Airless Tires Market Report Scope & Overview:

Get more information on Airless Tires Market - Request Sample Report

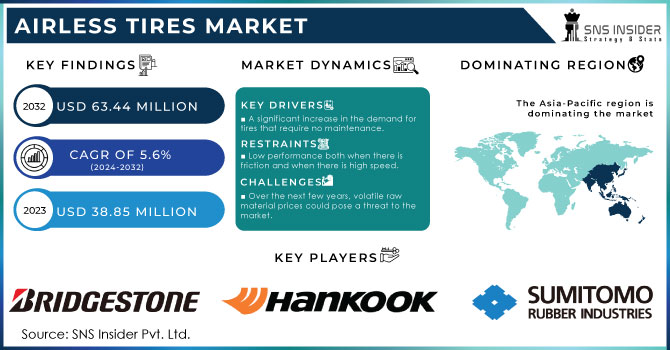

The Airless Tires Market Size was valued at USD 38.85 million in 2023 and is expected to reach USD 63.44 million by 2032 and grow at a CAGR of 5.6% over the forecast period 2024-2032.

The automotive tire is an essential component of every vehicle since it protects and comforts the driver and passengers. The primary purpose of the tire is to act as a barrier between the wheel rim and the road surface, so preventing any damage to the wheel. Because the support provided by an airless tire does not depend on air pressure, this type of tire is also known as a non-pneumatic tire (NPT) or a flat-free tire. Because this type of tire does not require air pressure, there is no longer a need to periodically add air to the tires. Because it is made of rubber, it functions as a cushion that is both flexible and resilient, mitigating the effect of vibrations and absorbing the shock that the automobile causes. Solid or non-pneumatic tires, which do not rely on air pressure, are alternate names for airless tires. They are typically made of plastic or rubber, although 3D printing is also being used in their production.

In 2023, The Smart Tire Concept was revealed by Sumitomo Rubber Industries, Ltd. (Sumitomo Rubber). Despite the fact that the economic climate in which the automotive industry operates is undergoing massive shifts as a result of environmental concerns as well as the development of artificial intelligence and the Internet of Things, this new technology development concept has as its goal the production of tires that offer even greater levels of safety and environmental performance.

MARKET DYNAMICS:

KEY DRIVERS:

-

A significant increase in the demand for tires that require no maintenance.

-

As all-terrain and military vehicle demand grows, the market for airless tires is likely to expand.

-

The market for two-wheeler tires with plastic spokes will rise if more recycled plastic.

-

Demand for fuel-efficient tires is rising.

The surge in environmental consciousness and a growing emphasis on sustainable practices have fuelled an unprecedented increase in the demand for fuel-efficient tires. As society becomes increasingly aware of the ecological impact of everyday choices, consumers are gravitating towards products that align with their commitment to reducing carbon footprints. This burgeoning demand for fuel-efficient tires signifies a pivotal shift in the automotive industry, where efficiency and environmental responsibility converge. Manufacturers are responding by pushing the boundaries of tire technology, developing innovative designs that not only enhance fuel economy but also contribute to a greener and more sustainable future.

RESTRAINTS:

-

Low performance both when there is friction and when there is high speed.

-

High capital investment for new manufacturing facilities will limit market expansion.

-

The market's expansion is expected to be hampered by high manufacturing costs.

OPPORTUNITIES:

-

Plastics' greater capacity to be recycled.

-

Electric car usage is expected to boost the airless tire industry in the future years.

-

The use of advanced materials in new technologies is expected to open up a lot of market opportunities.

The fusion of nanotechnology, biotechnology, and smart materials not only amplifies the performance of existing technologies but also lays the groundwork for novel applications. As this wave of innovation sweeps across diverse sectors, from electronics to healthcare and energy, the marketplace becomes a dynamic canvas where adaptability and ingenuity thrive. The strategic adoption of advanced materials becomes not merely a choice but a pivotal strategy for businesses seeking to ride the crest of this transformative tide, unlocking doors to unprecedented market landscapes.

CHALLENGES:

-

Over the next few years, volatile raw material prices could pose a threat to the market.

