Boat Trailer Market Report Scope & Overview:

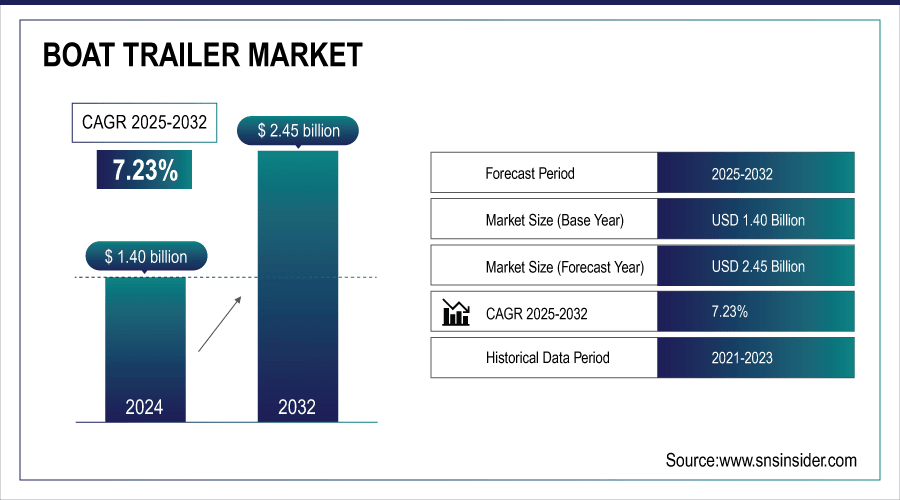

The Boat Trailer Market size was valued at USD 1.40 Billion in 2024 and is projected to reach USD 2.45 Billion by 2032, growing at a CAGR of 7.23% during 2025–2032.

The Boat Trailer Market is witnessing steady growth, driven by rising recreational boating activities and demand for reliable transport solutions for various boat types, including fishing boats, personal watercraft, and sailboats. Key trends include the use of durable materials such as aluminum and galvanized steel, versatile trailer configurations from single to triple axles, and load capacities catering to both small and large boats. Innovations in design ease of maintenance, and enhanced towing safety features are boosting market adoption. Increasing interest in water sports and leisure boating worldwide is expected to sustain demand over the forecast period.

Jun 18, 2025 – Malibu Boats has extended its partnership with General Motors, naming Chevrolet as its official vehicle brand, continuing to innovate with the Monsoon Line of engines and enhance boating experiences nationwide. This collaboration strengthens Malibu’s industry leadership, combining cutting-edge technology, performance, and exclusive initiatives for boating enthusiasts.

To Get More Information On Boat Trailer Market - Request Free Sample Report

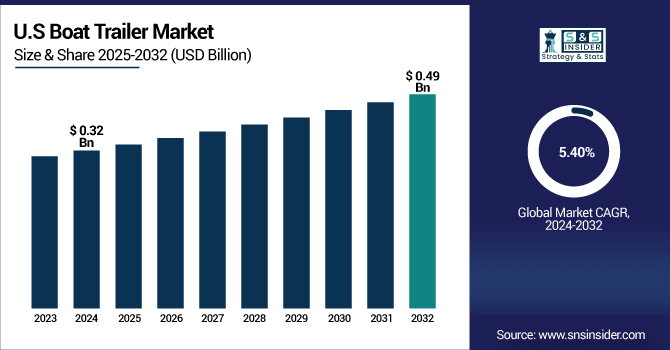

The U.S. Boat Trailer Market size was valued at USD 0.32 Billion in 2024 and is projected to reach USD 0.49 Billion by 2032, growing at a CAGR of 5.40% during 2025–2032.

Key market drivers include rising vehicle ownership, increased consumer awareness of proper tire maintenance for safety and fuel efficiency, and the growing convenience of portable digital inflators for immediate use.

