Automotive Camera Module Market Size & Overview:

Get More Information on Automotive Camera Module Market - Request Sample Report

The Automotive Camera Module Market Size was valued at USD 10.12 billion in 2023 and is expected to reach USD 27.61 billion by 2032 and grow at a CAGR of 11.8% over the forecast period 2024-2032.

The Cars depend intensely on modern camera systems to navigate the roads, particularly in bumper-to-bumper traffic. These automotive camera modules, packed with image sensors and other camera tech are situated deliberately inside and outside the vehicle, regularly on the front and rear.

Their essential work is to improve security. By providing a wider field of view, they offer assistance drivers see blind spots and move confidently while parking. Eventually, these cameras aim to prevent accidents, monitor driver behaviour, and create an overall smoother driving experience. They even double as high-tech security and observation systems for your car. Modern car manufacturers are pushing the boundaries with advanced camera innovations. Features like 3D depth sensing, ultra-high-definition displays, and infrared thermal imaging are becoming increasingly common. This focus on development amplifies to incorporating advanced driver-assistance systems (ADAS) for superior vehicle performance. ADAS includes a suite of features like lane departure warning, traffic sign recognition, and forward collision warning.

MARKET DYNAMICS:

KEY DRIVERS:

- Rising road deaths, focus on safety features like ADAS, and NCAP influence drive growth in automotive camera and integrated radar & camera market.

Road accidents are on the rise globally, driving demand for security features like collision avoidance and lane departure warnings. Advanced driver-assistance systems (ADAS) use integrated cameras and radar to detect objects and alert drivers, even automatically braking to prevent crashes. This growing need for safety, along with stricter regulations like NCAP and a preference for premium cars with advanced features, is fueling the expansion of the automotive camera and integrated radar and camera market.

RESTRAINTS:

- High initial costs and complex service needs may hinder growth in the automotive camera and integrated radar and camera market.

While advanced safety features like cameras and radar are in high demand due to rising accidents, their high cost is a hurdle for the automotive camera market. Equipping cars with these systems increases vehicle prices and requires specialized technicians for servicing. This complexity, coupled with the need for multiple cameras and sensors for ADAS features, is expected to slow market growth despite the strong demand for improved safety.

OPPORTUNITIES:

- Advancements in camera technology like 3D depth sensing and high-resolution displays is fueling market for innovative automotive camera modules.

- The rising popularity of premium vehicles with advanced safety features is creating a strong market for high-performance automotive camera modules.

CHALLENGES:

- Increased vehicle price due to advanced safety features might deter budget-conscious consumers.

- Servicing cars with complex camera and sensor setups requires specialized technicians, limiting options for repairs.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine is disrupting the automotive camera module market. Neon gas, essential for chip production in these modules, is facing supply constraints due to the conflict's impact on major suppliers Russia and Ukraine. This disruption, coupled with sanctions on Russia limiting access to other key materials, is forcing manufacturers to find alternatives, leading to delays and inflated prices. The consequence of this war is a slowdown in car production due to the global chip shortage, directly reducing demand for camera modules used in advanced driver-assistance systems. To mitigate these risks, car manufacturers might diversify their supplier base away from the region, potentially creating a shift in production and opportunities for new players in the market. The war has injected uncertainty into the camera module landscape, with immediate challenges of production slowdowns, price hikes, and a potential supplier reshuffle.

IMPACT OF ECONOMIC SLOWDOWN

The economic slowdown led causes to the automotive camera module market. The downturn governs the impact, with a mild recession potentially causing a 5-10% decline in car sales. This directly translates to a decrease in camera module demand, a key component in Advanced Driver-Assistance Systems that are becoming increasingly common even in mid-range vehicles. Economic uncertainty can also lead car manufacturers to delay investments in new technologies by 10-15% that could stall the camera module market's growth. The car buyers become more price-sensitive during downturns and this might pressure automakers to prioritize affordability by potentially using lower-resolution or less feature-rich camera modules. Financial strain on suppliers of camera module components could impact production or lead to consolidation. In essence, an economic slowdown can lead to a decline in camera module demand due to lower car sales and cautious consumer spending. Automakers might prioritize cost-cutting measures and delay investments in ADAS, further impacting market growth.

KEY MARKET SEGMENTS:

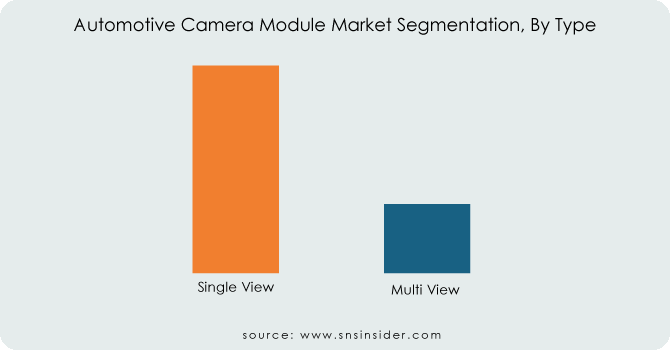

By Type

- Single View

- Multi View

The Single View Cameras is the dominating sub-segment in the Automotive Camera Module Market by type holding around 70-80% of market share. Single view cameras are simpler and more cost-effective, making them ideal for basic driver-assistance systems like Lane Departure Warning and Park Assist that are becoming increasingly common across all vehicle segments.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

- Park Assist (PA)

- Autonomous Emergency Braking (AEB)

Park Assist (PA) is the dominating sub-segment in the Automotive Camera Module Market by application holding around 20-22% of market share. PA systems are experiencing rapid adoption due to their convenience and safety benefits, particularly in urban areas with tight parking spaces. This fuels the demand for single-view camera modules used in PA systems.

