Automotive Brake Fluid Market Report Scope & Overview:

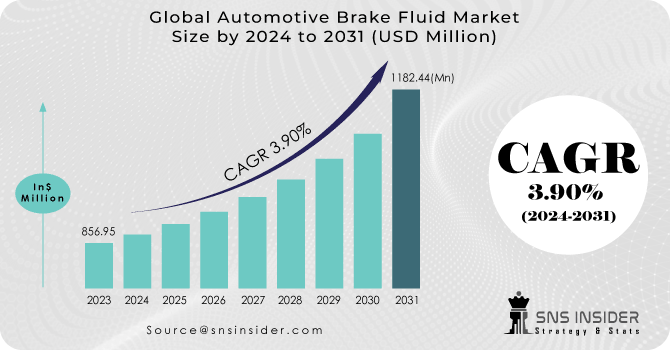

The Automotive Brake Fluid Market Size was valued at USD 856.95 million in 2023 and is expected to reach USD 1182.44 million by 2031 and grow at a CAGR of 3.90% over the forecast period 2024-2031.

Get More Information on Automotive Brake Fluid Market - Request Sample Report

The automotive brake fluid market is on an interested route, characterized by a blend of steady expansion and potential disruption. The growth is fueled by factors such as increased vehicle production and a heightened emphasis on safety features. However, underlying dynamics are shaping the landscape in compelling ways. Government initiatives, particularly in regions like the European Union, where the mandatory implementation of Advanced Driver Assistance Systems (ADAS) is set for 2023, are expected to drive demand for advanced brake fluids. Specifically, there is a rising need for fluids compatible with electronic braking systems, presenting an opportunity for glycol-based fluids like DOT 4 & DOT 5.1. These fluids offer enhanced boiling points and superior resistance to vapor lock. Conversely, the emergence of electric vehicles (EVs) and autonomous driving technology poses a potential disruption to traditional hydraulic braking systems. Brake-by-wire technologies could reduce reliance on brake fluids in the long term. However, even as EVs evolve, some form of wet braking system will likely remain necessary for redundancy purposes, ensuring sustained demand.

The market is ready for innovation, particularly in sustainable and high-performance fluids. Investments in research and development are projected to exceed $100 million annually by 2025. Key focus areas include eco-friendly glycol-ether based fluids with extended service life. Major industry players like BASF and Exxon Mobil are already spearheading advancements in this realm.

Automotive Brake Fluid Market Dynamics:

KEY DRIVERS:

-

An increasing number of people are becoming aware of how essential automobile maintenance

-

Increasing the efficiency of the brakes while also enhancing their lubrication

-

The current surge in electric car production is mostly due to government initiatives aimed at zero-emission vehicles

The current surge in electric car production is fundamentally propelled by a confluence of government initiatives geared towards fostering the adoption of zero-emission vehicles, the current adoption rates has reached 42%. With a steadfast commitment to combatting climate change and reducing greenhouse gas emissions, governments worldwide are implementing ambitious policies and incentives to incentivize manufacturers and consumers alike to embrace electric mobility.

RESTRAINTS:

-

The automotive brake fluid market's expansion is being hampered by a lack of awareness among end-users

-

In the brake fluid market, the key limitations are the high price and the need to be installed in the vehicle

OPPORTUNITIES:

-

It is anticipated that the non-petroleum sector will develop into the fastest-growing one

-

Many automotive manufacturers from around the world are making investments in electric vehicles

With the proliferation of electric propulsion systems, traditional brake fluid technologies are adapting to meet the distinct demands of EVs, ensuring optimal performance, efficiency, and safety. As automotive giants navigate this electrified future, the brake fluid market emerges as a nexus of innovation, poised to redefine the standards of automotive excellence in an increasingly sustainable era. For instance, OEMS have started escalating their investments benchmark by approx. 20%-25%.

CHALLENGES:

-

The disruption of the supply chain will slow down growth

-

Due to hydraulic system leaks, the brake system may fail, which could lead to an accident

IMPACT OF RUSSIA -UKRAINE WAR:

The Russia-Ukraine war has significantly disrupted the automotive brake fluid market, sending shockwaves through the global automotive industry. The conflict has led to uncertainties in the supply chain, causing fluctuations in raw material prices By 12% and obstructing manufacturing processes. As both countries are key players in the production of brake fluid components, the ongoing tensions have created supply shortages and increased costs by approximately 22% for manufacturers worldwide. Moreover, the geopolitical instability has fueled market volatility, impacting consumer confidence and leading to a slowdown in automotive sales. To adapt to these challenges, companies are exploring alternative sourcing strategies and investing in research and development to mitigate the effects of the crisis on the automotive brake fluid market.

