Automotive Center Stack Market Report Scope & Overview:

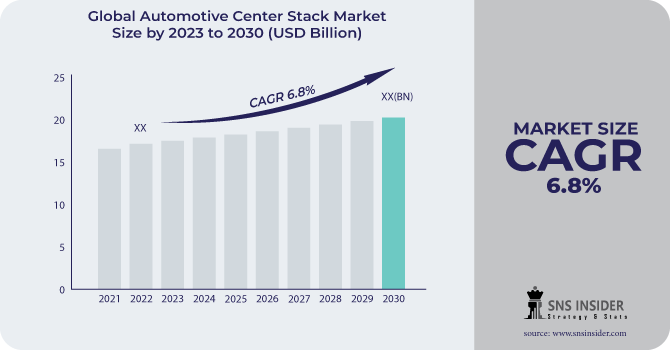

The Automotive Center Stack Market is expected to grow at a CAGR of 6.8% over the forecast period of 2023-2030.

The infotainment system of the automobile, which includes a touchscreen display for managing audio, navigation, phone connectivity, and other entertainment features, is frequently housed in the centre stack. The HVAC (heating, ventilation, and air conditioning) controls for a car are often found in the centre stack. This includes changing the temperature, the fan speed, and the airflow path. The volume, radio station, and source options for the car's audio system (such as AM/FM radio, CD player, Bluetooth, etc.) are all controlled by buttons and knobs on the dashboard. To connect and charge electronics like smartphones and tablets, many contemporary cars have USB ports, auxiliary input jacks, and occasionally wireless charging pads in the centre stack region. Access to a variety of car personalization options, including lighting preferences and driver assistance.

Customers anticipate the same amenities in their automobiles as they grow accustomed to the connectivity and convenience provided by smartphones and other personal devices. Smartphones and infotainment systems work together seamlessly because to technologies like Bluetooth connectivity, music streaming, and hands-free calling. Information-display systems have substantially advanced technologically, enabling larger, more responsive touchscreen displays, enhanced speech recognition, and more user-friendly user interfaces. Consumers now find infotainment systems to be more appealing because to these developments. Infotainment systems sometimes include integrated navigation and mapping systems because they offer real-time traffic updates, turn-by-turn directions, and sites of interest. For many car purchasers, this might be a crucial selling feature.

Market Dynamics

Driver

-

The rising need of customers for connected devices.

-

The urge of having a competitive advantage from supplier’s end.

A key selling point for infotainment systems is the ability to integrate smartphones through platforms like Apple CarPlay and Android Auto. These systems allow customers to access their preferred apps, send messages, and use navigation services straight from their phones. Smartphone apps are mirrored on the car's display via these systems.

Automakers are aware that cutting-edge infotainment systems can provide them a market advantage. As a result, they are spending money on R&D to develop novel and user-friendly solutions that will draw clients.

Restrain

-

The ongoing constrains related to shortages of semiconductors and other critical components.

Opportunity

-

The rising technological advancements in automotive industry.

-

The rising concerns of customers related to the safety.

-

The latest innovations of autonomous cars and ADAS systems.

Passengers in autonomous vehicles have the option of using their trip time for leisure activities. Access to a wide variety of entertainment alternatives, including streaming services, movies, music, and games, is made possible via the infotainment systems in these automobiles. Passengers who wish to work or keep connected while driving might be more productive with the help of infotainment systems. This could involve access to email, web surfing, and productivity app integration. Advanced voice recognition technology enables users to make calls, send messages, and access information while keeping their hands on the wheel and their eyes on the road. In autonomous vehicles, voice control is especially crucial for a secure and simple user interface.

Challenge

-

The issues related to rising cyberattacks and concerns related to refurbished parts.

Impact of Recession

As they compete for the attention of budget-conscious consumers, automakers may experience additional pricing pressure. This might lead to a focus on cutting costs, which might affect the centre stack components' quality and functionalities. Automakers may postpone or reduce their investments in research and development for cutting-edge infotainment devices during uncertain economic times. This could have an impact on the introduction of cutting-edge features in the centre stack. Recessions may cause disruptions in global supply chains, affecting the availability of touchscreens, CPUs, and other infotainment system-related technology such as electronic components. Delays or manufacturing bottlenecks may result from this. Most of the major OEMs have experienced a drop of approx. 10-15% in sales of passenger cars. Also, the high nominal wages are creating issues, for instance in Germany the nominal wage rate is declined by 6%.

Market Segmentation

By Vehicle Type

-

Passenger Vehicles

-

Commercial Vehicles

By Sales Channel

-

OEMs

-

Aftermarket

By Display Technology

-

LED

-

OLED

.png)

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Regional Analysis

North America will be the region which will have a good growth during forecasted period because of strong demand for cutting-edge infotainment systems, connection features, and user-friendly interfaces define the U.S. automobile centre stack market. Notable trends include consumer preferences for larger touchscreen screens and integration with cellphones. The market is also shaped by the regulatory environment, which sets standards for safety features and emissions. Like the American market, the Canadian market places importance on connectivity and infotainment features. Regional climatic circumstances and demand for bilingual interfaces may have an impact on the market.

APAC will be the region with the highest CAGR growth rate because the biggest automobile market in the world is China, where modern infotainment systems, connectivity, and electric vehicles are heavily promoted. The centre stack market in China is significantly influenced by regional laws and consumer preferences. Due to price sensitivity in India, cost-effective solutions and localization of features are crucial. The market is expanding, and the demand for cost-effective infotainment choices is rising. Modern technology and top-notch infotainment systems are preferred by Japanese consumers. Modern features are frequently introduced first by Japanese automakers.

Key Players

The major key players are Preh GmbH, Hyundai Mobis, Marelli Corp, Methode Electronics, Visteon Corp, and others.

Hyundai Mobis-Company Financial Analysis

| Report Attributes | Details |

| CAGR | CAGR of 6.8 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger Vehicles, Commercial Vehicles) • By Sales Channel (OEMs, Aftermarket) • By Display Technology (LED, OLED) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Preh GmbH, Hyundai Mobis, Marelli Corp, Methode Electronics, Visteon Corp |

| Key Drivers | • The rising need of customers for connected devices. • The urge of having a competitive advantage from supplier’s end. |

| Market Opportunity | • The rising technological advancements in automotive industry. • The rising concerns of customers related to the safety. • The latest innovations of autonomous cars and ADAS systems. |