Boat Trailer Market Highlights:

-

Rising demand for rare vehicles is driving global interest in classic, rare, and pre-owned vehicles, enabling cross-border transactions

-

Technology-driven engagement with high-quality imagery, detailed listings, and secure bidding enhances buyer confidence and participation

-

European expansion by Bring a Trailer in 2024 provides localized auction services in the Netherlands, Germany, and Belgium for buyers and sellers

-

Logistics and inspection challenges, including limited physical inspection, complex shipping, taxes, and regulatory differences, restrain online auction adoption

-

Value-added services such as on-water and roadside assistance boost customer loyalty and enable premium pricing

-

Strategic partnerships like MYCO Trailers with Sea Tow Gold Card and Trailer Care+ improve safety, convenience, and market differentiation

Boat Trailer Market Drivers:

-

Rising Global Demand for Rare Vehicles Drives Growth of Online Automotive Auctions

The growth of the online automotive auction market is being driven by increasing global demand for rare, classic, and pre-owned vehicles, coupled with the convenience and transparency offered by digital platforms. Enthusiasts and collectors seek access to a wider selection of vehicles beyond their local markets, creating opportunities for cross-border transactions. Advanced online auction technologies, including high-quality imagery, detailed listings, and secure bidding processes, enhance buyer confidence and engagement. Additionally, localized support and logistics solutions for shipping and vehicle inspection further stimulate adoption. The market benefits from a unique combination of community-driven engagement and technology-enabled accessibility, setting it apart from traditional sales channels.

Feb 12, 2025 – Bring a Trailer expanded into Europe in 2024, establishing partner locations in the Netherlands, Germany, and Belgium to offer localized auction services while maintaining its signature platform and auction experience. This expansion allows European enthusiasts to buy and sell rare and pre-owned vehicles seamlessly, supporting both local and cross-continental transactions.

Boat Trailer Market Restraints:

-

Limited Vehicle Inspection and Complex Logistics Restrict Online Automotive Auction Growth

The online automotive auction market faces several challenges that could limit growth. Buyers’ inability to physically inspect vehicles reduces trust, while complex cross-border logistics, shipping costs, and varying import regulations complicate transactions. Currency conversion, taxes, and VAT inconsistencies create financial burdens, and limited digital infrastructure in some regions restricts access. Regulatory differences, vehicle compliance standards, and fraud risks further hinder participation. Competition from traditional dealerships, high listing fees, and cultural resistance to digital sales slow adoption. Additionally, seasonal demand fluctuations, economic uncertainty, and logistical challenges for specialty vehicles affect bidding activity, requiring platforms to enhance transparency, technology, and localized support.

Boat Trailer Market Opportunities:

-

Bundled Safety and Support Services Expand Boat Trailer Market Potential

The integration of value-added services, such as comprehensive on-water and roadside assistance, presents significant growth opportunities for the boat trailer market. Manufacturers can differentiate products, increase customer loyalty, and justify premium pricing by offering safety, convenience, and reliability features. Rising demand for enhanced support and service in recreational boating encourages adoption of trailers with bundled assistance options. Strategic partnerships with service providers enable companies to expand offerings and reach new customer segments. This trend fosters innovation, improves customer experience, and drives revenue growth in the competitive boat trailer industry.

Feb 28, 2024 – MYCO Trailers now includes a Sea Tow Gold Card membership and Trailer Care+ benefits with every trailer purchase, offering 24/7 on-water and roadside assistance for boats and trailers.This partnership enhances customer safety, convenience, and peace of mind, reinforcing MYCO’s reputation for premium, custom-built trailers and comprehensive support services.

Boat Trailer Market Segment Highlights:

-

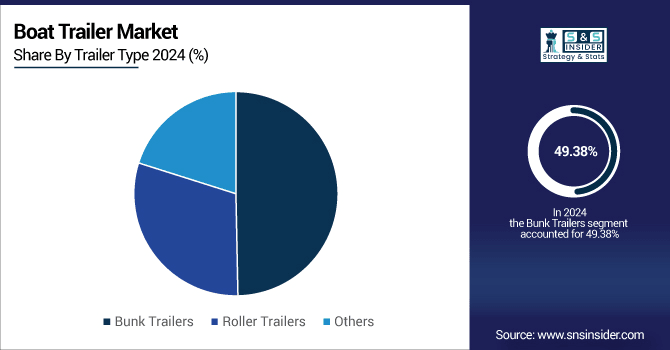

By Trailer Type: Dominant – Bunk Trailers: 49.38%, Fastest-growing – Roller Trailers: 8.49% CAGR

-

By Material & Dimensions: Dominant – Aluminum: 49.50%, Fastest-growing – Galvanized Steel: 8.41% CAGR

-

By Load & Axle Configuration: Dominant – Up to 1000kg: 39.38%, Fastest-growing – More than 2000kg: 8.37% CAGR

-

By Boat Type: Dominant – Fishing Boat: 44.63%, Fastest-growing – Personal Watercraft: 9.06% CAGR

Boat Trailer Market Segment Analysis:

By Trailer Type, Bunk Trailers Lead as Roller Trailers Gain Traction

Bunk trailers continue to dominate the market due to their widespread use and reliable performance across various boat types. At the same time, roller trailers are experiencing the fastest growth, driven by increasing demand for easier loading, better hull support, and enhanced versatility. This trend highlights a shift toward trailers that improve handling, convenience, and overall boating efficiency for recreational, fishing, and personal watercraft applications.

