360 Degree Camera Market Size Analysis:

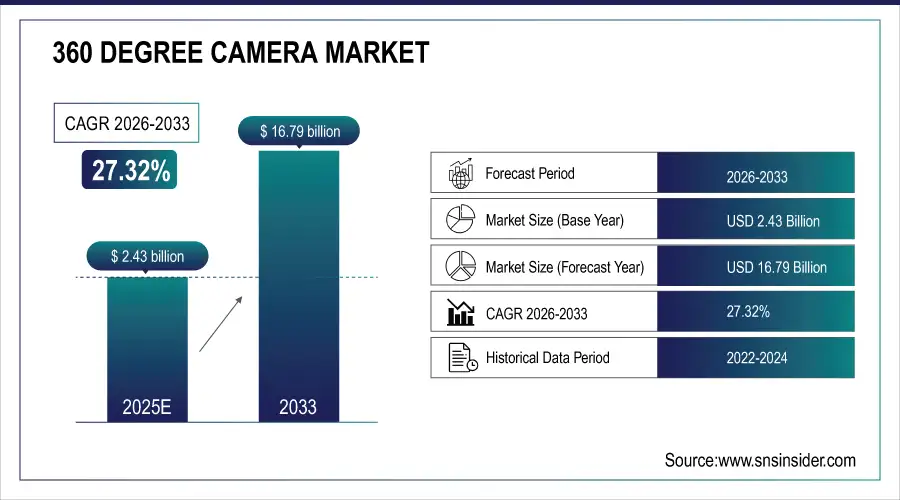

The 360 Degree Camera Market Size is Estimated at USD 2.43 Billion in 2025E and is projected to reach USD 16.79 Billion by 2033, growing at a CAGR of 27.32% during 2026–2033.

The 360 Degree Camera Market analysis report provides a comprehensive overview of camera technologies, connectivity types, resolution advancements and adoption trends across real estate, tourism, education, construction, entertainment and immersive technologies. Rising demand for immersive visual content, increasing use of virtual tours, rapid expansion of VR/AR ecosystems and continuous advancements in AI-driven image processing and LiDAR-enabled depth sensing are expected to drive robust market growth during the forecast period.

360-degree cameras are increasingly deployed across construction sites, real estate projects, tourism destinations and enterprise training environments, enabling immersive visualization, remote collaboration and enhanced decision-making.

360 Degree Camera Market Size and Growth Projection:

-

Market Size in 2025E: USD 2.43 Billion

-

Market Size by 2033: USD 16.79 Billion

-

CAGR: 27.32% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on 360 Degree Camera Market - Request Free Sample Report

360 Degree Camera Market Trends:

-

Rising demand for immersive content across real estate, tourism, education and entertainment is accelerating adoption of 360° cameras, with virtual tours increasing property sales by up to 30%.

-

Integration of AI and LiDAR technologies is enhancing image stabilization, object tracking, depth mapping and resolution, expanding professional and enterprise use cases.

-

Entertainment and gaming industries are key adopters, leveraging 360° cameras for VR storytelling, interactive gameplay and immersive media production.

-

Strong impact of visual marketing continues to drive demand, as 65% of individuals are visual learners and visual content generates 94% more engagement than text-based formats.

-

Education and corporate training sectors are increasingly deploying 360° video simulations to improve learning retention, engagement and remote training efficiency.

-

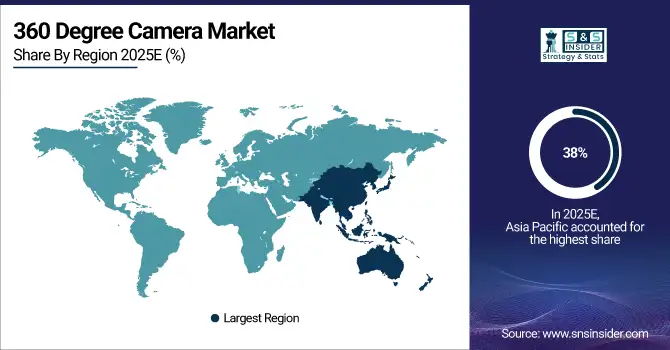

Asia-Pacific is emerging as the fastest-growing region due to expanding smartphone penetration, affordable VR devices, rising virtual tourism adoption and strong social media integration.

