Automotive Data Management Market Report Scope & Overview:

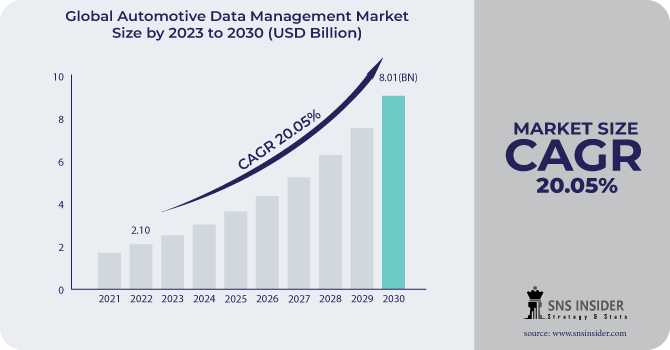

The Automotive Data Management Market size is expected to reach USD 8.01 Bn by 2030, the market was valued at USD 2.10 Bn in 2022 and will grow at a CAGR of 20.05% over the forecast period of 2023-2030.

Modern vehicles come with telematics systems that gather and communicate information about the operation, location, and driving habits of the vehicle. Cloud-based technologies are frequently used to send this data for management and analysis. Through the use of sensors, cameras, GPS, and onboard computers, vehicles produce enormous volumes of data. This data consists of details on car diagnostics, driving habits, traffic situations, and other things. To maintain its dependability and accessibility, automotive data must be securely kept, frequently in the cloud or in data centers. Regulations governing data privacy and security should be taken into account while developing data storage systems. Data cleaning, organization, and preparation for analysis are all part of data processing. Making sense of the enormous amount of raw data provided by cars requires the completion of this step.

Get More Information on Automotive Data Management Market - Request Sample Report

To gain insights that can enhance vehicle performance, safety, fuel efficiency, and user experience, automotive data is studied. To extract useful information from data, advanced analytics techniques like machine learning and artificial intelligence are frequently used. Automotive data can be used to forecast when a vehicle or one of its parts may require maintenance or repair. This can improve safety, cut down on downtime, and save maintenance costs. Data is used by vehicle manufacturers and service providers to provide users with linked services. This covers functions including over-the-air software updates, remote vehicle monitoring, and real-time traffic updates. Automotive data is essential to fleet management because it enables companies to optimize routes, track driver behaviour, and cut operating costs.

Market Dynamics:

Driver

-

The rising trend of connected cars in automotive industry.

With cellular or Wi-Fi connectivity, connected automobiles can connect to the internet and communicate with other servers and devices. Many sophisticated functions are built on top of this connectivity. Modern vehicles are equipped with high-tech infotainment systems, such Apple CarPlay and Android Auto, that enable streaming media, navigation, and smartphone connectivity. For passengers, these gadgets offer entertainment and convenience. Telematics systems in linked cars gather and communicate information on the operation, location, and driving style of the vehicle. Diagnostics, maintenance warnings, and fleet management all make use of this data.

Restrain

-

The rising cyberthreats

Opportunity

-

The rising production of vehicles post pandemic.

Artificial intelligence (AI) and machine learning algorithms are at the core of autonomous driving systems. cars may now learn from their experiences and make judgments in real time using information from sensors, maps, and other cars thanks to advancements in AI. For precise navigation, autonomous cars utilize high-definition maps. Real-time map updates, crowd-sourced data, and improved mapping of complicated situations like urban areas are examples of innovations in mapping technology. Computer vision systems have been substantially enhanced by deep learning techniques, making it possible for vehicles to perceive and comprehend their surrounding surroundings more accurately. This is essential for spotting people on foot, other cars, traffic signs, and lane lines.

Challenge

-

Lack of adaptation and the constrains related to infrastructure

An ethical and legal difficulty in data management is getting explicit, informed agreement from vehicle owners and users for data collection and utilization. To guarantee that data is managed responsibly and in accordance with rules, it is crucial to have strong data governance procedures and policies. For some organizations, it might be difficult to develop and retain the requisite data analytics capabilities and knowledge to extract useful insights from automobile data.

