Sensor Fusion Market Size & Overview:

The Sensor Fusion Market Size was valued at USD 6.86 Billion in 2023 and is expected to reach USD 31.91 Billion by 2032 and grow at a CAGR of 18.65% over the forecast period 2024-2032.

The sensor fusion market is growing significantly, driven by government policies, technological inventions, and strategic developments in the industry. In 2023 and 2024, the countries have introduced projects aimed at improving sensor fusion technology deployment, mainly in automobiles, consumer electronics, and industrial automation applications. For instance, Japan has produced government initiatives in the form of improvements in safety systems in automobiles. Japan focuses on the advanced capability of sensor fusion in Autonomous Driving and Advanced Driver Assistance Systems (ADAS) applications where incidents involving traffic are fewer. It further encourages manufacturers of automotive products to put standardized usage into practice with the implementation of these types of technology. The government in China emphasizes smart manufacturing and automobile innovation in developing autonomous vehicles by laying down policies that would lead to sensor fusion innovations in the analysis of complex data for more productive and safe industrial and auto applications.

To get more information on Sensor Fusion Market - Request Free Sample Report

Government programs in the U.S. are similar but also of the same magnitude as sensors combine applications within both its civilian and defense sectors are encouraged and supported. Thus, for example, while this is an oversimplification, some of those government programs sponsored by Department of Defense involve the integrating multiple sensor technologies to amplify a surveillance and reconnaissance power combination. For example, In the case of Lockheed Martin F35, the advanced sensor fusion enables it to merge into a single picture or image of the battle place that dramatically enhances awareness of their surroundings and survivability. The advanced sensor system on the F-35 acts as a communications gateway by providing an operational picture of the battlefield with ground, sea, and other in-air assets. France and Germany, part of the European Union's broader goals for industrial automation and autonomous mobility, are increasingly supporting research and development in sensor fusion technologies. Germany's automotive sector has been one of the most important contributors, with heavy investments in merging sensor data from LIDAR, radar, and camera systems to enhance ADAS functionalities.

With Sensor Fusion, MicroVision presents a trend-setting milestone for next generation Advanced Driver Assistance Systems and Automated Driving Systems. Sensor Fusion will enable a broader functional scope at constantly increasing speed ranges that minimizes disturbances for the passenger and maximizes comfort. The new level of high performance and safety in L2+ and L3 applications creates a demand for the system. With Sensor Fusion, MicroVision achieve a heterogeneous sensor setup to cover the 360-degree field view for passenger cars as well as trucks. It has also been seen how France has been channeling resources towards the fusion of sensor in industrial robots to pave the way to smarter and more adaptable environments in manufacturing.

MARKET DYNAMICS

KEY DRIVERS:

-

The growing demand for autonomous vehicles is fueling the adoption of sensor fusion.

Autonomous vehicles are one of the prime drivers for sensor fusion technology because they rely on the integrated data of sensors to perceive and interpret the environment correctly. Sensor fusion, which pools LIDAR, radar, and camera sensor information for self-driving systems to make real-time obstacle detections and monitor lane positions besides identify other vehicles, has improved safe and efficient navigation through the system. In this regard, the Autonomous Vehicles Market Size was valued at USD 43.5 billion in 2023 and is projected to reach USD 260.45 billion by 2032 and grow at a CAGR of 22% over the forecast period of 2024-2032.

Countries like the U.S. and Japan are setting aggressive goals because the global markets are moving towards semi-autonomous to fully autonomous driving. It demands robust sensor fusion capability for safety regulation compliance in a country like the United States, where the NHTSA has specified requirements in ADAS. This will continue to grow at a compound annual growth rate of 12.4% through government support and the need for safety in autonomous vehicles.

-

Advances in consumer electronics drive the growth of sensor fusion technology.

RESTRAIN:

-

High costs of sensor fusion systems limit market adoption globally.

Integration of different sensors like radar, LIDAR, and IMU requires highly complex software and hardware. Production costs, therefore, will increase because of these expensive systems, which are considered a main challenge for the automotive industry in general, where safety is mandatory and must not be expensive at the same time. Additional cost is involved with every sensor used for sensor fusion, which further increases the manufacturing costs and eventually is transferred to the consumers, and hence, self-driving or ADAS-equipped vehicles will not be easily accessible in a wider market.

Governments are trying to standardize in regions like Europe and North America, but it may increase costs even more with rigorous safety and compliance measures. Small and medium-sized companies find it extremely difficult to invest in these high-cost sensor fusion solutions, which will further impact their adoption and potential technological advancement for the diverse industries.

