Automotive Climate Control Market Report Scope & Overview

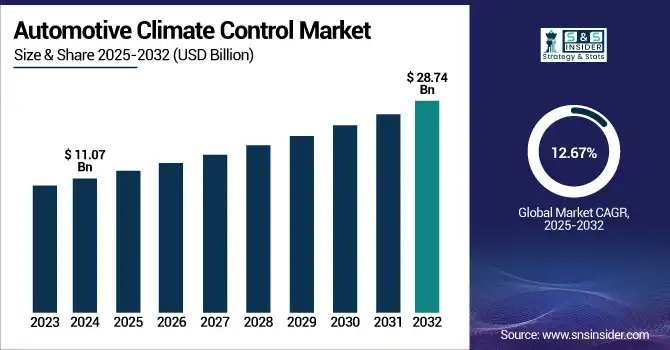

The Automotive Climate Control Market size was USD 11.07 billion in 2024 and is expected to reach USD 28.74 billion by 2032, growing at a CAGR of 12.67% over the forecast period of 2025-2032.

To Get more information on Automotive Climate Control Market - Request Free Sample Report

Automotive Climate Control market analysis highlights increasing vehicle production as a key driver of market expansion. It is due to as global vehicle manufacturing continues to rise, especially in emerging economies, the demand for integrated comfort systems such as HVAC units also increases. Each new vehicle, whether passenger car or commercial, requires a climate control system to meet consumer expectations for comfort, safety, and energy efficiency. The expansion of automobile production boosts the need for compressors, evaporators, condensers, and advanced climate control modules. Moreover, the rise in demand for electric and hybrid vehicles has further spurred the development of specialized thermal management systems, contributing to the overall growth of the market.

For example, India’s automotive sector produced a record USD 28.4 million vehicles during fiscal year 2023–24, up from 2.59 crore in 2022–23.

Market Dynamics

Drivers

-

Rising adoption of electric and hybrid vehicles drives the market growth.

The growing adoption of electric and hybrid vehicles will boost the growth of automotive climate control market. While managing the engine in conventional internal combustion engine passenger vehicles has well-understood ambient thermal issues, electric and hybrid vehicles need special thermal management systems to maintain battery efficiency and a comfortable cabin without compromising energy consumption. As the EV and hybrid adoption spiked around the world, due to elements such as environmental regulations, government subsidies, and technology, OEMs began to incorporate climate control systems that were more efficient, smaller, and smarter. These systems should be optimized to minimize the power draw from the battery, but also provide a stable performance. In addition, OEM use of new technologies such as heat pumps, electric compressors and new HVAC controls for EVs is driving new opportunities for innovation and market growth in automotive climate control.

Restrain

-

Complexity in system design and integration may hamper the market growth.

The growing technological demands from modern vehicles can hinder the growth of the Automotive Climate Control Market since it brings complexity in system design and integration. With growing capabilities automatic multi-zone, air purification, heat pumps, energy recovery and the rest the complexity of integrating these systems with vehicle electronics, powertrains and onboard computers only grows. The integrated vehicle control software requires advanced software-design methods, accurate hardware co-simulation, and suitability for different vehicle architectures, making the development cycle time-consuming and costly. In addition to all of those features, climate control systems must also be able to communicate with battery management systems in electric and hybrid vehicles while consuming a minimal amount of energy, adding extra hurdles to design and efficiency goals.

Opportunities

-

Advancements in Heat Pump Technology creates an opportunity in the market.

Growing opportunities in the automotive climate control market due to the development of heat pump technologies. On the other hand, heat pumps provide a more energy-efficient approach compared to conventional heating systems, which is important in electric and hybrid cars, where saving battery power plays a vital role. Instead of less efficient conventional resistive heaters, heat pumps can heat (and cool) the cabin using less energy, thus making the vehicle more efficient overall with a longer range. With car makers looking for sustainable, low-energy climate solutions, many manufacturers are now adopting the use of modern heat pump systems like those found in the above EV models. These systems are especially beneficial in colder climates were keeping the cabin warm impacts battery life. Compact and highly efficient automotive-specific heat pumps will continue to be developed, further expanding market potential as electric vehicles gain ground worldwide and drive the Automotive Climate Control market trends.

Segmentation Analysis

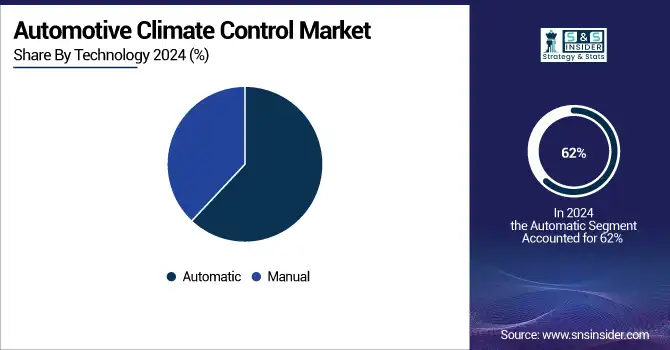

By Technology

The automatic technology segment held the largest market share, around 62%, in 2024. As automatic devices are more advanced, fare better in terms of user ease, and show a noticeable trend in consumer preferences towards comfort-led features. Automatic climate control systems adjust the cabin temperature automatically without requiring user input. It works by utilizing a temperature sensor to continuously monitor the ambient temperature in the car and comparing that to what the driver and passengers are telling it they want, factoring in how hot (or cold) it is outside.