Impact of Recession

Businesses frequently reduce their funding for research and development during recessions. This might have an effect on the development of data management and analytics solutions for the automotive industry, slowing down progress in the area. Due to resource limitations, businesses may need to prioritize some types of data over others. Non-essential data may not always take precedence over critical data relating to vehicle safety, maintenance, and regulatory compliance. Businesses may scrimp on cybersecurity measures as a result of budgetary constraints, which could increase the danger of data breaches or cyberattacks on automobile data.

Impact of Russia Ukraine War:

Some automakers might have cloud infrastructure or data centers based in or connected through conflict-affected areas. The availability and dependability of data management services can be impacted by disruptions in data center operations. Geopolitical tensions and online threats may make it more likely that automotive data systems may be the target of hackers. It becomes extremely important to protect data and the infrastructure that manages data from potential attackers. Geopolitical developments may have an impact on data privacy laws and data sovereignty needs. Companies might need to reevaluate their adherence to national and international data transfer agreements as well as local data protection legislation.

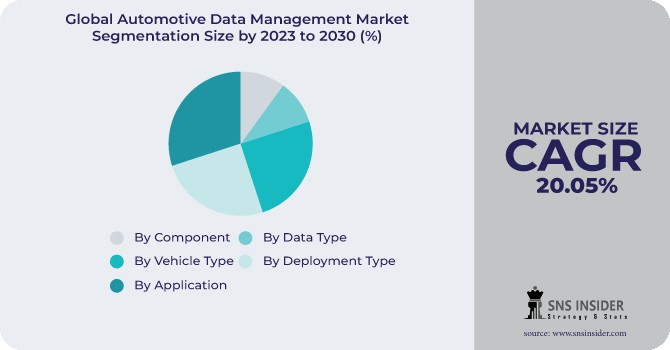

Market Segmentation

By Component

-

Software

-

Service

By Data Type

-

Structured

-

Unstructured

By Vehicle Type

-

Autonomous

-

Non-Autonomous

By Deployment Type

-

On-Premise

-

Cloud

By Application

-

Predictive Maintenance

-

Warranty Analytics

-

Others

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Coverage

North America

- US

- Canada

- Mexico

Europe

- Eastern Europe

- Poland

- Romania

- Hungary

- Turkey

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Switzerland

- Austria

- Rest of Western Europe

Asia Pacific

- China

- India

- Japan

- South Korea

- Vietnam

- Singapore

- Australia

- Rest of Asia Pacific

Middle East & Africa

- Middle East

- UAE

- Egypt

- Saudi Arabia

- Qatar

- Rest of Middle East

- Africa

- Nigeria

- South Africa

- Rest of Africa

Latin America

- Brazil

- Argentina

- Colombia

- Rest of Latin America

Regional Analysis

North America region will have the highest share because U.S. in particular is a prominent centre for the administration of vehicle data in North America. The demand for data management solutions is fuelled by the region's robust automotive industry and leadership in the development of autonomous vehicles.

In terms of data management and automotive technology, nations like Germany, France, and the United Kingdom are leading the way. In this region, data collection, storage, and use are impacted by strict data privacy laws like GDPR. Despite not being as developed as Western Europe, the region's automotive industry is growing, and as a result, more and more Eastern European nations are implementing automotive data management strategies.

APAC region will have the highest CAGR growth rate because the automobile market in China is expanding quickly, with an emphasis on electrified and connected vehicles. The demand for data management services is being fuelled by the government's promotion of smart transportation and data-driven solutions. Japan is renowned for its automobile industry innovation, which includes data management. Japanese automakers are implementing data-driven strategies to improve car safety and performance.

Key Players

The major key players are Sibros Technologies, Azuga, Microsoft, SAP SE, IBM, Amazon Web Services, Otonomo, AGNIK, Procon Analytics, Xevo and others.

Sibros Technologies-Company Financial Analysis

| Report Attributes | Details |

| Market Size in 2022 | US$ 2.01 Bn |

| Market Size by 2030 | US$ 8.01 Bn |

| CAGR | CAGR of 20.05 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Service), • By Data Type (Structured, Unstructured), • By Vehicle Type (Autonomous, Non-Autonomous), • by Deployment, • by Application |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Cargo Carriers, UPS, FedEx, Ceva Holdings, Tuma Transport, Swift Transport, Interlogix, Transtech Logistics Procet, Concargo and others. |

| Key Drivers | • The rising trend of connected cars in automotive industry. |

| Market Restraints | • Lack of adaptation and the constrains related to infrastructure |