Mechanical Performance Tuning Components Market Key Insights:

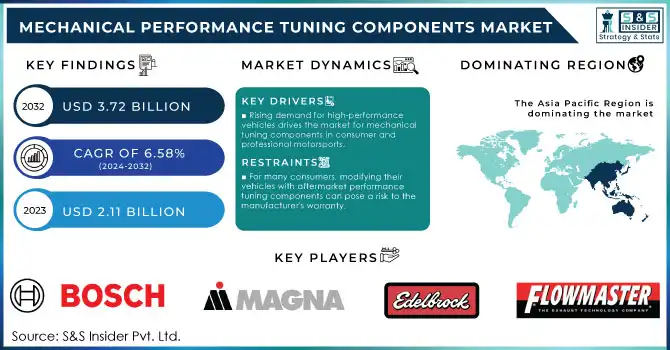

The Mechanical Performance Tuning Components Market size was valued at USD 2.11 Bn in 2023 and will reach $3.72 Bn by 2032 & grow at a CAGR of 6.58% over the forecast period of 2024-2032.

Get More Information on Mechanical Performance Tuning Components Market - Request Sample Report

The mechanical performance tuning components market is experiencing significant growth due to advancements in technology, the rising demand for high-performance machinery, and the increasing need for cost-effective solutions that extend the lifespan of equipment. In the automotive industry, the adoption of mechanical performance tuning components is becoming more widespread, driven by the need to improve power output, fuel efficiency, and the overall driving experience of vehicles. With global auto sales projected to surpass 92 million units in 2024, and vehicle sales in the U.S. expected to grow moderately to 15.9 million units, the demand for tuning components is on the rise. Key components such as turbochargers, performance exhaust systems, and engine control units (ECUs) are in high demand as they help optimize engine performance, boost acceleration, and enhance fuel efficiency while adhering to stringent emission standards. As manufacturers and consumers alike seek solutions to meet tightening emission regulations and improve fuel economy, the need for mechanical performance tuning components continues to grow, driving the market's expansion.

In the industrial sector, including manufacturing and construction, mechanical performance tuning components are crucial for enhancing the functionality and efficiency of machines and equipment, such as motors, pumps, and conveyors. Essential components like high-efficiency bearings, vibration dampers, and advanced lubrication systems ensure smooth operations and minimize downtime in industrial processes. The increasing demand for automation, precision machinery, and innovation in robotics, metalworking, and heavy machinery is further fueling the growth of the mechanical performance tuning components market. As industries prioritize cost-effective and high-performance solutions to improve operational efficiency, the market for these components is poised for continued expansion.

Mechanical Performance Tuning Components Market Dynamics

Drivers

-

The increasing demand for high-performance vehicles, in both consumer and professional motorsports sectors, is a key factor driving the market for mechanical performance tuning components.

Consumers are increasingly looking to tune components to improve engine power, handling, and driving experience as they become more interested in vehicle performance. This request is fueled not just by car lovers, but also by the growing trend of high-performance vehicles such as luxury cars and SUVs. These cars typically have basic setups that can be upgraded with aftermarket parts like performance exhausts, turbochargers, cold air intakes, and ECU tuning chips. Furthermore, motorsports contribute significantly to the development of performance-tuning components. Both professional racing teams and hobbyist racers are always looking for ways to enhance their vehicle's performance to gain a competitive edge. This has resulted in the creation and enhancement of aftermarket components providing better performance without sacrificing safety or dependability. For instance, upgrades in mechanical performance like lightweight engine parts, enhanced suspension systems, and high-performance brakes help vehicles achieve quicker lap times, superior handling, and increased durability in extreme conditions.

-

With governments worldwide enforcing more stringent emissions rules and consumers growing more aware of the environment, the automotive sector faces mounting demands to enhance fuel efficiency and lower vehicles' carbon footprint.

There is a high demand for performance tuning components that enhance engine performance, boost fuel efficiency, and cut down on harmful emissions. For instance, optimizing components like high-flow air filters, performance exhaust systems, and electronic tuning chips can enhance engine combustion efficiency, resulting in improved fuel economy and decreased emissions. Numerous customers are seeking aftermarket components to improve their vehicles' performance and environmental friendliness. This movement has resulted in the increase of environmentally friendly performance tuning parts that assist in obtaining a equilibrium between higher horsepower and lower environmental harm. As governments further implement strict regulations on fuel efficiency and emissions, the need for tuning components that adhere to these rules will rise. This set of regulations is pushing the creation of new technologies focused on enhancing performance and sustainability of the environment. Producers of performance tuning parts are now more dedicated to creating items that improve vehicle performance while also having a smaller environmental footprint.