-

The impact on the supply chain can make the market vulnerable to disruption.

Impact of Russia Ukraine War:

The Russia-Ukraine war has sent shockwaves through various industries, and the airless tires market is no exception. As geopolitical tensions escalate, global supply chains face unprecedented challenges, impacting the production and distribution of airless tires. The conflict has disrupted the flow of raw materials, leading to shortages and price fluctuations. Additionally, the uncertainty surrounding the situation has created a cautious atmosphere among key players in the market, affecting investment decisions and strategic planning. The airless tires sector, known for innovation and sustainability, now grapples with the dual challenge of adapting to the geopolitical landscape and maintaining its commitment to environmental consciousness. The war has underscored the vulnerability of interconnected global markets, prompting the airless tires industry to reassess its supply chain resilience and foster collaborative efforts for long-term stability amidst geopolitical uncertainties.

Impact of Economic Slowdown:

The economic slowdown has cast a formidable shadow over the Airless Tires Market, reshaping the dynamics of an industry that once seemed impervious to external turbulence. As consumer spending contracts and businesses tighten their budgets, the demand for innovative yet cost-effective solutions in the automotive sector undergoes a transformative shift. In this landscape, airless tires find themselves navigating a terrain of both challenges and opportunities. On one hand, the economic downturn prompts a reevaluation of priorities, emphasizing the need for durable and low-maintenance tire solutions that can withstand the test of time and reduce overall operational costs for vehicle owners. On the other hand, the initial capital investment required for adopting airless tire technology becomes a potential stumbling block, as organizations and individuals alike seek to economize in the face of uncertainty. The Airless Tires Market, therefore, stands at a crossroads where adaptability, affordability, and long-term benefits will be crucial factors in determining its resilience amidst the economic headwinds.

Market, By Rim Size:

The global market has been divided into Less than 15 Inches, 15 to 20 Inches, and More than 20 Inches based on the rim size segment. Tires with a diameter of 20 inches or less are in high demand. Changing from more than 20-inches wheel diameter necessitates the purchase of new tires. When driving over bumps and potholes, these tires require a lower profile to keep the suspension from fully compressing and rebounding.

Market, By Material:

The global market has been divided into rubber, and plastic Based on the material segment. Rubber is a low-cost, high-load bearing material. High stiffness is required in rubber components for airless tires, such as vulcanized rubber compounds utilized in the tire's inner casing such as the bead apex. Plastic is often used to make airless tires because it can be reused and recycled.

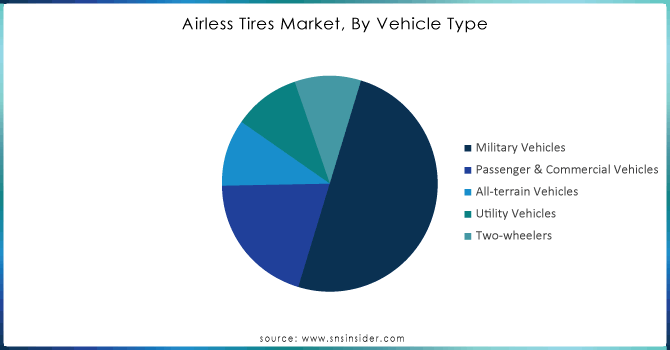

Market, By Vehicle Type:

The global market has been divided into Military Vehicles, Passenger & Commercial Vehicles, All-terrain Vehicles, Utility Vehicles, and Two-wheelers based on the vehicle type segment. Airless tires are more durable than pneumatic ones. Two-wheeler airless tires are created from extruded foams. Population growth, strong purchasing power, and favorable legislation enhance demand for passenger vehicles. Minivans, pickups, and buses are LCVs.

