Automotive Brake Valve Market Report Scope & Overview:

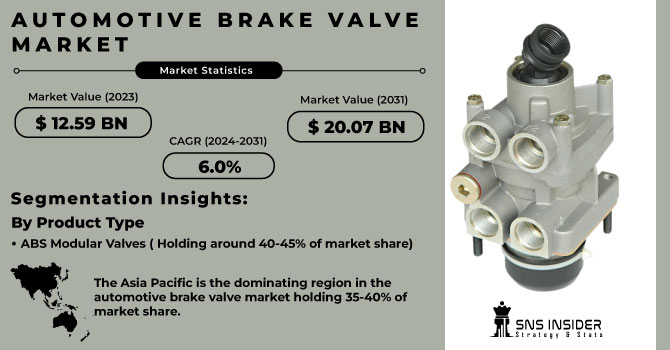

The Automotive Brake Valve Market size was valued at USD 12.59 billion in 2023 and is expected to reach USD 20.07 billion by 2031 and grow at a CAGR of 6% over the forecast period 2024-2031.

The automotive brake system's functionality and safety hinge on the brake valve. This valve plays a crucial role in managing hydraulic pressure and distributing braking force. By regulating pressure, the brake valve ensures efficient transmission of pedal force to the braking components, preventing uneven wear and extending the system's lifespan. The automotive brake valve market is increasing stringency of safety regulations worldwide. Governments and international organizations prioritize improved vehicle safety standards to decrease accidents and fatalities. As these regulations tighten, automotive brake valves, vital to braking system function, experience high demand from manufacturers striving for compliance. The automotive sector's relentless innovation has led to advancements in braking system technologies. Electronic Brake Systems (EBS) and Anti-lock Braking Systems (ABS) are now commonplace in modern vehicles, necessitating more sophisticated brake valves for optimal performance.

Get E-PDF Sample Report on Automotive Brake Valve Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Evolving Braking Technologies Drive Demand for Advanced Automotive Brake Valves

Technological advancements are revolutionizing automotive braking systems. Electronic Brake Systems (EBS) and Advanced Driver Assistance Systems (ADAS) are now standard in many vehicles. These systems necessitate compatible brake valves for seamless integration. The automotive industry's relentless pursuit of performance, efficiency, and intelligent braking systems drives research and development in the brake valve market. This focus ensures ongoing innovation in valve design to meet the evolving needs of modern braking technology.

-

Industry Collaboration Drives Innovation in Automotive Brake Valve Technology

RESTRAINTS:

-

The complexity of advanced brake valve technology can strain research and development budgets.

-

Expensive brake valves may not be affordable for manufacturers of budget-friendly cars.

OPPORTUNITIES:

-

Developing brake valves that seamlessly integrate with next-generation Electronic Brake Systems (EBS) and Advanced Driver-Assistance Systems (ADAS).

-

Utilizing lighter and more durable materials to reduce weight and enhance fuel efficiency.

CHALLENGES:

-

Alternative Braking Technologies Challenge Traditional Automotive Brake Valve Market

-

Integrating Brake Valves with Evolving Electric and Hybrid Vehicle Architectures

The industry's shift towards electric and hybrid platforms necessitates brake valve manufacturers to adapt. These new vehicle structures present unique requirements, and developing compatible brake valve systems demands constant innovation. Manufacturers must address potential compatibility issues to ensure their valves function seamlessly with the latest automotive technologies.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has significantly disrupted the automotive brake valve market. Ukraine's role as a key supplier of wiring harnesses, vital components in brake valve systems, has been delayed by halted production and transportation. This could lead to a short-term production decline of 15-20% for brake valves globally. The sanctions on Russia have limited access to steel and aluminium, essential raw materials. This, along with wartime inflation, is expected to cause a 5-10% price increase for brake valves. The overall disruption to the automotive supply chain, including the lack of brake valve components, is forcing major car manufacturers to slow down production lines. This slowdown could result in a market contraction of around 7-10% showcasing the bad effect of the conflict on the global automotive brake valve market.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown impacts the automotive brake valve market. Consumer spending might limit, leading to a 5-10% decline in car sales and a corresponding drop in demand for new brake valve installations. To brace for lower sales, car manufacturers could adjust production lines, potentially causing a 7-10% decrease in brake valve demand and temporary inventory gluts for manufacturers. The aftermarket won't be spared either, with a predicted 3-5% decline in replacement brake valve demand as consumers delay car maintenance. With a looming market contraction of around 5-10%, the automotive brake valve industry must adapt to navigate these challenging economic conditions.

KEY MARKET SEGMENTS:

By Product Type:

-

Combination Valves

-

Quick Release Valves

-

Metering Valves

-

ABS Modular Valves

-

Foot & Hand Valves

-

Parking Brake Valves

-

Emergency Valves

-

Check Valves

-

Spring valves

-

Proportional valves

ABS Modular Valves is the dominating sub-segment in the Automotive Brake Valve Market by product type holding around 40-45% of market share. The growing adoption of Anti-Lock Braking Systems (ABS) in modern vehicles is driving the demand for ABS modular valves. These valves integrate various functionalities within a single unit, simplifying system design and enhancing braking performance.

