Automotive Camera Market Size & Overview:

Get More Information on Automotive Camera Market - Request Sample Report

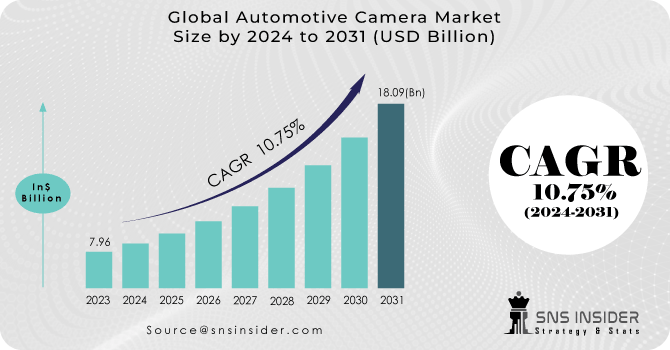

The Automotive Camera Market size was valued at USD 7.96 billion in 2023 and is expected to reach USD 19.95 billion by 2032, and grow at a CAGR of 10.75% over the forecast period 2024-2032.

The increase in demand for automotive cameras stems from several influential factors. Primarily, stringent regulations mandating features such as rearview cameras and lane departure warnings are compelling automakers to incorporate more cameras into their vehicles. For instance, the European Union has enforced rear camera mandates in all new cars since 2018, with the National Highway Traffic Safety Administration (NHTSA) in the U.S. likely to follow suit. The increasing consumer interest in Advanced Driver-Assistance Systems (ADAS) is a significant driver of market growth. ADAS functionalities such as automatic emergency braking, blind-spot detection, and adaptive cruise control heavily rely on camera data, thus contributing to market expansion. The addition of autonomous vehicles is another pivotal driver. Cameras are integral components of perception systems for autonomous vehicles, and with substantial investments pouring into this sector, the demand for automotive cameras is poised to surge significantly in the foreseeable future.

During the anticipated period, the market for AI cameras is expected to rise at a quicker rate. This could be attributed to the cameras' broader range of applications in advanced driver assistance systems. The passenger car camera market dominated the broader automotive market.

MARKET DYNAMICS:

KEY DRIVERS:

-

The high demand for the product, particularly in passenger cars, is likely to boost industry size.

-

The rising use of complementary metal-oxide-semiconductor (CMOS) image sensors in-vehicle cameras is driving market expansion.

-

The government's increased attention on road safety is projected to stimulate industry expansion.

Increased government efforts to address road accidents are anticipated to ignite substantial growth in the automotive camera market. With stricter regulations requiring features such as rearview cameras and advanced driver-assistance systems (ADAS), there will be a notable uptick in camera installations per vehicle. This trend, combined with escalating consumer interest in safety features, is forecasted to propel the market towards significant expansion. Consequently, investments are poised to escalate, with analysts foreseeing a CAGR of approximately 12.5%.

RESTRAINTS:

-

The increased overall cost of vehicles as a result of upgraded safety measures may stifle the multi-camera system market's growth.

-

If the system's cameras are broken, the consumer would have to replace the entire multi-camera system, which will be quite expensive.

Nevertheless, the expansion can become problematic for consumers due to a design flaw. Non-modular camera systems necessitate replacing the entire unit if one camera malfunctions, proving to be costly. For instance, in a standard setup with four cameras priced at $100 each, replacing the entire system would result in a 300% cost surge, amounting to an extra $300. This underscores the significance of modular camera designs, which facilitate individual camera replacement, thereby lowering repair expenses for consumers.

OPPORTUNITIES:

-

The growing popularity of these semi-autonomous functions opens up a huge market for automobile cameras.

-

Due to the developing trend, camera systems that can deliver a variety of advanced features have a lucrative market.

CHALLENGES:

-

Rising car prices, along with high design and testing expenses, are likely to provide a significant impediment to market expansion.

-

The multi-camera system has a hard time separating different perspectives from many camera inputs & displaying them in real-time.