Restraints

-

For many consumers, modifying their vehicles with aftermarket performance tuning components can pose a risk to the manufacturer's warranty.

Many automakers have strict policies that prohibit modifications to key vehicle systems, such as the engine, exhaust, or suspension, as these can affect the vehicle's overall performance, safety, and emissions compliance. If a vehicle owner installs aftermarket tuning components, it could void the warranty, leaving them responsible for any potential repairs or replacements. This risk can deter consumers from pursuing vehicle performance tuning, especially those who rely on their vehicle warranties for peace of mind. Some tuning component manufacturers offer warranties on their parts, but these warranties may not cover any damage to the vehicle itself or any issues caused by the modification. As a result, consumers may be hesitant to invest in tuning components if they perceive the risk of voiding their vehicle's warranty to be too great.

Key Segmentation Analysis

By Distribution Channel

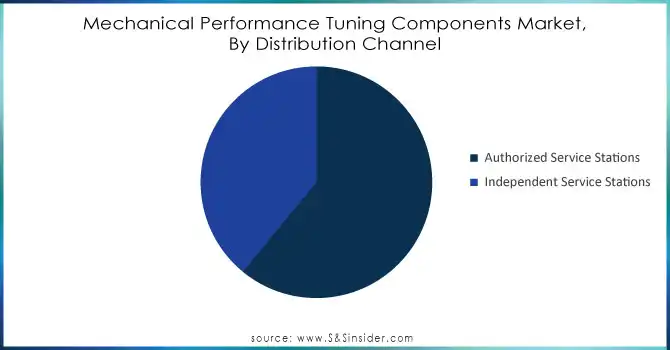

The authorized service stations segment dominated in 2023 with a 58% market share. These stations are typically affiliated with well-established vehicle manufacturers and offer a range of services that are guaranteed and supported by original equipment manufacturers (OEMs). Customers often prefer these stations for the assurance of quality and adherence to warranty standards. For instance, Bosch provides advanced fuel management systems and exhaust tuning solutions used in authorized service stations to enhance engine performance and efficiency.

The independent service stations segment is anticipated to become the fastest-growing segment due to the rising demand for cost-effective and customized performance tuning solutions. These stations offer more flexibility in services and use both OEM and aftermarket parts. They attract customers who seek personalized, budget-friendly tuning options. Independent stations tend to specialize in specific vehicle modifications, such as suspension or exhaust upgrades. Companies like HKS and Borla Exhaust supply aftermarket performance parts for such stations.

Need Any Customization Research On Mechanical Performance Tuning Components Market - Inquiry Now

By Vehicle Type

The passenger cars segment dominated in 2023, securing a 45% market share, driven by the rising popularity of personal vehicles among consumers and the growing focus on improving vehicle performance. As customers seek improved fuel efficiency, increased power output, and an enhanced driving experience, mechanical performance tuning parts like turbochargers, exhaust systems, and engine remapping kits are now necessary. Major companies such as Borla Exhaust and HKS provide custom items such as high-performance exhaust systems and air intakes designed to enhance the performance of passenger vehicle engines.

The LCVs segment is expected to experience a rapid growth rate during 2024-2032, due to the rising need for fleet efficiency and vehicle customization in logistics, delivery services, and small enterprises. With the growth of the e-commerce industry, companies such as Ford and Mercedes-Benz are incorporating performance tuning choices to improve the capability of carrying loads, fuel efficiency, and power in their vehicles. For instance, Eibach provides suspension kits designed for LCVs to enhance performance when transporting heavy loads.

