Head-Up Display Market Size & Overview

Get More Information on Head-Up Display Market - Request Sample Report

The Head-Up Display Market Size was valued at USD 1.15 billion in 2023 and will reach USD 4.72 billion by 2032 and grow at a CAGR of 17% by 2024-2032

Head-Up Displays (HUDs) are very crucial for safety as they project essential information like speed, navigation, and warnings directly onto the windshield, keeping drivers informed without compromising their focus on the road.

This keeps drivers' eyes focused on the road, reducing distraction and reaction times, leading to safer journeys. The rise of advanced driver-assistance systems (ADAS) and autonomous vehicles is fueling Head-Up Display adoption. As cars become more automated, seamlessly integrating sensor data, navigation cues, and safety alerts onto a HUD becomes crucial. This trend is mirrored in aviation, where advanced HUDs are being developed to display critical flight information and enhance pilot situational awareness.

The advancements in Head-Up Display technology are creating new possibilities. Augmented Reality (AR) HUDs are gaining traction, overlaying virtual objects onto the real world to provide even more intuitive information display. The AR-HUD highlighting pedestrians crossing the street or displaying turn-by-turn navigation arrows directly on the road ahead. Cost remains a factor, with complex AR-HUD systems adding to vehicle prices. The safety regulations regarding projected content and potential driver distraction need to be carefully considered.

MARKET DYNAMICS:

KEY DRIVERS:

-

HUDs in both cars and aircraft improve situational awareness by displaying critical information in the driver's or pilot's line of sight.

The Head-Up Displays (HUDs) are emerging as a transformative technology. They function by projecting essential information directly onto the windshield of a car or the transparent display within an aircraft cockpit. This crucial data, encompassing speed, navigation guidance, and critical warnings, remains constantly within the driver's or pilot's field of view. This eliminates the need to divert attention to instrument panels or traditional navigation systems, significantly enhancing situational awareness. For drivers, this translates to quicker reaction times and a reduced risk of accidents. The pilots benefit from improved awareness of their surroundings and critical flight parameters, leading to safer and more efficient air travel. As advancements in HUD technology continue, we can expect even greater integration with other onboard systems, further solidifying their role as a cornerstone of modern transportation safety.

-

Augmented reality (AR) HUDs overlay virtual objects onto the real world, offering a more intuitive and user-friendly information experience.

RESTRAINTS:

-

Complex AR-HUD systems can significantly increase vehicle or aircraft production costs.

-

Achieving high brightness and resolution for clear visibility can lead to increased power consumption in vehicles.

Balancing clear visibility with efficient power consumption in vehicles proves to be a hurdle. Achieving high brightness and resolution for optimal viewing can lead to increased power draw. This becomes a concern especially for car manufacturers striving for better fuel efficiency. The safety regulations regarding projected content and potential driver distraction require careful consideration. Striking a balance between functionality and responsible use is crucial.

OPPORTUNITIES:

-

The development of affordable and easy-to-install after-market HUDs can broaden market reach and cater to a wider range of vehicles.

-

Improvements in microLEDs, microdisplays, and holographic projections can create even more compact, high-resolution, and visually appealing HUDs.

CHALLENGES:

-

Raising consumer awareness and building trust in HUD technology is crucial for achieving broader market adoption.

KEY MARKET SEGMENTS:

by Type

-

Fixed Mounted

-

Helmet Mounted

Fixed Mounted is the dominating sub-segment in the Head-Up Display Market by type. This is primarily due to its widespread adoption in the automotive industry, the largest application segment for HUDs. Fixed-mounted HUDs are integrated directly into the vehicle's dashboard, projecting information onto the windshield. This permanent placement offers several advantages, including better image clarity, ease of use, and compatibility with a wider range of vehicle models. While helmet-mounted HUDs are finding niche applications in aviation and personal use, their limited adoption in the high-volume automotive sector keeps them in the secondary position.

by Component

-

Combiner

-

Video Generator

-

Projector Unit

Combiners is the dominating sub-segment in the Head-Up Display Market by component. These transparent elements are positioned in the driver's line of sight and reflect the projected HUD image onto the windshield. The dominance of combiners stems from their critical role in ensuring a clear, high-quality image for the driver. Advancements in combiner technology, such as holographic combiners offering a wider field of view and improved clarity, are further solidifying their position in the market. Video generators and projector units, while crucial components, play a more supporting role in the overall HUD functionality.

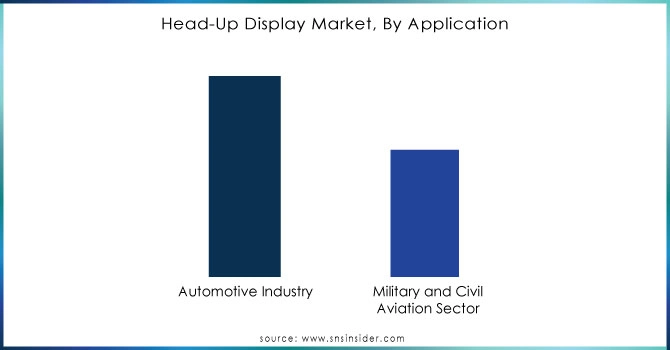

by Application

-

Automotive Industry

-

Military and Civil Aviation Sector

Automotive Industry is the dominating sub-segment in the Head-Up Display Market by application holding around 60-65% of market share. The increasing focus on driver safety, coupled with the growing adoption of ADAS features, is fueling the demand for HUDs in cars. These displays provide drivers with crucial information without taking their eyes off the road, enhancing safety and convenience. While the military and civil aviation sectors also utilize HUDs, their application is on a smaller scale due to the more specialized nature of these vehicles and the higher cost associated with integrating complex HUD systems.

