Parking Sensors Market Report Scope & Overview:

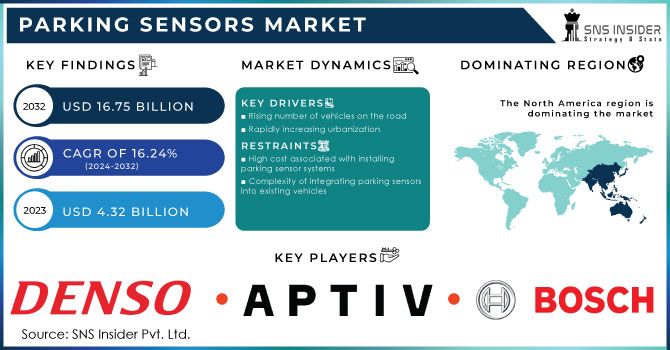

The Parking Sensors Market Size was valued at USD 7.42 Billion in 2023 and is expected to reach USD 26.28 Billion by 2032 and grow at a CAGR of 15.13% over the forecast period 2024-2032. The rise in the adoption of technology in the Parking Sensors Market is attributed to the increasing use of ultrasonic and electromagnetic sensors to detect nearby cars for increased safety. Optimization metrics aim to design multi-task heads and task adjacency to improve the detection accuracy, processing speed, and power consumption of the vehicle while delivering a desired user experience. Tech Supply chain and production metrics focus on optimizing semiconductor production and inventory management to satisfy increasing demand. Adoption and integration metrics showcase the rise of the parking sensors in ADAS and connected vehicle platforms for automation & connectivity and native integration with other safety features.

Get E-PDF Sample Report on Parking Sensors Market - Request Sample Report

Market Dynamics:

Key Drivers

-

Rapid ADAS Adoption and Urbanization Drive Parking Sensors Market Growth with Enhanced Safety and Efficiency

One of the most important factors driving the growth of the parking sensors market is the rapid adoption of advanced driver-assistance systems (ADAS) to increase the safety and comfort of vehicles. Greater penetration of safety features, such as rearview cameras and parking sensors, due to strict government regulations, is a major contributing factor to the market growth. An increase in consumer awareness about vehicle safety and the rapid adoption of autonomous and semi-autonomous vehicles drive the growth of the parking sensors market. Multiple projects over the urbanization resulting in parking space congestion over the excessive number of vehicles on the road will also drive the demand for efficient parking solutions, thereby fuelling market growth.

Restrain

-

Technical Limitations and Cybersecurity Challenges Restrain Parking Sensors Market Growth and ADAS Integration

One of the significant factors that hinder the parking sensors market growth is the technical limitation of the sensors in adverse weather conditions such as heavy rain, snow, and fog, which reduces their precision and accuracy. Besides, electromagnetic noise from other electronic appliances or peripherals also affects the sensor functionalities, causing false alarms or malfunctioning of the system. Manufacturers also face the challenge of integrating parking sensors into advanced driver-assistance systems (ADAS) and ensuring compatibility with a wide range of vehicle models. In addition, issues concerning data privacy and cybersecurity in connected cars could delay the large-scale deployment of smart parking systems.

Opportunity

-

Electric Vehicles and IoT Integration Boost Parking Sensors Market Growth in Emerging Asia-Pacific and Latin America

The upward trend for electric and connected cars and vehicles is providing a lucrative opportunity for the parking sensors market. Parking sensors can be integrated with IoT-enabled systems and vehicle-to-everything (V2X) communication to provide additional capabilities, including remote parking assistance and automated valet parking. Asia-Pacific and Latin America present a unique opportunity for growth with growing automotive sales and the development of infrastructure. In addition to this, improvements in sensors along with the availability of smaller, cheaper, and more accurate sensors have created opportunities for manufacturers to work to expand their product portfolio to meet the needs of the growing automotive market.

Challenges

-

Rapid Tech Advancements and Strict Regulations Challenge Parking Sensors Market Amid High Competition and Innovation

The ever-fast progress of technical advances makes it hard for manufacturers to adapt to changing industrial norms and consumer life. The challenge is to build smaller sensors with higher accuracy, longer ranges, and longer lifetimes. There are also strict safety regulations and certification standards for each region around the world, further complicating the product development process. Furthermore, the market is highly competitive with several significant players present in the market which requires constant innovation and strategic collaborations to retain market share. Industry challenges are compounded by the lack of robust testing and validation processes that demonstrate the reliability and safety of parking sensor systems.