SEGMENT ANALYSIS

BY TECHNOLOGY

MEMS technology was the most leading technology in 2023 with a 59% share of the market share. This is due to the fact that it is implemented into compact and power-efficient sensors used in consumer electronics, automotive systems, and industrial automation. MEMS sensors are light in weight and economical yet very appropriate for applications such as smartphones, wearable devices, and portable IoT systems that demand space and power efficiency. MEMS technology has slowly become more adopted because of its increased accuracy in motion as well as environmental sensing in wearable and vehicle ADAS systems.

With the tendency of industries to miniaturize and save power capabilities, MEMS technology would expand with the fastest estimated CAGR of 19.13% from the years 2024 and 2032, wherein its use cases are exponentially growing in the healthcare and automotive sectors and consumer electronics markets.

There is not a very widespread practice about the application of Non-MEMS sensors. Still, in its niche applications in those markets where it was seen necessary to perform efficiently with better robustness performance. There is still need from applications using Non-MEMS sensors based devices for advanced smart industries in Europe and more especially North America where performance levels required in industry, automobiles are of stringent kinds.

BY PRODUCT TYPE

In 2023, IMUs dominated market share, accounting for about 34% as they play critical roles in applications that make use of precise motion detection, a function it provides in autonomously operating vehicles, drone, and robotics. IMUs are crucial devices in providing accurate positioning and orientation data by combining inputs from accelerometers, gyroscope, and magnetometers. They are highly valuable in autonomous navigation systems as well as advanced robotics systems. They have become something of a staple in automotive and aerospace industries due to their high degree of precision and reliability in dynamically changing environments.

IMUs are expected to grow at CAGR of 19.05% from 2024 to 2032, mainly due to increased demand in applications that require smooth motion tracking and real-time positioning. Automotive ADAS, consumer electronics, and drones are some of the high-growth segments for IMUs, where sensor fusion technology is critical for operational accuracy and enhanced functionality. As the world pushes forward toward autonomous systems, IMUs would likely be at the heart of it all with elevated investments in R&D and miniaturization and energy efficiency.

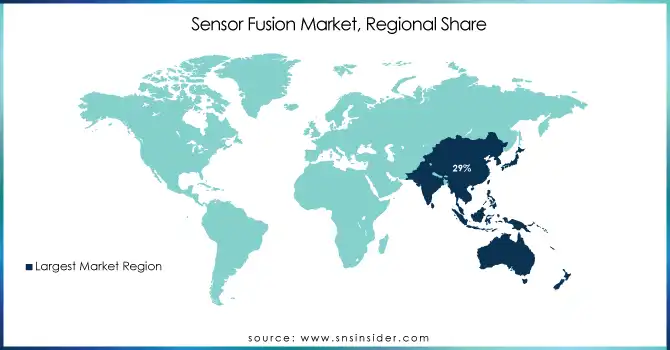

REGIONAL ANALYSIS

Sensor Fusion Market in the Asia Pacific dominated in 2023 with a market share of 29% owing to tremendous advancement in consumer electronics and automotive production. Countries like China, Japan, and South Korea have taken sensor fusion as the top priority in all their developmental strategies of the smart device, automotive, and industrial automation sectors. The governments in these respective countries also encourage sensor invention and integration, where China develops smart manufacturing, and an investment by Japan in automated driving systems has led to increased demand. High demand for smart devices and speedy growth of industries boost sensor fusion technologies in Asia Pacific.

Asia Pacific is expected to grow at the fastest CAGR of 18.92% between 2024 and 2032, mainly because of the fact that consumers show high demand in this region, the government is also trying to put resources into the development of technology, and an increasing manufacturing base for electronic and automotive applications are added factors. Increasing industries will continue to be one of the leading regions in the Sensor Fusion Market as the countries will bring policies forward to encourage the development and integration of the advanced sensor technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS

Some of the major players in the Sensor Fusion Market are

-

Bosch (ADAS, MEMS sensors)

-

InvenSense (gyroscopes, accelerometers)

-

STMicroelectronics (IMUs, magnetometers)

-

NXP Semiconductors (radar sensors, LIDAR sensors)

-

Analog Devices (accelerometers, pressure sensors)

-

TDK Corporation (MEMS microphones, IMUs)

-

Texas Instruments (ultrasonic sensors, radar sensors)

-

Infineon Technologies (image sensors, radar sensors)