By Technology

- Digital

- Thermal

- Infrared

The Digital Cameras is the dominating sub-segment in the Automotive Camera Module Market by technology holding around 85-90% of market share. Digital cameras offers superior image quality and functionality at a reasonable cost, making them suitable for a wide range of ADAS applications like LDW, Blind Spot Detection, and Adaptive Cruise Control.

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

Passenger Cars is the dominating sub-segment in the Automotive Camera Module Market by vehicle type holding around 60-65% of market share. Passenger cars account for the majority of vehicle sales globally, leading to a higher demand for camera modules in this segment. Additionally, stricter safety regulations and consumer preference for ADAS features in passenger cars are driving growth.

By Distribution Channel

- OEM

- Aftermarket

OEM (Original Equipment Manufacturer) is the dominating sub-segment in the Automotive Camera Module Market by distribution channel holding around 80% of market share. Camera modules are pre-integrated into vehicles during the manufacturing process. This ensures compatibility and optimal performance within the specific ADAS system of a car.

REGIONAL ANALYSIS:

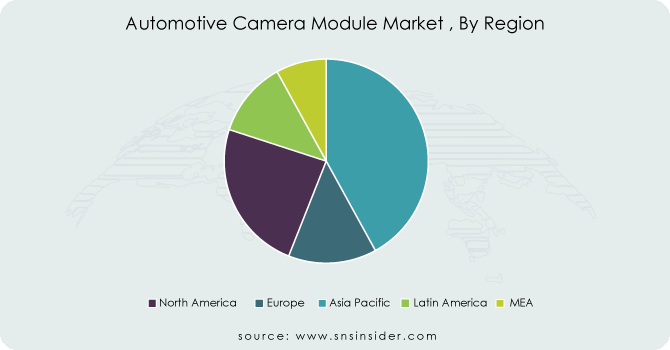

The North America is the dominating region in the automotive camera module market with 35-40% of market share due to its robust automotive sector prioritizing advanced driver-assistance systems and safety, along with early adoption of advanced technologies and stringent regulations mandating ADAS features.

Europe is the second highest region in this market holding around 25-30% of market share with a well-established, innovation-focused automotive industry and a growing demand for premium vehicles with advanced ADAS.

The Asia Pacific region is the fastest growing region with 12-15% of market share fueled by the growing passenger and commercial vehicle market, rising disposable income driving demand for safety features, and government initiatives promoting ADAS adoption.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

- Middle East

- UAE

- Egypt

- Saudi Arabia

- Qatar

- Rest of the Middle East

- Africa

- Nigeria

- South Africa

- Rest of Africa

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

The major key players are Aptiv PLC, Omnivision Technologies Inc, Continental AG, DENSO Corporation, Veoneer Inc., Ficosa Internacional SA, Mobileye, Intel Corporation, Robert Bosch GmbH, Autoliv Inc, Magna International Inc., ZF Friedrichshafen AG, Hyundai Mobis Co., Ltd., Valeo, and AEI Inc. and other key players.

Omnivision Technologies Inc-Company Financial Analysis

RECENT DEVELOPMENTS:

-

In June 2020: OMNIVISION has launched the OX03C10, the world's first automotive image sensor designed specifically for car cameras. This innovative sensor boasts a large pixel size (3.0 microns) for exceptional low-light performance and an impressive 140dB high dynamic range (HDR) to capture clear images in all lighting conditions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.12 Billion |

| Market Size by 2032 | US$ 27.61 Billion |

| CAGR | CAGR of 11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Vehicle Type (Passenger car, Commercial vehicle) • By Technology (Digital, Infrared, Thermal) • by Application (Lane Departure Warning (LDW), Blind Spot Detection (BSD), Adaptive Cruise Control (ACC), Park Assist (PA), Autonomous Emergency Braking (AEB)) • by Distribution Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Aptiv PLC, Omnivision Technologies Inc, Continental AG, DENSO Corporation, Veoneer Inc., Ficosa Internacional SA, Mobileye, Intel Corporation, Robert Bosch GmbH, Autoliv Inc, Magna International Inc., ZF Friedrichshafen AG, Hyundai Mobis Co., Ltd., Valeo, and AEI Inc. |

| Key Drivers | • Reduced camera pricing. • In the automotive business, there is a growing demand for autonomous technologies. |

| RESTRAINTS | • Camera module replacement is a time-consuming task that could stifle future business expansion. • The operational flaws in the cameras are another key stumbling block. |