IMPACT OF ECONOMIC SLOWDOWN:

The economic slowdown has exerted significant pressure on the Automotive Brake Fluid Market, prompting a bundle of challenges for industry players. As consumer spending contracts amidst financial uncertainty, demand for automotive products, including brake fluid, diminishes. This reduction in demand by 8% not only restrains revenue growth but also intensifies competition among market participants fight for a shrinking pool of customers. Consequently, companies within the Automotive Brake Fluid Market must reassess their strategies, focusing on cost optimization, diversification into emerging markets, and innovation in product offerings to weather the downturn effectively. Moreover, prudent risk management practices become paramount to mitigate the adverse effects of economic volatility, ensuring sustainability and resilience in the face of fluctuating market conditions.

Automotive Brake Fluid Market Segment Overview:

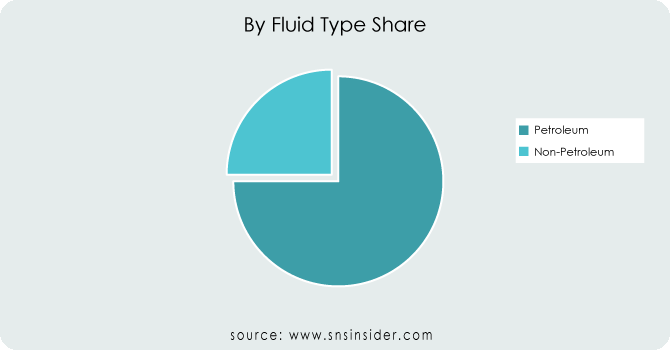

By Fluid Type:

The automotive brake fluid market is predominantly split into two categories according to fluid type: petroleum-based and non-petroleum based. Presently, petroleum-based fluids command the largest market share, comprising approximately 75% of the global market. This dominance stems from their lower cost and longstanding position in the industry. Nevertheless, there's a notable trend towards non-petroleum fluids, expected to experience accelerated growth due to their superior performance attributes.

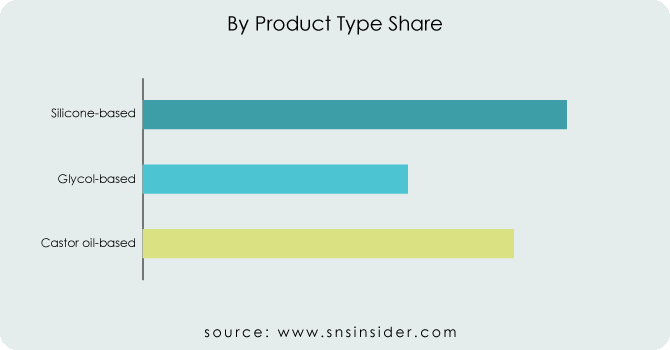

By Product Type:

In 2023, glycol-based fluids commanded the majority share, representing 40% of the automotive brake fluid market and yielding an estimated value of USD 400 million. Castor oil-based fluids, renowned for their natural lubricating properties, accounted for 25% of the market, valued at approximately USD 250 million. Silicone-based fluids, capturing the remaining 35% share, equated to around USD 350 million, appealing particularly to consumers desiring a high boiling point and compatibility with ABS systems.

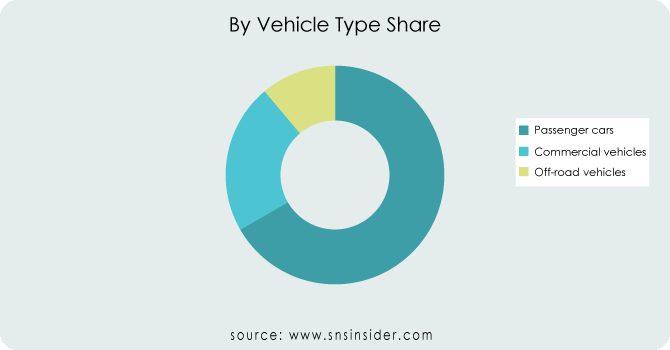

By Vehicle Type:

The global market for automotive brake fluid is segmented into two primary categories: passenger cars (PC) and commercial vehicles (CV). Despite the PV segment currently commanding a larger market share of 70% in 2023, compared to CV, the PV segment is forecasted to experience steady growth at a rate of 5% by 2031. This growth is likely fueled by the expanding global production and sales of passenger cars. In contrast, the CV segment is projected to witness a more substantial growth rate of 7%, driven by factors such as increased demand for heavy-duty vehicles and the escalation of infrastructure projects worldwide.