U.S. 360-Degree Camera Market Insights:

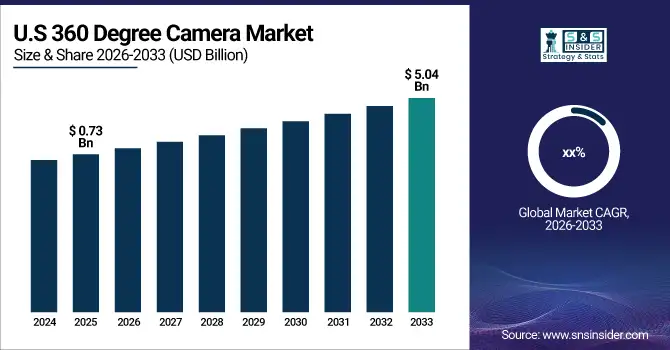

The U.S. 360-Degree Camera Market size is worth USD 0.73 Billion in 2025E and is expected to be valued at USD 5.04 Billion by 2033. According to industry analysis, the key driver of 360-degree camera adoption in the U.S. is the high demand from virtual tours, and automotive safety systems, immersive content creation. Also, according to studies, the integration of 360-degree cameras can improve training effectiveness by around 50% and enhance real estate engagement by more than 60%, further transforming user experience and operational visualization.

360 Degree Camera Market Growth Drivers:

-

Growing Demand for Immersive Visualization Across Construction, Marketing and Virtual Technologies is Driving Market Expansion

The 360 Degree Camera Market is driven primarily by demand for immersive visualization solutions. From construction and real estate to architecture, engineering and marketing, industries are leveraging 360° cameras to enhance project oversight, document processes and engage customers. The construction sector sees professionals at 72% of the market employing 360° cameras on project management, while 54%, used for design visualization, and 51%, for construction monitoring, are also fighting for the other share.

360-degree cameras allow for full coverage of space capturing, backed up by instant on-site view and collaboration to minimize mistakes and boost efficiency. Able to design self-guided virtual tours, platforms, such as CloudPano enable transparency of unofficial buildings, real and aspirational alike, for the better decision making of businesses and would-be tourists. Advancements that are still addressing multiple challenges including limitations related to image quality and a complicated capture & sharing process are cementing adoption further.

Furthermore, the distinct separation between CGI-based virtual reality and real-world 360° video content is fueling demand, where real-world footage captured with 360° cameras provides realistic spatial content, which is critical for true VR/AR l integration. All of the above features combine to make 360-degree cameras essential building blocks in modern digital workflows, which will continue to drive the market up.

360 Degree Camera Market Restraints:

-

Complex System Integration, Synchronization Challenges and High Data Processing Requirements are Restraining Adoption

Significant restraints in the market lie in the high technical complexity related to the integration of 360-degree cameras. These present challenges in hardware-software synchronization, camera calibration to ensure no distortion while stitching, and a choice of interface, such as MIPI vs USB matching available platforms, such as NVIDIA Jetson. Such precise hardware synchronization for real-time apps raises the deployment complexity.

Moreover, with high data transfer requirements, infrastructure restrictions and camera placement constraints, its seamless functioning is limited in areas, such as construction, robotics and live streaming. Despite the huge efficiency and cost advantages that these cameras give, calibration accuracy, system compatibility and data handling must be dealt with in order for these cameras to be widely adopted. While continued advances in technology are slowly addressing these issues, the complexity of the integration is still preventing the fast scaling across industries.

360 Degree Camera Market Opportunities:

-

Expanding Adoption of VR/AR, Virtual Tourism and Enterprise Training Presents Significant Growth Opportunities

The market for 360 degree cameras is expected to grow significantly due to the increasing use of virtual reality, augmented reality, immersive marketing, and enterprise training. Investment in cutting-edge 360° camera solutions is being driven by the growing need for excellent immersive experiences in corporate learning environments, gaming, education, and tourism.