Mechanical Performance Tuning Components Market Regional Analysis

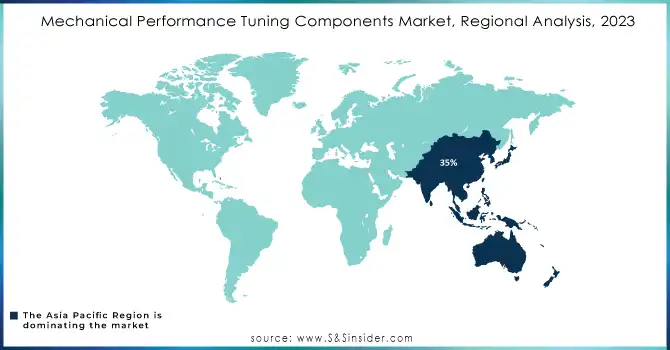

Asia-Pacific region dominated the market with a 35% market share in 2023, driven by strong growth in the automotive sector, higher disposable incomes, and the growing trend of motorsports and vehicle personalization. China, India, and Japan play a major role in driving the demand for performance tuning components due to their large automotive production and increasing consumer interest in improved vehicle performance. Key players such as DENSO Corporation, Mahle GmbH, and Hitachi Ltd. are increasing their presence in this area.

North America is forecasted to grow with the fastest CAGR between 2024 and 2032, fueled by a robust automotive enthusiast community, stricter emission standards, and the continual advancement of electric vehicles. Car enthusiasts and motorsports are driving the demand for performance tuning components, especially in the United States and Canada, as interest in customizing vehicles for improved fuel efficiency, safety, and performance continues to rise. Key players like Tenneco Inc., BorgWarner Inc., and Honeywell International Inc., play a vital role in advancing innovation in performance parts such as turbochargers and exhaust systems.

Key Players in Mechanical Performance Tuning Components Market

The major key players in the Mechanical Performance Tuning Components Market are:

-

Bosch Engineering (Turbochargers, Engine Management Systems)

-

Magna International (Suspension Systems, Performance Exhaust Systems)

-

Edelbrock (Intake Manifolds, Superchargers)

-

K&N Engineering (Air Filters, Cold Air Intakes)

-

Flowmaster (Performance Mufflers, Exhaust Systems)

-

Brembo (Brake Calipers, Performance Brake Pads)

-

HKS (Turbo Kits, Performance Intercoolers)

-

Sachs (Shock Absorbers, Performance Springs)

-

Bilstein (Shock Absorbers, Performance Dampers)

-

AEM Performance Electronics (Air Fuel Ratio Gauges, Fuel Management Systems)

-

APR (Turbocharger Kits, Performance ECU Tuning)

-

Tein (Coilover Kits, Performance Springs)

-

SPARCO (Racing Seats, Performance Steering Wheels)

-

Tomei Powered (Exhaust Manifolds, Performance Camshafts)

-

Garrett Motion (Turbochargers, Wastegates)

-

Mishimoto (Radiators, Performance Cooling Fans)

-

Greddy (Intercoolers, Exhaust Systems)

-

Vortech Superchargers (Supercharger Kits, Fuel Systems)

-

Racepak (Data Loggers, Performance Gauges)

-

Cobb Tuning (ECU Tuning, Performance Exhaust Systems)

Suppliers that provide raw materials/components to these manufacturers:

-

Alcoa (Aluminum)

-

Acerinox (Stainless Steel)

-

SABIC (Plastics and Polymers)

-

ArcelorMittal (Steel Alloys)

-

Freudenberg Sealing Technologies (Seals and Gaskets)

-

3M (Adhesives, Performance Materials)

-

Saint-Gobain (Ceramic Materials, Bearings)

-

SKF (Bearings, Seals)

-

Dow Chemical (Silicones, Lubricants)

-

Sumitomo Electric (Wires, Cables, Electrical Components)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 205.88 Billion |

| Market Size by 2032 | USD 281.21 Billion |

| CAGR | CAGR of 3.57% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Engine, Transmission, Fuel System, Brake, Body & Suspension, Exhaust Mufflers) • By Distribution Channel (Authorized Service Stations, Independent Service Stations) • By Vehicle Type (Passenger Cars, LCVs, HCVs) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bosch Engineering, Magna International, Edelbrock, K&N Engineering, Flowmaster, Brembo, HKS, Sachs, Bilstein, AEM Performance Electronics, APR, Tein, SPARCO, Tomei Powered, Garrett Motion, Mishimoto, Greddy, Vortech Superchargers, Racepak, Cobb Tuning |

| Key Drivers | • The increasing demand for high-performance vehicles, in both consumer and professional motorsports sectors, is a key factor driving the market for mechanical performance tuning components. • With strict government rules, the automotive sector faces mounting demands to enhance fuel efficiency and lower vehicles' carbon footprint. |

| Restraints | • Governments around the world are implementing increasingly stringent regulations regarding vehicle emissions and safety, and these regulations can impact the market. |