Automotive Alloy Wheel Market Report Scope & Overview:

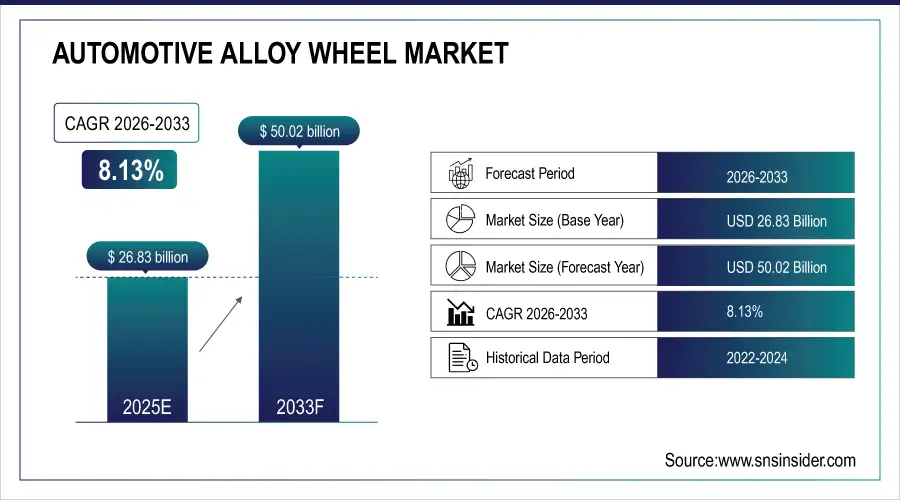

The Automotive Alloy Wheel Market Size was valued at USD 26.83 Billion in 2025E and is projected to reach USD 50.02 Billion by 2033, growing at a CAGR of 8.13% during the forecast period 2026–2033.

The Automotive Alloy Wheel Market analysis report highlights growth driven by rising vehicle production, increasing demand for lightweight and fuel-efficient wheels, expanding aftermarket customization, and growing adoption in electric and premium vehicles. Market growth is further supported by technological advancements and evolving consumer preferences for alloy wheels.

Automotive Alloy Wheel production reached 320 million units in 2025, driven by rising EV adoption, passenger car demand, and aftermarket customization.

Market Size and Forecast:

-

Market Size in 2025: USD 26.83 Billion

-

Market Size by 2033: USD 50.02 Billion

-

CAGR: 8.13% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Automotive Alloy Wheel Market - Request Free Sample Report

Automotive Alloy Wheel Market Trends:

-

Rising adoption of electric and premium vehicles is driving demand for lightweight, high-performance alloy wheels.

-

Growing aftermarket customization and personalization trends are encouraging innovative designs and finishes for alloy wheels.

-

E-commerce platforms and organized retail are improving availability, boosting sales in urban and developing regions.

-

Increasing focus on fuel efficiency and vehicle performance is prompting investment in advanced materials and manufacturing technologies.

-

Market consolidation is expected as automakers and wheel manufacturers focus on premiumization, brand differentiation, and tailored solutions to meet evolving consumer preferences.

U.S. Automotive Alloy Wheel Market Insights:

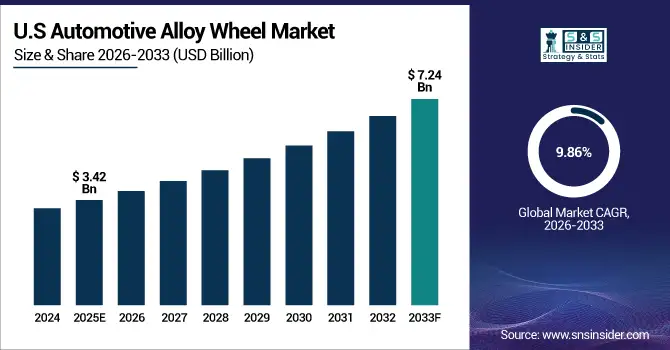

The U.S. Automotive Alloy Wheel Market is projected to grow from USD 3.42 Billion in 2025E to USD 7.24 Billion by 2033, at a CAGR of 9.86%. Market growth is driven by rising adoption of electric and premium vehicles, increasing aftermarket customization, and growing consumer demand for lightweight, high-performance, and stylish alloy wheels.

Automotive Alloy Wheel Market Growth Drivers:

-

Rising demand for lightweight, high-performance alloy wheels, driven by electric vehicle adoption and premium car trends.