Adoption is anticipated to increase across professional and consumer categories as UHD resolution becomes more accessible and AI-enabled picture enhancement enhances content quality. Long-term growth prospects for camera makers and solution providers are presented by emerging use cases including digital twins, smart cities, virtual exhibitions, and remote inspections.

360 Degree Camera Market Segmentation Analysis:

-

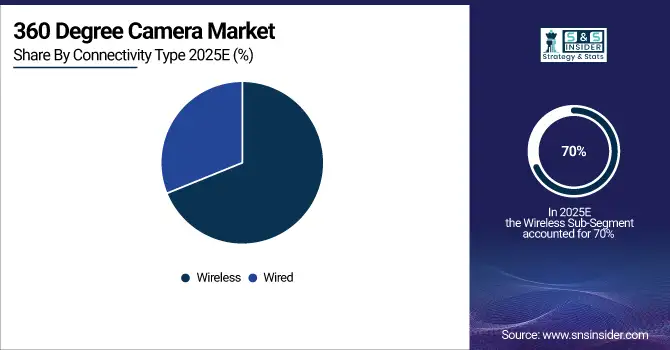

By Connectivity Type, Wireless connectivity dominated the market, accounting for approximately 70% market share in 2024, while wired connectivity is expected to grow at the fastest CAGR during the forecast period.

-

By Resolution, HD resolution held the largest share of around 69% in 2024, while UHD (Ultra-High Definition) is projected to grow at the fastest CAGR through 2025–2032.

By Connectivity Type, Wireless Dominates While Wired Expands Rapidly

Owing to its adaptability, simplicity of deployment, and smooth cloud integration, the wireless sector dominated the market. Wireless cameras are perfect for real estate, tourism, events, and business applications since they allow for remote access, real-time streaming, and easier setup.

Due to the need for reliable, high-quality video streams for professional uses, such as live broadcasting, security, and surveillance, the wired category is expanding at the highest rate. The growing demand for HD and UHD content is supported by wired connectivity, which guarantees consistent performance with no interruption.

By Resolution, HD Dominates While UHD Expands Rapidly

Due to its extensive use in the media, entertainment, and real estate industries, especially in North America and Europe, HD resolution dominated the market in 2024.

The need for better image quality and immersive experiences in gaming, virtual tours, entertainment, and professional content creation is driving the fastest-growing market for UHD resolution. The use of UHD is accelerating internationally due to advancements in sensor technology and falling costs.

Asia Pacific 360 Degree Camera Market Insights:

With a about 38% market share in 2024, Asia Pacific led the 360° camera market thanks to rising smartphone adoption, reasonably priced 360° cameras, and robust digital ecosystems in China, India, Japan, and South Korea. Asia Pacific is currently the fastest-growing global market due to the rapid expansion of tourism, e-learning platforms, and social media content generation, all of which are accelerating the adoption of immersive visual technology.

Get Customized Report as per Your Business Requirement - Enquiry Now

China 360 Degree Camera Market Insights:

China is the biggest market in Asia Pacific due to its extensive consumer electronics manufacturing base, robust smartphone ecosystem, and expanding use of immersive content on social media, e-commerce, and travel platforms. China is positioned to play a significant role in the expansion of the regional market due to the rising demand for virtual property tours, livestreaming, and VR-enabled entertainment, and domestic manufacturing of reasonably priced 360° cameras.

North America 360 Degree Camera Market Insights:

Due to its widespread use in the entertainment, real estate, corporate training, and filmmaking industries, North America held about 28% of the global market share. Stable market growth is sustained by sophisticated VR/AR infrastructure, robust digital marketing adoption, and extensive use of immersive content in business and educational applications.

U.S. 360 Degree Camera Market Insights:

With the help of sophisticated content generation ecosystems, broad VR/AR adoption, and a significant presence of media, entertainment, and real estate firms, the U.S. leads the North American industry. The U.S. is positioned as a major force behind regional market expansion due to the significant demand for virtual tours, immersive marketing, and enterprise training simulations, as well as technical innovation and high consumer expenditure.