By Trailer Material, Aluminum Prevails While Galvanized Steel Expands Rapidly

Aluminum remains the dominant choice for boat trailers due to its lightweight, corrosion resistance, and durability. Meanwhile, galvanized steel is experiencing the fastest growth, driven by demand for stronger, cost-effective, and long-lasting trailer solutions. This trend reflects a shift toward materials that balance performance, longevity, and maintenance efficiency across various trailer sizes and types.

By Load & Axle, Light Trailers Lead as Heavy-Duty Trailers See Fastest Growth

Trailers with loads up to 1000kg continue to dominate the market due to their ease of use and suitability for most recreational boats. Meanwhile, trailers supporting more than 2000kg are experiencing the fastest growth, driven by rising demand for heavy-duty solutions capable of handling larger boats with enhanced durability. This trend reflects a shift toward robust, high-capacity trailers that provide greater reliability, performance, and safety for commercial, recreational, and specialty boating applications.

By Boat Type, Fishing Boats Lead as Personal Watercraft Trailers Grow Fastest

Fishing boat trailers continue to dominate the market due to their widespread use and compatibility with various recreational vessels. Meanwhile, trailers for personal watercraft are experiencing the fastest growth, driven by rising popularity of water sports and smaller, more versatile boats. This trend reflects a shift toward specialized trailer solutions that enhance convenience, safety, and performance for diverse boating activities, catering to both traditional anglers and recreational watercraft enthusiasts.

Boat Trailer Market Regional Highlights:

-

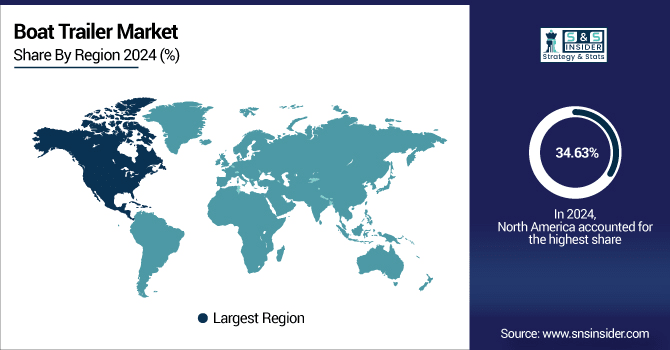

By Region – Dominating: North America (34.63% in 2024 → 32.38% in 2032, CAGR 3.38%)

-

Fastest-Growing Region: Asia-Pacific (20.88% in 2024 → 26.13% in 2032, CAGR 7.17%)

-

Europe: 24.88% → 24.13% (CAGR 3.85%)

-

South America: 9.88% → 9.13% (CAGR 3.22%, declining)

-

Middle East & Africa: 9.75% → 8.25% (CAGR 2.08%, declining)

Boat Trailer Market Regional Analysis:

North America Boat Trailer Market Insights:

North America leads the Boat Trailer Market, driven by widespread recreational boating, strong consumer spending, and advanced distribution networks. High demand for fishing boats and personal watercraft, coupled with increasing adoption of premium trailers and supportive infrastructure, sustains market growth and reinforces the region’s dominance in the global boat trailer industry.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

U.S. Boat Trailer Market Insights:

The U.S. leads North America’s Boat Trailer Market, driven by strong recreational boating culture, high demand for fishing boats and personal watercraft, and widespread adoption of premium, reliable trailer solutions.

Asia-Pacific Boat Trailer Market Insights:

Asia-Pacific is the fastest-growing region in the Boat Trailer Market, driven by rising recreational boating, increasing disposable incomes, expanding tourism, and growing demand for personal watercraft and high-quality trailer solutions across emerging economies. This growth is expected to continue through 2032, reflecting strong regional market potential.

-

China Boat Trailer Market Insights:

China leads Asia-Pacific in electric outboard adoption, driven by government incentives, growing environmental awareness, and rising recreational boating demand, positioning the country as a key market for sustainable marine propulsion solutions.

Europe Boat Trailer Market Insights:

The European Boat Trailer Market is expanding steadily, driven by increasing recreational boating, enhanced marina facilities, and rising demand for durable, high-quality trailers, enabling manufacturers to capitalize on diverse customer requirements and expand their presence across key countries in the region.