Rising demand for lightweight, high-performance alloy wheels is the primary driver of Automotive Alloy Wheel Market growth. Increasing adoption of electric and premium vehicles is boosting demand for fuel-efficient, durable, and stylish wheels. Aftermarket customization trends and consumer preference for personalized designs are further accelerating sales. Advancements in alloy materials and manufacturing technologies are enhancing quality, performance, and aesthetics, supporting brand differentiation and long-term market expansion.

Automotive Alloy Wheel sales grew 7.5% in 2025, driven by rising electric vehicle adoption, premium car demand, and aftermarket customization trends.

Automotive Alloy Wheel Market Restraints:

-

High raw material costs, stringent manufacturing standards, and safety regulations are limiting rapid expansion of the alloy wheel market.

High raw material costs, stringent manufacturing standards, and safety regulations are key restraints for the Automotive Alloy Wheel Market. Manufacturers face challenges in sourcing premium alloys such as aluminum and magnesium at competitive prices. Compliance with safety and performance regulations across different regions increases production complexity and cost. Additionally, rising labor, machining, and quality control expenses limit pricing flexibility, hindering market expansion, particularly in emerging markets, and making it challenging for new entrants to gain significant market share.

Automotive Alloy Wheel Market Opportunities:

-

Growing adoption of electric and premium vehicles presents opportunities for lightweight, high-performance, and customized alloy wheel designs.

Growing adoption of electric and premium vehicles presents a major opportunity for the Automotive Alloy Wheel Market. Consumers increasingly demand lightweight, high-performance, and visually appealing wheels, prompting manufacturers to innovate with advanced alloys, designs, and customization options. Focus on fuel efficiency, durability, and aesthetics is encouraging investment in new materials and technologies. This shift toward performance and personalization enhances product differentiation, brand value, and long-term growth potential in the alloy wheel market.

Lightweight and high-performance alloy wheels accounted for 28% of total automotive wheel innovations in 2025, driven by rising EV adoption and premium vehicle demand.

Automotive Alloy Wheel Market Segmentation Analysis:

-

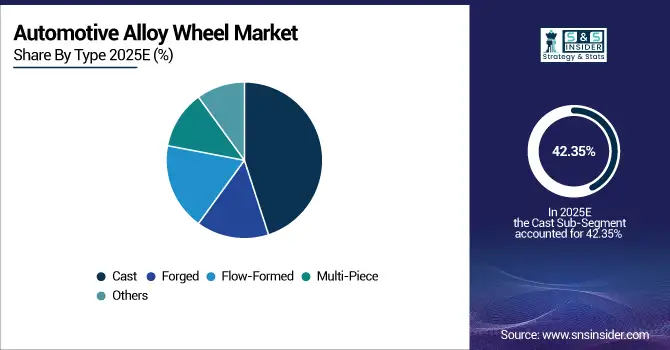

By Type, Cast held the largest market share of 42.35% in 2025, while Flow-Formed is expected to grow at the fastest CAGR of 9.12%.

-

By Vehicle Type, Passenger Cars dominated with a 55.62% share in 2025, while Electric Vehicles are projected to expand at the fastest CAGR of 11.24%.

-

By Diameter, 16–18” accounted for the highest market share of 48.21% in 2025, and >21” is expected to record the fastest CAGR of 10.11%.

-

By Material, Aluminum held the largest share of 67.14% in 2025, while Magnesium is projected to grow at the fastest CAGR of 10.52%.

-

By Distribution Channel, OEM dominated with a 61.39% share in 2025, while E-Commerce is expected to grow at the fastest CAGR of 12.18%.

By Type, Cast Dominates While Flow-Formed Expands Rapidly:

Cast segment dominated the market due to their cost-effectiveness, durability, and widespread adoption across passenger cars and light commercial vehicles. Manufacturers and OEMs prefer cast wheels for standard production models, ensuring consistent demand. Flow-Formed are the fastest-growing segment, driven by increasing consumer preference for lightweight, high-performance wheels. The segment benefits from expanding adoption in premium and electric vehicles, as well as rising aftermarket customization, accelerating its market growth.

By Vehicle Type, Passenger Cars Dominate While Electric Vehicles Expand Rapidly:

Passenger Cars segment dominated the market due to their sheer volume, widespread affordability, and high alloy wheel adoption rates. OEMs prioritize alloy wheels for style, fuel efficiency, and performance enhancements in this segment. Electric vehicles are the fastest-growing segment, fueled by EV adoption, government incentives, and consumer demand for energy-efficient and lightweight wheels. Innovations in design and material technology further support rapid growth in this segment.