Europe 360 Degree Camera Market Insights:

Due to growing use in the real estate marketing, museums, tourism, and creative production sectors, Europe accounted for almost 20% of the global 360-degree camera market. Demand throughout the region is supported by a strong emphasis on data security, professional-grade imaging solutions, and content quality.

Germany 360 Degree Camera Market Insights:

Germany is one of Europe's top markets thanks to its sophisticated industrial infrastructure, robust media and creative sectors, and expanding usage of immersive visualization in manufacturing, real estate, and cultural displays. Germany's contribution to regional development is further strengthened by the use of 360° cameras for digital twins, virtual trade exhibitions, and industrial documentation.

Latin America 360 Degree Camera Market Insights:

Latin America accounted for around 7% of the market, and its use in travel, entertainment, and real estate marketing is growing. Despite issues with infrastructure and cost, the growing usage of affordable 360° cameras by content producers, SMEs, and travel agencies continues to encourage regional market expansion.

Brazil 360 Degree Camera Market Insights:

Due to its robust tourism industry, growing acceptance of digital marketing, and increasing use of immersive content by event planners and real estate developers, Brazil leads the Latin American market. 360° cameras are becoming more widely used in both consumer and business sectors as a result of rising social media involvement and the need for virtual storytelling.

Middle East & Africa 360 Degree Camera Market Insights:

Due to smart city initiatives, premium real estate developments, and extensive tourist initiatives, the Middle East and Africa accounted for around 7% of the global market share. The use of immersive visual technology is still being encouraged by government-led initiatives for digital transformation and tourism promotion.

United Arab Emirates 360 Degree Camera Market Insights:

The UAE leads the Middle East & Africa market, supported by high-end real estate marketing, large tourism projects and smart city initiatives. Strong investment in digital infrastructure, immersive promotional content and virtual property showcasing positions the UAE as a key regional adopter of 360° camera solutions.

360 Degree Camera Market Competitive Landscape:

Nikon Corporation, established in 1917, is a Japan-based multinational specializing in optical products and precision technologies. The company designs and manufactures cameras, imaging systems, microscopes, semiconductor lithography equipment, and industrial metrology solutions, serving consumer, healthcare, and advanced manufacturing industries worldwide.

-

October 2024: Nikon strengthened its photographic innovation capabilities supporting immersive content creation with the release of the Nikkor Z 600mm F6.3 VR S.

Xiaomi Corporation, established in 2010, is a global consumer electronics and smart manufacturing company specializing in smartphones, smart home devices, IoT products, and internet services. The company serves consumers and enterprises worldwide, delivering integrated hardware–software ecosystems that enable connected living, digital convenience, and enhanced user experiences.

-

July 2024: Xiaomi expanded its immersive imaging portfolio with the release of the 360 Home Security Camera 2K, which has panoramic coverage and motion detection driven by AI.

360 Degree Camera Companies are:

-

Denso Corporation

-

Digital Domain Productions

-

Freedom360 LLC

-

GoPro

-

LG Electronics

-

Nikon Corporation

-

PONONO (Professional 360 GmbH)

-

Ricoh

-

Samsung Electronics

-

Vuze Camera

-

Xiaomi Corporation

-

YI Technology

-

Immervision

Key Raw Material & Component Suppliers:

-

Sony Corporation

-

LG Electronics

-

Panasonic Corporation

-

Samsung Electronics

-

Nikon Corporation

-

Canon

-

Sharp Corporation

-

Omnivision Technologies

-

STMicroelectronics

-

Qualcomm

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.43 Billion |

| Market Size by 2033 | USD 16.79 Billion |

| CAGR | CAGR of 27.32 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Connectivity Type (Wired, Wireless) • By Resolution (HD, UHD) • By Verticals (Automotive, Commercials, Military, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | 360fly, Denso Corporation, Digital Domain Productions, Freedom360 LLC, GoPro, Insta360, LG Electronics, Nikon, PONONO, Ricoh, Samsung Electronics, Vuze Camera, Xiaomi, YI Technology, and Immervision are key players in the 360-degree camera market. |