-

Germany Boat Trailer Market Insights:

Germany dominates the European Boat Trailer market, due to its strong boating culture, advanced manufacturing capabilities, and high demand for reliable, durable trailers, making it a key hub for market growth and innovation.

Latin America Boat Trailer Market Insights:

The Latin American Boat Trailer Market is emerging, driven by increasing recreational boating, growing tourism, and rising disposable incomes. The region is witnessing expanding marine infrastructure and rising demand for high-quality trailers across fishing, leisure, and personal watercraft segments.

-

Brazil Boat Trailer Market Insights:

Brazil leads the Latin America Boat Trailer market, driven by growing recreational boating, expanding marine infrastructure, and increasing demand for high-quality trailers for fishing, leisure, and personal watercraft across the country.

Middle East & Africa Boat Trailer Market Insights:

The Middle East & Africa Boat Trailer market is growing steadily, fueled by rising recreational boating activities, increasing marine tourism, and expanding investment in waterfront infrastructure, creating demand for durable, high-performance trailers for fishing boats, personal watercraft, and sailboats across the region’s emerging and established markets.

-

Saudi Arabia Boat Trailer Market Insights:

Saudi Arabia dominates the Middle East & Africa Boat Trailer market, driven by its well-established marine recreation sector, extensive coastline, and growing investment in boating infrastructure.

Boat Trailer Market Competitive Landscape:

Karavan Trailers, founded on June 23, 1986, by brothers Mike and Scott Boyd in Hartford, Wisconsin, is a leading U.S. manufacturer of boat, utility, and recreational trailers.Karavan Trailers, a leading U.S. manufacturer of boat trailers, specializes in durable and high-performance solutions for small fishing and jon boats. Known for galvanized and powder-coated finishes, QuietTow™ engineering, SwayControl™, and Sure-Lube wheel systems, the company delivers reliable, safe, and easy-to-maintain trailers designed for superior road performance and longevity.

- In 2025, Karavan Trailers launched the Single Axle 1250# Bunk Trailer (217 in.), featuring galvanized or black powder-coated finishes, QuietTow™ engineering, SwayControl™, smart lighting, and Sure-Lube wheel bearings for reliable road performance.

Four Winns, established over 50 years ago, is a premier U.S. boat manufacturer renowned for craftsmanship, innovation, and performance. Specializing in bowriders, deck boats, and cruisers, the company combines sleek design, premium materials, and advanced propulsion options to deliver versatile, high-quality vessels for leisure, watersports, and coastal navigation.

- In April 2025 – Four Winns unveiled the new H33 flagship bowrider, featuring sleek 33-foot design, premium materials, outboard/inboard options, and enhanced outdoor spaces for versatile boating experiences.

Boat Trailer Market Key Players:

-

Alumaweld Boats, Inc.

-

Amera Trail, Inc.

-

Boatmate Trailers Inc.

-

EZ Loader

-

Four Winns

-

Road King Trailers Inc.

-

Kropf Industrial Inc.

-

Load Rite Trailers Inc.

-

Magic Tilt Trailers Inc.

-

Magnum Trailers Inc.

-

Marine Master Trailers

-

McClain Trailers Inc.

-

Malibu Boats LLC – Trailers

-

Venture Trailers

-

Crest Trailers

-

Shoremaster Trailers

-

Triton Trailers

-

Loadmaster Trailers

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.40 Billion |

| Market Size by 2032 | USD 2.45 Billion |

| CAGR | CAGR of 7.23% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Trailer Type(Bunk Trailers, Roller Trailers and Others) • By Material & Dimensions(Aluminum, Galvanized Steel) • By Load & Axle Configuration(Upto 1000kg, 1000kg–2000kg and More than 2000kg) • By Boat Type(Fishing Boat, Personal Watercraft, Sailboats and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Karavan Trailers, LLC, Alumaweld Boats, Inc., Amera Trail, Inc., Bear Trailer Manufacturing, Inc., Boatmate Trailers Inc., EZ Loader, Four Winns, Road King Trailers Inc., Kropf Industrial Inc., Load Rite Trailers Inc., Magic Tilt Trailers Inc., Magnum Trailers Inc., Marine Master Trailers, McClain Trailers Inc., Malibu Boats LLC – Trailers, Venture Trailers, Crest Trailers, Shoremaster Trailers, Triton Trailers, Loadmaster Trailers. |