By Diameter, 16–18” Dominates While >21” Expands Rapidly:

16–18” segment dominated the market, favored for compatibility with most passenger and light commercial vehicles. Their balanced combination of performance, cost, and aesthetics ensures continued demand from both OEMs and aftermarket buyers. >21” are the fastest-growing segment, driven by rising adoption in premium, luxury, and sports vehicles. Consumer preference for bold styling, performance enhancements, and personalization options is accelerating growth in this segment across world markets.

By Material, Aluminum Dominates While Magnesium Expands Rapidly:

Aluminum segment dominated the market due to their lightweight, cost-efficiency, corrosion resistance, and widespread use across passenger cars and commercial vehicles. Manufacturers prefer aluminum for fuel efficiency and performance benefits. Magnesium is the fastest-growing segment, supported by demand for ultra-lightweight, high-performance wheels in premium, electric, and sports vehicles. Technological advancements and limited production volumes make magnesium wheels highly desirable, fueling rapid growth and creating premium differentiation opportunities in the market.

By Distribution Channel, OEM Dominates While E-Commerce Expands Rapidly:

OEM segment dominated the market due to direct integration with vehicle production and long-term contracts with automakers. OEMs ensure quality, safety compliance, and consistent demand for alloy wheels across multiple vehicle types. E-Commerce is the fastest-growing segment, driven by rising consumer preference for online purchases, convenient access to aftermarket options, and customization services. Growth in digital retail platforms and urban markets further accelerates adoption in this channel.

Automotive Alloy Wheel Market Regional Analysis:

Asia-Pacific Automotive Alloy Wheel Market Insights:

The Asia-Pacific Automotive Alloy Wheel Market dominates with a 43.76% market share in 2025, driven by rising vehicle production, growing electric and premium car adoption, and increasing demand for lightweight, high-performance wheels. Growth is fueled by expanding automotive manufacturing in China, India, Japan, and South Korea. Rising consumer preference for customized and stylish alloy wheels, combined with rapid urbanization and increasing disposable income, is sustaining regional market leadership and long-term growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Automotive Alloy Wheel Market Insights:

The China Automotive Alloy Wheel Market growth is driven by rising vehicle production, growing electric and premium car adoption, and increasing consumer preference for lightweight, stylish, and high-performance wheels. Expanding automotive manufacturing, urbanization, and aftermarket customization trends are making China one of the largest revenue contributors to Asia-Pacific market dominance.

North America Automotive Alloy Wheel Market Insights:

North America is the fastest-growing Automotive Alloy Wheel Market with a CAGR of 10.33%, driven by increasing adoption of electric and premium vehicles and rising consumer preference for lightweight, high-performance wheels. Growing aftermarket customization, higher disposable income, and focus on fuel efficiency are accelerating demand. Expansion of e-commerce platforms and urban mobility trends are further boosting adoption, strengthening the region’s market position and supporting long-term growth in North America.

U.S. Automotive Alloy Wheel Market Insights:

The U.S. Automotive Alloy Wheel Market is anticipated to be driven by increasing consumer preference for lightweight, high-performance, and visually appealing wheels. Rising adoption of electric and premium vehicles, growth in aftermarket customization, higher disposable income, and expanding e-commerce and retail channels are fueling market growth and innovation across the region.

Europe Automotive Alloy Wheel Market Insights:

The Europe Automotive Alloy Wheel Market is witnessing strong growth due to rising demand for lightweight, high-performance, and stylish wheels across passenger and premium vehicles. Key markets include Germany, the UK, and France. Expansion is driven by growing electric vehicle adoption, increasing aftermarket customization, rising disposable income, and e-commerce penetration. Innovations in design, advanced alloys, and sustainability initiatives are strengthening brand presence and supporting long-term market growth across the region.

Germany Automotive Alloy Wheel Market Insights:

Germany is a key market for Automotive Alloy Wheels, with strong demand across passenger and premium vehicles. Growth is driven by rising adoption of electric cars, increasing preference for lightweight and high-performance wheels, and expanding aftermarket customization. Innovations in design, advanced materials, and sustainability-focused products are further fueling market expansion.