By Vehicle Type:

-

Compact Cars

-

Mid-Sized

-

Luxury Cars

-

SUVs

-

HCVs

-

LCVs

Mid-Sized & SUVs are the dominating sub-segments in the Automotive Brake Valve Market by vehicle type holding around 55-60% of market share. Rising global sales of mid-sized cars and SUVs, particularly in emerging markets, are propelling the demand for brake valves in this segment. These vehicles often come equipped with advanced braking systems, requiring sophisticated brake valve technologies.

By Material Type:

-

Steel

-

Copper

-

Brass

-

Alloys

Steel is the dominating sub-segment in the Automotive Brake Valve Market by material type holding around 60-65% of market share. Steel offers a robust combination of strength, durability, and affordability, making it the preferred material for most brake valve applications. However, advancements in lightweight materials like aluminium alloys are gaining traction for specific performance-oriented vehicles.

By Sales Channel:

-

OEM

-

Aftermarket

OEM is the dominating sub-segment in the Automotive Brake Valve Market by sales channel holding around 65-70% of market share. OEMs directly integrate brake valves into new vehicle production lines, accounting for the larger market share. However, the aftermarket segment for brake valve replacements and repairs is expected to grow steadily due to the increasing global vehicle parc (number of vehicles in operation).

REGIONAL ANALYSIS:

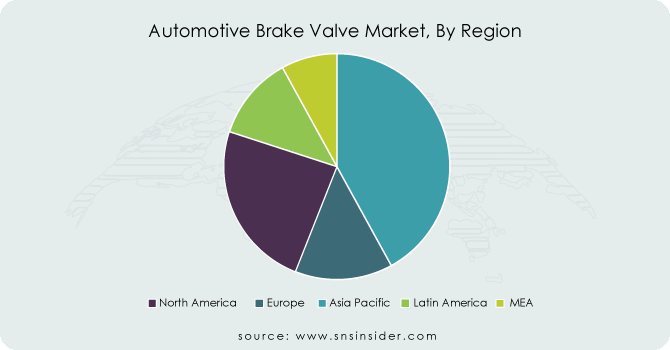

The Asia Pacific is the dominating region in the automotive brake valve market holding 35-40% of market share. This dominance stems from its position as a manufacturing powerhouse for passenger cars, particularly mid-sized sedans and SUVs. Fueled by economic growth and rising consumer spending in giants like China and India, the demand for vehicles with advanced braking systems surges, driving the need for sophisticated brake valve technology.

Europe follows is the second highest region in this ,market due to its rich heritage in high-performance car manufacturing. These vehicles necessitate top-tier brake valves to handle their advanced braking systems.

North America is experiencing the fastest growth with CAGR of 8-10% due to a renewed interest in muscle cars, sports cars, and performance upgrades. This trend, coupled with rising vehicle production and consumer preference for features like ABS and EBD, accelerates the demand for advanced brake valve technology in the region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Continental AG (Germany), Hitachi Ltd. (Japan), WABCO (Belgium), Delphi Automotive (U.K.), Denso Corporation (Japan), Knorr-Bremse AG (Hungary), WABCO (Belgium), Eaton Corporation Plc (Ireland), Sundoz Co., Ltd (Taiwan), Alfmeier precision SE (Germany), Federal-Mogul Holdings Corp. (USA), MAHLE GmbH (Germany), EBS Aftermarket Group Limited (UK), Poclain Hydraulics (France) and other key players.

Hitachi Ltd. (Japan)-Company Financial Analysis

RECENT DEVELOPMENT

-

In March 2023: ZF showcased its innovative brake-by-wire technology designed specifically for heavy-duty vehicles in mining, off-highway, and agricultural applications. This system replaces traditional hydraulic lines with electronic controls, offering improved control and paving the way for future autonomous operation.

-

In June 2023: Continental and Nisshinbo's new partnership establishes a plant for valve block production, increasing the use of locally-sourced parts within electronic braking systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.59 Billion |

| Market Size by 2031 | US$ 20.07 Billion |

| CAGR | CAGR of 6% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Combination Valves, Quick Release Valves, Metering Valves, ABS Modular Valves, Foot & Hand Valves, Parking Brake Valves, Emergency Valves, Check Valves, Spring valves, Proportional valves) • By Vehicle Type (Compact Cars, Mid-Sized, Luxury Cars, SUVs, HCVs, LCVs) • By Material Type (Steel, Copper, Brass, Alloys) • By Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG (Germany), Hitachi Ltd. (Japan), WABCO (Belgium), Delphi Automotive (U.K.), Denso Corporation (Japan), Knorr-Bremse AG (Hungary), WABCO (Belgium), Eaton Corporation Plc (Ireland), Sundoz Co., Ltd (Taiwan), Alfmeier precision SE (Germany), Federal-Mogul Holdings Corp. (USA), MAHLE GmbH (Germany), EBS Aftermarket Group Limited (UK), Poclain Hydraulics (France) |

| Key Drivers | • Evolving Braking Technologies Drive Demand for Advanced Automotive Brake Valves • Industry Collaboration Drives Innovation in Automotive Brake Valve Technology |

| Restraints | • The complexity of advanced brake valve technology can strain research and development budgets. • Expensive brake valves may not be affordable for manufacturers of budget-friendly cars. |