Get Customized Report as per your Business Requirement - Request For Customized Report

MARKET SEGMENTATION:

By Rim Size:

-

Less than 15 Inches

-

15 to 20 Inches

-

More than 20 Inches

By Material:

-

Rubber

-

Plastic

By Vehicle Type:

-

Military Vehicles

-

Passenger & Commercial Vehicles

-

All-terrain Vehicles

-

Utility Vehicles

-

Two-wheelers

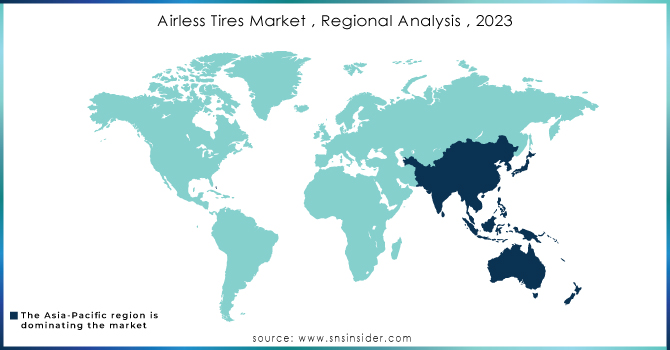

REGIONAL ANALYSIS:

The airless tires market was separated into four regions: North America; Europe; Asia-Pacific; and everywhere else on Earth. As the automotive sector in nations like China, India, and Japan expands at a rapid pace, the Asia-Pacific region has one of the world's largest aftermarkets. The expanding building activity, industrial expansion, and need for fuel-efficient technology all contribute to the region's increased interest in airless tires. In countries like Japan, China, and South Korea, there are plenty of raw material suppliers and low labor prices in the Asia-Pacific region. Airless tires are projected to be in high demand in the agricultural sector in these countries as well, given the importance of agriculture in these countries. China is the world's largest automotive market. There are numerous opportunities for tire producers to invest in the industry through joint ventures with local car manufacturers. The North American airless tire industry is predicted to develop in response to the increasing use of airless tires in construction and industrial equipment trucks.

REGIONAL COVERAGE:

North America

- US

- Canada

- Mexico

Europe

- Eastern Europe

- Poland

- Romania

- Hungary

- Turkey

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Switzerland

- Austria

- Rest of Western Europe

Asia Pacific

- China

- India

- Japan

- South Korea

- Vietnam

- Singapore

- Australia

- Rest of Asia Pacific

KEY PLAYERS:

Bridgestone Corporation (Japan), Pirelli (U.S.), Sumitomo Rubber Industries (Japan), Hankook Tire (South Korea), The Goodyear Tire and Rubber Company (U.S.), Amerityre Corporation (U.S.), Toyo Tire and Rubber Co. Ltd. (Japan), Michelin (France), Cooper Tire (U.S.), Tannus Ltd. (Korea) are some of the affluent competitors with significant market share in the Airless Tires Market.

Recent Developments:

-

Pioneering the revolution is Michelin, unveiling their advanced airless tire prototypes equipped with next-gen materials that promise enhanced durability and sustainability.

-

Bridgestone, another key player, has propelled the market forward with its cutting-edge design featuring 3D-printed treads, setting new standards for tire customization and performance.

-

Goodyear has entered the fray with their revolutionary IntelliGrip Urban concept, integrating artificial intelligence to optimize traction and ensure a safer driving experience in urban environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 38.85 Million |

| Market Size by 2032 | US$ 63.44 Million |

| CAGR | CAGR of 5.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Rim Size (Less than 15 Inches, 15 to 20 Inches, more than 20 Inches) • by Material (Rubber, Plastic) • by Vehicle Type (Military Vehicles, Passenger & Commercial Vehicles, All-terrain Vehicles, Utility Vehicles, Two-wheelers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bridgestone Corporation (Japan), Pirelli (U.S.), Sumitomo Rubber Industries (Japan), Hankook Tire (South Korea), The Goodyear Tire and Rubber Company (U.S.), Amerityre Corporation (U.S.), Toyo Tire and Rubber Co. Ltd. (Japan), Michelin (France), Cooper Tire (U.S.), Tannus Ltd. (Korea) |

| Key Drivers | •A significant increase in the demand for tires that require no maintenance. •As all-terrain and military vehicle demand grows, the market for airless tires is likely to expand. |

| RESTRAINTS | •Low performance both when there is friction and when there is high speed. •High capital investment for new manufacturing facilities will limit market expansion. |