Latin America Automotive Alloy Wheel Market Insights:

The Latin America Automotive Alloy Wheel Market is growing with rising demand for lightweight, high-performance, and stylish wheels. Growth is driven by increasing vehicle production, expanding aftermarket customization, and rising disposable income. Innovations in advanced alloys, design, and sustainability are creating opportunities in key markets such as Brazil, Mexico, and Argentina.

Middle East and Africa Automotive Alloy Wheel Market Insights:

The Middle East & Africa Automotive Alloy Wheel Market is rising with growing demand for premium, high-performance, and lightweight wheels across passenger and commercial vehicles. Increasing vehicle production, rising disposable income, and expanding aftermarket customization are key factors. Innovations in design, advanced alloys, and e-commerce adoption further boost regional market growth.

Automotive Alloy Wheel Market Competitive Landscape:

Maxion Wheels is a globally recognized leader in wheel manufacturing, offering a wide range of steel and aluminum wheels for passenger, commercial, and specialty vehicles. Its market dominance is driven by a strong heritage, continuous innovation in design and production processes, and a robust international presence. The company focuses on sustainability, quality, and durability, ensuring customer trust. Strategic partnerships, efficient supply chains, and adaptability to market trends reinforce Maxion’s position as a market leader.

-

In September 2025, Maxion Wheels launched the Maxion FUSION, a hybrid aluminum-steel wheel offering improved performance, styling freedom, and reduced CO₂ emissions, catering to OEM demand for affordable, lightweight, and sustainable wheel solutions across markets.

CITIC Dicastal has emerged as one of the most influential aluminum wheel manufacturers worldwide. The company’s dominance stems from its advanced production technologies, commitment to quality, and extensive operations. By catering to both original equipment manufacturers and aftermarket demand, it has strengthened its market presence. Innovation in design, lightweight materials, and strategic international expansion, combined with a strong focus on research and development, ensures its continued leadership in the competitive automotive alloy wheel sector.

-

In March 2025, CITIC Dicastal introduced its integrated die-casting solution, combining multiple components into a lightweight chassis, reducing weight, simplifying manufacturing, and providing an efficient, durable, and environmentally friendly solution for automotive production.

Enkei Corporation is a leading Japanese manufacturer of high-performance aluminum wheels, serving both OEM and aftermarket segments globally. Its market dominance is rooted in superior manufacturing techniques, innovative designs, and strong collaborations with automakers. By focusing on quality, lightweight solutions, and aesthetic appeal, Enkei has built a strong reputation. Continuous investment in technology, product development, and distribution networks has allowed the company to maintain a leadership position in the automotive alloy wheel industry.

-

In August 2025, Enkei launched the Phoenix Wheels, a 6-spoke performance wheel with street-style design and high durability, tested under strict quality standards, offering enthusiasts a reliable, stylish, and performance-oriented aftermarket option.

Automotive Alloy Wheel Market Key Players:

Some of the Automotive Alloy Wheel Market Companies are:

-

Maxion Wheels

-

CITIC Dicastal

-

Enkei Corporation

-

BBS (KW automotive GmbH)

-

Ronal Group

-

BORBET GmbH

-

Superior Industries

-

Kosei Aluminum

-

Topy Industries

-

Foshan Nanhai Zhongnan Aluminum Wheel

-

Iochpe-Maxion

-

Wheel Pros

-

RAYS Engineering

-

OZ S.p.A.

-

HRE Performance Wheels

-

American Racing

-

YHI International

-

Forgeline Motorsports

-

MHT Luxury Wheels

-

Lexani Wheels

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 26.83 Billion |

| Market Size by 2033 | USD 50.02 Billion |

| CAGR | CAGR of 8.13% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cast, Forged, Flow-Formed, Multi-Piece) • By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles) • By Diameter (≤15”, 16–18”, 19–21”, >21”) • By Material (Aluminum, Magnesium, Others) • By Distribution Channel (OEM, Aftermarket, E-Commerce) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Maxion Wheels, CITIC Dicastal, Enkei Corporation, BBS (KW automotive GmbH), Ronal Group, BORBET GmbH, Superior Industries, Kosei Aluminum, Topy Industries, Foshan Nanhai Zhongnan Aluminum Wheel, Iochpe-Maxion, Wheel Pros, RAYS Engineering, OZ S.p.A., HRE Performance Wheels, American Racing, YHI International, Forgeline Motorsports, MHT Luxury Wheels, Lexani Wheels |