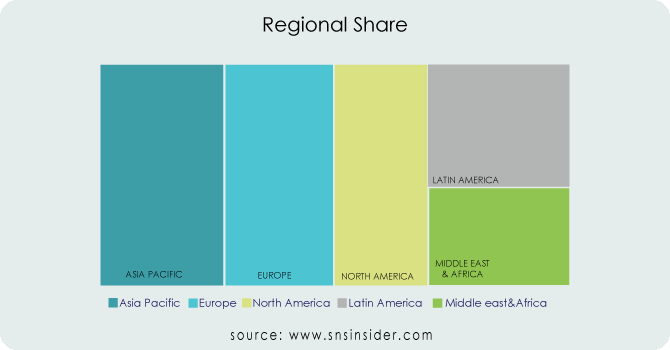

Automotive Brake Fluid Market Regional Analysis:

The APAC region asserts its dominance in the global Automotive Brake Fluid market, securing a significant 35% share. Several factors contribute to this leadership position. APAC hosts major automotive manufacturing hubs such as China, India, Japan, and South Korea, fostering a robust vehicle production landscape. These countries actively invest in enhancing manufacturing capabilities and optimizing supply chains for enhanced profitability. Demographic shifts, infrastructural advancements, and improved living standards drive a surge in car ownership across the region, consequently increasing the demand for automotive components, including brake fluids.

APAC governments are implementing policies to encourage the adoption of electric vehicles (EVs), spurring the development of a thriving EV manufacturing ecosystem. This necessitates the production of high-performance brake fluids compatible with EVs. Recognizing this opportunity, leading international players are channeling substantial investments into establishing or expanding manufacturing facilities in key APAC markets like China and India. This infusion of capital, combined with the aforementioned growth catalysts, positions the APAC Automotive Brake Fluid market for a promising trajectory, with a projected CAGR surpassing 4.65% until 2031.

Get Customized Report as per your Business Requirement - Ask For Customized Report

KEY PLAYERS:

Robert Bosch GmbH (Germany), Chevron Corporation (U.S.), Exxon Mobil Corporation (U.S.), Valvoline, The China National Petroleum Corporation (China), Castrol (UK), Fuchs Petrolub SE (Germany), Royal Dutch Shell plc (the Netherlands), China Petroleum & Chemical Corporation (China), Total S.A. (France), and Qingdao Compton Technology Company Limited (China) are some of the affluent competitors with significant market share in the Automotive Brake Fluid Market.

Recent Developments:

-

In recent developments within the Automotive Brake Fluid Market, major players such as Exxon Mobil Corporation, Bosch GmbH, and TotalEnergies SE have been pioneering advancements in brake fluid technology.

-

Exxon Mobil Corporation unveiled a breakthrough formulation aimed at enhancing brake system performance while ensuring maximum safety standards.

-

Bosch GmbH introduced innovative solutions geared towards optimizing brake fluid viscosity for improved efficiency and durability.

-

TotalEnergies SE has been focusing on eco-friendly alternatives, aligning with the industry's shift towards sustainability by introducing bio-based brake fluids.

-

These developments underscore a collective commitment among key players to drive innovation and address evolving consumer demands for safer, more efficient, and environmentally conscious automotive brake fluid solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 856.95 Million |

| Market Size by 2031 | US$ 1182.44 Million |

| CAGR | CAGR of 3.90% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-20222 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Fluid Type (Petroleum, Non-Petroleum) • by Product Type (Castor oil-based, Glycol-based, Silicone-based) • by Vehicle Type (Passenger cars, Commercial vehicles, Off-road vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH (Germany), Chevron Corporation (U.S.), Exxon Mobil Corporation (U.S.), Valvoline, The China National Petroleum Corporation (China), Castrol (UK), Fuchs Petrolub SE (Germany), Royal Dutch Shell plc (the Netherlands), China Petroleum & Chemical Corporation (China), Total S.A. (France), and Qingdao Compton Technology Company Limited (China) |

| Key Drivers | • An increasing number of people are becoming aware of how essential automobile maintenance is. • Increasing the efficiency of the brakes while also enhancing their lubrication. |

| RESTRAINTS | • An increasing number of people are becoming aware of how essential automobile maintenance is. • Increasing the efficiency of the brakes while also enhancing their lubrication. |