Segment Analysis:

By Technology

The market share for parking sensors was led by Ultrasonic Sensors at 43.6% in 2023. Factors such as cost-effectiveness, ease of installation, and reliable short-range object detection capabilities make them attractive for use in functions like reverse and parking assistance, thus contributing to their popularity in passenger vehicles. Ultrasonic sensors were most widely used in entry-level and mid-range cars, which in turn helped them to maintain their leadership in the market.

Electromagnetic Sensor segment has the fastest CAGR by 2024 to 2032. This enhances its growth by more demand for higher-level ADAS and integration in the latest designs of automobiles. It also makes the car look better since the sensor itself doesn't have physical protrusions to show its presence, which will increase demand for the latter.

By Type

The parking sensors market was led by reverse parking with a whopping share of 53.7% in 2023. This is because of the rising demand for safety-related functions that help reduce the risk of collisions during reversing. The growing safety regulations regarding rearview cameras and parking sensors in passenger vehicles have further led to the growth of reverse parking sensors. Consumers have grown fond of their ability to identify obstacles in blind zones and increase overall driving safety.

The Front Parking segment is projected to have the highest growth from 2024 to 2032. The reason for this growth is the increasing adoption of advanced driver-assistance systems (ADAS) in premium and mid-range cars. Due to the rapid increase in urbanization, parking spaces have become congested, hence, the need for front parking assistance to avoid small collisions and better maneuverability is rising. Moreover, front parking systems adoption is being driven by technological advancement in the manufacturing of sensors which provides a more highly accurate and large range of data.

By Component

In 2023, Sensors occupied the largest revenue share of 48.2% within the parking sensors market. As they are critical to identifying near-field obstructions and securing these vehicles, they lead. For short-range detection, such as in the popular parking assist systems, ultrasonic and electromagnetic sensors are commonly used due to their measurement accuracy. The high demand for passenger vehicles can be attributed to stringent safety regulations and increasing consumer awareness regarding collision avoidance.

Control Modules are projected to develop with the highest CAGR from 2024-2032. This expansion has been fueled by increased processing capabilities and the implementation of AI to improve decision-making. Control modules serve an important function in processing sensor data and delivering real-time information to drivers or automated systems. The increasing popularity of completely autonomous and semi-autonomous vehicles, which need more advanced control systems for safe travel as well as parking, is encouraging demand for sophisticated control modules.

By Sales Channel

The parking sensors market by OEM held a significant share of 62.2% in 2023. The ever-expanding presence of parking sensors as standard safety features in new automobiles–a trend spurred by expanding safety mandates and soaring consumer interest in automated driver-assistance systems (ADAS)–is driving this dominance. OEMs are embedding parking sensors in passenger cars as well as commercial vehicles to achieve safety and convenience, which is contributing to the continued strong share of the OEM market.

The aftermarket is estimated to register the highest growth rate from 2024 to 2032. The increasing trend to upgrade the existing old cars with new and modern parking assistant systems accounts for the growth of the parking assistance system market. With the increasing inclination of consumers towards low-cost solutions for improving vehicle safety and convenience, the aftermarket parking sensors market is expected to feel ample demand in the upcoming years. Furthermore, the aftermarket growth is propelled by the easy-to-install and wireless sensor systems and the rising online sales channels.

By Application

In 2023, Passenger Cars accounted for 68.2% share of the parking sensors market, and they are projected to grow at the highest CAGR over the forecast period. The increasing consumer demand for advanced safety features such as parking assistance systems and collision avoidance technologies, is contributing to this growth. Passenger cars are also projected to face an increase in demand for parking sensors, thanks to rising automotive production and sales, particularly in emerging economies. Along with the penetration of advanced driver-assistance systems (ADAS) powered by sophisticated connectivity technologies in medium to high-end passenger cars, the installation of parking sensors is on a continuous rise. Moreover, the favorable safety regulations, including rearview cameras and parking Sensors in new vehicles, are driving the growth of the market. The growth of this segment is driven by a growing need for improved parking convenience and safety with the increasing urbanization, which has resulted in space-crunched parking spaces.