-

Continental AG (ADAS systems, radar sensors)

-

Denso Corporation (LIDAR sensors, image sensors)

-

Honeywell (pressure sensors, MEMS sensors)

-

Kionix (gyroscopes, accelerometers)

-

Sensata Technologies (position sensors, temperature sensors)

-

Qualcomm (IMUs, image sensors)

-

Robert Bosch GmbH (MEMS sensors, IMUs)

-

Murata Manufacturing (pressure sensors, gyroscopes)

-

Maxim Integrated (temperature sensors, accelerometers)

-

Omnivision Technologies (image sensors, vision sensors)

-

Aptiv PLC (ADAS systems, radar sensors)

-

Panasonic Corporation (gyroscopes, accelerometers)

MAJOR SUPPLIERS (Components, Technologies)

-

Micron Technology (Memory Solutions, DRAM)

-

Corning Inc. (Glass for Sensor Modules, Optical Solutions)

-

3M Company (Electronic Materials, Film Solutions)

-

Murata Manufacturing (Ceramic Capacitors, Crystal Oscillators)

-

Skyworks Solutions (RF Components, Filters)

-

Texas Instruments (Semiconductors, Processors)

-

Analog Devices (Signal Processing Solutions, MEMS)

-

Amphenol Corporation (Interconnect Solutions, Fiber Optics)

-

TDK Corporation (Magnetic Components, Power Solutions)

-

ON Semiconductor (Image Sensors, Power Management)

-

Infineon Technologies (Semiconductors, RF Sensors)

-

STMicroelectronics (Microcontrollers, MEMS)

-

Renesas Electronics (Microcontrollers, Power Semiconductors)

-

Samsung Electronics (Memory Chips, Display Solutions)

-

Kyocera Corporation (Ceramic Components, Connectors)

-

Vishay Intertechnology (Resistors, Capacitors)

-

Broadcom Inc. (Wireless Solutions, Fiber Optic Components)

-

Rohm Semiconductor (Diodes, Transistors)

-

Panasonic Corporation (Film Capacitors, Relays)

-

Fujitsu Ltd. (Microelectronics, AI Processors)

MAJOR CLIENTS

-

Automotive OEMs:

-

Toyota

-

Ford

-

General Motors

-

Volkswagen

-

BMW

-

Honda

-

-

Consumer Electronics:

-

Apple

-

Samsung

-

Sony

-

LG

-

Google

-

-

Industrial Automation:

-

Siemens

-

ABB

-

Mitsubishi Electric

-

Honeywell

-

-

Healthcare and Wearables:

-

Philips

-

Medtronic

-

Fitbit

-

Garmin

-

RECENT TRENDS

-

June 2024: GalaxEye has signed an agreement with the iDEX DIO towards designing and developing a multi-sensor fusion processing system, developed for miniaturized satellites that can carry payload upto 150 kg payload with the Indian Air Force. This novel system will bring to the ground station processed information from SAR, EO, IR, and Hyper-spectral sensors.

-

September 2024: Boeing plans to demonstrate sensor fusion technology, an idea that could be used to enhance military situation awareness through the confluence of data coming from airborne and space-based sensors, according to a top executive. Sensor data will be delivered both on the ground and inside cockpits, according to Boeing Space, Intelligence & Weapon Systems Vice President and General Manager Kay Sears.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.86 Billion |

| Market Size by 2032 | USD 31.91 Billion |

| CAGR | CAGR of 18.65 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (MEMS, Non-MEMS), • By Offering (Hardware, Software), • By Product Type (Radar Sensors, Image Sensors, IMU, Temperature Sensors, Others), • By End User (Automotive, Healthcare, Consumer Electronics, Military & Defense, Industrial, Others), • By Algorithms (Kalman Filter, Bayesian Filter, Central Limit Theorem, Convolutional Neural Networks) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bosch, STMicroelectronics, TDK Corporation, Texas Instruments, Invensense, Analog Devices, Murata Manufacturing, NXP Semiconductors, Infineon Technologies, Sensata Technologies, Honeywell International, TE Connectivity, Renesas Electronics, Qualcomm, Panasonic Corporation, Sony Semiconductor, Samsung Electronics, Broadcom Inc., Continental AG, ZF Friedrichshafen. |

| Key Drivers | • The growing demand for autonomous vehicles is fueling the adoption of sensor fusion. • Advances in consumer electronics drive the growth of sensor fusion technology. |

| Restraints | • High costs of sensor fusion systems limit market adoption globally. |