Get Customized Report as per Your Business Requirement - Request For Customized Report

by Technology

-

CRT-based HUD

-

Digital HUD

Digital HUDs is the dominating sub-segment in the Head-Up Display Market by technology holding around 65-70% of market share. The digital HUD segment is rapidly outpacing its CRT-based counterpart. This shift is driven by the numerous advantages offered by digital technology. Digital HUDs offer superior image quality, resolution, and brightness compared to CRT displays. Additionally, they are lighter, more compact, and consume less power, making them ideal for modern vehicles. The ability of digital HUDs to integrate seamlessly with advanced driver-assistance systems and display a wider range of information further cements their dominance in the market.

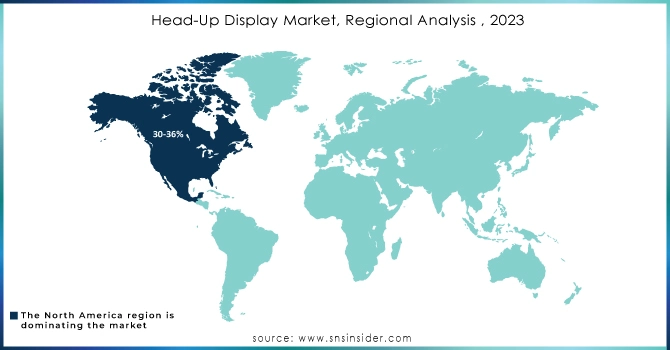

REGIONAL ANALYSES

The North America is the dominating region in the Head-Up Display (HUD) Market holding around 30-36% of market share, driven by a thriving automotive market demanding premium features, a strong presence of leading technology companies investing heavily in HUD R&D, and supportive government regulations prioritizing driver safety features.

The Asia Pacific is experiencing the rapid growth fueled by a burgeoning middle class demanding advanced vehicles with features like HUDs. Government initiatives promoting electric vehicles and ADAS further bolster this growth, along with a focus on domestic automotive production. These emerging economies are also transforming into major automotive hubs, attracting investments and production of advanced vehicles that often include HUDs.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Hudway (U.S.), Penny AB (Sweden), Robert Bosch GMBH (Germany), Denso Corporation (Japan), Micro Vision Inc. (U.S.), Yazaki Corporation (Japan), BAE Systems Inc. (U.K.), Honeywell Aerospace (U.S.), Visteon Corporation (U.S.), Continental AG (Germany), Esterline Technologies Corporation (U.S.), Nippon Seiki Co. Ltd (Japan), Saab Automobile AB (Sweden) and other key players.

RECENT DEVELOPMENT

-

In Jan. 2024: Air Canada signed a multi-year deal with Airbus to modernize the cockpits of up to 76 A320 planes. The upgrades include advanced displays, Head-Up Displays (HUDs), and various avionics systems. This will enhance pilot situational awareness and improve overall fleet performance.

-

In Jan. 2024: German automaker BMW announced the all-electric iX3 refresh, featuring a next-generation head-up display. This 2025 model will be built on the new Neue Klasse platform.

-

In Dec. 2023: The Federal Aviation Administration greenlit a wearable head-up display system for Boeing 737NGs. This AerAware EFVS, developed by a collaboration between Universal Avionics and AerSale, marks the first certified system of its kind.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.15 Billion |

| Market Size by 2032 | US$ 4.72 Billion |

| CAGR | CAGR of 17% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Fixed Mounted, Helmet Mounted) • by Component (Combiner, Video Generator, Projector Unit) • by Application (Automotive Industry, Military and Civil Aviation Sector) • by Technology (CRT-based HUD, Digital HUD) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hudway (U.S.), Penny AB (Sweden), Robert Bosch GMBH (Germany), Denso Corporation (Japan), Micro Vision Inc. (U.S.), Yazaki Corporation (Japan), BAE Systems Inc. (U.K.), Honeywell Aerospace (U.S.), Visteon Corporation (U.S.), Continental AG (Germany), Esterline Technologies Corporation (U.S.), Nippon Seiki Co. Ltd (Japan) and Saab Automobile AB (Sweden). |

| Key Drivers | • The market is growing because of the increased safety provided by head-up displays. • The head-up display market is expected to be transformed by advances in augmented reality technologies. |

| RESTRAINTS | • The negative impact of the COVID 19 epidemic is a major limitation for the head-up display market. • The limitations of space in automotive cockpits for AR-based head-up displays. |