAGR during the prediction timeframe between 2024-2032. Growing focus on fleet safety and government mandates laid by countries for large trucks and buses is supporting the adoption. Furthermore, the logistics and transportation sector is also actively adopting backup cameras to prevent accidents and enhance operational efficiency, hence generating lucrative growth opportunities for this segment across the forecast period.

By Mounting Position

The flush-mounted segment led the automotive backup camera market as it accounted for 42.8% of the total revenue share in 2023. This dominance was fueled by its elegant integration with vehicle designs, providing an OEM look and feel. Most automakers offer flush-mounted cameras as OEM equipment, especially in mid-range and premium vehicles. This was consolidated with a head-up display that delivered a clear and distortion-free look at the rearview, night vision, and wide dynamic range, which rounded out a head-up display that made it easy to foresee their clearance of the market.

License Plate segment to exhibit fastest CAGR from 2024-2032. The demand for these cameras is mainly driving growth in aftermarket installations, as they can be easily installed and used with different vehicles as well. Further, awareness about vehicle safety is growing rapidly and the development of new technologies such as wireless communication, and artificial intelligence in image capturing and processing are some of the factors anticipated to boost growth of the market.

By Sales Channel

In 2023, the OEM (Original Equipment Manufacturer) segment was the largest contributor, sharing 64.8% of the total automotive backup camera market. This was mainly because of strict government regulations requiring backup cameras to be installed in new cars from the factory and also due to the higher adoption of advanced driver assistance systems (ADAS). High-quality, flush-mounted, and wide-angle cameras are now becoming standard safety features among many new mid-range and premium vehicles at the automakers' expense. OEMs maintained their leadership position thanks to the increasing demand for technologically advanced and integrated camera systems.

The aftermarket segment is expected to witness the fastest CAGR from 2024-2032, due to increasing demand for affordable safety improvement upgrades among consumers. The vast majority of currently on-the-road older vehicles did not come with a backup camera as a factory-installed feature a gaping hole for aftermarket solutions. More people are buying backup cameras, thanks to their growing availability in wireless, AI-based, and high-definition form factors, as well as the spread of e-commerce sites.

By Viewing Angle

The standard-angle segment held a 56.3% market share in 2023. It has gained traction due to carmakers seeking low-cost safety solutions for budget cars and compact and midsized vehicles. But standard-angle cameras have a wide enough field of view to be suitable for basic reversing help which is one of the reasons OEMs use them for installations. Along with the above, their reliability and seamless integration with existing vehicle systems made them a leader in the market.

The wide-angle segment is projected to grow at the fastest CAGR between 2024 and 2032. A surge in demand for such rearview safety & clarity is propelling uptake, especially across premium & commercial vehicles. Wide-angle cameras remove the blind spots and this is beneficial in preventing any accidents. This segment will continue to gain traction with advances in image processing and AI-enabled object detection and a rise in the integration of 360-degree surround-view systems.

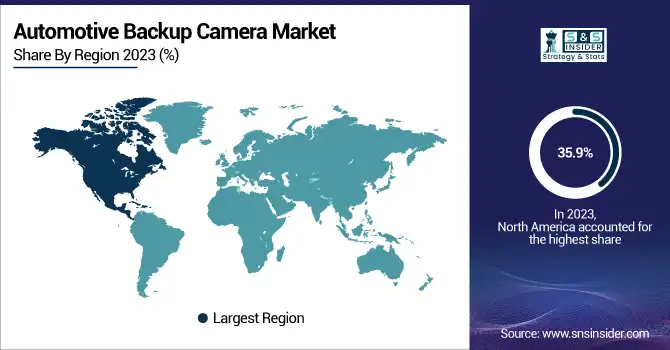

Automotive Backup Camera Market Regional Overview

North America held the biggest share of 35.9% of the automotive backup camera market in 2023. That leadership stemmed in large part from the high levels of safety regulations, such as the U.S. federal requirement that all new vehicles less than 10,000 pounds shall come with rearview cameras. This driver is additionally contributing to regional leadership as major automotive manufacturers such as Ford, General Motors and Tesla incorporate a variety of advanced driver assistance systems (ADAS). Moreover, the rising consumer inclination towards SUVs and pickup trucks, in which backup cameras serve a key role in ease of maneuverability and safety, has propelled the market growth. Increased investments in AI-enabled and cloud-connected camera systems, which are also favoring innovative backup camera solutions, are another major factor contributing to the growth of this equipment market.

Asia Pacific is anticipated to be the fastest-growing region with a CAGR of 2024 to 2032, due to rapid urbanization, an increase in vehicle sales, and growing awareness of safety. Countries with strong demand for passenger and commercial vehicles – including China, Japan, and India will account for the majority of OEM and aftermarket backup camera sales. Car companies like Toyota, Honda, and Hyundai are adding new safety features, like wide-angle cameras, and AI. Moreover, government initiatives for vehicle safety and the rise of e-commerce platforms for aftermarket solutions in the region are propelling the market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Automotive Backup Camera Market are:

-

Continental AG (Surround View System, Night Vision Camera)

-

Bosch (Multi-Camera System, Rearview Camera)

-

Valeo (360-degree Camera System, Park4U)

-

Autoliv (Mono Vision Camera, Stereo Vision Camera)

-

Ficosa International (Rearview Camera, Lane Departure Warning Camera)

-

Denso (Parking Assistance Camera, Night Vision Camera)

-

Magna International (Rearview Camera System, Surround View System)

-

ZF Friedrichshafen (S-Cam4 Camera, Tri-Cam Camera)

-

Aptiv (Forward-Facing Camera, Surround View Camera)

-

Mobileye (EyeQ Camera, Shield+)

-

Gentex Corporation (Full Display Mirror, Rear Camera Mirror)

-

Panasonic Corporation (Rear-View Camera System, 360-Degree Surround View System)

-

Garmin Ltd (BC™ 40 Wireless Backup Camera, BC™ 30 Backup Camera)

-

Harman Becker Automotive Systems (Rear-View Camera, Surround View Camera)

-

Pro-Vision (HD Backup Camera System, Side Vision Camera)

Recent Trends

-

In September 2024, Continental launched the ProViu Mirror System, enhancing commercial vehicle safety with high-definition cameras replacing traditional mirrors.

-

In January 2024, Ficosa and Indie Semiconductor announced a partnership to develop AI-based automotive camera solutions for enhanced safety. The collaboration aims to deliver smart imaging and in-camera object detection, with production set for 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.70 Billion |

| Market Size by 2032 | USD 4.91 Billion |

| CAGR | CAGR of 12.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger Vehicle, Commercial Vehicle) • By Mounting Position (Flush Mounted, License Plate Mounted, Surface Mounted) • By Sales Channel (OEM, Aftermarket) • By Viewing Angle (Standard Angle, Wide Angle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG, Bosch, Valeo, Autoliv, Ficosa International, Denso, Magna International, ZF Friedrichshafen, Aptiv, Mobileye, Gentex Corporation, Panasonic Corporation, Garmin Ltd, Harman Becker Automotive Systems, Pro-Vision. |