By Component

The Compressors segment held the largest market share, around 36%, in 2024. It is due to the vehicle's air conditioning system. Compressors, which serve as the HVAC system's heart, compress and circulate the refrigerant, allowing an efficient heat transfer process and ultimately temperature control in the vehicle cabin. That key role results in them being indispensable for gas, diesel, hybrid, and electric vehicles alike. As production volumes of vehicles around the world rise, and as more advanced climate control features become preferred in newer vehicles, demand is increasing for reliable, high-performance compressors.

By Vehicle

Passenger cars held the largest market share, around 68%, in 2024. It is due to their high production volume, widespread consumer ownership, and increasing demand for enhanced in-cabin comfort. As personal vehicles continue to dominate global automotive sales, automakers are prioritizing the integration of advanced HVAC systems to meet consumer expectations for convenience, temperature control, and air quality. Features such as automatic climate control, dual-zone systems, and cabin air filtration are becoming standard even in mid-range car models, further driving adoption.

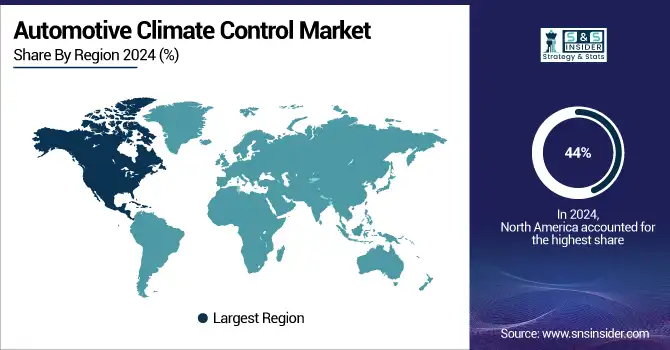

Regional Analysis

North America held the largest market share, around 44%, in 2024. It is due to its strong automotive manufacturing base, high consumer demand for advanced vehicle features, and early adoption of cutting-edge technologies. The region is home to leading automakers and HVAC system manufacturers who continuously invest in innovation and integration of smart climate control technologies in both passenger and commercial vehicles. Additionally, extreme seasonal weather conditions in parts of the U.S. and Canada increase the reliance on efficient heating and cooling systems, boosting the demand for high-performance climate control solutions. The presence of a large electric vehicle market and favorable regulatory policies promoting energy-efficient and environmentally friendly HVAC systems also support the growth of the market.

The U.S. held the largest market share in the North America region, around 74% in 2024. It is due to its well-established automotive industry, high vehicle production and ownership rates, and strong consumer preference for comfort and advanced in-cabin features. The U.S. is home to major automobile manufacturers, OEMs, and climate control system suppliers that drive continuous innovation and large-scale integration of automatic HVAC technologies.

Asia Pacific Automotive Climate Control market held a significant market share and is the fastest-growing segment in the forecast period. It is due to the region’s rapidly growing automotive production, rising urbanization, and increasing consumer demand for comfort features in vehicles. Countries such as China, India, Japan, and South Korea are major automotive manufacturing hubs, producing a large volume of passenger and commercial vehicles each year. As living standards and disposable incomes rise across developing nations in the region, more consumers are opting for vehicles equipped with advanced climate control systems.

Europe held a significant market share in the forecast period. It is due to its strong automotive manufacturing presence, stringent environmental regulations, and high consumer preference for technologically advanced and energy-efficient vehicles. The region is home to several premium and luxury vehicle manufacturers that prioritize in-cabin comfort and advanced HVAC systems as standard features. Moreover, the European Union's strict emissions and refrigerant regulations have accelerated the development and adoption of eco-friendly climate control technologies, such as heat pumps and low-GWP refrigerants. The increasing penetration of electric and hybrid vehicles across key European markets like Germany, France, and the U.K. further drives demand for efficient thermal management solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Denso Corporation, Valeo SA, Hanon Systems, MAHLE GmbH, Sanden Holdings Corporation, Calsonic Kansei, Eberspächer Group, BorgWarner Inc., Behr-Hella Thermocontrol (BHTC), Johnson Electric.

Recent Development:

-

In February 2024, Hanon Systems launched a new engineering center in Palmela, Portugal, its European flagship for the development of electric scroll compressors with large testing facilities.

-

In September 2024, Denso Corporation launched next-generation, energy-efficient electric HVAC compressors specifically designed for electric and hybrid vehicle

| Report Attributes | Details |

| Market Size in 2024 | USD11.07 Billion |

| Market Size by 2032 | USD28.74 Billion |

| CAGR | CAGR of12.67% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Automatic, Manual) • By Component (Compressors, Condensers, Evaporators, Control panels, Sensors, Others) • By Vehicle (Passenger cars, Commercial vehicle) • By Fuel (Gasoline, Diesel, All-electric, PHEV, HEV) • By End-Use (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Denso Corporation, Valeo SA, Hanon Systems, MAHLE GmbH, Sanden Holdings Corporation, Calsonic Kansei, Eberspächer Group, BorgWarner Inc., Behr-Hella Thermocontrol (BHTC), Johnson Electric. |