-

Combining & converting the data into a single image has a high risk of degrading the quality of the image.

IMPACT OF RUSSIA-UKRAINE WAR:

The disruption in Ukraine, a major supplier of wiring harnesses crucial for connecting cameras to car electronics, has triggered production slowdowns and part shortages. LMC Automotive predicts a global vehicle production decrease of 400,000 units in 2022 as a result. Costs are on the rise due to sanctions and logistical challenges, leading to spikes in neon and palladium prices, essential materials for camera image sensors. This, in turn, increases the costs of camera components for manufacturers. Consumer preferences are shifting amidst inflation and escalating fuel prices, potentially favoring smaller, fuel-efficient vehicles. These models typically feature fewer cameras compared to luxury counterparts, which could impact the high-end camera segment. Governments are taking steps to address the crisis. The US is exploring alternative sources for wiring harnesses, while the EU is concentrating on diversifying its semiconductor supply chain. Nevertheless, implementing these solutions requires time.

IMPACT OF ECONOMIC SLOWDOWN:

Economic downturns typically lead to consumers postponing discretionary purchases, such as new cars. Consequently, there would be a direct reduction in the number of vehicles equipped with cameras, resulting in decreased market demand. For instance, during the Great Recession in 2009, global vehicle sales dropped by 16%, according to data from IHS Markit. A similar trend could be anticipated in future economic slowdowns. Economic strain may prompt consumers to opt for base models when purchasing new vehicles, foregoing advanced driver-assistance systems (ADAS) that often rely on cameras. This would lead to diminished demand for high-resolution and sophisticated camera technologies. Tier 1 suppliers, responsible for manufacturing components such as automotive cameras for carmakers, may experience production cuts and order cancellations as automakers adjust to lower demand. This would create significant challenges for suppliers in managing their operations and maintaining profitability.

MARKET SEGMENTATION ANALYSIS:

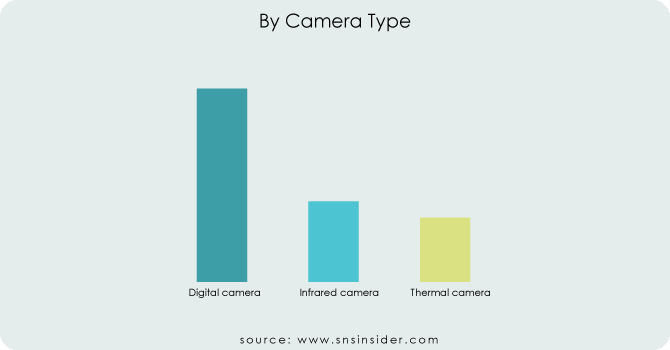

By Camera Type Share

The leading segment in the automotive camera market is digital cameras, constituting more than 60% of the market share in 2023 (specific figures available in final report). These cameras find extensive application in Advanced Driver-Assistance Systems (ADAS), including functions such as rearview cameras, lane departure warning, automatic emergency braking, and traffic sign recognition. Their popularity stems from their cost-effectiveness compared to infrared and thermal cameras, while still delivering adequate image quality for most ADAS functionalities under standard lighting conditions.

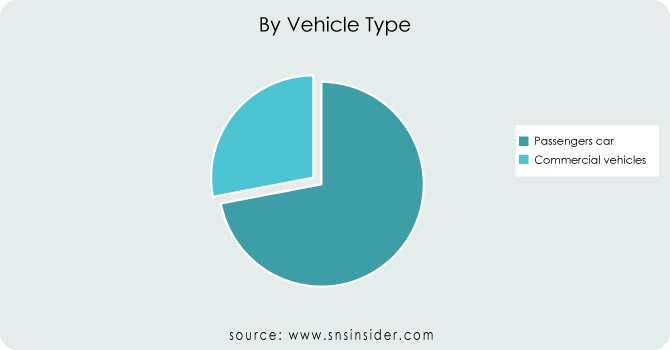

By Vehicle Type Share

Get Customized Report as per Your Business Requirement - Request For Customized Report