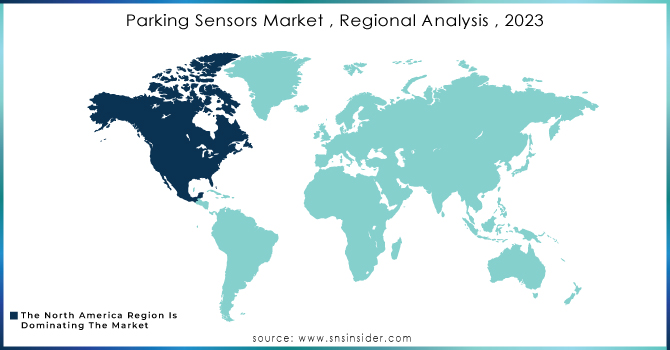

Regional Analysis:

North America held the largest share of the parking sensors market at 41.4% in 2023, owing to the widespread adoption of advanced driver-assistance systems (ADAS) and stringent regulatory requirements for vehicle safety. Due to the decent automotive industry in the region with major manufacturers such as Ford, General Motors, and Tesla extensively using parking sensors in vehicles due to increasing safety and comfort, parking sensors are expected to witness substantial growth. Moreover, the growing consumer preference for high-end cars with advanced safety features drives the market in North America. The increasing acceptance of autonomous and semi-autonomous vehicles also propels the demand for advanced parking sensors in the region.

Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2032, owing to urbanization rates, vehicle sales growth, and rising safety awareness. Rapid developments in automotive production and sales in developing economies such as China, India, and Southeast Asia will spur growth in demand for parking sensors. As expectations increase and costs decline, parking assistance systems are being integrated into more mid-range and premium models from all leading automakers, including Toyota, Hyundai, and Honda. Furthermore, the implementation of government regulations regarding the use of safety features provided in vehicles is fueling the market growth in this region. Increasing growth opportunities for parking sensors due to the growing electric and connected vehicle market in the Asia Pacific.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players:

Some of the major players in the Parking Sensors Market are:

-

Valeo (Beep&Park™, Park Vision™)

-

Pepperl+Fuchs (Inductive Proximity Sensors, Ultrasonic Sensors)

-

Gentex Corporation (Automatic-Dimming Mirrors with Integrated Sensors, Full Display Mirror®)

-

Scheidt & Bachmann (Parking Management Systems, Parking Fee Collection Systems)

-

Vayyar Imaging (Walabot DIY Wall Scanner, Vayyar Care Fall Detection System)

-

Brose Fahrzeugteile (Sensor-Based Door Systems, Liftgate Sensors)

-

Bosch (Park Pilot Ultrasonic Sensors, Rear-View Camera Systems)

-

Continental AG (Advanced Radar Sensors, Surround View Systems)

-

Denso Corporation (Ultrasonic Parking Sensors, Intelligent Parking Assist Systems)

-

Hella (Intelligent Parking Assist Sensors, 24GHz Radar Sensors)

-

Magna International (Rearview Camera Systems, Park Assist Sensors)

-

ZF Friedrichshafen (TRW Parking Sensors, Reversing Cameras)

-

Aptiv (Ultrasonic Park Assist Sensors, Surround View Camera Systems)

-

Mando Corporation (Ultrasonic Parking Assist Sensors, Around View Monitoring Systems)

-

Hyundai Mobis (Parking Assist Systems, Ultrasonic Sensors)

Recent Trends:

-

In October 2024, Valeo and HERE Technologies unveiled the Valeo Smart Safety 360 with Navigation on Pilot, offering advanced automated driving assistance.

-

In December 2024, DENSO Corporation and Onsemi announced an enhanced collaboration to advance autonomous driving (AD) and advanced driver assistance systems (ADAS) technologies.

Parking Sensors Market Report Scope:

Report Attributes Details Market Size in 2023

USD 7.42 Billion

Market Size by 2032

USD 26.28 Billion

CAGR

CAGR of 15.13% From 2024 to 2032

Base Year

2023

Forecast Period

2024-2032

Historical Data

2020-2022

Report Scope & Coverage

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook

Key Segments

• By Technology (Ultrasonic Sensors, Infrared Sensors, Electromagnetic Sensors, Others)

• By Type (Front Parking, Reverse Parking, Others)

• By Component (Sensors, Displays, Control Modules, Others)

• By Sales Channel (Aftermarket, OEM)

• By Application (Passenger Cars, Heavy Commercial Vehicles, Light Commercial Vehicles)Regional Analysis/Coverage

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America)

Company Profiles

Valeo, Pepperl+Fuchs, Gentex Corporation, Scheidt & Bachmann, Vayyar Imaging, Brose Fahrzeugteile, Bosch, Continental AG, Denso Corporation, Hella, Magna International, ZF Friedrichshafen, Aptiv, Mando Corporation, Hyundai Mobis.