Passenger cars are poised to dominate the automotive camera market holding the share of 72%, driven by the increasing integration of Advanced Driver-Assistance Systems (ADAS) and the progression of smart city initiatives. Government regulations and heightened consumer awareness regarding safety functionalities are fueling the demand for cameras in passenger vehicles. These cameras facilitate critical features such as lane departure warning, automatic emergency braking, and blind-spot detection. In the commercial vehicle segment, the rear-view enhancement segment commands a significant share, especially in North America, where it finds widespread adoption in light-duty trucks. Europe mirrors this trend, with mid-sized passenger cars playing a pivotal role in driving the demand for rear-view cameras. Safety Regulations: Rigorous safety mandates for commercial vehicles are necessitating camera usage for functions like blind-spot monitoring and lane departure warning systems. This regulatory push is expected to drive market expansion further.

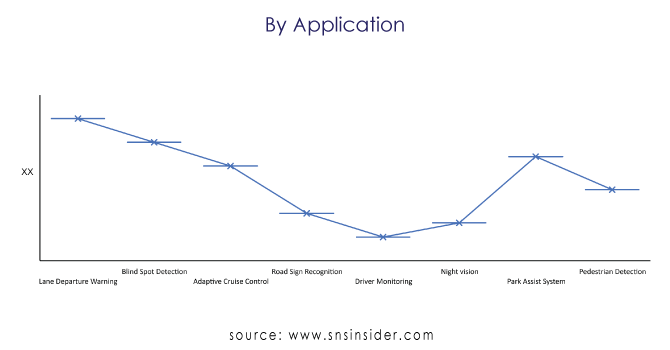

By Application Type Share

The automotive camera market is strongly influenced by a range of functionalities geared towards enhancing safety and driver assistance. These applications encompass various critical aspects of driving, each contributing differently to the market share. Lane Departure Warning (LDW) cameras, constituting approximately 25-30% of the market, hold the largest share due to their widespread use in basic Advanced Driver Assistance Systems (ADAS) and regulatory mandates in certain regions. Blind Spot Detection (BSD) cameras follow closely, accounting for around 15-20% of the market share, as they address a significant safety concern for drivers. Adaptive Cruise Control (ACC) cameras, with a share of approximately 10-15%, are witnessing a growing demand, driven by the increasing popularity of semi-autonomous driving features such as maintaining safe following distances. Park Assist System cameras also capture a notable share, around 10-15%, as they often work in tandem with sensors to provide comprehensive parking solutions. Pedestrian Detection cameras hold approximately 10-15% of the market share, propelled by safety regulations and heightened awareness of pedestrian safety. Night Vision and Road Sign Recognition (RSR) segments, while smaller at 5-10% each, are primarily found in high-end vehicles, with night vision expected to grow as technology advances and becomes more affordable. Driver Monitoring cameras, an emerging segment, currently hold around 5% of the market share but show promise for fatigue detection and enhanced safety measures in the future. While these figures are estimates and may vary depending on the source, they offer valuable insights into the distribution of application types within the automotive camera market.

The final report will include insights related to what are the trends of mentioned sub-segments and what are the segments on which the companies should focus during the forecasted period, ultimately to improve their array of opportunities.

By Camera Type:

-

Digital camera

-

Infrared camera

-

Thermal camera

By Vehicle Type:

-

Passengers car

-

Commercial vehicles

By Application Type:

-

Lane Departure Warning

-

Blind Spot Detection

-

Adaptive Cruise Control

-

Park Assist System

-

Pedestrian Detection

-

Night vision

-

Road Sign Recognition

-

Driver Monitoring

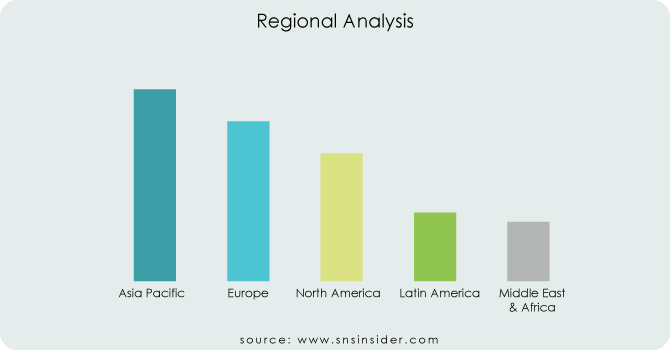

REGIONAL ANALYSIS:

The automotive camera market is currently witnessing a surge in both APAC regions, largely driven by a combination of governmental regulations and increasing consumer demand for safety features. In APAC, the market is projected to experience a remarkable CAGR of approximately 11.9%, surpassing the global average. This remarkable growth is attributed to several factors such as rapid industrialization, escalating disposable incomes, and a expanding number of vehicles being manufactured, particularly in nations like China and India. Moreover, governmental initiatives advocating Advanced Driver-Assistance Systems (ADAS) and mandatory installation of rearview cameras in new vehicles are further stimulating market adoption in the region.

On the other hand, NA is anticipated to witness a more gradual growth, estimated at around 9.20%. This growth is underpinned by a strong focus on safety regulations and a mature automotive industry, characterized by established players seamlessly integrating camera technology. Notably, government investments in autonomous vehicle research are driving demand for high-resolution and advanced camera systems. Despite APAC's higher growth rate, NA maintains a significant market share owing to its well-developed infrastructure and established industry presence. Both regions present promising opportunities for automotive camera manufacturers, with APAC offering immense growth potential and NA showcasing a robust and reliable market landscape.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Continental (Germany), Robert Bosch (Germany), Valeo (France), Aptiv (Ireland), ADA-ES Inc. (U.S.), Allied Vision Technologies (Germany), Balluf (Germany), Basler AG (Germany), Autoliv, Inc (Sweden), Delhi Automotive PLC (U.K.), Denso Corporation (Japan), TRW Automotive (U.S.) and Magna (Ireland) dominate the global automotive camera market (Canada).

RECENT DEVELOPMENTS:

-

Continental AG's recent development includes advanced camera solutions equipped with artificial intelligence algorithms for enhanced object detection and recognition, paving the way for autonomous driving capabilities.

-

Bosch, on the other hand, focuses on scalable camera platforms, offering flexibility and integration with other vehicle systems for seamless functionality.

-

Aptiv PLC stands out with its emphasis on high-resolution cameras and advanced driver assistance systems, ensuring optimal performance even in challenging driving conditions.

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.96 Billion |

| Market Size by 2032 | US$ 19.95 Billion |

| CAGR | CAGR of 10.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Camera Type (Digital Camera, Infrared Camera, Thermal Camera) • By Vehicle Type (Passengers Car, Commercial Vehicles) • By Application Type (Lane Departure, Warning, Blind Spot Detection, Adaptive Cruise Control, Park Assist System, Pedestrian Detection, Night Vision, Road Sign Recognition, Driver Monitoring) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental (Germany), Robert Bosch (Germany), Valeo (France), Aptiv (Ireland), ADA-ES Inc. (U.S.), Allied Vision Technologies (Germany), Balluf (Germany), Basler AG (Germany), Autoliv, Inc (Sweden), Delhi Automotive PLC (U.K.), Denso Corporation (Japan), TRW Automotive (U.S.) and Magna (Ireland) dominate the global automotive camera market (Canada). |

| Key Drivers | • The high demand for the product, particularly in passenger cars, is likely to boost industry size. • The rising use of complementary metal-oxide-semiconductor (CMOS) image sensors in-vehicle cameras is driving market expansion. • The government's increased attention on road safety is projected to stimulate industry expansion. |

| Market Restraint | • The increased overall cost of vehicles as a result of upgraded safety measures may stifle the multi-camera system market's growth. • If the system's cameras are broken, the consumer would have to replace the entire multi-camera system, which will be quite expensive. |